Get the free Beneficial Owners and Documentation

Get, Create, Make and Sign beneficial owners and documentation

How to edit beneficial owners and documentation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficial owners and documentation

How to fill out beneficial owners and documentation

Who needs beneficial owners and documentation?

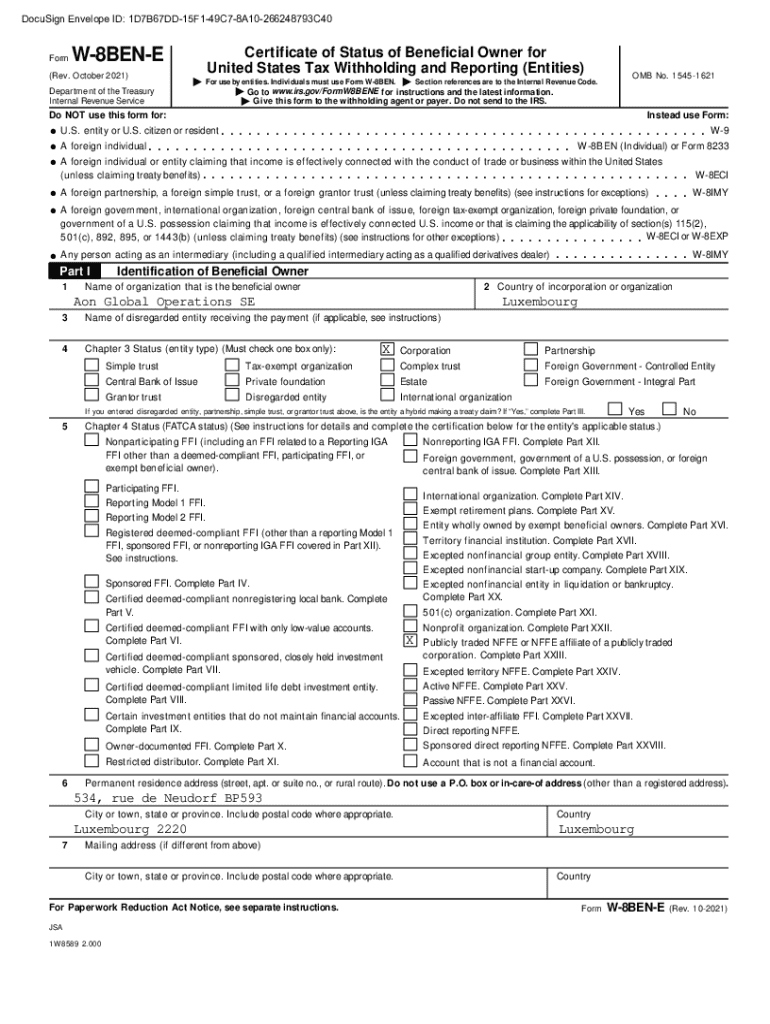

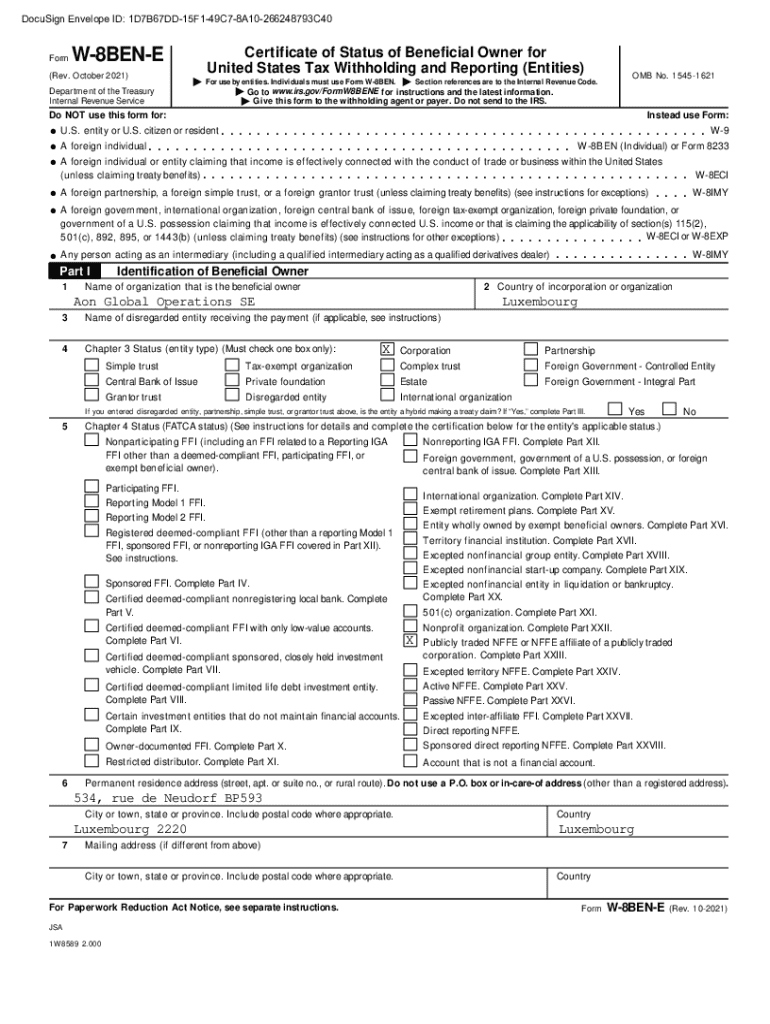

Beneficial Owners and Documentation Form

Understanding beneficial ownership

Beneficial ownership refers to the natural persons who ultimately own or control a legal entity, such as a corporation or trust, even if their ownership is mediated through one or more layers of intermediaries. Identifying beneficial owners is essential for various reasons, including compliance with regulatory frameworks aimed at combating money laundering, tax evasion, and other illicit activities. Failure to properly identify and report beneficial owners can lead to severe legal consequences, including fines and reputational harm.

The importance of identifying beneficial owners extends beyond regulatory compliance. It enhances transparency in business transactions and helps build trust among stakeholders. For instance, in the state of Florida, organizations are encouraged to maintain accurate records and comply with the Business Entity Index, overseen by the Division of Corporations. This not only aids in legal compliance but also facilitates sound business practices.

Overview of beneficial ownership information reporting

Beneficial ownership reports serve as a foundational document that delineates the individuals who own or control an entity. This process is critical for upholding financial integrity and facilitating transparency in business operations. Entities required to file these reports range from corporations to limited liability companies, particularly those registered in jurisdictions that mandate compliance with beneficial ownership regulations.

The key benefits of accurate reporting include the reduction of risks related to fraud, money laundering, and other illicit activities, providing a clear trail of ownership that can be verified by authorities. In addition, accurate beneficial ownership reporting can shield organizations from legal repercussions and enhance their reputation in the marketplace.

Essential documentation for beneficial ownership

When preparing beneficial ownership documentation, several critical forms and documents are essential. This includes written consent forms, ID verification forms, and records representing the corporate structures of the business entities involved. Each of these plays a significant role in ensuring the accuracy and credibility of the reported ownership information.

Collecting the necessary information is equally crucial, requiring personal identification details of beneficial owners, including names, addresses, and ownership percentages. Some common challenges in documentation include ensuring complete and accurate information and navigating varying state-specific reporting requirements, particularly in states like Florida where guidelines are stringent.

How to complete the beneficial ownership documentation form

Completing the beneficial ownership documentation form can be simplified by following a series of methodical steps. First, gather all required information such as personal identification details of all beneficial owners and their ownership percentages. Next, navigate to the specific fields of the form designed for this information. Accurate input is crucial; any discrepancies can lead to significant issues down the line.

Common errors to avoid include neglecting to double-check the names and figures entered on the form. Additionally, ensure all signatures and consent declarations are collected before submission. As a tip, utilizing platforms like pdfFiller can also enhance the ease of completing these forms through user-friendly interactive tools.

Using pdfFiller for beneficial ownership documentation

Using pdfFiller to manage beneficial ownership documentation streamlines the process significantly. The platform offers seamless eSigning features that facilitate quick and secure sign-offs from all relevant parties. Furthermore, pdfFiller promotes easy document collaboration, allowing teams to work together on the same form, regardless of their physical locations.

The platform provides interactive tools such as drag-and-drop editing, which simplifies the customization of document templates to fit specific needs. Real-time collaboration features enable users to make adjustments on the fly, ensuring documents are completed accurately and efficiently.

Signing and submitting the beneficial ownership form

Once the beneficial ownership documentation form is completed, the next step is the signing process. This is where the eSignature capabilities of pdfFiller can streamline submission. By following the eSignature process, users can ensure that all necessary signatories provide their consent without the need for physical paperwork, minimizing processing time.

Submission can be performed electronically or via physical means, depending on jurisdictional requirements. Understanding the tracking mechanism provided by pdfFiller allows users to keep tabs on the status of their submission, ensuring compliance with crucial deadlines.

Managing your beneficial ownership documentation

Managing beneficial ownership documentation is crucial for businesses to maintain compliance and updated records. With pdfFiller, users can organize their documents efficiently within the platform, enabling easy access and retrieval of necessary forms. Implementing secure storage practices, such as setting permissions for document access, helps protect sensitive information regarding beneficial ownership.

Retrieving and editing submitted forms is also facilitated on the platform, allowing organizations to make updates as ownership structures change. This flexibility is essential in ensuring that businesses remain compliant with evolving regulations pertaining to beneficial ownership reporting.

Frequently asked questions (FAQs)

Commonly asked questions regarding beneficial ownership documentation often revolve around the nuances of reporting and compliance. For instance, what if a mistake is made on the beneficial ownership form? It's crucial to promptly correct any inaccuracies to avoid compliance issues. Those needing to update their beneficial ownership data must ensure they follow the proper procedures as outlined by their state’s regulations. Additionally, missing reporting deadlines can lead to penalties, so understanding the implications of failure to comply is necessary.

Regulatory compliance and best practices

Understanding compliance obligations surrounding beneficial ownership documentation is critical for organizations. This includes familiarity with both federal regulations and state-specific requirements, such as those mandated by the state of Florida. Best practices for maintaining accurate records involve regular audits of submitted information and ensuring that all ownership structures are well documented and updated promptly.

Staying informed about changing laws and requirements, particularly in an environment where beneficial ownership regulations are evolving, is essential. Organizations must remain vigilant to any updates from regulatory bodies, such as the Secretary of State, to avoid compliance risks.

Other related services offered by pdfFiller

Beyond beneficial ownership documentation, pdfFiller provides a range of other document automation solutions. These services cater to teams that require enhanced collaboration tools, enabling seamless interactions on multiple documents. Advanced reporting features for document management allow organizations to monitor the status and efficacy of their documentation processes effectively.

These additional offerings make pdfFiller a comprehensive platform for businesses, ensuring all document-related needs can be managed from a single location. From document creation to submission and ongoing management, pdfFiller empowers users in navigating the complexities of compliance and regulatory requirements.

Contact us and support options

For users of pdfFiller seeking assistance, various support channels are available to ensure that help is at hand when needed. This includes live chat options for real-time assistance as well as email support for more detailed inquiries about problematic issues. Community forums and help centers also provide substantial resources for troubleshooting common questions regarding beneficial ownership documentation and other related topics.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the beneficial owners and documentation form on my smartphone?

How do I edit beneficial owners and documentation on an Android device?

How do I fill out beneficial owners and documentation on an Android device?

What is beneficial owners and documentation?

Who is required to file beneficial owners and documentation?

How to fill out beneficial owners and documentation?

What is the purpose of beneficial owners and documentation?

What information must be reported on beneficial owners and documentation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.