Get the free Maricopa County Deferred Compensation Plan Incoming ...

Get, Create, Make and Sign maricopa county deferred compensation

How to edit maricopa county deferred compensation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maricopa county deferred compensation

How to fill out maricopa county deferred compensation

Who needs maricopa county deferred compensation?

Maricopa County Deferred Compensation Form: A Comprehensive Guide

Overview of the Maricopa County Deferred Compensation Program

The Maricopa County Deferred Compensation Program is a retirement savings plan designed specifically for county employees. This incentivized program allows employees to set aside a portion of their earnings before taxes are deducted, fostering financial security for their future. In a landscape where retirement planning is crucial, understanding how to leverage this program is essential.

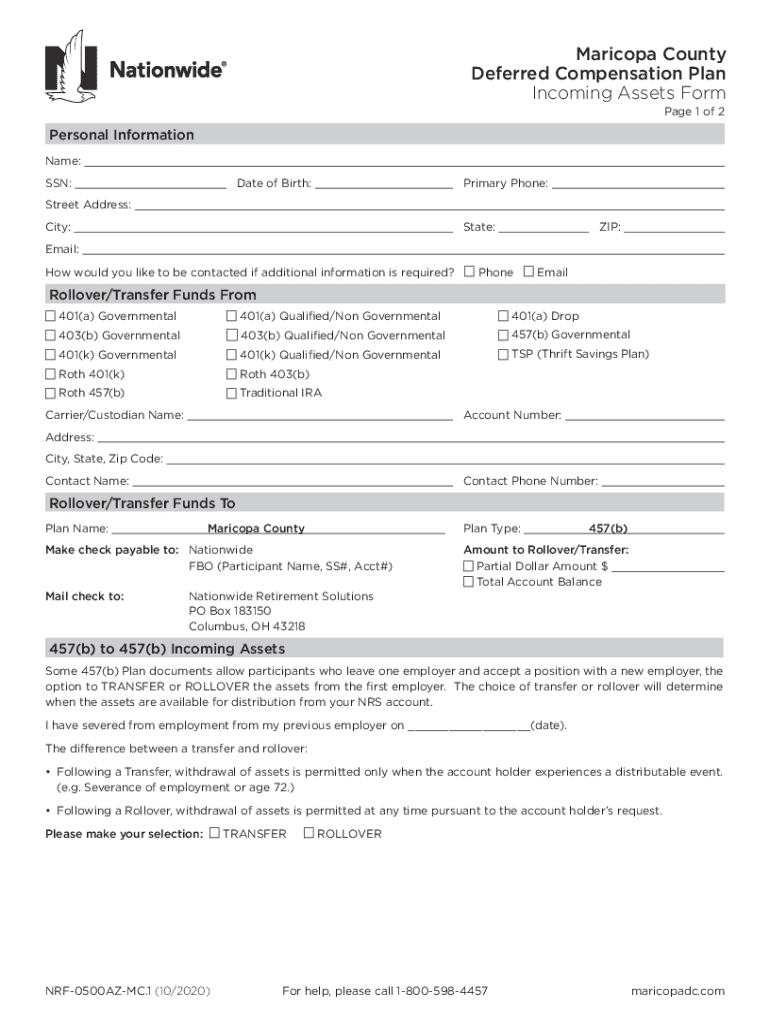

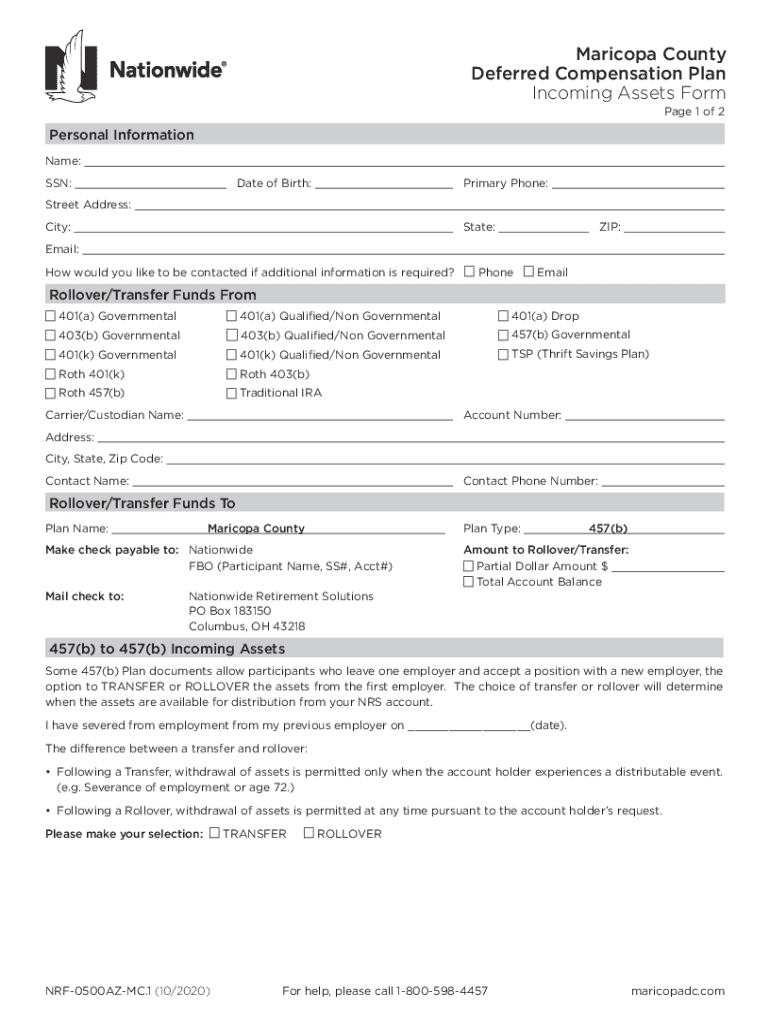

Understanding the Maricopa County Deferred Compensation Form

The Maricopa County Deferred Compensation Form is a crucial document that initiates your engagement with the Deferred Compensation Program. By completing this form, you unlock the potential to secure a more stable financial future.

Step-by-step guide to filling out the form

Filling out the Maricopa County Deferred Compensation Form may seem daunting at first, but breaking it down into manageable steps simplifies the process significantly. Start with gathering all necessary documents, such as employment verification and previous retirement account statements.

Editing and signing the form with pdfFiller

Utilizing pdfFiller enhances the experience of completing the Maricopa County Deferred Compensation Form. The platform allows you to edit your forms easily, ensuring that all your details are accurate before submission.

Submitting your completed form

Once you’ve completed the Maricopa County Deferred Compensation Form, finalizing your submission is the next critical step. Ensure you have reviewed everything thoroughly and confirmed that no details are missing.

Frequently asked questions (FAQs)

As you navigate the Maricopa County Deferred Compensation Program, you may encounter various questions. Knowing the answers can save you time and enhance your understanding.

Benefits of using pdfFiller for your deferred compensation form

Turning to pdfFiller not only simplifies the process of filling out the Maricopa County Deferred Compensation Form but also enhances your overall user experience. Accessible from anywhere, pdfFiller ensures that you can manage your documents efficiently.

Related information and resources

Having access to relevant information and resources is vital for effective retirement planning. Utilize the tools provided to guide your journey towards achieving your retirement goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the maricopa county deferred compensation in Chrome?

How do I edit maricopa county deferred compensation straight from my smartphone?

How do I fill out maricopa county deferred compensation using my mobile device?

What is maricopa county deferred compensation?

Who is required to file maricopa county deferred compensation?

How to fill out maricopa county deferred compensation?

What is the purpose of maricopa county deferred compensation?

What information must be reported on maricopa county deferred compensation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.