Get the free Nov-15-10 (CN-07-10)

Get, Create, Make and Sign nov-15-10 cn-07-10

Editing nov-15-10 cn-07-10 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nov-15-10 cn-07-10

How to fill out nov-15-10 cn-07-10

Who needs nov-15-10 cn-07-10?

Understanding the nov-15-10 cn-07-10 form: A Comprehensive Guide

Understanding the nov-15-10 cn-07-10 form

The nov-15-10 cn-07-10 form is a specific document utilized primarily in the context of taxation and legal compliance. Its primary purpose is to provide necessary information for processing various financial and legal transactions. This form is crucial for individuals and organizations to ensure correct and timely submissions, addressing their obligations in fields such as tax reporting and compliance.

In certain scenarios, failure to complete or accurately submit the nov-15-10 cn-07-10 form can result in complications ranging from financial penalties to legal disputes. Therefore, understanding the nuances of this form is important for abiding by regulations and avoiding unnecessary issues.

Who needs to use this form?

The nov-15-10 cn-07-10 form is essential for various stakeholders. Individuals like freelancers, small business owners, and contractors who deal with tax declarations often require this form to maintain compliance with tax regulations. For teams within organizations, particularly in finance and human resources, this form serves as a regular component in managing financial documentation and ensuring proper tax reporting.

Organizations that frequently engage in legal contracts, tax reporting, or financial auditing will find the regular use of the nov-15-10 cn-07-10 form beneficial. Familiarity with this form not only promotes smoother operations but also aids in fostering trust with regulatory bodies.

Key features of the nov-15-10 cn-07-10 form

Understanding the essential components of the nov-15-10 cn-07-10 form is crucial for effective usage. The form typically includes sections that require specific information such as personal identification details, financial summaries, and declaration of compliance with applicable laws. Each section is designed to capture vital information necessary for processing the submission.

These unique fields are tailored to meet the requirements of compliance checks, ensuring that every relevant detail is documented. Additionally, users seeking to utilize the nov-15-10 cn-07-10 form can benefit from interactive tools provided by pdfFiller. These tools can assist in customizing the form to fit specific needs, enhancing the overall efficiency of document handling.

Step-by-step guide to filling out the nov-15-10 cn-07-10 form

Filling out the nov-15-10 cn-07-10 form may seem complex at first, but with careful preparation and attention to detail, it can be a straightforward process. Before starting, it’s essential to gather all required documents such as previous tax returns, financial statements, and identification records to ensure that you have all necessary data on hand.

Taking the time to double-check every entry not only minimizes errors but also boosts the credibility of your submission.

Editing and modifying the nov-15-10 cn-07-10 form

In cases where modifications to the nov-15-10 cn-07-10 form are necessary, pdfFiller offers a suite of editing tools that make it easy to adjust text, images, and even the layout of the form. Users can add, remove, or alter information with convenience, ensuring that the form reflects the most accurate and updated details at all times.

Moreover, managing different versions of the form is crucial. Keeping track of modifications helps maintain a clear history of changes, which can be essential for reference during audits or legal scrutiny.

Signing the nov-15-10 cn-07-10 form

The nov-15-10 cn-07-10 form requires a signature to authenticate the information provided. pdfFiller supports various eSignature options, including typed signatures, drawn signatures with a mouse or touchscreen, and even uploading scanned images of handwritten signatures. Electronic signatures are legally valid, aligning with regulations that govern eSignatures, making the process both secure and efficient.

Additionally, if collaboration on the nov-15-10 cn-07-10 form is necessary, sharing it with team members for collective signatures can be easily accomplished. This facilitates smooth processes when multiple approvals are required.

Common issues and troubleshooting

Frequently, users encounter challenges when filling out the nov-15-10 cn-07-10 form. Common queries often revolve around the requirements for accurate completion, methods of submission, and electronic signatures. Knowing these common issues can help preempt difficulties, ensuring that users are better prepared to navigate potential pitfalls.

A proactive approach to understanding these common issues, along with the appropriate solutions, can significantly improve user experience.

Best practices for submission

When finalizing your nov-15-10 cn-07-10 form for submission, it's beneficial to have a checklist to ensure that all steps are completed properly. This may include reviewing all filled sections for accuracy, confirming that all required documents are attached, and checking for signatures where applicable. Ensuring compliance with submission guidelines can greatly enhance the likelihood of automatic approval.

Upon submission, it’s worth noting the follow-up procedures to track the form’s status and ensure it has been processed. Understanding how to monitor progress can provide peace of mind that your submission is being handled appropriately.

Leveraging additional document management features of pdfFiller

Integrating the nov-15-10 cn-07-10 form into broader document management strategies can enhance organizational efficiency. The ability to manage multiple documents, collaborate among team members, and track edits ensures that users benefit from a streamlined workflow. Teams can significantly reduce the risk of errors and improve collaboration by working from a single platform.

Furthermore, safeguarding sensitive documents is vital. pdfFiller implements robust security measures that protect confidential information as it's shared or stored.

Advanced capabilities for power users

For those using the nov-15-10 cn-07-10 form regularly, utilizing advanced capabilities can lead to enhanced productivity. One useful feature is the ability to create reusable templates. Saving the form as a template allows frequent users to streamline future submissions, greatly reducing the time invested in document preparation.

By continually leveraging the unique tools offered by pdfFiller, users can optimize their document workflows, ensuring compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in nov-15-10 cn-07-10?

How do I edit nov-15-10 cn-07-10 in Chrome?

Can I sign the nov-15-10 cn-07-10 electronically in Chrome?

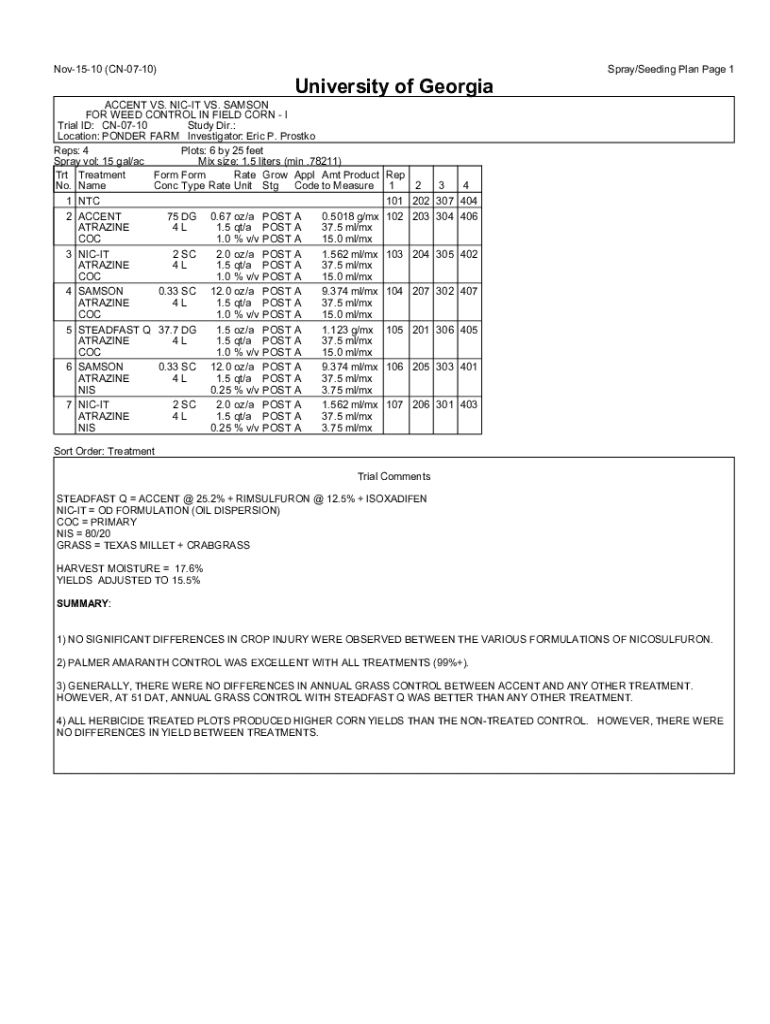

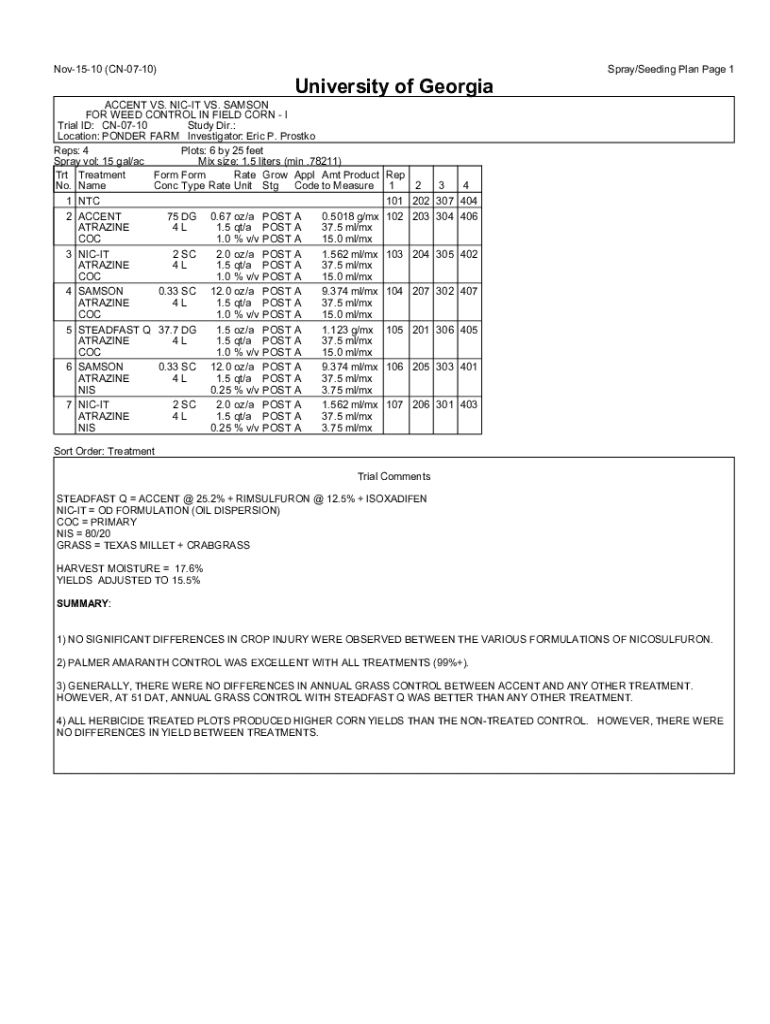

What is nov-15-10 cn-07-10?

Who is required to file nov-15-10 cn-07-10?

How to fill out nov-15-10 cn-07-10?

What is the purpose of nov-15-10 cn-07-10?

What information must be reported on nov-15-10 cn-07-10?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.