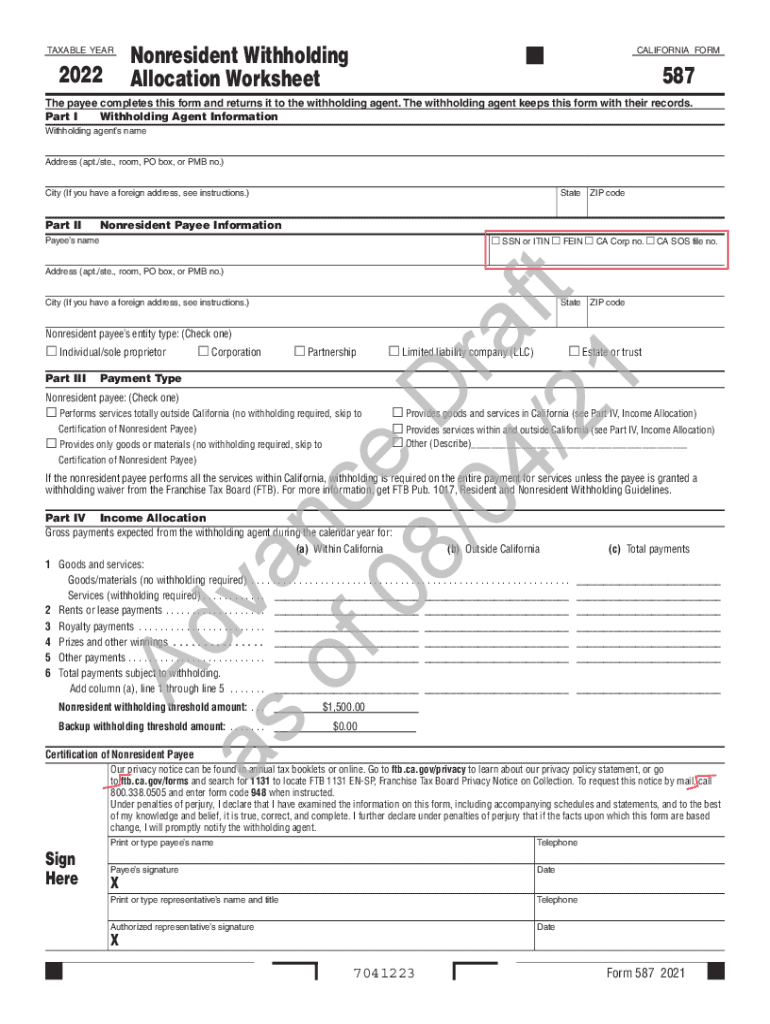

Get the free 587 form 2025

Get, Create, Make and Sign 587 form 2025

Editing 587 form 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 587 form 2025

How to fill out 2025 form 587 nonresident

Who needs 2025 form 587 nonresident?

2025 Form 587 Nonresident Form: A Comprehensive Guide

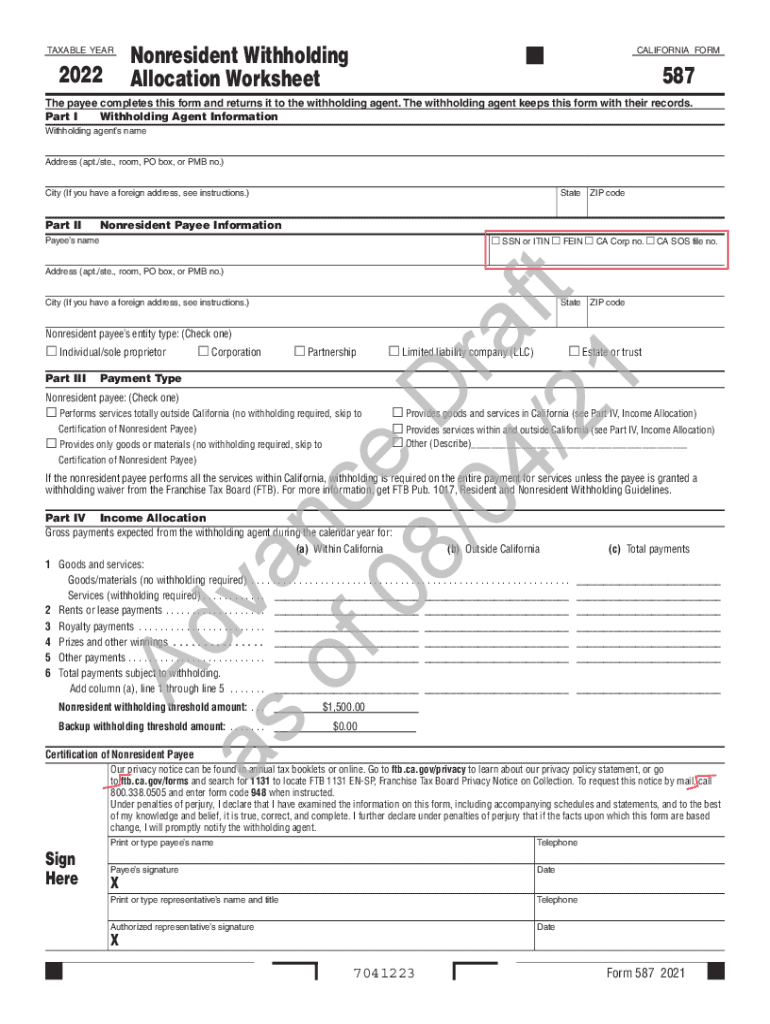

Understanding the 2025 Form 587 Nonresident Form

The 2025 Form 587, primarily designed for nonresident individuals and entities, plays a critical role in tax compliance for those who earn income in the U.S. but do not reside there. This form is essential not only for reporting tax obligations but also for ensuring that nonresidents do not face undue penalties for non-compliance.

Nonresident status is determined by specific criteria, which greatly influences tax obligations. Understanding these parameters can help individuals avoid common pitfalls and ensure adherence to the law.

Preparing to complete the 2025 Form 587

Before filling out the 2025 Form 587, it’s vital to gather all necessary documentation. Key documents typically include W-2 forms, 1099s, and a government-issued identification to verify personal information.

Additionally, understanding the distinctions between U.S. sourced income and foreign income is crucial. Nonresidents must report any income earned within the U.S. borders—this includes wages earned from a payee or income generated through services rendered domestically.

Step-by-step instructions for completing the form

Completing the 2025 Form 587 requires careful attention to detail. Start with Section 1, which prompts for personal information such as your name and address. Ensure that the information is accurate to prevent delays in processing.

Next, navigate through Sections 2 and 3, which require details on U.S. sourced income. Nonresidents must list any applicable income and identify the sources, such as wages or other payments received. Avoid common pitfalls by double-checking your entries for accuracy—mistakes in reporting income can lead to penalties or audits.

Editing and managing your Form 587

Using pdfFiller can significantly ease the editing process for the 2025 Form 587. This cloud-based platform allows users to update PDFs seamlessly. For instance, if you find an error after initial completion, you can swiftly edit your document without hassle.

Additionally, maintaining document versions is critical. Whether you’re collaborating with a tax professional or revising your own entries, pdfFiller offers version control that helps track changes and manage different document iterations efficiently.

eSignature process for Form 587

Electronic signatures are valid for tax submissions, including the 2025 Form 587. Understanding the legality surrounding eSignatures can ensure that your submissions are properly acknowledged.

To add your eSignature using pdfFiller, navigate to the designated signature field, select 'Sign,' and follow prompts to create or insert your signature. Ensure that your signature complies with IRS requirements, as improper signing can lead to rejected forms.

Submission process for Form 587

Submitting the 2025 Form 587 is straightforward with multiple methods available. You can choose to submit electronically through the IRS e-file system or opt for mail. Each method has its procedures and deadlines, so make sure you follow them closely.

Upon submission, it’s advisable to confirm receipt of your form. If mailing, consider using registered post or a similar service to track your submission. For electronic submissions, receiving a confirmation email from the IRS will verify that your form is in the queue for processing.

Post-submission actions

After filing the 2025 Form 587, you can expect processing times to vary. The IRS typically processes forms in a few weeks, but follow-up correspondence may occur if there are discrepancies or further requirements.

If you receive a notice from the IRS, respond promptly to address any issues. Maintaining transparency and communication will help clear up potential misunderstandings regarding your tax obligations.

FAQs about the 2025 Form 587 Nonresident Form

Common questions around the 2025 Form 587 often relate to specific requirements for nonresidents. It's crucial to clarify definitions around residency and the specific income types needing reporting.

Accessing customer support through pdfFiller can provide additional resources and assistance. Their team can answer specific queries related to eSigning, document management, and complying with tax requirements.

Additional insights

As tax regulations evolve, keeping informed about changes for 2025 is vital. Recent updates may affect the reporting thresholds or forms required for nonresident filers.

For effective tax planning, nonresidents should consider strategies to potentially minimize their overall tax liabilities. Consulting with a tax professional who understands U.S. regulations can offer tailored advice based on individual circumstances.

Conclusion—maximizing efficiency with pdfFiller

Navigating the complexities of the 2025 Form 587 nonresident form can be overwhelming, but using pdfFiller streamlines the process. From editing capabilities to eSigning features, pdfFiller empowers users to efficiently manage their tax documentation needs while ensuring compliance with U.S. tax regulations.

By utilizing this platform, nonresidents can focus on their core responsibilities without the added stress of tax form management, providing peace of mind throughout the tax filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 587 form 2025 online?

Can I edit 587 form 2025 on an iOS device?

Can I edit 587 form 2025 on an Android device?

What is 2025 form 587 nonresident?

Who is required to file 2025 form 587 nonresident?

How to fill out 2025 form 587 nonresident?

What is the purpose of 2025 form 587 nonresident?

What information must be reported on 2025 form 587 nonresident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.