Get the free Wisconsin State Tax Information

Get, Create, Make and Sign wisconsin state tax information

Editing wisconsin state tax information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wisconsin state tax information

How to fill out wisconsin state tax information

Who needs wisconsin state tax information?

Wisconsin State Tax Information Form: A Comprehensive Guide

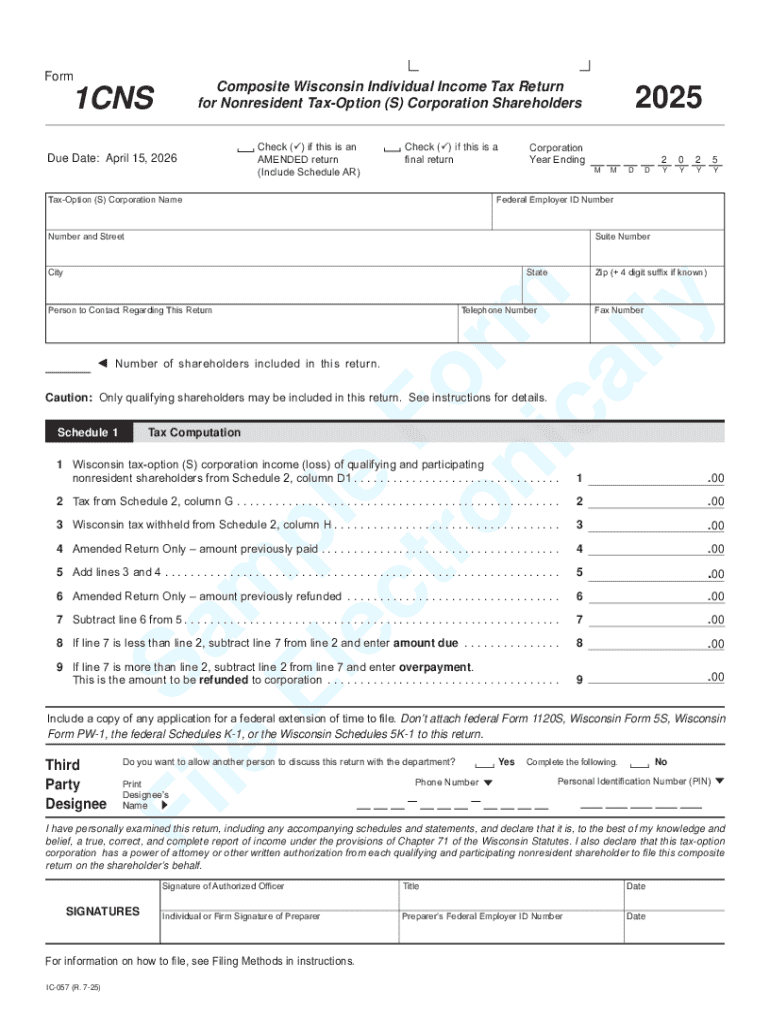

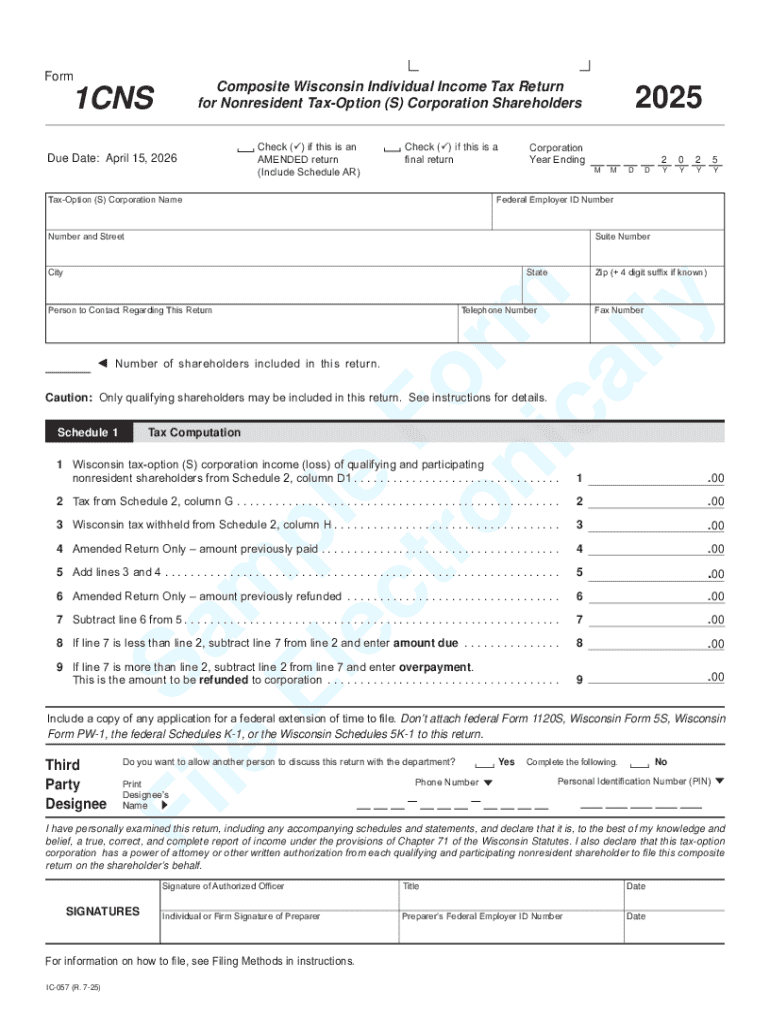

Overview of Wisconsin state tax forms

Wisconsin's state tax forms have evolved significantly since their inception, playing a crucial role in the state's finance management. These forms are essential tools for both individuals and businesses to report income accurately and adhere to tax responsibilities. The importance of these forms lies not only in fulfilling legal obligations but also in ensuring the proper allocation of funds for public services and infrastructure.

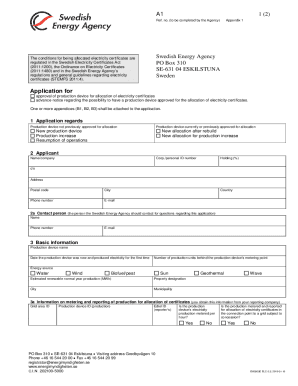

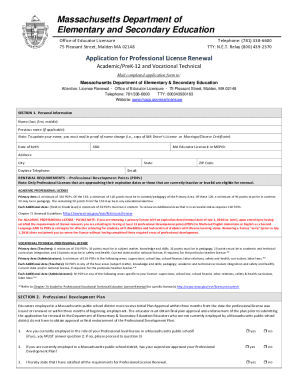

Various tax forms are required depending on the individual's or business’s financial situation. Key categories include Individual Income Tax Forms, which deal with personal income; Corporate Income Tax Forms, necessary for businesses; Sales and Use Tax Forms, essential for retail operations; and Property Tax Forms, which apply to property ownership. Understanding these different forms is critical as misfiling can lead to penalties and interest.

Accurate form submission has far-reaching implications. Not only does it affect your financial class status, but it also ensures compliance with Wisconsin's tax laws, potentially safeguarding you against audits or financial pitfalls.

Understanding the Wisconsin income tax system

Wisconsin's income tax system is structured progressively, with rates and brackets that increase with income levels. Understanding this system is crucial for filing accurate returns and maximizing eligible deductions. Each year, the State of Wisconsin reviews and adjusts tax rates, requiring residents to be vigilant about updates that may affect their filings.

Key terms you’ll encounter include tax brackets, which determine the rate applied to different income ranges; deductions, which lower your taxable income; credits, which directly reduce your tax due; and filing statuses, which define your obligations based on your personal situation, such as single or married filing jointly. All these components work together to shape your overall tax responsibility.

When comparing Wisconsin’s tax rates to those of neighboring states like Illinois and Minnesota, both advantages and disadvantages emerge. Wisconsin often has higher income tax rates, but it compensates with various deductions and credits that might benefit taxpayers. A thorough understanding of these nuances can assist in making informed tax decisions.

Accessing Wisconsin state tax information forms

Finding your necessary Wisconsin state tax forms is a critical first step in the filing process. The primary resource is the Wisconsin Department of Revenue website, which houses a comprehensive library of forms, updated annually. Utilizing their FAQ section can also clarify doubts about which forms you need based on your specific circumstances.

You can download PDF forms directly from the website for free. Ensure you save the most recent versions to avoid issues with outdated forms, which might cause incorrect filings and penalties. For those preferring personal assistance, local tax offices are available, providing additional support and guidance.

How to fill out Wisconsin state tax forms

When filling out Wisconsin state tax forms, there are common requirements that typically appear across various forms. These include personal information like your Social Security number and address, comprehensive income reporting, and correctly applying deductions and credits available to you. Familiarity with these components streamlines the filling process.

One of the most important forms is the Wisconsin Form 1 for individual income tax. To complete it, first gather your W-2s and 1099s, then follow the structured instructions for reporting income earned. For businesses, Wisconsin Form 2 is vital for corporations; it entails a thorough understanding of the company's finances and application of corporate deductions. Be sure to consult any additional schedules required to avoid errors.

Common mistakes often arise from miscalculating income or overlooking eligible deductions and credits. Double-checking your entries and consulting the guidelines can mitigate these errors.

Editing and managing your tax forms with pdfFiller

pdfFiller offers robust features for managing your tax forms. With this platform, you can effortlessly edit, sign, and share your documents all in one cloud-based solution. The tool allows for seamless modifications to existing forms, making it ideal for adjusting entries without the need to start from scratch.

To edit PDF tax forms, simply upload your document to pdfFiller. From there, you can make changes using versatile editing tools to input or modify information. Once completed, you can easily add electronic signatures and dates, ensuring compliance with official requirements.

This collaborative approach is especially beneficial for teams filing multiple forms or those needing to verify each other's work, enhancing accuracy and efficiency.

Signing and submitting Wisconsin tax forms

Signing Wisconsin tax forms requires adherence to specific rules and guidelines. Typically, taxpayers must sign their returns to authenticate them, with electronic signatures now widely accepted. Utilizing pdfFiller's electronic signing tools simplifies this process, ensuring your forms are immediately ready for submission.

When it comes to submission, several methods exist. Electronic submission via the Department of Revenue’s secure portal is the fastest and most convenient option. Alternatively, forms can be mailed, requiring adherence to specific guidelines regarding packaging and sending to the correct address. Always keep track of submitted forms and any confirmations received to avoid future discrepancies.

Filing deadlines and important dates

Filing deadlines are crucial for Wisconsin taxpayers to avoid penalties and interest. Typically, annual returns for individual taxpayers are due by April 15th. Business filers must check their specific deadlines as these can vary based on the entity type and fiscal year.

Additionally, quarterly estimated tax payments have their own deadlines, often falling in April, July, October, and January. It's essential to stay updated on these dates to make timely payments and avoid late fees. If you anticipate being late, consider applying for an extension; however, remember that this does not extend the deadline for any payments due.

Frequently asked questions about Wisconsin state tax information forms

Mistakes on tax forms happen and should be addressed quickly. If you realize you've made an error after submission, the first step is to amend your Wisconsin tax return using Form 1X. This form allows for corrections and adjustments to your income, deductions, or credits. Timeliness is key, as late amendments can lead to complications.

For more assistance with tax inquiries, various resources are available. The Wisconsin Department of Revenue's website offers an array of information for taxpayers, including contact numbers for further personalized support. Familiarizing yourself with these resources is a proactive step in managing tax obligations effectively.

Tips for efficient tax filing in Wisconsin

Preparation is integral to efficient tax filing. Keeping your documents organized throughout the year can significantly streamline the process when tax season arrives. This includes securing W-2 forms, receipts for deductions, and any other pertinent information. When documents are well-organized, the filing process becomes less stressful and more straightforward.

Leveraging technology, such as pdfFiller, can make tax filing even smoother. With its document management capabilities, users can create, edit, and sign documents without the hassles of printing and scanning. Furthermore, implementing a tax planning strategy can help set aside funds for future obligations, minimizing the chances of being caught off-guard by tax payments.

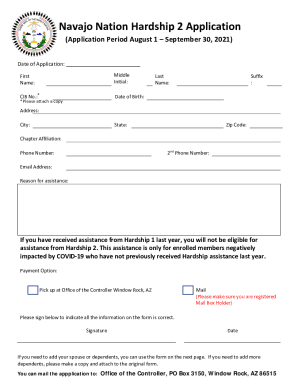

Understanding additional tax forms related to special situations

Specific circumstances may require additional forms beyond the standard tax filings. For example, individuals involved in the sale of alcohol, cigarettes, tobacco, or vapor products need to complete specialized tax forms specific to these industries. Familiarity with these regulations and forms is crucial for compliance if you're part of these markets.

Property tax forms also have unique requirements, often dictated by local municipalities. Homeowners must be aware of exemptions and the applicability of various forms when claiming property tax reductions. Additionally, those with investment income or capital gains need to ensure that they fill out the correct forms to properly report these earnings.

Conclusion on navigating Wisconsin state tax forms

Accurate tax documentation is pivotal in navigating the complexities of Wisconsin state tax forms. By understanding the various requirements, accessing the right resources, and utilizing tools like pdfFiller, you can simplify your filing process. Timely and precise submissions help ensure compliance while potentially maximizing your eligibility for deductions and credits.

As you prepare for your tax obligations, embrace the efficiency that pdfFiller offers to enhance your document management. Engage proactively in your tax management strategy to mitigate any anxiety come tax season. Remember, informed preparedness leads to successful financial planning and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my wisconsin state tax information in Gmail?

Where do I find wisconsin state tax information?

Can I create an eSignature for the wisconsin state tax information in Gmail?

What is wisconsin state tax information?

Who is required to file wisconsin state tax information?

How to fill out wisconsin state tax information?

What is the purpose of wisconsin state tax information?

What information must be reported on wisconsin state tax information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.