Get the free surety bonds bail

Get, Create, Make and Sign surety bonds bail form

Editing surety bonds bail form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out surety bonds bail form

How to fill out performance bond know all

Who needs performance bond know all?

Performance Bond Know All Form: A Comprehensive Guide

Understanding performance bonds

Performance bonds are crucial guarantees in the world of contracting, ensuring that a contractor fulfills their obligations as per the terms of a contract. Essentially, a performance bond is a type of surety bond that provides a safety net for project owners against the risk of a contractor failing to complete the project or not adhering to contract specifications.

The importance of performance bonds extends beyond just financial security; they promote a culture of reliability and accountability in project management. They are indispensable in various sectors, especially construction, where large sums are at stake, and timely completions are critical.

When is a performance bond required?

Performance bonds are typically required in scenarios where significant investments or public funds are involved. For instance, many government projects mandate performance bonds due to the considerable public interest and financial implications involved. This requirement helps ensure that contractors will complete projects on time and according to specifications.

Legally, various jurisdictions mandate performance bonds in public contracts above a certain threshold, solidifying their role in safeguarding taxpayer money and ensuring compliance with regulations. They protect stakeholders by offering a layer of security—if a contractor defaults, the owner can claim against the bond to recover losses.

The components of a performance bond

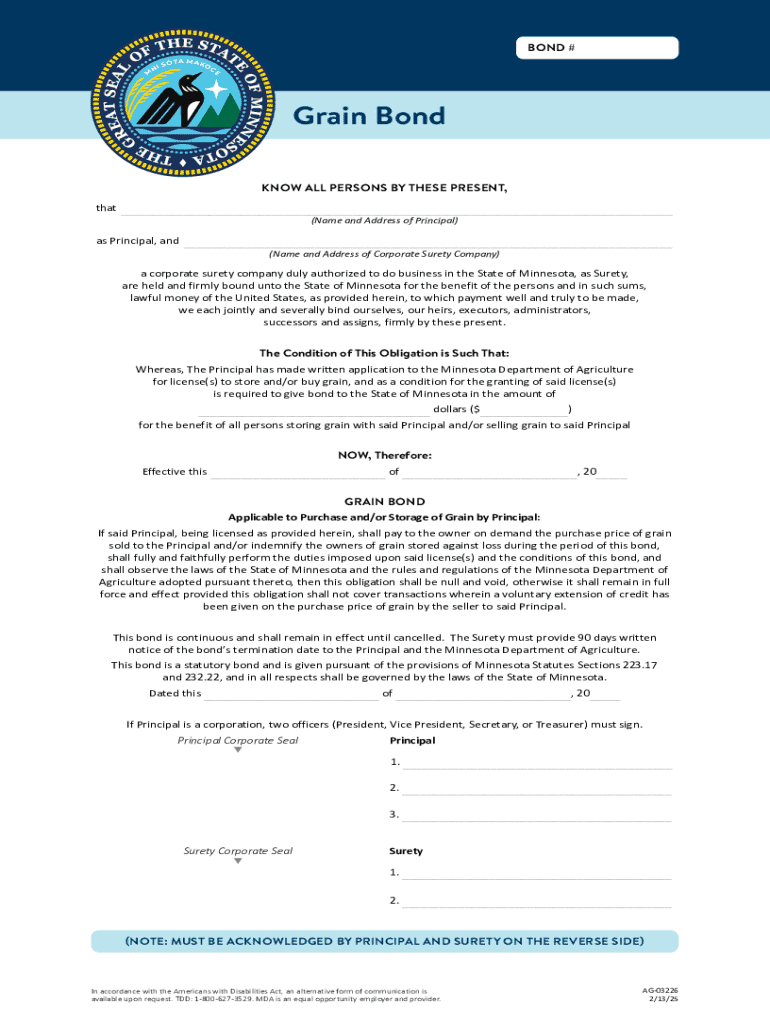

Understanding a performance bond's components is integral to utilizing them effectively. Typically, a performance bond comprises three primary parties: the principal (the contractor), the obligee (the entity requiring the bond), and the surety (the company issuing the bond). Each of these parties plays a vital role in the bond's purpose and effectiveness.

The coverage amount of a performance bond is also critical, often calculated as a percentage of the contract value. It serves as the maximum payout in the event of a claim, ensuring that stakeholders are compensated adequately while preserving the financial integrity of the surety provider.

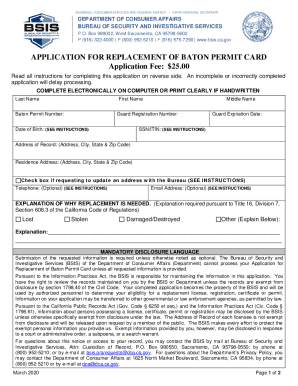

How to fill out a performance bond form

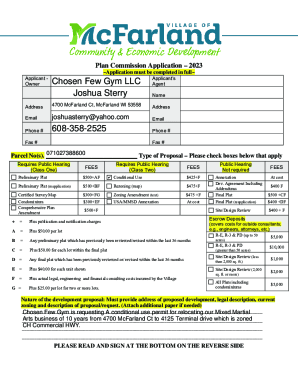

Filling out a performance bond form may seem intimidating, but breaking it down into manageable steps simplifies the process. Start by gathering necessary information, including the contract details, bond amounts, and identification of the parties involved. This preparation creates a foundation for accurately filling out the form.

Once you’ve gathered all relevant information, you can proceed to fill out the form. Be diligent and ensure that all key sections are completed, including signature lines and relevant dates. Common mistakes to avoid include typos in names or contract amounts that could invalidate the bond. After filling in the form, inspect it thoroughly for accuracy before submission.

Utilizing pdfFiller for performance bond forms

pdfFiller streamlines the process of managing performance bond forms with its user-friendly platform. With cloud-based access, you can create, edit, and eSign performance bonds from anywhere, allowing contractors and project owners to stay organized and compliant regardless of their location.

The platform offers interactive tools for editing and signing, making it easy for users to personalize performance bond templates according to their specific project requirements. This eliminates the hassle of dealing with physical paperwork and enhances collaboration among team members.

Special considerations in performance bonds

When dealing with performance bonds, it’s crucial to understand the differences between performance bonds and other types of surety bonds, like payment bonds and bid bonds. Each serves distinct purposes and may have varying requirements based on the specifics of the project.

Moreover, factors such as the contractor's creditworthiness and the project's complexity can affect performance bond costs. Typically, a higher risk project will result in higher bond premiums. Understanding these nuances aids in better financial planning and management of projects.

Best practices for managing performance bonds

Effective management of performance bonds begins with tracking expiration dates. Regularly reviewing the status of bonds and updating the terms, if necessary, can prevent lapses in coverage that could jeopardize project security.

Moreover, maintaining open communication channels with surety providers is essential. By fostering these relationships, contractors can receive timely notifications about upcoming expiration dates or changes to bond terms, leading to a more seamless project management experience.

Troubleshooting common issues with performance bonds

Failures in project completion can occur for various reasons, leading to a bond being called. In such cases, it’s essential to understand the steps involved in invoking the bond. Project owners should promptly notify the surety company while providing documentation of the contractor's non-compliance.

Issues often arise during the claims process, so recognizing how to resolve disputes with surety companies can save time and reduce frustration. Establishing clear communication and providing accurate information are critical steps when navigating these complex interactions.

The future of performance bonds

The landscape of performance bonds is transforming, influenced by emerging trends and technologies. With the rise of digital solutions and the increasing importance of compliance, performance bonds are becoming more integral to project management, especially in government contracts across the United States.

Technology's role is expected to grow, simplifying the process of managing performance bonds. Innovations may lead to smarter forms, automated reminders, and better tracking systems, thereby enhancing efficiency while ensuring compliance with regulatory frameworks.

Interactive tools and resources offered by pdfFiller

pdfFiller offers exceptional collaborative features that allow users to compare documents and work effectively within teams. This capability significantly reduces the time spent on revisions and enhances communication among stakeholders involved in performance bonds.

Integration capabilities with various platforms further bolster the user experience, enabling seamless transitions between different forms and documents. Furthermore, pdfFiller’s customer support ensures that any inquiries or issues can be addressed promptly, promoting a user-centric approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete surety bonds bail form online?

How do I edit surety bonds bail form online?

Can I create an electronic signature for the surety bonds bail form in Chrome?

What is performance bond know all?

Who is required to file performance bond know all?

How to fill out performance bond know all?

What is the purpose of performance bond know all?

What information must be reported on performance bond know all?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.