Get the free Registered Stock Brokers in equity segment

Get, Create, Make and Sign registered stock brokers in

Editing registered stock brokers in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registered stock brokers in

How to fill out registered stock brokers in

Who needs registered stock brokers in?

Registered Stock Brokers in Form: A Comprehensive Guide

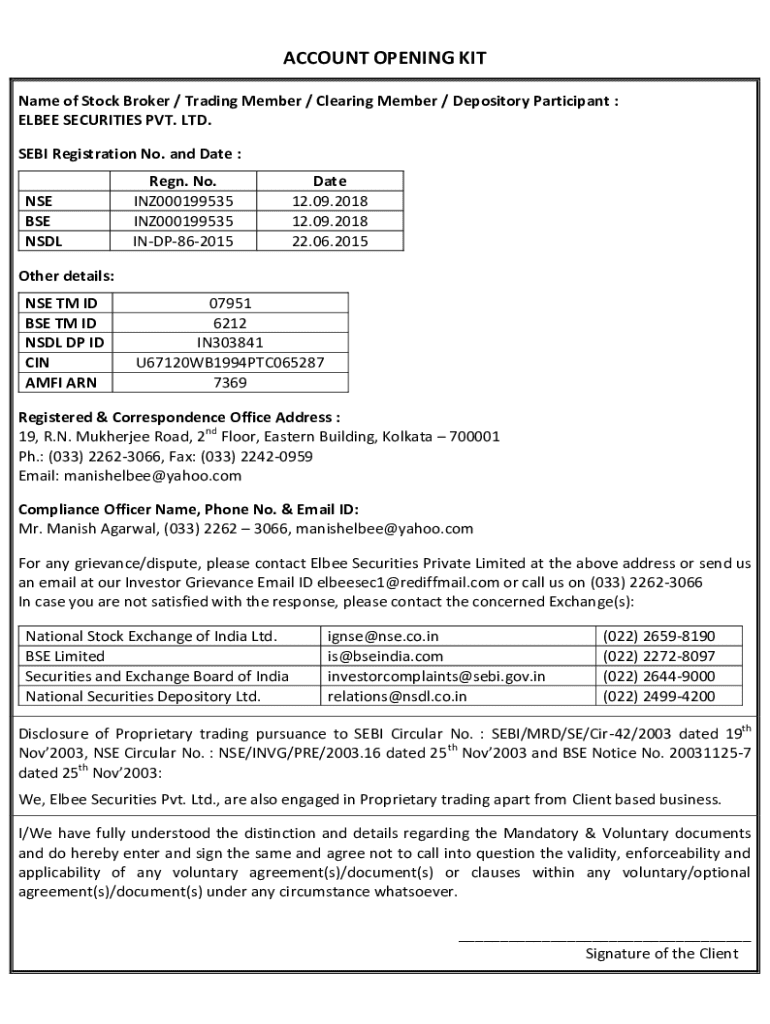

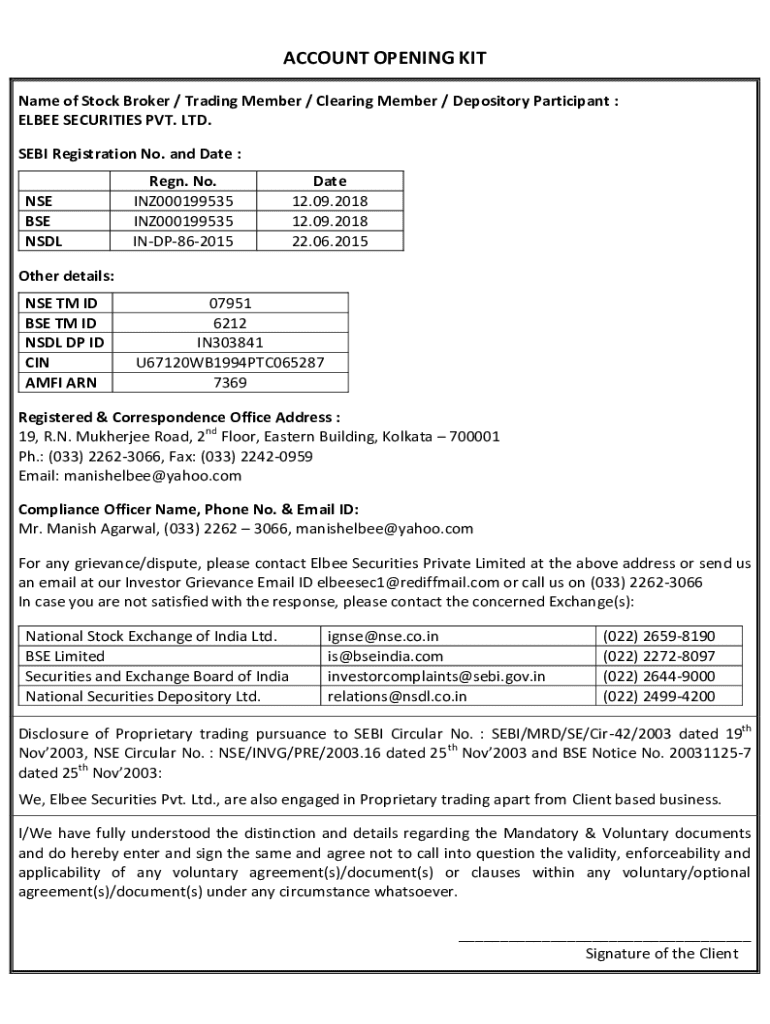

Understanding registered stock brokers

Registered stock brokers are financial professionals who buy and sell securities on behalf of clients. They are crucial players in the financial market, acting as intermediaries between investors and the stock exchange. Their primary role is to execute trades, provide investment advice, and manage client portfolios.

The importance of registration cannot be overstated; it ensures that brokers comply with legal standards, providing a layer of trust for investors. Regulatory authorities like the Securities and Exchange Commission (SEC) in the United States oversee broker registration. These bodies enforce rules that maintain market integrity and protect investors from fraud.

Types of stock brokerage firms

Stock brokerage firms come in various types, each catering to different investor needs. Understanding these types is crucial for making informed decisions about which broker to engage with.

The registration process for stock brokers

The registration process for stock brokers is critical to ensuring they meet regulatory standards. This process requires thorough preparation and understanding of specific requirements.

Essential forms for registered stock brokers

Certain key forms must be filled out during the registration process. Understanding these forms is vital for compliance and operational readiness.

Completing these forms accurately is critical. Failure to do so may result in processing delays or rejections, impacting the broker's ability to operate.

Compliance and post-registration requirements

Once registered, stock brokers face ongoing compliance responsibilities. This includes adhering to continuing education requirements and regular reporting obligations, ensuring they remain up to date with regulatory changes and market practices.

Compliance professionals play a key role here, as they oversee adherence to legal and ethical standards. Brokers must maintain transparency in their operations and keep all documentation related to transactions and communications accurate and current.

Tips for a successful registration

Success in the registration process can greatly affect a broker's career. To navigate this phase smoothly, several strategies can be beneficial.

Tools and resources for registered stock brokers

Efficient management of documentation is vital for registered stock brokers. Tools like pdfFiller offer features that streamline the document management process.

FAQs on registered stock brokers

Understanding the registration process, requirements, and ongoing responsibilities is imperative for new stock brokers. Here are some frequently asked questions that clarify common concerns.

Real-life examples of successful registered brokers

The impact of being a registered stock broker extends beyond compliance; it influences operations and client trust. Successful brokers often share their registration experiences, highlighting the advantages of adhering to regulatory standards.

Case studies reveal that registered brokers enjoy enhanced credibility within the market, leading to better client retention and more referrals. Their commitment to preparing proper documentation and maintaining compliance underscores the importance of registration in building a sustainable business.

Related links and further reading

For brokers seeking to deepen their understanding of the registration process and regulations, exploring related resources is imperative.

Legal links and disclaimers

As a registered stock broker, understanding and adhering to legal obligations is crucial. Brokers must stay informed about the regulations, which can constantly evolve.

Disclaimers regarding the use of registered brokers are essential for transparency. They should always inform clients about potential risks, the nature of investments, and any fees associated with trading.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify registered stock brokers in without leaving Google Drive?

How do I make changes in registered stock brokers in?

How do I make edits in registered stock brokers in without leaving Chrome?

What is registered stock brokers in?

Who is required to file registered stock brokers in?

How to fill out registered stock brokers in?

What is the purpose of registered stock brokers in?

What information must be reported on registered stock brokers in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.