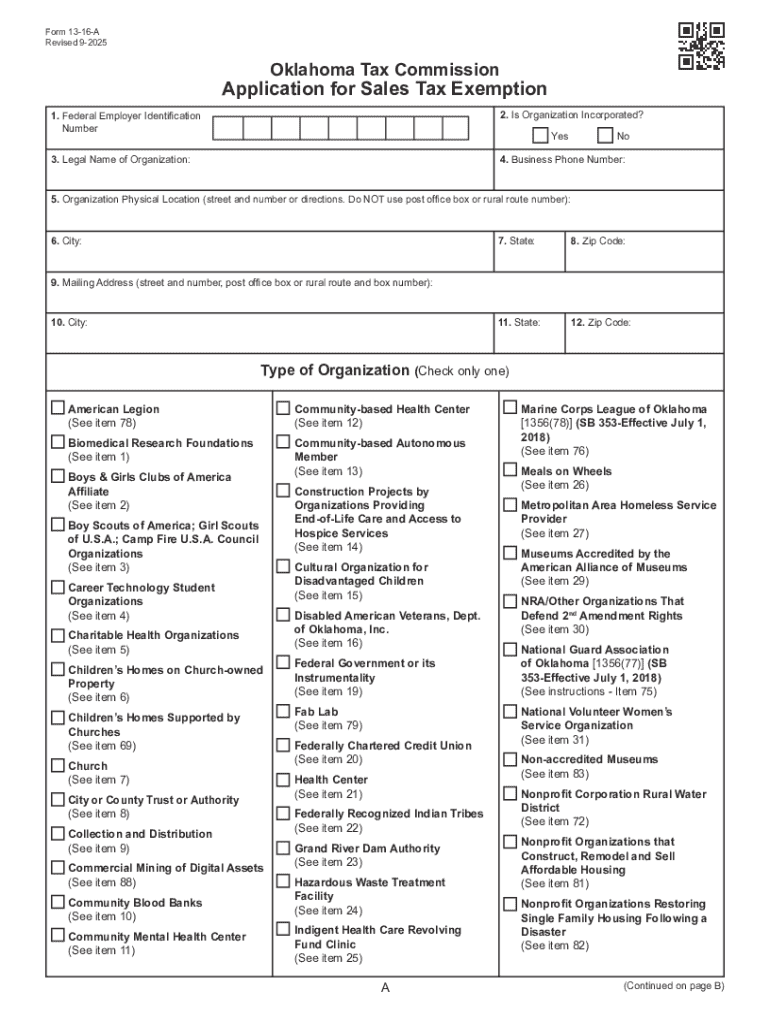

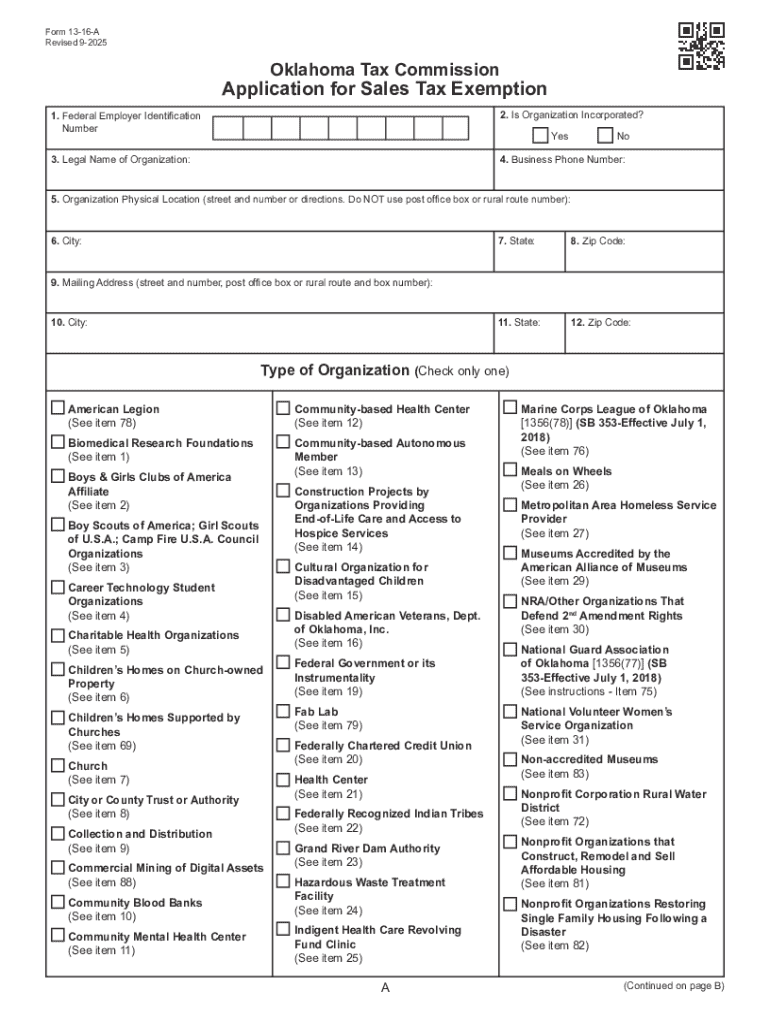

OK Sales Tax Exemption Packet E 2025 free printable template

Get, Create, Make and Sign OK Sales Tax Exemption Packet E

How to edit OK Sales Tax Exemption Packet E online

Uncompromising security for your PDF editing and eSignature needs

OK Sales Tax Exemption Packet E Form Versions

How to fill out OK Sales Tax Exemption Packet E

How to fill out packet e oklahoma sales

Who needs packet e oklahoma sales?

A comprehensive guide to the Packet E Oklahoma Sales Form

Understanding the Packet E Oklahoma Sales Form

The Packet E Oklahoma Sales Form serves as a vital instrument in real estate transactions within the state. Specifically designed for documenting the sale agreement between a buyer and a seller, this form streamlines the complexities of property transactions, ensuring compliance with local laws.

Utilizing the Packet E Form effectively can significantly impact the buying and selling experience in Oklahoma. By clarifying the roles, responsibilities, and expectations of all parties involved, it mitigates potential disputes that may arise during the transaction process.

Preparing to fill out the Packet E Form

Before diving into filling out the Packet E Oklahoma Sales Form, it's imperative to gather relevant information and documents. This ensures that the completion of the form is smooth and accurate. First and foremost, identification requirements include providing government-issued IDs like a driver’s license for both parties.

Additionally, potential sellers and buyers should assemble supporting documents. These may include property tax forms, proof of ownership, and any previously signed agreements related to the property. Having these documents at your disposal can help eliminate confusion and streamline the filling process.

Step-by-step instructions for filling out the Packet E Form

Successfully completing the Packet E Oklahoma Sales Form requires a clear understanding of its layout and information needs. First, familiarize yourself with sections such as Seller Information and Buyer Information, where you'll list relevant personal data of both parties.

Next, outline the Property Details including the address and legal description, ensuring to specify any inclusions like appliances or fixtures. After establishing these foundational elements, you'll need to clarify the Sales Price and Terms, defining the financial specifics of the sale. It's crucial to pay close attention to mandatory fields to avoid processing delays.

Editing and managing the Packet E Form

Once you've filled out the Packet E Form, you may find that you need to make edits or adjustments. Utilizing tools like pdfFiller can be instrumental in this regard. With its user-friendly editing suite, you can modify nearly any element of the form, whether that involves correcting typographical errors or adjusting content as per evolving negotiations.

In addition to editing capabilities, pdfFiller allows you to save and organize your forms efficiently. Establish a structured approach to document management—one that includes clear version control to track changes and updates throughout the real estate transaction process.

Signing the Packet E Form

The signing process of the Packet E Oklahoma Sales Form involves ensuring compliance with Oklahoma's eSignature laws. These laws permit electronic signatures, making it efficient to finalize agreements without the need for physical meetings. An advantage of eSigning is the ability to streamline the entire process, making it faster and reducing paper usage.

To add an eSignature using pdfFiller, simply follow the platform's intuitive interface. Designate the roles of each signer and manage permissions to ensure that the signing process is secure and organized. This electronic approach not only maintains authenticity but also enhances collaboration between parties.

After submission: What’s next?

After submitting the Packet E Oklahoma Sales Form, it's important to be aware of the typical follow-up steps involved. Generally, this includes waiting for processing and approval from the relevant authorities, which could range from a few days to a couple of weeks depending on the complexity of the transaction and local procedures.

During this period, maintain communication with your real estate agent or legal consultant. Should there be any changes or additional documentation needed, knowing the process for amendments and timely submissions will be crucial.

Frequently asked questions about the Packet E Oklahoma Sales Form

Common queries surrounding the Packet E Oklahoma Sales Form typically address concerns about potential mistakes or processing timelines. It's critical to understand that errors on the form can delay the transaction and may require resubmission. Therefore, verifying all entries prior to submission is a recommended best practice.

As for the duration from submission to finalization, be prepared for varying timelines depending on local jurisdiction. Many transactions may take anywhere from a week to several weeks for approval. If you choose to submit the form online, ensure you are aware of the platform's processing times and any additional steps needed for online filings.

Related topics and further reading

Beyond the Packet E Oklahoma Sales Form, exploring other relevant forms within the Oklahoma real estate framework can bolster your preparedness. Understanding the nuances of each form you encounter in a real estate transaction will greatly aid in ensuring compliance and smooth processes.

Additionally, gathering general advice for buyers and sellers can provide insights into market trends and negotiation strategies. Never underestimate the importance of consulting with a legal professional when navigating complex transactions. Their expertise can illuminate potential pitfalls and safeguard your interests.

Related documents and resources

For those seeking additional resources, pdfFiller offers a suite of templates and forms relevant to real estate transactions. Accessing these documents can ease the administrative burden and ensure you have the most current versions.

In conjunction with these forms, leveraging tools like mortgage calculators and budgeting tools can aid in making informed financial decisions. Familiarize yourself with the process of home inspections and appraisals to ensure you are well-prepared for your real estate transaction.

People Also Ask about

Do I claim 0 or 1 on my w4?

Does Oklahoma have a tax exemption certificate?

Who is exempt from oil and gas sales tax in Oklahoma?

Do you get a W-2 if you are exempt?

What is exempt from Oklahoma state sales tax?

How do I get a tax-exempt certificate in Oklahoma?

What form is exempt on taxes?

How do I claim exempt on my taxes?

Should I claim 1 or 0?

What is exempt from state of Oklahoma tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the OK Sales Tax Exemption Packet E form on my smartphone?

How do I complete OK Sales Tax Exemption Packet E on an iOS device?

How do I fill out OK Sales Tax Exemption Packet E on an Android device?

What is packet e oklahoma sales?

Who is required to file packet e oklahoma sales?

How to fill out packet e oklahoma sales?

What is the purpose of packet e oklahoma sales?

What information must be reported on packet e oklahoma sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.