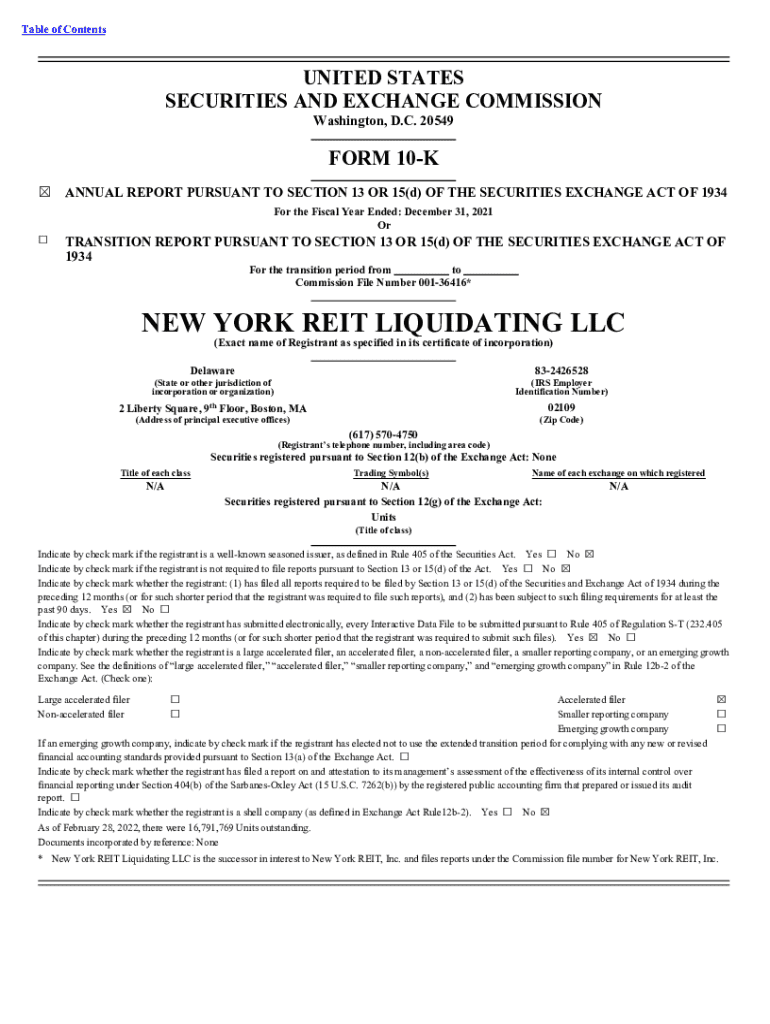

Get the free NEW YORK REIT LIQUIDATING LLC

Get, Create, Make and Sign new york reit liquidating

Editing new york reit liquidating online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york reit liquidating

How to fill out new york reit liquidating

Who needs new york reit liquidating?

Comprehensive Guide to the New York REIT Liquidating Form

Understanding the New York REIT liquidating form

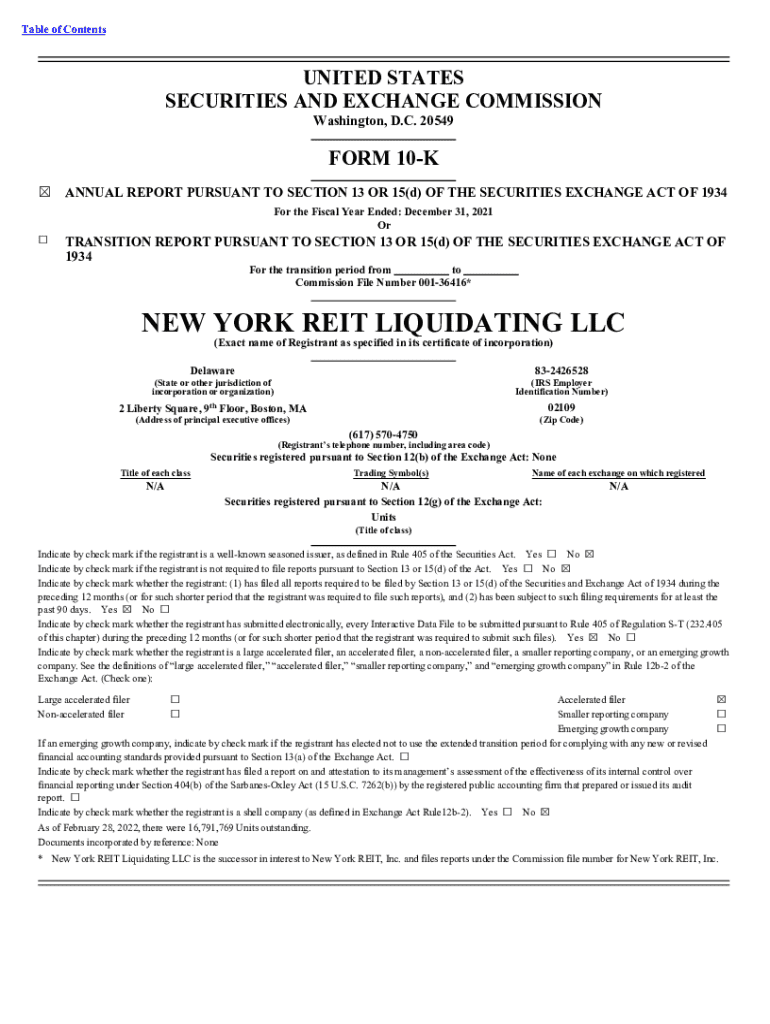

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate across a range of property sectors. By pooling funds from multiple investors, REITs offer an opportunity for individuals to invest in real estate and gain a share of the income produced without having to buy properties directly. In certain circumstances, however, a REIT may need to liquidate its assets, leading to the creation of the New York REIT liquidating form, which serves as a formal declaration of this intent.

The primary purpose of this form is to notify stakeholders of the decision to liquidate assets, driven typically by a need to address financial difficulties, change in business objectives, or market conditions. This legal instrument not only encompasses the REIT's financial dealings but also ensures compliance with state laws and regulations, thereby safeguarding the interests of investors and creditors alike.

Key components of the New York REIT liquidating form

The New York REIT liquidating form contains several essential components designed to collect relevant information for the liquidation process. Firstly, required information sections include basic details that identify the REIT, such as the name, contact details, and address. This foundational data is critical to ensure that all communications are directed toward the appropriate party.

Secondly, the form mandates comprehensive financial disclosures, including a detailed account of the REIT's assets, liabilities, and shareholder information. This transparency is vital for regulators, allowing them to verify the REIT's financial health and the state of its portfolio. Additionally, the legal affirmations and declarations section captures statements required for compliance with New York state laws, outlining the conditions under which a liquidation can occur and how distributions to shareholders will be managed.

Step-by-step guide to completing the New York REIT liquidating form

Completing the New York REIT liquidating form requires careful preparation and organization. Start by gathering all necessary documentation well in advance, including recent financial statements, shareholder lists, and any prior press releases relevant to the liquidation. Ensuring the accuracy of these records is crucial, as they will underpin the financial disclosures required on the form.

Once the documents are prepared, begin filling out the form with precise attention to detail. Each section should be completed thoroughly, with particular care taken in reporting financial information to avoid discrepancies. It’s advisable to cross-verify financial data with your accounting records as you fill out the form. After completing the form, undergo a review and verification process where entries are double-checked for accuracy. Common errors include misreporting figures or omitting essential details, which can lead to delays in processing.

Managing the form post-submission

After submitting the New York REIT liquidating form, it’s crucial to understand what comes next. Typically, there will be a processing timeline that can range anywhere from a few weeks to several months, depending on the state’s regulatory workload and any potential issues with the form’s completeness. It’s in your best interest to keep track of your application status, which may often be done via the New York State Department of State's website or through direct inquiries.

Furthermore, be prepared to respond to any follow-up requests from regulators. Such requests may include additional financial documentation or clarifications regarding your financial states, such as K-1 forms or specific asset evaluations. Efficiently addressing these requests can facilitate a smoother liquidation process, helping you to distribute assets to shareholders in alignment with the declaration of distribution.

Using pdfFiller for the New York REIT liquidating form

In managing the New York REIT liquidating form, pdfFiller offers a robust platform that streamlines the editing, signing, and collaboration processes. With pdfFiller, users can easily make edits to the form to ensure all entries are current and accurate, minimizing the risk of errors. The platform's eSigning capabilities allow stakeholders to sign documents electronically, promoting a faster turnaround and enhancing efficiency.

Collaboration tools within pdfFiller make it easy for teams to provide input and feedback, ensuring that every aspect of the form is vetted before submission. Users can upload the form directly to the platform, utilize a suite of editing tools, and manage submissions seamlessly without switching between multiple applications. This all-in-one approach greatly simplifies the documentation process, making it a preferred option for those navigating the complexities of REIT liquidations.

Common challenges and solutions

Navigating the legal complexities associated with liquidating a REIT presents challenges that require careful consideration. It's crucial for those involved to consult with legal experts well-versed in real estate and corporate law to address potential legal concerns effectively. Engaging with experienced attorneys can offer clarity on the implications of liquidation and help mitigate risks associated with investor disputes or regulatory violations.

Additionally, handling financial reporting issues is another common hurdle during liquidation processes. Teams may encounter difficulties in accurately consolidating financial data or managing outstanding debts. It's advisable to work alongside financial advisors familiar with REIT operations to properly structure financial disclosures and ensure compliance with all reporting standards. Being proactive in these areas can ease the overall liquidation process.

Frequently asked questions (FAQ)

The liquidation process for a REIT can often be misunderstood, leading to various misconceptions. A common question is regarding the timeline for liquidation and what responsibilities shareholders retain during this process. Liquidation is not an instant process; it involves meticulous planning and adherence to state regulations, which can affect how quickly assets are sold and distributed. During this phase, shareholders typically retain rights to any distributions that are declared in the liquidation process.

Specific inquiries about the liquidating form often focus on requirements and best practices for completion. Understanding what documentation needs to be submitted alongside the form can alleviate anxiety. Key aspects include accurate financial disclosures and detailed asset evaluations, which can be pivotal in ensuring compliance with legal mandates. Engaging with resources or guidance can help clarify these nuances.

Resources for further assistance

For further support regarding REIT liquidations and the related New York REIT liquidating form, numerous legal resources are available. Organizations such as the New York State Bar Association offer connections to legal professionals specializing in corporate and real estate law. Engaging with these resources may provide invaluable insights and legal advice tailored to your specific circumstances.

Additionally, financial advisory services focused on REIT matters can lend considerable expertise. Identifying consultants with a solid track record in handling liquidations can enhance your ability to navigate the complexities associated with financial reporting and asset management. These professionals can guide you through regulatory compliance and strategic planning, ultimately positioning you for success throughout the liquidation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new york reit liquidating directly from Gmail?

How do I execute new york reit liquidating online?

Can I create an eSignature for the new york reit liquidating in Gmail?

What is new york reit liquidating?

Who is required to file new york reit liquidating?

How to fill out new york reit liquidating?

What is the purpose of new york reit liquidating?

What information must be reported on new york reit liquidating?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.