Get the free NAIC 2025 Quarterly Statement BlankProperty/Casualty

Get, Create, Make and Sign naic 2025 quarterly statement

Editing naic 2025 quarterly statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out naic 2025 quarterly statement

How to fill out naic 2025 quarterly statement

Who needs naic 2025 quarterly statement?

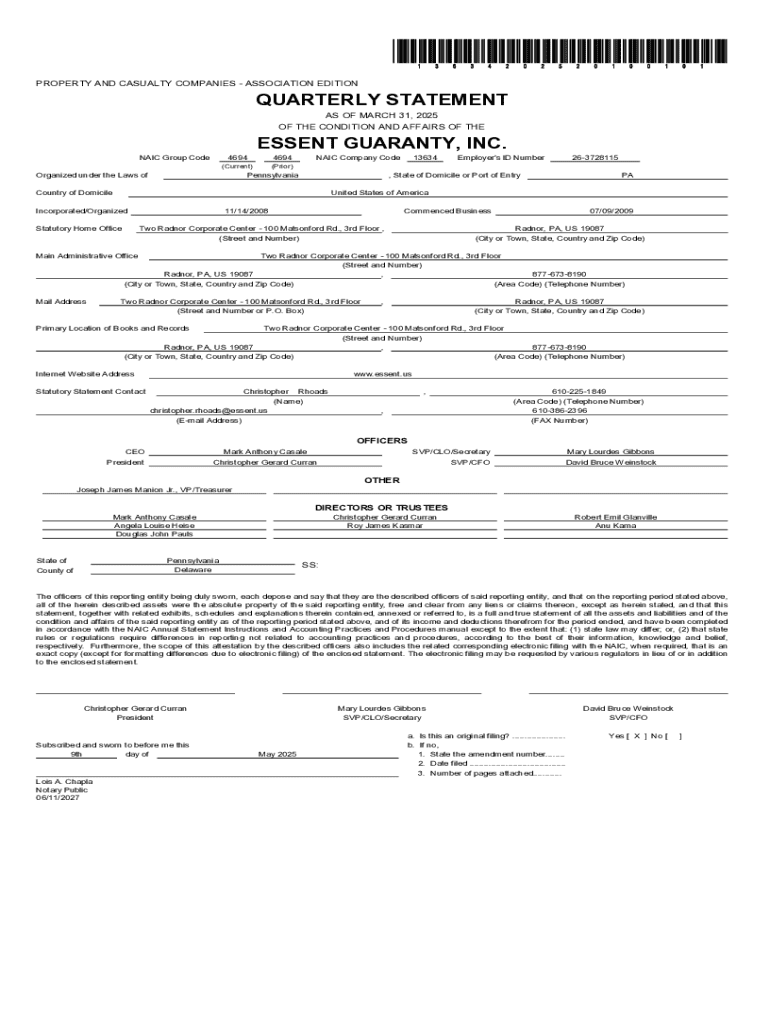

Understanding the NAIC 2025 Quarterly Statement Form: A Comprehensive Guide

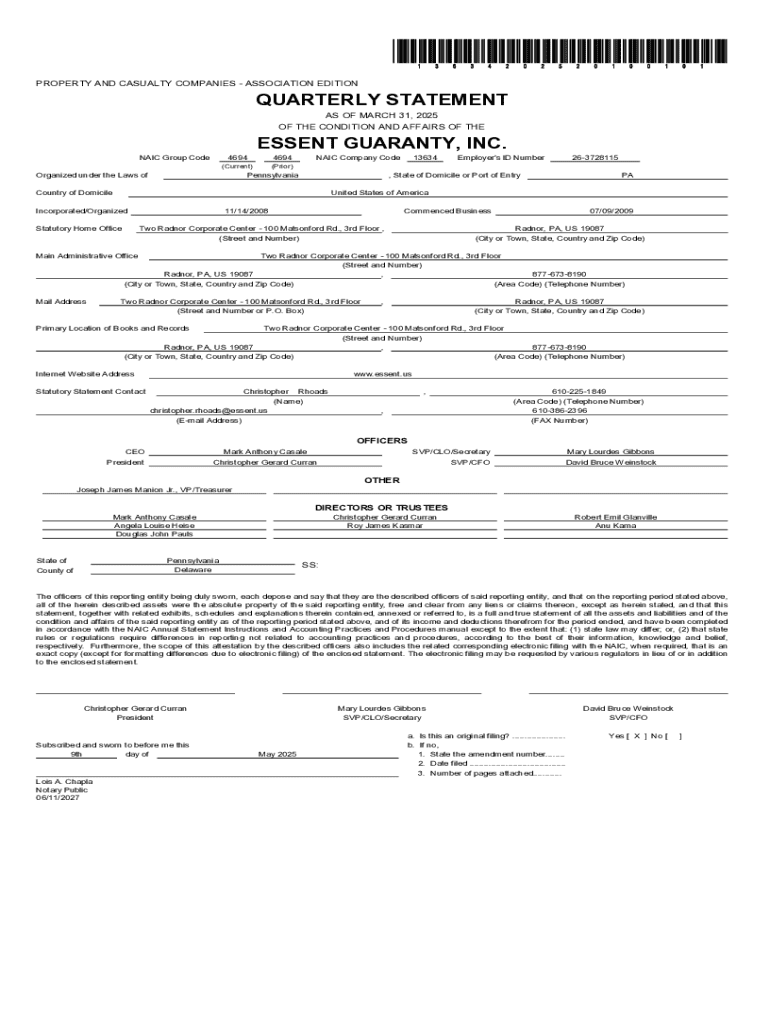

Overview of the NAIC 2025 quarterly statement form

The NAIC 2025 Quarterly Statement Form plays a pivotal role in the insurance industry by serving as a standard document for quarterly reporting. Accurate reporting is essential for insurance entities to maintain trust among stakeholders, ensure compliance with regulatory frameworks, and foster sound financial practices. This form not only represents a company's financial standing but also aids in assessing its operational efficiency and risk management abilities.

Key objectives of the quarterly statement include facilitating transparent financial disclosures, enabling regulators to monitor the industry, and providing stakeholders with critical insights into the entity's performance. Furthermore, compliance with the National Association of Insurance Commissioners (NAIC) standards is instrumental in reinforcing the financial integrity of insurance companies across the nation.

Understanding the structure of the NAIC quarterly statement

Navigating the NAIC 2025 Quarterly Statement Form requires a firm understanding of its structural components. Each major section contributes greatly to the overall health of an insurance entity’s financial reporting framework. Primarily, the form consists of three key sections: Financial Information, Revenue and Expense Accounts, and Statutory Reserves and Surplus Requirements.

The Financial Information section, for instance, presents a comprehensive overview of Assets, Liabilities, and Surplus, which provide insights into the company’s financial stability. This section details the total assets owned by the entity and outlines obligations to policyholders through liabilities, influencing solvency assessments significantly. Conversely, the Revenue and Expense Accounts section elaborates on the income streams generated and expenses incurred, critical for monitoring profitability and operational efficiency.

Step-by-step guide to completing the form

Completing the NAIC 2025 Quarterly Statement Form involves meticulous attention to detail and comprehensive documentation. First, gather all required documentation, including previous quarter statements, financial audits, and supporting evidence of income and expenses. This step is critical to ensure accuracy and minimize discrepancies.

Next, filling out each section demands careful consideration. Here, each line item should be addressed with precision, avoiding common pitfalls such as miscalculations or overlooking essential entries. A checklist can be beneficial here, ensuring that every aspect of the form is accounted for while aiding in a seamless review process before final submission.

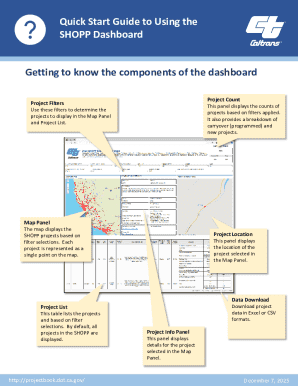

Tools for managing the NAIC quarterly statement

Turning to technology can streamline the management of the NAIC 2025 Quarterly Statement Form. pdfFiller provides document management solutions that facilitate the editing, signing, and collaboration required for effective reporting. Features such as real-time data entry, e-signature capabilities, and cloud-based access empower users to work efficiently from any location.

Interactive tools offered by pdfFiller allow teams to manage documents collectively, ensuring everyone is aligned and up-to-date on changes made to the quarterly statements. Employing cloud-based solutions mitigates risks associated with lost documents and fosters a collaborative environment that can significantly reduce workload during peak reporting periods.

Frequently asked questions

Questions regarding the NAIC 2025 Quarterly Statement Form abound, reflecting the complexities involved in its preparation and submission. One common inquiry pertains to who must file the quarterly statement. Generally, all licensed insurance entities are required to submit this form to ensure regulatory compliance.

Another prevalent concern addresses the penalties for late submission. Regulatory bodies often impose fines or escalate reporting requirements for overdue filings, emphasizing the importance of timely submissions. Lastly, many organizations query how discrepancies can be addressed post-submission, which often involves submitting an amended statement or communicating with regulators to rectify errors.

Best practices for ensuring compliance

Compliance with the NAIC 2025 Quarterly Statement Form mandates continuous vigilance. Regular updates on regulatory changes are crucial, and it is beneficial to stay informed of any NAIC developments affecting reporting requirements. By subscribing to relevant newsletters or attending industry seminars, insurance professionals can remain cognizant of changes that may influence their submissions.

Engaging with industry networks offers additional layers of support. Joining professional committees can provide access to shared resources, best practices, and industry insights, while also fostering a sense of community among peers. Furthermore, utilizing resources from state insurance departments can guide teams in addressing specific regulation questions, ensuring consistent compliance as requirements evolve.

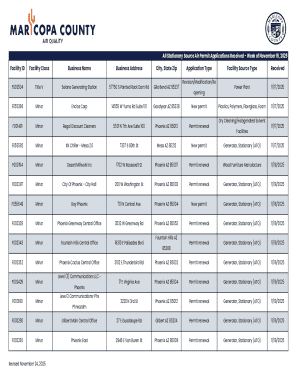

Case studies: successful submissions

Examining successful submissions can yield valuable insights for insurance entities navigating the NAIC 2025 Quarterly Statement Form. A recent case study highlighted a medium-sized insurer that streamlined the completion of its quarterly statement by adopting advanced documentation tools. By employing a cloud-based document management system, the company was able to enhance accuracy and reduce the turnaround time from weeks to days.

Lessons learned from this case emphasize the importance of early preparation, regular internal audits, and collaboration among departments. By establishing clear responsibilities and timelines, organizations can create a structured workflow that mitigates last-minute bottlenecks and encourages thorough reviews, ultimately leading to successful, compliant submissions.

Looking ahead: future changes to the NAIC quarterly statement form

As we approach 2025, stakeholders should prepare for expected revisions to the NAIC Quarterly Statement Form, which may introduce new data requirements or alter existing reporting standards. Anticipating these changes early allows organizations to adapt their practices and incorporate these adjustments into their workflows efficiently.

The implications of these changes could be significant, necessitating enhanced reporting capabilities or additional documentation. Insurance entities should proactively align their processes with evolving regulatory landscapes to ensure compliance and safeguard operational integrity.

Final remarks on effective document management

Effective document management is paramount in the context of the NAIC 2025 Quarterly Statement Form. Utilizing cloud-based tools like pdfFiller not only enhances workflow efficiency but also ensures that documents are secure and accessible from anywhere. Emphasizing such technology solutions within teams alleviates risks associated with data loss and fosters a collaborative atmosphere conducive to accurate reporting.

A holistic approach to document management, encompassing editing, eSigning, and real-time collaboration, empowers users to maintain compliance effortlessly while enhancing overall productivity. As insurance companies navigate the complex landscape of regulatory requirements, the importance of integrating robust tools into their reporting processes cannot be overstated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get naic 2025 quarterly statement?

How do I make edits in naic 2025 quarterly statement without leaving Chrome?

Can I create an electronic signature for the naic 2025 quarterly statement in Chrome?

What is naic 2025 quarterly statement?

Who is required to file naic 2025 quarterly statement?

How to fill out naic 2025 quarterly statement?

What is the purpose of naic 2025 quarterly statement?

What information must be reported on naic 2025 quarterly statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.