Get the free Diesel Fuel and Motor Vehicle Fuel Tax Refund Claims - CDTFA

Get, Create, Make and Sign diesel fuel and motor

Editing diesel fuel and motor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out diesel fuel and motor

How to fill out diesel fuel and motor

Who needs diesel fuel and motor?

Diesel Fuel and Motor Form How-to Guide

Understanding diesel fuel regulations

Diesel fuel plays a pivotal role in various industries, especially in transportation, agriculture, and construction sectors. Understanding the regulations surrounding diesel fuel usage is crucial for compliance and avoiding penalties. These regulations are designed to ensure that businesses operate within the legal framework while contributing to environmental conservation.

Compliance with regulatory guidelines is essential not only for legal reasons but also for maintaining industry standards. Non-compliance can lead to hefty fines, shutdowns, or damage to reputation, affecting long-term business viability. Knowing the specific diesel fuel regulations for your state or region can provide an edge in operational reliability.

Types of diesel fuel forms

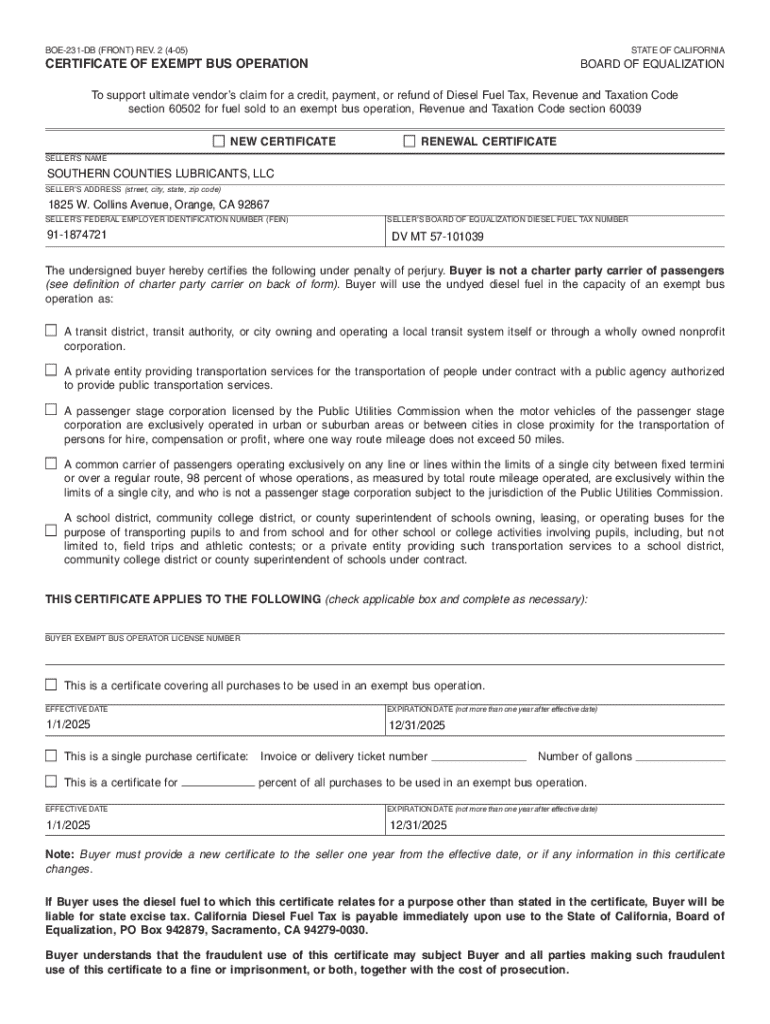

In the realm of diesel fuel management, various forms are employed to ensure proper reporting and compliance. These forms are crucial for documenting the production, distribution, and consumption of diesel fuel. The two primary forms you will encounter are Form 3520-12A and Form 3520-12Q.

Form 3520-12A is the Fuel Manufacturer Annual Report. Its purpose is to summarize all diesel fuel transactions over the year, allowing regulators to assess fuel usage and tax compliance holistically. This form includes vital sections such as business identification, summary of fuel production, and details of fuel sales.

Key requirements for filling out diesel fuel forms

Filing diesel fuel forms accurately is vital for regulatory compliance. Essential information needed on these forms includes business identification details, transaction specifics regarding diesel fuel, such as quantities and prices. Each section of the form demands careful attention to detail to avoid mistakes that could lead to compliance issues.

Common mistakes can arise during the filling process, such as incorrect business identification or entering inaccurate transaction data. Keeping accurate records and supporting documentation can mitigate these risks. Invoices and delivery receipts are critical documents that provide necessary evidence for your reported transactions.

Step-by-step guide for completing diesel fuel forms

Completing diesel fuel forms is a task that requires organization and accuracy. Here, we’ll break down the steps necessary to fill out Form 3520-12A and Form 3520-12Q.

Utilizing pdfFiller for diesel fuel forms

pdfFiller stands out as an innovative solution for managing diesel fuel forms through its user-friendly interface and cloud-based capabilities. Users can easily access and fill out necessary forms, enhancing their document management processes.

One notable feature is the editing capabilities that allow users to streamline fillable fields, ensuring that all information can be accurately captured. Additionally, the eSignature function enables users to legally validate submissions. Collaboration tools facilitate teamwork, providing real-time feedback for efficient completion.

Troubleshooting common issues with diesel fuel forms

Even with careful attention to detail, issues can arise during the submission of diesel fuel forms. Common problems include submission delays, form rejections, or incorrect data entries.

Contacting regulatory bodies for clarifications is advisable when uncertainties occur. Moreover, being familiar with the procedures for making amendments to already submitted forms can save time and help to maintain compliance.

Ensuring ongoing compliance and recordkeeping

Establishing best practices for recordkeeping is essential for businesses involved in diesel fuel management. Proper documentation and systematic record maintenance not only aid in compliance but also facilitate smoother operations during audits.

Staying updated on regulatory changes affecting diesel fuel is vital for compliance. Utilizing pdfFiller enhances record maintenance efforts, allowing for the seamless organization and retrieval of documents when needed.

FAQs about diesel fuel and motor forms

Understanding common queries about diesel fuel forms can help streamline the management process. Potential questions may arise during the filling out or submission phases and addressing these can ease the burden on businesses.

For example, knowing what actions to take if a form is rejected or determining the retention period for fuel records can prevent future complications. Being aware of fuel tax credits and deductions adds another layer of financial benefit to proper diesel fuel management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my diesel fuel and motor directly from Gmail?

Can I create an electronic signature for signing my diesel fuel and motor in Gmail?

How can I edit diesel fuel and motor on a smartphone?

What is diesel fuel and motor?

Who is required to file diesel fuel and motor?

How to fill out diesel fuel and motor?

What is the purpose of diesel fuel and motor?

What information must be reported on diesel fuel and motor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.