Get the free TAX$AVE NEWS

Get, Create, Make and Sign taxave news

Editing taxave news online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxave news

How to fill out taxave news

Who needs taxave news?

Taxave News Form: Detailed How-to Guide

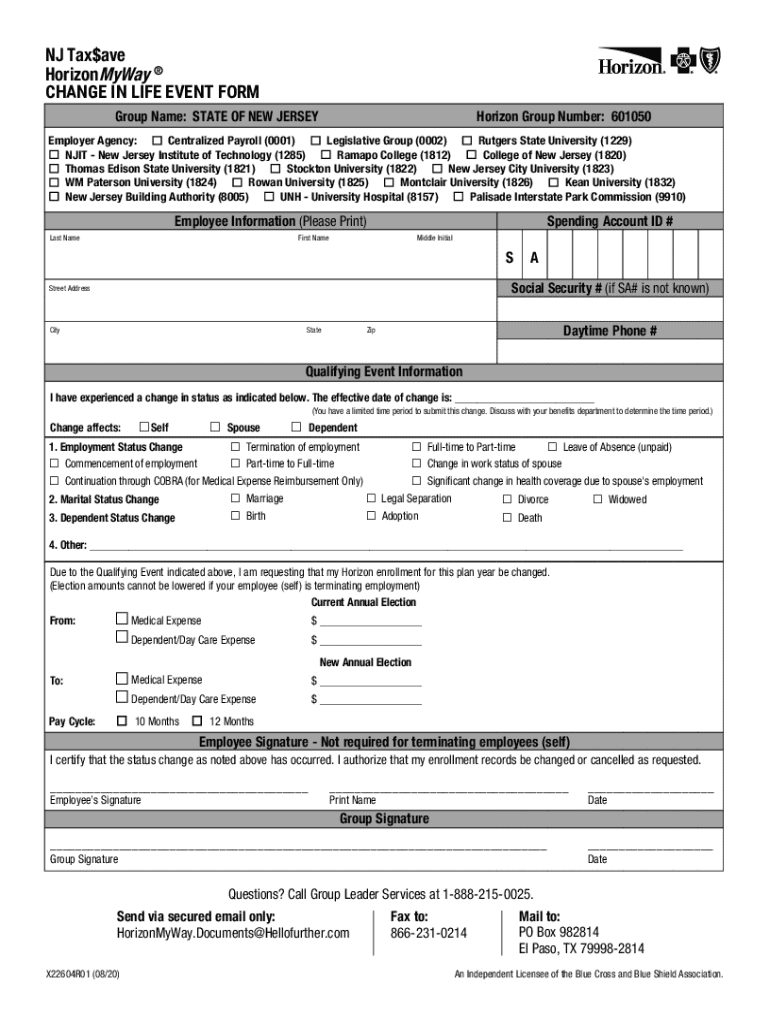

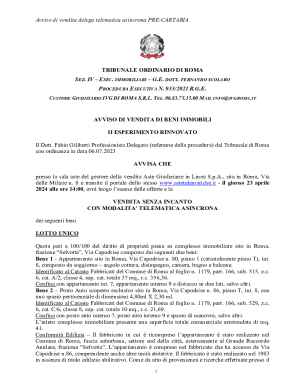

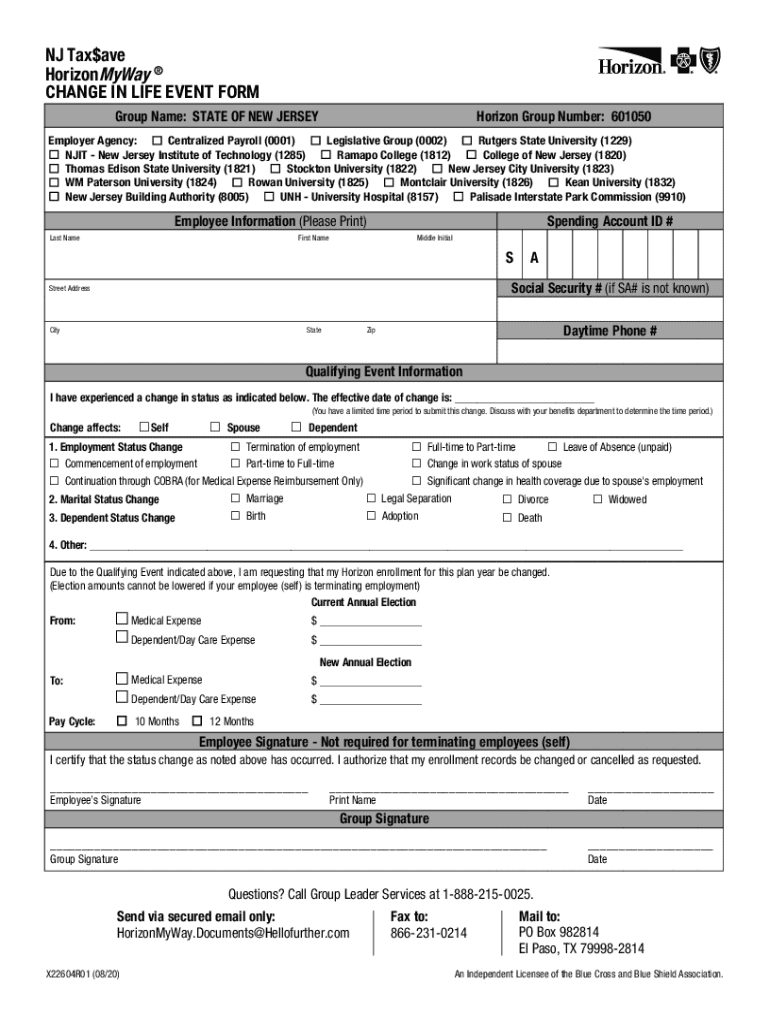

Understanding the Taxave News Form

The Taxave News Form serves as a vital tool for individuals and organizations alike, streamlining the process of tax reporting and compliance. This form is designed to collect essential information required for accurate tax filings, contributing to both individual tax obligations and broader organizational accounting practices.

Having a clear understanding of the Taxave News Form is crucial for those who must navigate the complex tax landscape. By utilizing this form, users can ensure their tax submissions are complete and compliant with regulations, ultimately avoiding potential legal issues and fines.

Who needs to use the Taxave News Form?

The Taxave News Form is essential for two primary groups: individuals and organizations. Individuals seeking to file taxes for the first time or needing to update their financial information will find this form invaluable. Similarly, teams and organizations can utilize it to maintain comprehensive records of financial activities, ensuring that all members are aligned and compliant with tax laws.

Employers managing numerous employees can streamline their reporting processes by implementing this form. This collaborative approach not only enhances accuracy but also fosters a culture of transparency around financial obligations within the organization.

Key features of the Taxave News Form

The Taxave News Form stands out due to its user-friendly interface that allows for seamless data entry. Users can navigate through the form with ease, ensuring they complete necessary sections without feeling overwhelmed. One significant feature is its capacity for advanced data reporting and financial disclosures, accommodating detailed accounts of income, expenditures, and supporting documents.

Integration with other tax documents allows users to create a cohesive filing system, improving efficiency when managing multiple forms. The adaptability of the Taxave News Form ensures that it meets the unique needs of different users, making it a versatile addition to any tax toolkit.

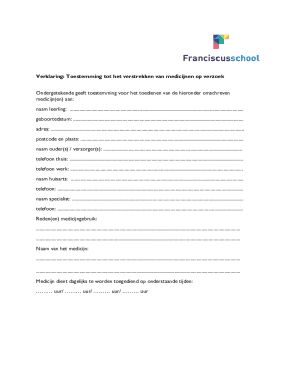

Preparing to fill out the Taxave News Form

Preparing to complete the Taxave News Form necessitates gathering and organizing key personal information. Before diving into the form, users should compile their identification details, including Social Security numbers, taxpayer ID numbers, and contact information. Additionally, financial details like income statements, expense receipts, and prior tax returns will be vital.

Having supporting documents on hand will streamline the process, ensuring accuracy and completeness. Essential documents may include W-2 forms, 1099s, and any relevant financial statements from bank accounts or investment portfolios.

Tools for successful form completion

Using digital tools like pdfFiller dramatically enhances the ease of filling out the Taxave News Form. This software allows for real-time edits and changes, making it easier to manage any required adjustments. Moreover, pdfFiller’s template library provides a straightforward way to access the specific form necessary for tax reporting.

When opting to fill the form manually, ensure you have reliable writing instruments and a quiet space to prevent distractions. Digital tools typically offer advantages such as spell checking, easy reordering of pages, and a cleaner layout.

Step-by-step guide to completing the Taxave News Form

Accessing the Taxave News Form online starts by navigating to the pdfFiller platform. Once there, users can search for the Taxave News Form in the template section. The power of pdfFiller lies in its ability to provide an intuitive interface where forms can be easily filled out and saved.

Detailed instructions for each section of the form

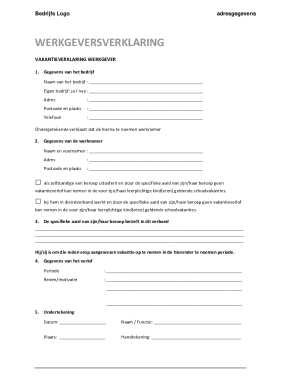

Section 1: Personal information

In this crucial section, users must provide accurate personal details, including full names, addresses, and contact information. Common mistakes include typos and omissions, which can lead to processing delays.

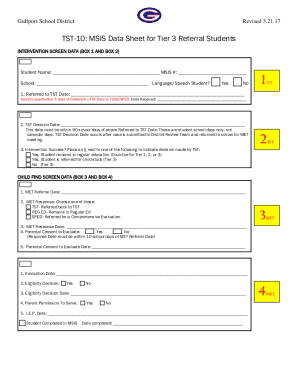

Section 2: Financial disclosure

This section requires users to input income amounts and detail any potential deductions. Keeping a calculator handy can aid in ensuring all numbers are accurate and double-checked.

Section 3: Supplementary information

This section invites users to add comments, explanations, or notable circumstances regarding their tax situation. Clarity is key here, so providing concise but comprehensive information is advisable.

Using pdfFiller tools for efficient editing

Through pdfFiller, users can easily insert text, images, or even signatures directly into the form. The eSignature feature further simplifies approvals, making this an efficient avenue for both individuals and teams.

Collaborative features for teams

Collaboration on the Taxave News Form not only simplifies the workload but also enhances accuracy through team input. pdfFiller allows multiple users to access the form, facilitating real-time edits that can be viewed instantly.

Managing user permissions is another essential aspect of collaboration. Leaders can set access levels for team members, determining who can edit, view, or comment on the form. This function serves to protect sensitive information while allowing for necessary contributions from various stakeholders.

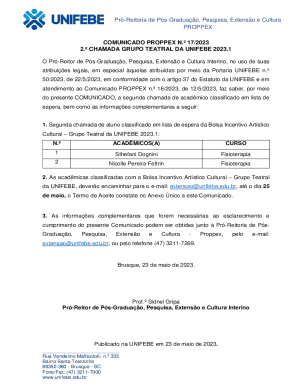

Finalizing and submitting the Taxave News Form

Once the form is complete, it's vital to take the time to review it thoroughly. A checklist can help ensure every section is filled out correctly. Pay particular attention to potential spelling mistakes and arithmetic errors, which could lead to serious processing issues.

Submitting the Taxave News Form via pdfFiller can be done effortlessly. Users can leverage the eSigning functionality to sign the document digitally, which ensures both authenticity and security. Understanding submission guidelines is crucial; different scenarios may dictate whether to file electronically or via mail.

Troubleshooting common issues with the Taxave News Form

Common mistakes when filling out the Taxave News Form typically involve incomplete sections or incorrect data entries. To prevent these pitfalls, users should refer to comprehensive examples and possibly consult a tax professional when unsure about specific entries.

Frequently asked questions often include inquiries about submission deadlines, document types required, and how to amend previously submitted forms. If challenges arise, leveraging resources and community support through pdfFiller can offer additional assistance and clarity.

Advanced tips for managing your Taxave News Form

Keeping your documents organized within pdfFiller can drastically improve efficiency. Implementing file management strategies—such as creating folders for each tax year or prominent financial categories—will streamline the retrieval of these forms in the future.

Regularly updating your Taxave News Form when any personal or financial changes occur is critical. Version control features allow users to keep track of changes over time, minimizing confusion when referencing past information.

Best practices for maintaining tax compliance

Understanding the specific tax obligations related to your Taxave News Form is paramount. Compliance requirements can vary by location and financial circumstance, so staying informed on local regulations will help ensure adherence to deadlines and minimize penalties.

Utilizing pdfFiller’s features can also assist in compliance tracking. Setting reminders for critical tax deadlines through the platform can prevent missed submissions or late fees, keeping users aligned with their financial responsibilities.

Exploring additional features of pdfFiller for document management

Beyond filling out forms, pdfFiller offers a suite of comprehensive document editing capabilities. Users can manipulate PDFs with ease, incorporating various templates tailored for different needs. This extends the functionality of the Taxave News Form into a broader context of document management.

The cloud-based platform ensures that documents are accessible from any device, allowing users to work from anywhere. This not only increases efficiency but also guarantees the security and backup of essential documents, offering peace of mind in an age where data breaches can occur.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit taxave news from Google Drive?

How do I make edits in taxave news without leaving Chrome?

How can I fill out taxave news on an iOS device?

What is taxave news?

Who is required to file taxave news?

How to fill out taxave news?

What is the purpose of taxave news?

What information must be reported on taxave news?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.