Get the free Instructions for Form 8810: Corporate Passive Activity Loss ...

Get, Create, Make and Sign instructions for form 8810

Editing instructions for form 8810 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 8810

How to fill out instructions for form 8810

Who needs instructions for form 8810?

Instructions for Form 8810: A Comprehensive Guide for Corporations

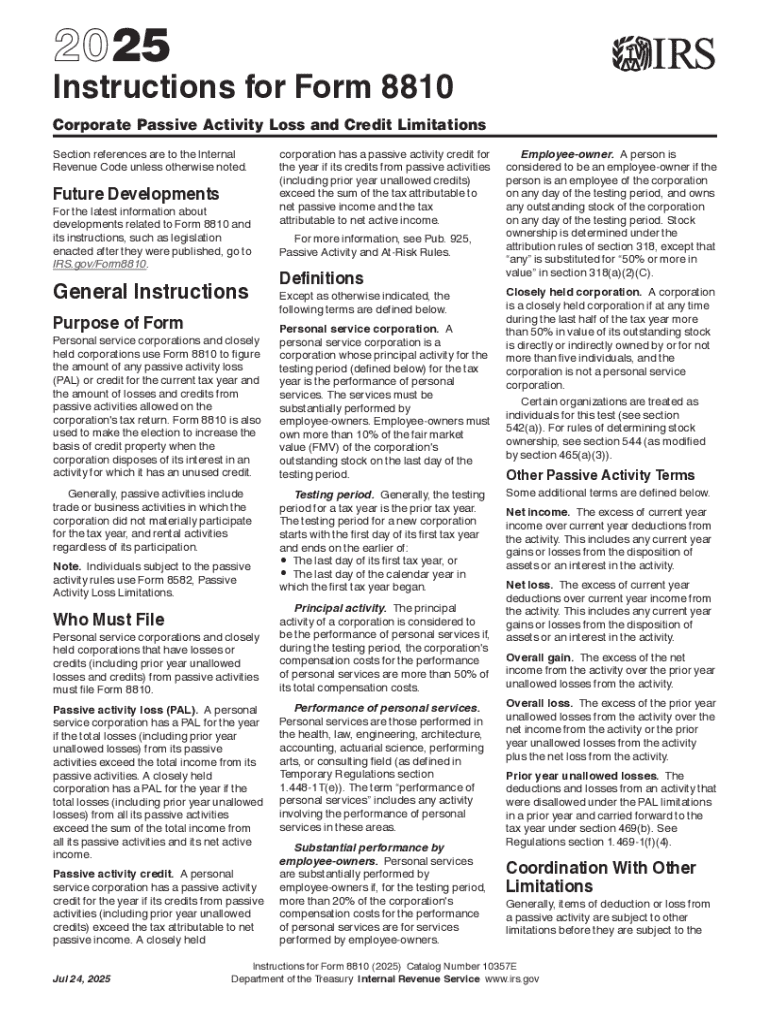

Understanding Form 8810: An overview

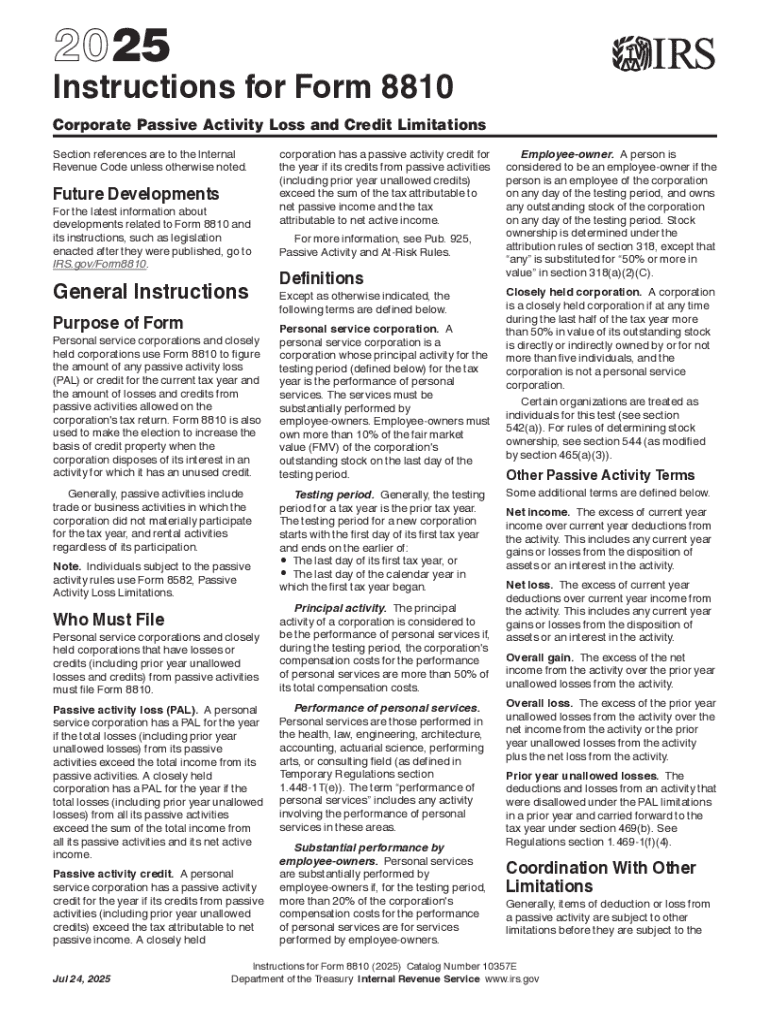

Form 8810 is a crucial document used by corporations to report passive activity losses and credits. This form provides the IRS with necessary information about corporate income generated from passive activities, which include investment in partnerships, rental activities, and more. The primary purpose of Form 8810 is to ensure that corporations accurately report passive activity losses that they may wish to deduct against their income for tax purposes.

Accurate filing of Form 8810 is essential, as it helps corporations maintain compliance with tax regulations while also optimizing their potential tax benefits. Failure to file correctly can lead to missed opportunities for loss deductions, or worse, unintended penalties from the IRS.

Key features of Form 8810

Understanding the key features of Form 8810 is vital for corporate tax planning. The form includes sections specifically designed to simplify the passive activity loss rules, making them easier for corporations to navigate. Corporations must provide detailed information such as their passive activity income, losses, and any applicable tax credits. This transparency enables the IRS to cross-check the provided figures with other tax documents.

Essential definitions associated with the form include passive activities, which refer to operations in which a business taxpayer does not materially participate, and credits that are derived from these activities. Having clarity on these terms ensures that corporations can correctly apply their losses against taxable income to minimize their tax liabilities effectively.

Who needs to file Form 8810?

Corporations with passive activity losses must file Form 8810. This generally includes C-corporations involved in rental activities, participating in partnerships, or earning income from trades where they do not materially participate. The criteria for filing can depend heavily on the nature of their operations and the amount of passive activity loss they are reporting.

Certain small corporations may qualify for exemptions and thus are not required to file this form. Additionally, corporations actively engaged in trade or businesses that do not involve passive activities may not need to submit Form 8810. Identifying the specific circumstances surrounding your corporation is essential for compliance.

Preparing to file Form 8810

Before submitting Form 8810, corporations should gather necessary documentation to ensure accurate reporting. Essential documents include the tax year information, previous years' records of passive activity losses and credits, as well as any relevant supporting statements. This preparation is crucial in minimizing errors, facilitating smoother processing, and ensuring all reported amounts are correct.

Corporations must also be aware of key dates and deadlines for filing Form 8810. Typically, deadlines coincide with the corporate tax return due date. Understanding whether to e-file or file a paper return is important, as electronic filing can often expedite processing and reduce potential errors.

Step-by-step instructions for completing Form 8810

Completing Form 8810 involves several sections that need careful attention. First, ensure that the header information is correct, including the corporation's name and identification number. The second section deals with passive activity loss details, where corporations must report their current year losses as well as any carryover loss information from previous years.

In the calculation of credits section, corporations must provide an overview of any passive activity credits they are claiming. Steps to calculate these credits involve identifying the appropriate amounts and ensuring they align with losses reported. To avoid common errors, it's recommended to review entries double-checking for mathematical accuracy.

Managing passive activity losses: advanced guidelines

Corporate tax managers must understand how passive activity loss limits work, particularly under the IRS guidelines. The general rule limits the amounts that can be deducted against non-passive income. Moreover, rental real estate activities have specific considerations, especially for controlled foreign corporations (CHCs) that could notify exceptions based on active participation thresholds.

Additionally, understanding how gains impact these losses is critical. Realizing that gains can offset passive activity losses can significantly affect overall tax liability. Therefore, corporate teams should regularly collaborate to manage and track such activities, ensuring compliance and maximizing benefits.

Troubleshooting common issues with Form 8810

Common filing errors can lead to unnecessary complications. Mismatched information, such as incorrect taxpayer ID numbers or misreported income, may trigger audits or delays in processing. Additionally, calculation errors are prevalent pitfalls that can fundamentally alter tax liability and create complications.

Corporations should know their options for amending previous submissions or correcting errors found in Form 8810. Understanding the amendment process is essential for staying compliant with IRS regulations and minimizing adverse repercussions.

Utilizing pdfFiller for Form 8810 management

Leveraging tools like pdfFiller for completing Form 8810 offers tremendous advantages. The platform allows users to manage, fill, and edit the form seamlessly without the hassle of downloading and printing. With interactive tools available, corporate teams can collaborate on document preparation effectively and ensure accuracy before submission.

Adding electronic signatures to a completed form within pdfFiller enhances efficiency considerably. Furthermore, the ability to store, share, and edit documents in the cloud makes managing these critical forms a streamlined process, especially for teams spread across various locations.

FAQs about Form 8810

Many corporations have questions surrounding the filing of Form 8810. Common queries include when the form is necessary, with the answer being when a corporation has passive activity losses to report. Filing deadlines are also critical; corporations must ensure they file by the stated due dates to avoid penalties.

Another frequently asked question relates to what to do if a corporation misses its filing deadline. In this case, they can file a late submission or request an extension, but they need to follow the IRS’s stipulated guidelines. Additionally, amending a previously filed Form 8810 is permissible but requires careful navigation of IRS procedures.

Conclusion: Ensuring compliance with Form 8810

Staying informed on the latest tax regulations regarding Form 8810 is vital for corporations. Proactively managing corporate documents and ensuring accurate submissions can prevent compliance issues. Utilizing robust document management solutions like pdfFiller can simplify the process of editing, signing, and storing critical forms, making the responsibility of navigating tax regulations much more manageable.

Ultimately, understanding and adhering to the requirements surrounding Form 8810 can provide significant benefits for corporations when it comes to reporting losses and credits effectively, all while ensuring compliance with IRS regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my instructions for form 8810 directly from Gmail?

How do I fill out the instructions for form 8810 form on my smartphone?

How can I fill out instructions for form 8810 on an iOS device?

What is instructions for form 8810?

Who is required to file instructions for form 8810?

How to fill out instructions for form 8810?

What is the purpose of instructions for form 8810?

What information must be reported on instructions for form 8810?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.