Get the free 2025 Form RI-1040H - tax ri

Get, Create, Make and Sign 2025 form ri-1040h

How to edit 2025 form ri-1040h online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form ri-1040h

How to fill out 2025 form ri-1040h

Who needs 2025 form ri-1040h?

Understanding the 2025 Form RI-1040H: A Comprehensive Guide

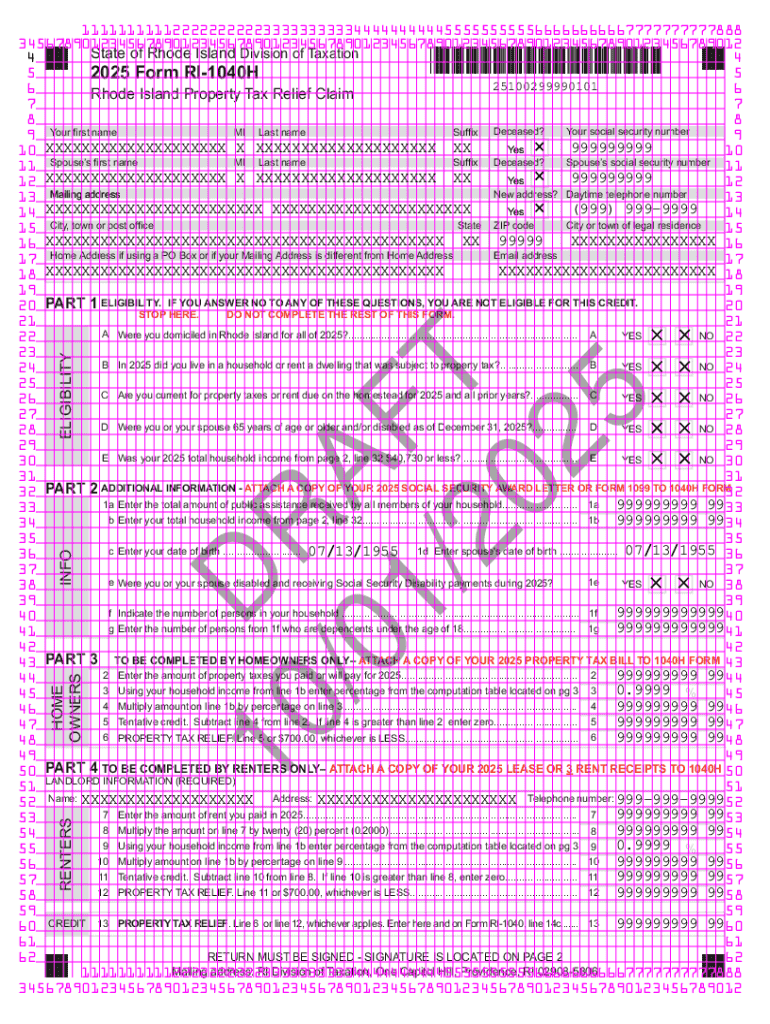

Overview of the 2025 Form RI-1040H

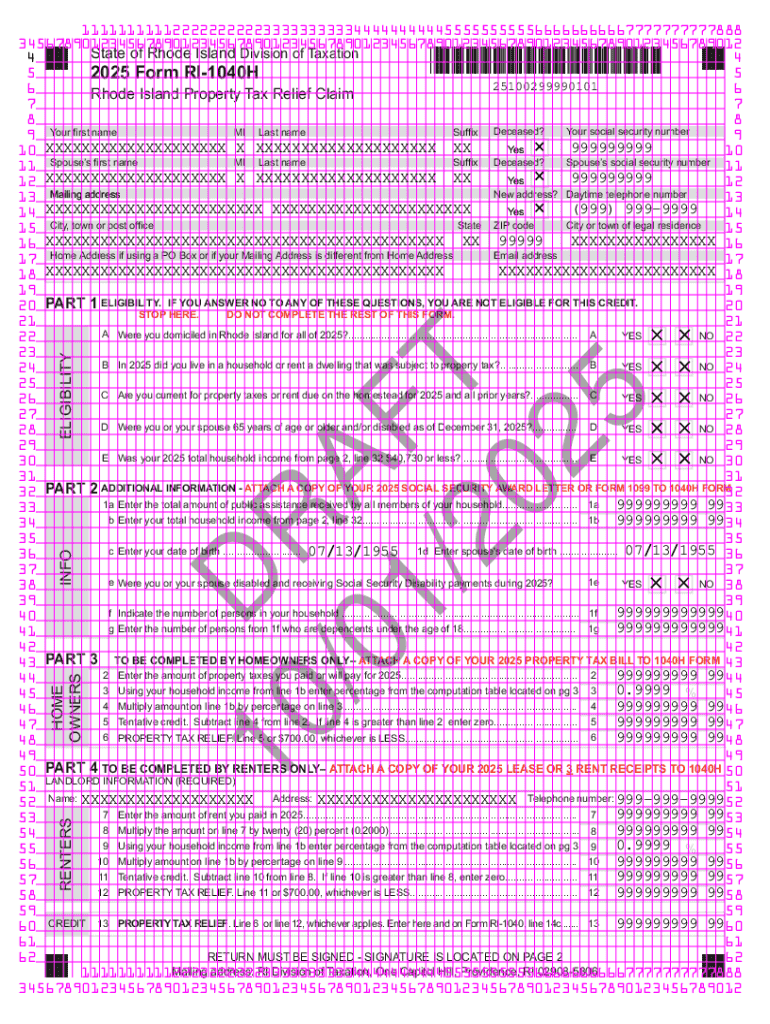

The 2025 Form RI-1040H is a crucial document for Rhode Island residents seeking property tax relief. This form serves as an application for the state's property tax relief program, which is designed to alleviate the financial burden on taxpayers, especially those in vulnerable demographics.

By filling out the RI-1040H, taxpayers are able to claim various forms of tax credits directly related to property ownership. It not only contributes to making housing more affordable but also supports the broader goal of economic stability within the state.

Key features of the RI-1040H Form

The RI-1040H form possesses several key features that streamline the process of claiming property tax relief. Understanding these features is vital for taxpayers aiming to maximize their benefits while ensuring compliance with state requirements.

Among the primary benefits of the form are the types of tax relief available, the simplified application process, and the direct connection to financial assistance for needy taxpayers. The eligibility criteria are aimed at fostering opportunities for marginalized groups, including seniors and low to moderate-income residents.

Step-by-step instructions for completing the 2025 RI-1040H Form

Completing the RI-1040H form can seem daunting, but breaking it down into manageable steps simplifies the task. The following sections outline how to properly fill out the form to ensure successful submission and optimal tax relief.

1. Personal Information: Start by accurately entering required details such as your name, address, and Social Security number. Ensure that all information matches your official documents to avoid processing delays.

2. Income Information: In this section, report your total taxable income. This will include wages, pensions, and any other sources of income. Be sure to include any adjustments applicable to your financial situation.

3. Property Information: Provide detailed documentation verifying your ownership of the property. This may include property deeds, tax bills, and any related correspondence from tax authorities.

4. Tax Relief Calculation: This step involves calculating your eligible tax relief amounts based on the provided income and property information. Familiarize yourself with the relevant tax codes to ensure accuracy.

5. Certification: Finally, review your completed form, sign, and date it. Ensure you follow guidelines for certification as required by the state.

Interactive tools and calculators

Utilizing interactive tools can simplify the process of completing your 2025 Form RI-1040H. pdfFiller offers a variety of utilities to assist during this process, enhancing both accuracy and efficiency.

Among the features are auto-fill sections where users can import their previously saved data, saving time and preventing errors. Additionally, there are tax credit calculators that help estimate eligible amounts, providing clarity on what assistance can be expected.

Common mistakes to avoid when completing the RI-1040H

Taxpayers often make several common errors when completing the RI-1040H, leading to delays or denial of their applications. Understanding these pitfalls can help ensure a smooth filing process.

To mitigate these issues, thoroughly review each entry before submission. It's advisable to have someone else check your form for additional verification.

Submitting the 2025 Form RI-1040H

Once the RI-1040H form is filled out completely, the next critical step is submission. Timeliness and proper delivery are crucial for ensuring your application is processed within the required deadlines.

1. Where to send: Completed forms should be mailed to the Rhode Island Division of Taxation. Be sure to check the most current address on the official website to avoid delays.

2. Key deadlines: Each year has specific cut-off dates for submission, primarily impacting recipients looking to benefit from the current tax year. Stay updated on all relevant deadlines to maximize your tax relief.

3. Electronic submission: Should you prefer, there may be options for electronic submission through designated portals that can streamline the process even further.

Next steps after submission

After submitting your 2025 Form RI-1040H, various next steps are essential for managing your tax relief process effectively. Knowing what to expect can assist in planning your finances.

1. What to expect: Processing times may vary, so it's important to be patient. Tax officials will notify you through the contact information provided on the form.

2. Checking the status: You can often check the status of your submission through the Rhode Island Division of Taxation's online platform or by calling their office directly.

3. Managing future applications: Keep a record of your application and be proactive in following up if there are any outstanding questions. This can simplify future claims.

Utilizing pdfFiller’s features for ongoing document management

pdfFiller provides advantageous tools for users mandating effective document management beyond just filing the 2025 Form RI-1040H. Leveraging these features can empower taxpayers to stay organized and compliant.

1. Editing and signing: Easily edit PDFs and add e-signatures using pdfFiller, allowing for a seamless signing experience without needing to print documents.

2. Keeping records organized: Utilize folders and tags within pdfFiller to categorize your tax-related documents for easy access whenever necessary.

3. Cloud storage: Store all your tax documentation securely in the cloud, ensuring that you can access them from anywhere when needed.

FAQs about the 2025 Form RI-1040H

Navigating the complexities of tax relief can raise numerous questions. The following FAQs address common concerns related to the 2025 Form RI-1040H and help demystify the filing process.

Contact information for further assistance

For taxpayers requiring additional guidance or those looking to resolve specific inquiries concerning the 2025 Form RI-1040H, reaching out to the proper resources is essential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2025 form ri-1040h online?

Can I create an electronic signature for the 2025 form ri-1040h in Chrome?

Can I create an eSignature for the 2025 form ri-1040h in Gmail?

What is 2025 form ri-1040h?

Who is required to file 2025 form ri-1040h?

How to fill out 2025 form ri-1040h?

What is the purpose of 2025 form ri-1040h?

What information must be reported on 2025 form ri-1040h?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.