Get the free North Dakota Tax CreditBismarck, ND - Official Website

Get, Create, Make and Sign north dakota tax creditbismarck

Editing north dakota tax creditbismarck online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north dakota tax creditbismarck

How to fill out north dakota tax creditbismarck

Who needs north dakota tax creditbismarck?

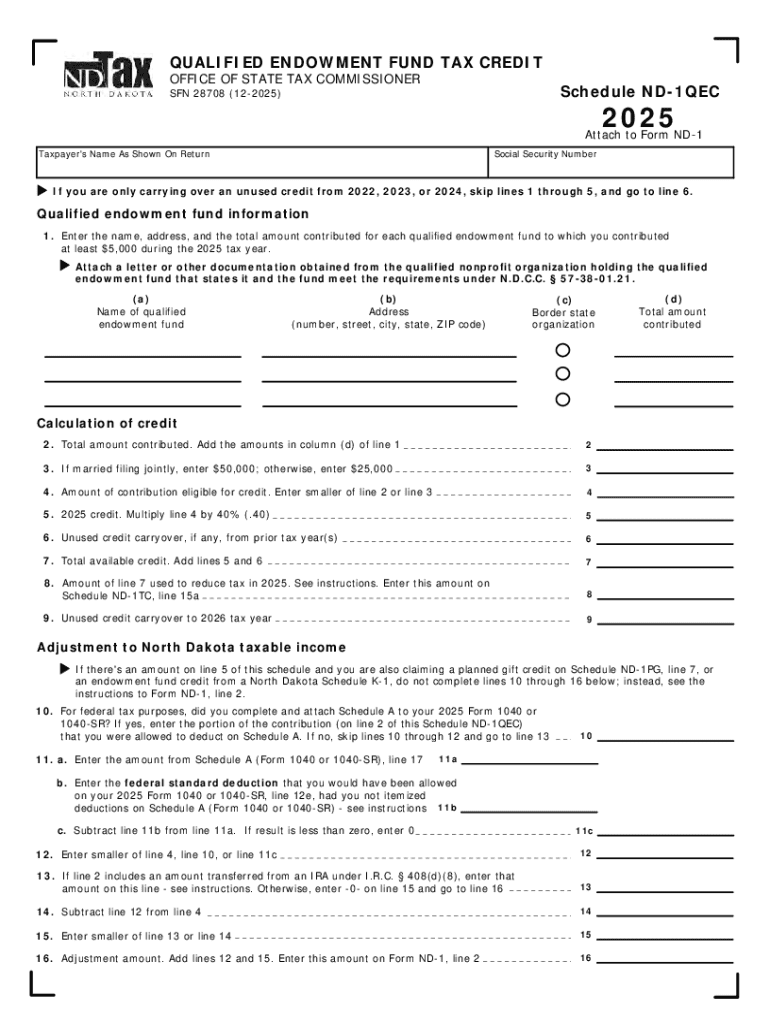

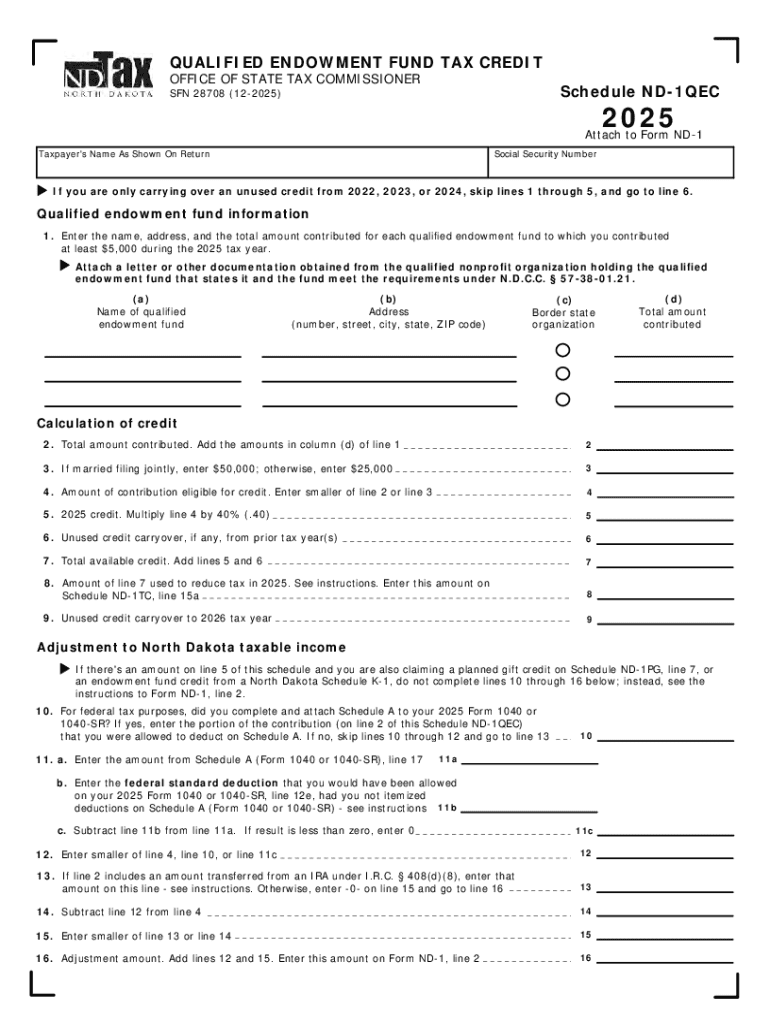

Understanding the North Dakota Tax Credit Bismarck Form

Overview of North Dakota tax credit

Tax credits in North Dakota are designed to provide financial relief to residents, reducing the amount of state tax owed. Understanding these credits is crucial, as they can significantly impact your tax return and overall financial health. For Bismarck residents, knowing how to correctly fill out the North Dakota tax credit Bismarck form can unlock valuable savings and ensure compliance with state tax laws.

Identifying the right tax credits and utilizing the appropriate forms can make a difference in your financial situation. These credits can cater to various income levels and circumstances, such as home ownership or low-income brackets. Engaging with tax credits not only saves money but can also contribute to enhanced public services through effectively utilized tax revenues.

Understanding the North Dakota tax credit Bismarck form

The North Dakota tax credit Bismarck form serves as an essential tool for residents seeking financial assistance through state tax credits. Its primary purpose is to streamline the application process for various tax credits, helping individuals and families navigate their eligibility and claim deductions efficiently. Depending on income levels, the available credits can significantly reduce tax burdens and provide much-needed support.

Understanding these elements helps taxpayers maximize their financial benefits and encourages more residents to apply for funds they might otherwise overlook.

Eligibility criteria for the North Dakota tax credit

To qualify for the North Dakota tax credits, applicants must meet specific eligibility criteria. Generally, this includes demographic requirements such as age and residency status. Additionally, there are established income thresholds that determine who can access these financial benefits.

Understanding these criteria ensures that applicants submit complete and accurate applications, reducing the likelihood of delays or denials.

Exploring the tax credit amount

The tax credit amount provided through the North Dakota tax credit Bismarck form is primarily determined by various factors, including income level, family size, and specific deductions claimed. For many residents, understanding this calculation can reveal potential tax savings.

When compared to neighboring states, North Dakota's tax credits often fall in the middle range—offering significant benefits but not the absolute highest amounts. However, localized adjustments ensure that Bismarck residents still find value in applying.

Step-by-step application process

Successfully applying for tax credits involves a systematic approach, starting with the preparation phase. Understanding what documents and information are required can enhance the likelihood of a smooth application process.

Applicants should double-check the requirements and consider organizing their financial records ahead of time. This planning will pay off by streamlining the completion of the North Dakota tax credit Bismarck form.

How to claim your North Dakota tax credit

After submitting the application for the North Dakota tax credit, understanding the timeline for processing and payment is crucial. Typically, processing times may vary, but applicants can expect to wait a few weeks to several months, depending on the volume of submissions.

This information will empower applicants to stay informed and take necessary steps if their claims encounter issues, such as disputes regarding credit amounts or application discrepancies.

Frequently asked questions (FAQ)

The North Dakota tax credit can raise several questions for potential applicants. Here are some common inquiries:

Answers to these questions play a vital role in ensuring residents understand their rights and responsibilities when applying for tax credits.

Interactive tools for managing your tax credits

Utilizing modern digital tools can simplify the process of managing tax credits. Platforms like pdfFiller are invaluable resources for applicants, allowing them to edit, sign, and collaborate on necessary documents.

These tools empower individuals and teams to streamline their documentation process, reduce errors, and facilitate collaboration—ultimately easing the burden of managing tax credits.

Closing thoughts on maximizing tax benefits

Thorough documentation is crucial when navigating tax credits. Maintaining up-to-date records and understanding eligibility requirements can lead to maximizing tax benefits. Furthermore, staying informed about changes in tax law or new credit opportunities can provide additional savings.

Harnessing the functionality of platforms like pdfFiller allows users to manage their tax documentation efficiently. The ease of editing, signing, and collaborating on forms cannot be overstated—it creates a fluid experience, particularly during tax season, where every detail matters.

Encouraging residents to leverage these tools and resources helps ensure they capture all available financial benefits, contributing positively to their overall economic well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my north dakota tax creditbismarck directly from Gmail?

How do I complete north dakota tax creditbismarck on an iOS device?

How do I complete north dakota tax creditbismarck on an Android device?

What is north dakota tax creditbismarck?

Who is required to file north dakota tax creditbismarck?

How to fill out north dakota tax creditbismarck?

What is the purpose of north dakota tax creditbismarck?

What information must be reported on north dakota tax creditbismarck?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.