Get the free Non-Tax Levy (NTL) Supplement Request Form For Full- ...

Get, Create, Make and Sign non-tax levy ntl supplement

Editing non-tax levy ntl supplement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-tax levy ntl supplement

How to fill out non-tax levy ntl supplement

Who needs non-tax levy ntl supplement?

Comprehensive Guide to the Non-Tax Levy NTL Supplement Form

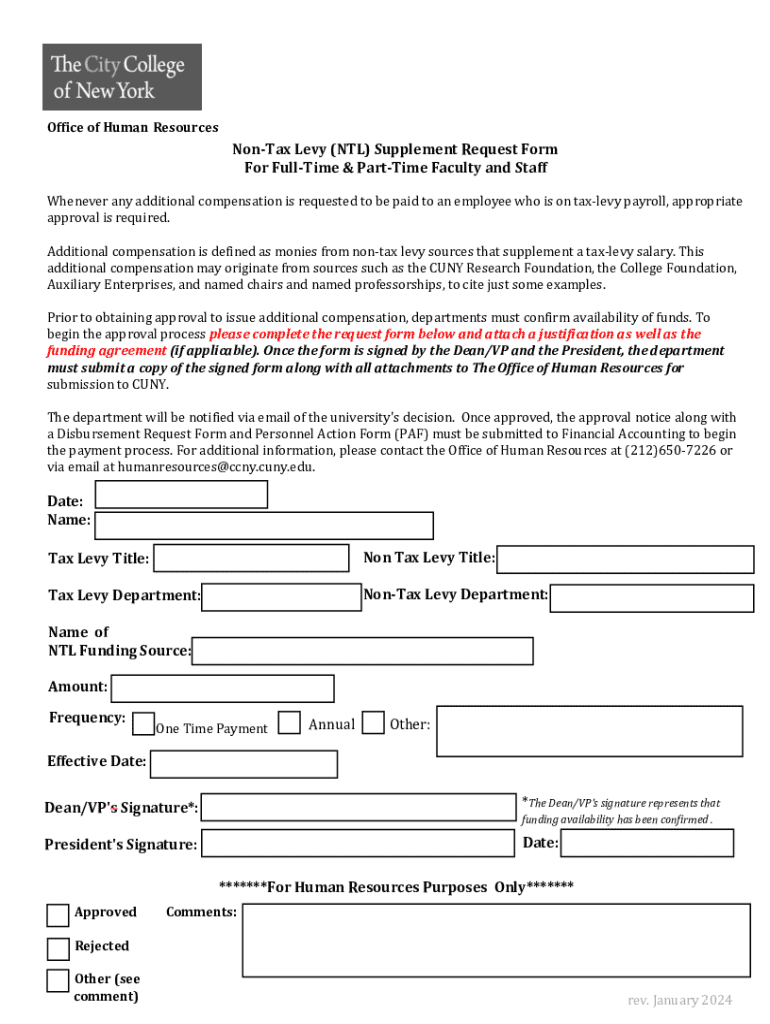

Understanding the non-tax levy NTL supplement form

The non-tax levy NTL supplement form is a critical document used by various institutions, including schools and municipalities, to articulate the financial requirements that do not derive from traditional taxation. This concept of non-tax levies is significant as it allows organizations to seek funding for essential services and programs without relying solely on taxpayer dollars. Understanding the nuances of this form is essential for stakeholders involved in budgeting and resource allocation.

Different stakeholders play crucial roles in this process. For instance, financial managers within schools must ensure that they accurately complete this form to reflect the financial realities they face. Similarly, municipal finance teams, including department heads and budget analysts, must work collaboratively to ascertain the viability of such non-tax funding strategies.

Purpose of the non-tax levy NTL supplement form

The primary purpose of the non-tax levy NTL supplement form lies in its importance for budgeting and funding. Completing this document properly provides a clear overview of financial needs which heavily influences both short-term and long-term resource allocation. By laying out a structured request, it enables financial teams to prioritize essential programs that may not be funded through regular tax revenues.

Various entities such as public schools, municipal governments, and other institutions are required to complete this form. For example, a school district may need to show funding requirements for enhanced educational programs, while a municipality might need it to justify expenses related to community service initiatives. Understanding who needs to submit this form is crucial to ensuring compliance and achieving necessary funding.

Step-by-step guide to completing the non-tax levy NTL supplement form

Preparing to fill out the form

Before diving into the completion of the non-tax levy NTL supplement form, it’s essential to gather all required documents and information. Typical requisites may include recent financial reports, budget statements, and records of prior levy supplement requests. This preparatory phase is vital for ensuring that every figure is accurate and comprehensive.

Detailed instructions for each section

Section 1: Basic information

In this section, you must include accurate contact details such as your name, address, and institutional affiliation. Ensure that this information is clear, as it is often used for communication regarding the form's processing.

Section 2: Financial overview

This part involves providing a comprehensive breakdown of both income and expenditures relevant to the requested non-tax levy. Be meticulous in detailing each source of income and justifying all associated costs to give a clear financial picture.

Section 3: Justification for non-tax levy

Here, you must clearly articulate the need for the non-tax levy. Specific criteria and examples that illustrate how the request supports necessary programs should be provided. This section is critical, as it is often the focal point of approval decisions from funding committees.

Section 4: Signature and submission instructions

Finally, ensuring you e-sign the document correctly is essential. It may contain instructions regarding electronic submission, email confirmation, or physical mailing depending on the institution's requirements.

Editing and customizing the non-tax levy NTL supplement form with pdfFiller

pdfFiller empowers users to streamline their document management processes, making it easy to edit and customize the non-tax levy NTL supplement form. Through its intuitive interface, users can modify the content of the form effortlessly, ensuring all figures and justifications are current and relevant.

To use pdfFiller’s tools for editing, simply upload your NTL supplement form, and utilize features such as the text editor to add or modify text, drop-downs for quick selections, and highlight sections that need attention. This flexibility allows for collaborative inputs while ensuring each stakeholder can access the most up-to-date version.

Adding and managing signatures

The benefits of electronic signatures in the context of the NTL supplement form cannot be overstated. pdfFiller facilitates the addition of electronic signatures, which ensures that the document is verified and dated without requiring physical presence. This aspect hastens the approval process significantly, allowing for quicker submission and review cycles.

Common mistakes to avoid when filling out the NTL supplement form

When completing the non-tax levy NTL supplement form, several misunderstandings can lead to errors. One common mistake is failing to provide a complete financial overview. Incompleteness can cause delays and even denial of requests. Therefore, it’s crucial to provide a thorough account of both income and expenditures.

Cross-verification after filling out the form is indispensable. Ensure all participants review the drafted document, as collaborative input can help refine the details and mitigate potential mistakes.

Collaborating with others on the non-tax levy NTL supplement form

Collaboration is key when it comes to completing the non-tax levy NTL supplement form. Engaging team members throughout the process ensures diverse perspectives and makes it easier to gather all necessary information. pdfFiller’s collaborative features allow users to invite colleagues to review and edit the document simultaneously.

Sharing your form with stakeholders can also enhance transparency and foster trust in the budgeting process. Utilize pdfFiller’s secure sharing options to send the document via email or through generated links, allowing stakeholders to review and provide feedback safely and conveniently.

Frequently asked questions (FAQs)

As users navigate the non-tax levy NTL supplement form, several common inquiries arise. The submission timeline is usually established by each institution's financial department, so checking with them is advisable. Questions often surface regarding penalties for incorrect filings, emphasizing the importance of accuracy in every submitted request.

Additionally, tracking the status of your submission is fundamental, particularly to ensure timely follow-up. Most institutions provide ways to check the status either through their dashboards or upon inquiry via phone or email.

Additional features of pdfFiller relevant to the NTL supplement form

One significant advantage of using pdfFiller is its cloud-based storage capabilities. This feature allows users to access their documents from anywhere, ensuring that you can manage your non-tax levy NTL supplement form even when you're away from the office. This flexibility is especially important for collaboration and time-sensitive submissions.

Furthermore, pdfFiller offers extensive support and resources, including tutorials and customer service options. Users having difficulties can find helpful information quickly, enhancing their experience and ensuring that they complete their forms correctly.

Related forms and templates for budgeting and financial requests

In addition to the non-tax levy NTL supplement form, various other related forms and templates can aid in budgeting and financial requests. For example, an organization may also need to utilize grant applications, budget allocation forms, or fiscal reports. These documents help provide a comprehensive view of an institution's financial status and future needs.

Links to other templates are often accessible through institutional finance departments or document management platforms like pdfFiller, making it easier for staff to align their requests and financial documentation with organizational policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete non-tax levy ntl supplement online?

Can I edit non-tax levy ntl supplement on an Android device?

How do I complete non-tax levy ntl supplement on an Android device?

What is non-tax levy ntl supplement?

Who is required to file non-tax levy ntl supplement?

How to fill out non-tax levy ntl supplement?

What is the purpose of non-tax levy ntl supplement?

What information must be reported on non-tax levy ntl supplement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.