Get the free Not Required to pay taxes per state and federal law affidavit

Get, Create, Make and Sign not required to pay

Editing not required to pay online

Uncompromising security for your PDF editing and eSignature needs

How to fill out not required to pay

How to fill out not required to pay

Who needs not required to pay?

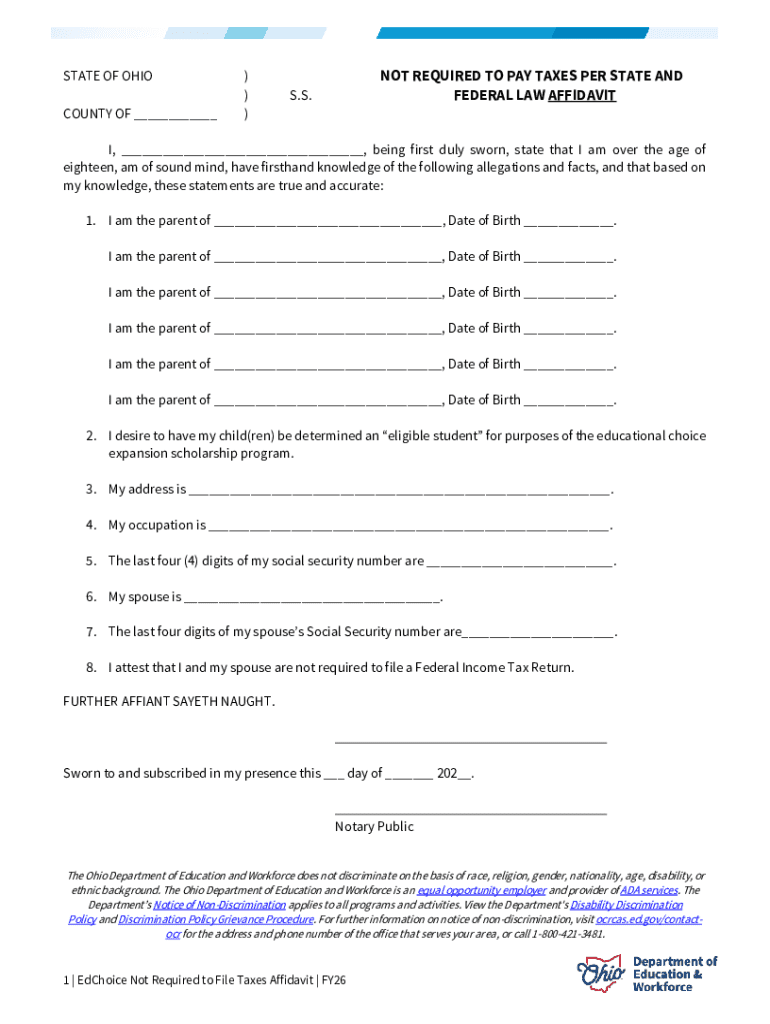

Not Required to Pay Form: A Comprehensive Guide

Understanding the 'not required to pay form'

The 'not required to pay form' is a crucial document that allows individuals and entities to declare their exempt status from certain financial obligations, particularly in the realms of taxes and fiduciary responsibilities. Its primary purpose is to provide a legal statement that specifies why a payment is not necessitated under specific circumstances. Understanding the intricacies of this form is essential, as improper submissions may lead to unwanted penalties or disputes.

Being aware of when payments are not required is vital for proper financial management. This form can shield individuals from unnecessary expenditures while maintaining compliance with regulations. Common scenarios where this form comes into play include claiming exemption for tax, filing returns for estates and trusts, or addressing payments in legal disputes.

Key features of the 'not required to pay form'

The 'not required to pay form' captures critical information relevant to the exemption claims. Primarily, it includes personal identification details, such as the individual's name, address, and contact information. Specific claims or exemptions must also be declared, outlining the basis for not being liable for payment.

This form is generally available in PDF format, which facilitates easy access and sharing. Users can find this form online on platforms like pdfFiller, which enhances accessibility and streamlines the submission process.

Navigating the process: Step-by-step instructions

To effectively navigate the submission of the 'not required to pay form,' follow these steps carefully.

Frequently asked questions

Several common questions arise regarding the 'not required to pay form.' Understanding these can ease the filing process.

Available tools and resources on pdfFiller

pdfFiller equips users with interactive features that make completing the 'not required to pay form' straightforward. Among its tools are options for highlighting key sections and providing in-line comments, which can be immensely helpful for collaborative work.

Understanding the importance of digital signatures is essential; they validate the authenticity of your submission. Here's how to eSign your form efficiently:

Managing your submitted forms

After submitting the 'not required to pay form,' tracking its status is essential. Users can check updates directly on their pdfFiller account. This transparency helps manage expectations and ensures you are on top of any requirements.

To amend or resubmit, simply access your records on pdfFiller, locate the submitted form, and follow steps to make necessary changes. Archiving and storing copies on pdfFiller ensures that you have access to all documents and can retrieve them when needed.

Related forms and documentation

While the 'not required to pay form' addresses specific exemptions, there may be other forms required depending on the situation. For instance, related tax forms or documents pertaining to estates and trusts might be necessary to accompany your exemption submission.

Accessing templates and additional guidance on document management is seamless on pdfFiller, presenting users with a definitive resource hub for their documentation needs.

User testimonials and success stories

Real-life experiences highlight the efficiency of the 'not required to pay form' process. Users often share how pdfFiller’s tools simplified what could have been a daunting task into a streamlined experience. Testimonials note the ease of access, collaborative features, and prompt submission processes.

Success stories from users underline the platform’s capability to empower individuals and teams, ensuring accuracy in submissions and ultimately saving time and money in managing payments.

Need further assistance?

If questions linger or issues arise regarding the 'not required to pay form,' pdfFiller offers robust customer support options. Users can access live chat, email, or phone support for immediate assistance.

Community forums and user guides further enrich the support environment, providing platforms for users to share advice and insights. Language options are available, ensuring all users receive the help they need.

Understanding your rights and responsibilities

Submitting the 'not required to pay form' comes with specific legal implications. A correct and truthful submission protects you while submitting false claims could lead to serious penalties.

Moreover, understanding how to protect your information during this process is paramount. Familiarize yourself with privacy practices, and ensure your personal data remains secure while navigating the intricacies of payments and obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in not required to pay without leaving Chrome?

Can I create an electronic signature for signing my not required to pay in Gmail?

How do I complete not required to pay on an iOS device?

What is not required to pay?

Who is required to file not required to pay?

How to fill out not required to pay?

What is the purpose of not required to pay?

What information must be reported on not required to pay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.