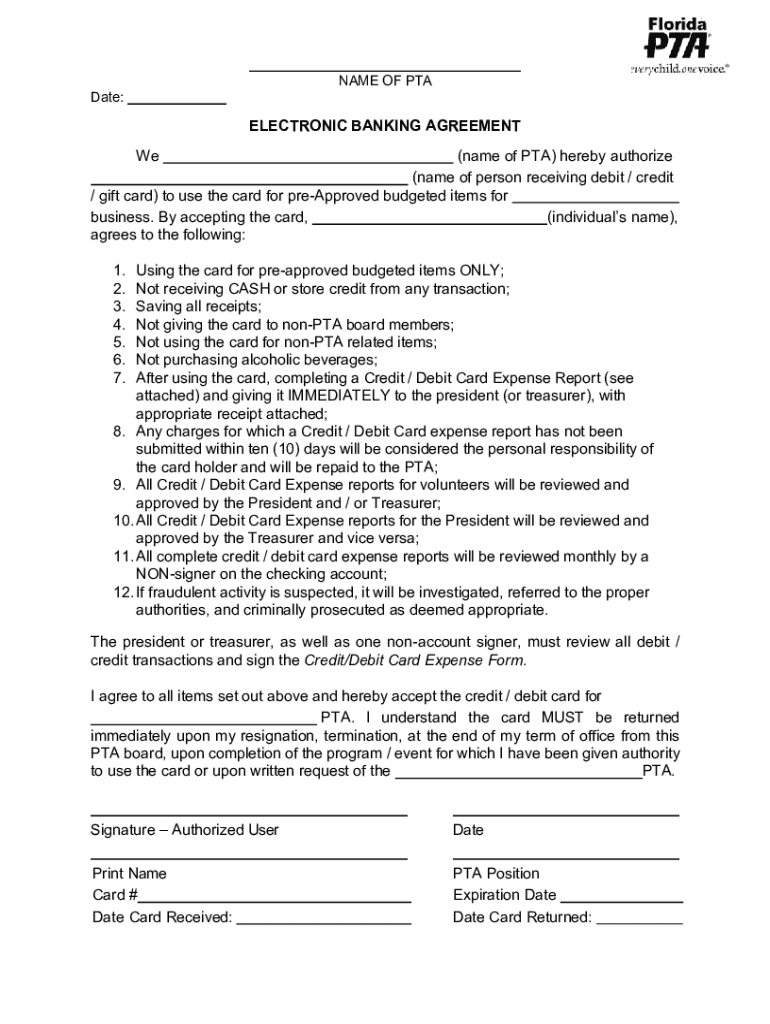

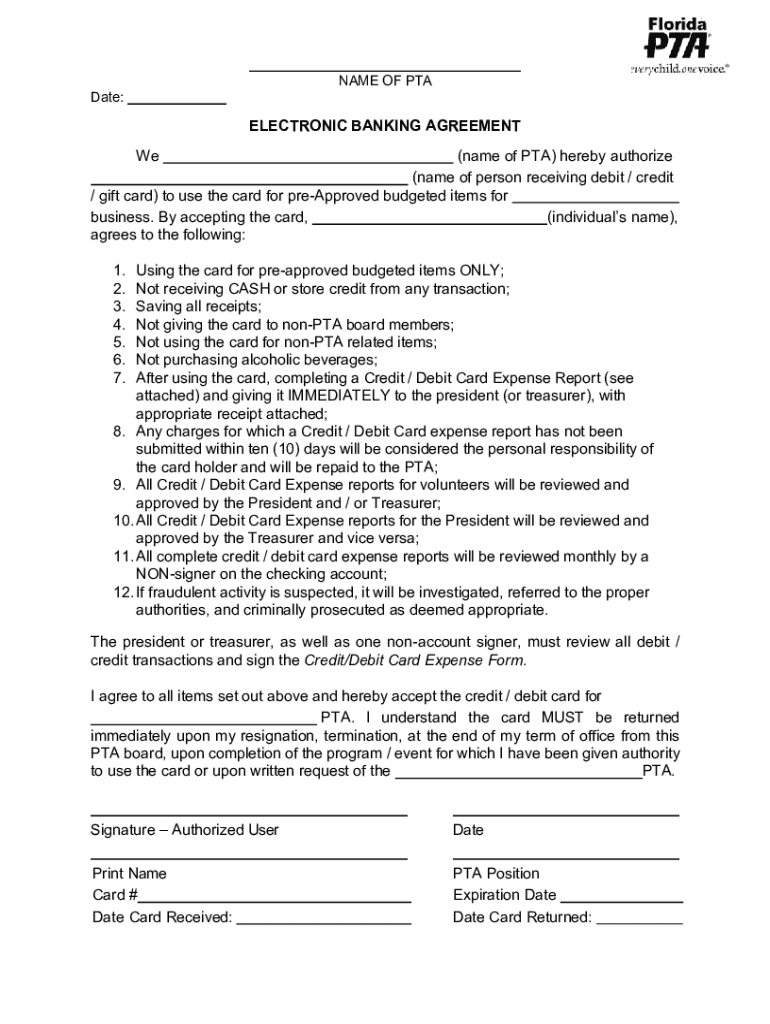

Get the free ELECTRONIC BANKING AGREEMENT We (name of PTA) hereby ...

Get, Create, Make and Sign electronic banking agreement we

Editing electronic banking agreement we online

Uncompromising security for your PDF editing and eSignature needs

How to fill out electronic banking agreement we

How to fill out electronic banking agreement we

Who needs electronic banking agreement we?

Comprehensive Guide to Electronic Banking Agreements We Form

Overview of electronic banking agreements

An electronic banking agreement is a pivotal document that outlines the terms and conditions between financial institutions and their customers. These agreements establish the framework for how banking services will be accessed, utilized, and managed electronically. It is essential for customers—individuals or small businesses—to fully understand this agreement to navigate the digital banking landscape effectively.

Understanding the terms and conditions set forth in these agreements ensures that customers are aware of their rights, responsibilities, and the services available, such as payments and invoicing services, account transfers, and limits regarding transactions. A clear grasp of the agreement can prevent misunderstandings and safeguard the interests of both parties.

Features and benefits of electronic banking agreements

Electronic banking agreements pave the way for revolutionary features that traditional banking methods do not offer. Here are some notable benefits:

Steps to create your electronic banking agreement

Creating your electronic banking agreement involves several straightforward steps, especially when utilizing user-friendly platforms like pdfFiller.

Step 1: Gathering required information is crucial. You will need personal identification details, such as your name, address, and Social Security number, alongside your banking information, including account numbers and types of services you wish to access.

Step 2: Selecting the correct template on pdfFiller can streamline the process. Navigate its template library to pick a format that fits your unique needs, ensuring you select a template that corresponds to your specific banking services.

Step 3: Customizing the agreement is vital. Edit fields to accurately reflect the necessary terms of service, and don’t forget to insert signature and date fields for completion.

Step 4: Reviewing your agreement is essential to confirm completeness and accuracy. Utilize pdfFiller’s review features to spot any errors or omissions before finalizing.

Essential clauses to include in your electronic banking agreement

Key clauses in your electronic banking agreement will govern the relationship between you and your bank and ensure clarity. Here are essential elements to include:

Signing and securing your electronic banking agreement

The signing of your electronic banking agreement holds significant importance. Electronic signatures are legally recognized and provide a seamless way to authenticate documents. Customers should ensure that these electronic signatures are applied correctly using a reliable platform, such as pdfFiller, which guarantees the legal validity of your agreement.

Signing your document can be completed easily with pdfFiller. Here’s a brief guide to eSigning with the platform: Simply upload your document, navigate to the signature field, and create or insert your signature. Once finalized, you can securely save the document—pdfFiller offers multiple secure storage options to keep your agreement safe.

Interpreting common terms and conditions

Many customers find it useful to understand the key banking terminology used in electronic agreements. Here are some common terms and what they mean:

For individuals or small businesses looking for clarity, frequently asked questions regarding these terms may available through customer service options offered by their banks.

Managing and modifying your electronic banking agreement

Changes in business circumstances often call for updates to existing agreements. Knowing how to manage and modify your agreement is essential. The original terms may need to be adjusted due to changes in services or new regulations.

Updating an existing agreement is straightforward with tools like pdfFiller. Users can revise documents directly and track changes efficiently. It's also essential to maintain organized records of all communication related to modifications to ensure everyone is aligned on the updated terms.

Procedures for amending terms can include reaching out to customer service for guidelines, filling out an amendment form, or simply drafting a new agreement that supersedes the previous one. Following best practices in electronic document management ensures all records are up-to-date and easily accessible.

Troubleshooting common issues with electronic banking agreements

Despite the efficiencies of electronic agreements, common issues may arise. Some of these include errors in document creation or misunderstanding agreement terms. If you make a mistake when drafting your electronic banking agreement, pdfFiller provides tools to edit your documents easily.

Understanding resolution procedures in the event of disputes is equally crucial. Most banks have dedicated teams to handle complaints, and escalating issues to management levels often leads to quicker resolutions. Keeping records of all transactions and correspondence can significantly aid in this process.

Important contacts for customer support can typically be found in the agreement or on the bank's website. Having these resources at hand can help expedite any troubleshooting efforts.

Compliance and legal considerations

When forming an electronic banking agreement, compliance with regulatory standards is non-negotiable. These standards ensure customer protection and the legitimacy of the banking process. Financial institutions are bound by legal frameworks at both local and national levels, which govern how electronic agreements should be structured.

Ensuring compliance means staying updated on local laws that may affect the terms and conditions of your agreement. As regulations can vary significantly, particularly for small business customers, consulting with a legal expert familiar with banking regulations can help in understanding obligations.

Additionally, utilizing services like pdfFiller can enhance compliance by providing templated agreements that already incorporate standard clauses recognized for legal integrity.

Leveraging pdfFiller tools for further efficiency

pdfFiller provides powerful tools that enhance document handling, making the creation and management of your electronic banking agreement even more efficient. These tools will allow users to streamline workflows, making managing accounts and transfers far more convenient.

Some features include additional templates designed for various banking needs, capabilities for integrating with other financial management tools, and collaborative environments that foster teamwork among business service teams. Utilizing these tools will not only speed up document management processes but also ensure that all legal standards are met.

With pdfFiller, working with your electronic banking agreements becomes a seamless experience, empowering individuals and teams to remain compliant and efficient while managing sensitive information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get electronic banking agreement we?

How do I make changes in electronic banking agreement we?

How do I edit electronic banking agreement we in Chrome?

What is electronic banking agreement we?

Who is required to file electronic banking agreement we?

How to fill out electronic banking agreement we?

What is the purpose of electronic banking agreement we?

What information must be reported on electronic banking agreement we?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.