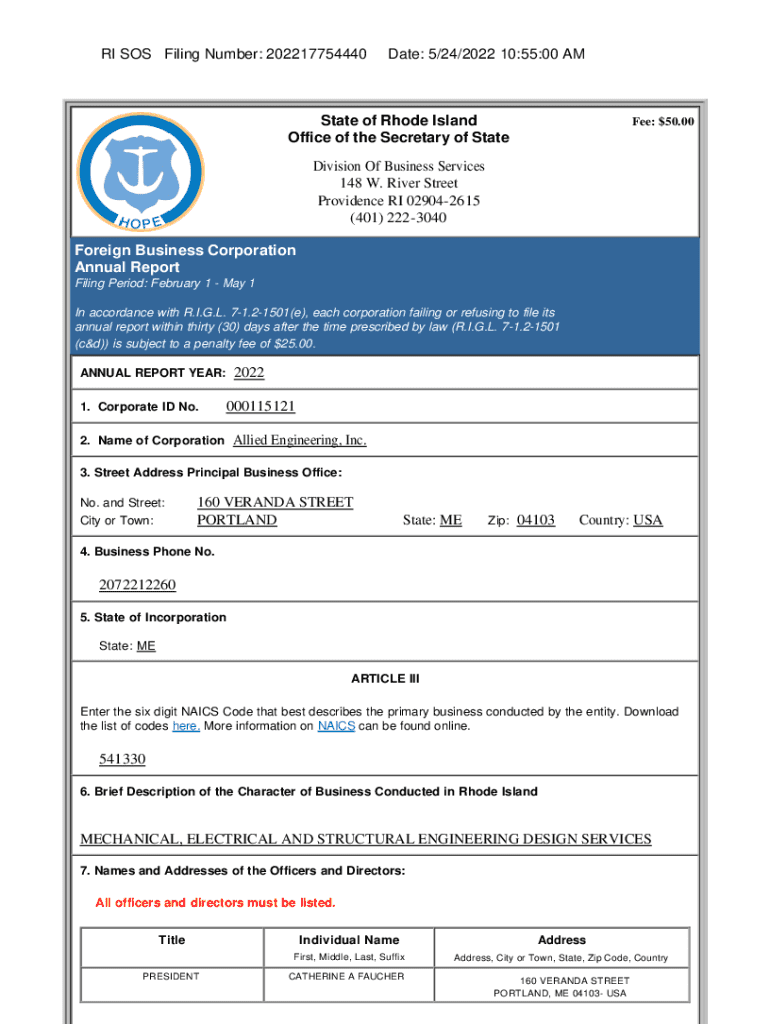

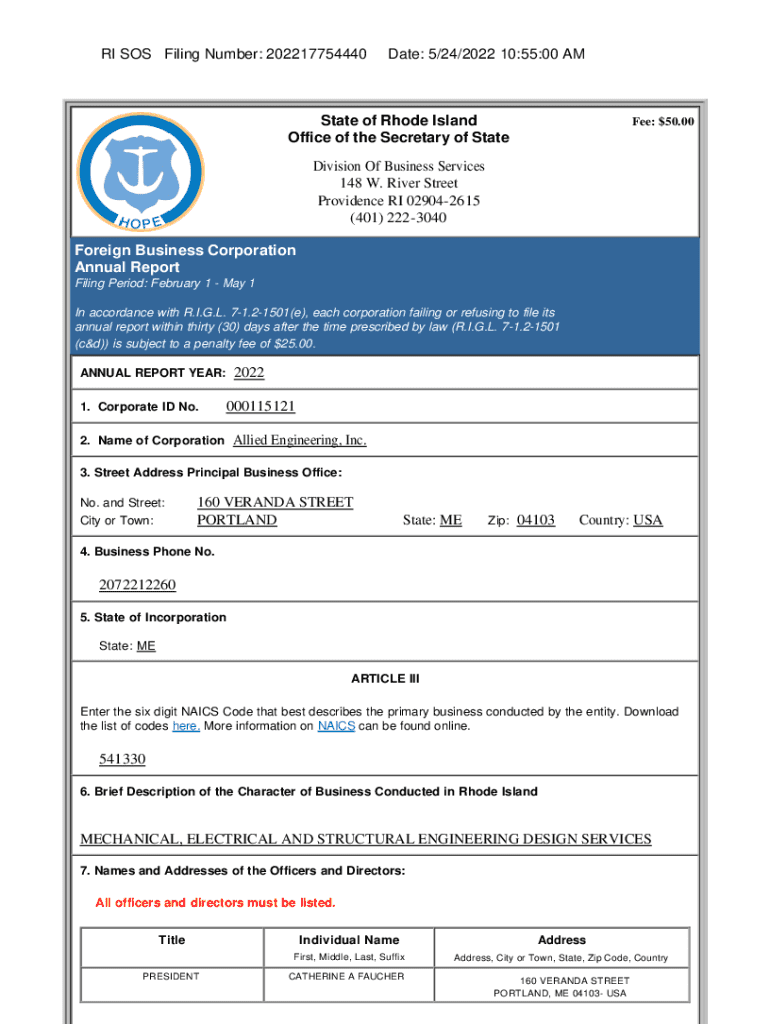

Get the free RI SOS Filing Number: 202217754440

Get, Create, Make and Sign ri sos filing number

Editing ri sos filing number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ri sos filing number

How to fill out ri sos filing number

Who needs ri sos filing number?

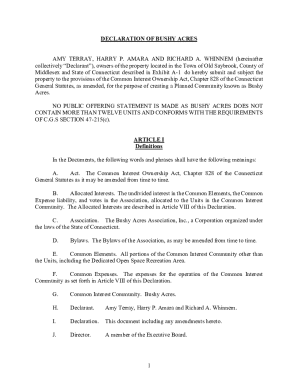

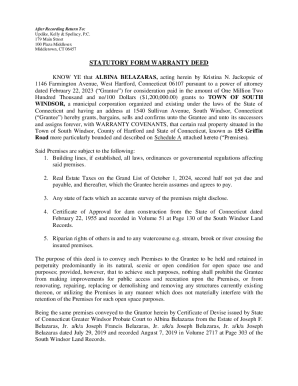

The Essential Guide to the RI SOS Filing Number Form

Understanding the RI SOS Filing Number Form

The RI SOS Filing Number Form is a crucial document for all business entities intending to operate within Rhode Island. This form not only grants businesses an official filing number but also connects them to the state’s corporate database. Owning a filing number is essential for legal compliance, as it allows businesses to conduct various operations, such as opening bank accounts, applying for permits, and filing taxes.

The importance of obtaining a filing number cannot be overstated; it serves as a unique identifier within state records. This number is often required in legal documents, contracts, and applications, making it a vital component of the business's identity in Rhode Island.

Who needs the RI SOS Filing Number Form?

Any individual or business entity planning to operate in Rhode Island is mandated to obtain the RI SOS Filing Number Form. This requirement applies to various types of entities, including LLCs, corporations, partnerships, and sole proprietorships. Essentially, if you intend to run a business in Rhode Island, you will need this filing number.

This filing number is crucial not only for legal identification but also for fostering transparency in business operations. It allows state agencies, customers, and partners to verify the legitimacy of your enterprise, thus playing a key role in building trust and credibility in the marketplace.

Step-by-step guide to completing the RI SOS Filing Number Form

Preparing to fill out the form

Before diving into the RI SOS Filing Number Form, it's essential to gather all necessary information and documents. Start with your business's basic details, including the legal name, entity type, and principal office address. You’ll also need information about the owners or principals, like their names and addresses, as well as a brief description of your business activities.

Filling out the RI SOS Filing Number Form

When filling out the RI SOS Filing Number Form, careful attention to detail is essential. Begin with Section 1, where you'll provide basic business information, such as your business's registered name, address, and type. For Section 2, list all owners or principals with their respective addresses to establish ownership records.

Next, in Section 3, give a succinct yet informative description of your business activities, providing insight into what the business does. Finally, Section 4 requires additional information about your business's legal structure and any relevant notes that might aid in processing your application.

Reviewing your completed form

Once you've completed the form, it's vital to review for common mistakes. Double-check all entries for accuracy, as errors or omissions can result in processing delays. Pay special attention to names and addresses, as discrepancies can complicate matters later. A thorough review will save you time and ensure a smoother submission process.

Submitting the RI SOS Filing Number Form

Where to submit the form

You have a couple of options when it comes to submitting your RI SOS Filing Number Form. The most convenient method is to file online through the Rhode Island Secretary of State’s official portal. This option is typically faster, allowing you to receive confirmation electronically.

If online submission is not feasible for you, you can opt for mail-in submissions. Just ensure you send your completed form to the appropriate department, following the outlined procedures on the state’s website.

Payment process

There is a nominal fee associated with filing for your RI SOS Filing Number. Payment methods may vary; however, you can generally pay via credit card when filing online or through checks when submitting by mail. Be sure to check the most recent fee schedule on the Rhode Island Secretary of State website to ensure you have the correct payment amount and method.

Tracking the status of your filing

How to check your filing status

After submitting your RI SOS Filing Number Form, you may want to track the status of your filing. The Rhode Island Secretary of State website offers online tracking tools that allow you to check the progress of your application. By entering your details, you can see if your submission is being processed or if further action is required.

If you encounter any difficulties or have questions regarding your filing status, you can contact office representatives. They can provide you guidance and clarify any uncertainties about your application.

What to do if there are issues with your filing

Should your filing encounter issues, such as a rejection, it’s crucial to understand common reasons this might happen. These can include incomplete forms, incorrect information, or missing signatures. If your submission is returned, follow the guidance provided in your notification to address the problem and resubmit promptly.

Keeping your information updated

When to update your filing information

Maintaining accurate information on file is vital for compliance. You'll need to update your RI SOS Filing Number Form whenever there are changes in your business structure or ownership, such as selling the business or adding new partners. Regularly checking and updating your records helps avoid legal issues down the road.

Being proactive about updating your filing information also helps maintain your standing with the state and ensures all stakeholders have access to current data about your business.

Steps to update your RI SOS Filing Number Form

Updating your filing information involves submitting a specific form to address the changes. Depending on the nature of your update, different forms may be required. Detailed instructions are available on the Rhode Island Secretary of State's website, guiding you through the amendment process to ensure a successful update.

Frequently asked questions (FAQs)

As you navigate through the filing process, you might have several questions about the RI SOS Filing Number Form. How long does it typically take to receive my filing number? Generally, online submissions are processed faster, often within a few business days, while mail submissions may take longer.

What if I lose my filing number? If this happens, do not worry—you can contact the Rhode Island Secretary of State’s office to retrieve your number based on your business name.

Can I amend my form after submission? Typically, yes. Amendments can be made, but it is crucial to follow the proper channels for updates to maintain compliance.

Utilizing the pdfFiller platform for your RI SOS Filing Number Form

Editing and managing your form with pdfFiller

pdfFiller provides an excellent platform for managing your RI SOS Filing Number Form. With its user-friendly interface, you can easily edit documents, making necessary changes without hassle. The platform includes features such as eSigning capabilities, ensuring your submissions meet legal requirements effortlessly.

Utilizing pdfFiller allows you to enhance your documents without having to print anything out. You can access your forms from any device with internet connectivity, making it a perfect tool for individuals and teams alike.

Collaborative tools for team filings

For teams working together on filing projects, pdfFiller offers collaborative tools that simplify the process. Team members can work simultaneously on documents, track changes, and manage workflows effectively, ensuring everyone is on the same page regarding submissions. This collaborative advantage can significantly streamline the filing process, making it efficient and less time-consuming.

Additional tips for successful filing

To ensure a smooth filing process, here are some best practices for completing and submitting the RI SOS Filing Number Form. First, make sure you gather all necessary documentation and information before starting the process. This preparation helps minimize errors and facilitates quicker submissions.

Moreover, leveraging pdfFiller’s resources can provide added guidance and support. Utilize the platform’s features to enhance your document quality and ensure compliance with state requirements, which is crucial for maintaining business legitimacy.

Finally, always stay up-to-date with any changes in state regulations regarding business filings. Checking the Secretary of State’s website regularly will keep you informed of changes that could affect your entity’s standing and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ri sos filing number in Gmail?

How do I make changes in ri sos filing number?

Can I create an electronic signature for the ri sos filing number in Chrome?

What is ri sos filing number?

Who is required to file ri sos filing number?

How to fill out ri sos filing number?

What is the purpose of ri sos filing number?

What information must be reported on ri sos filing number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.