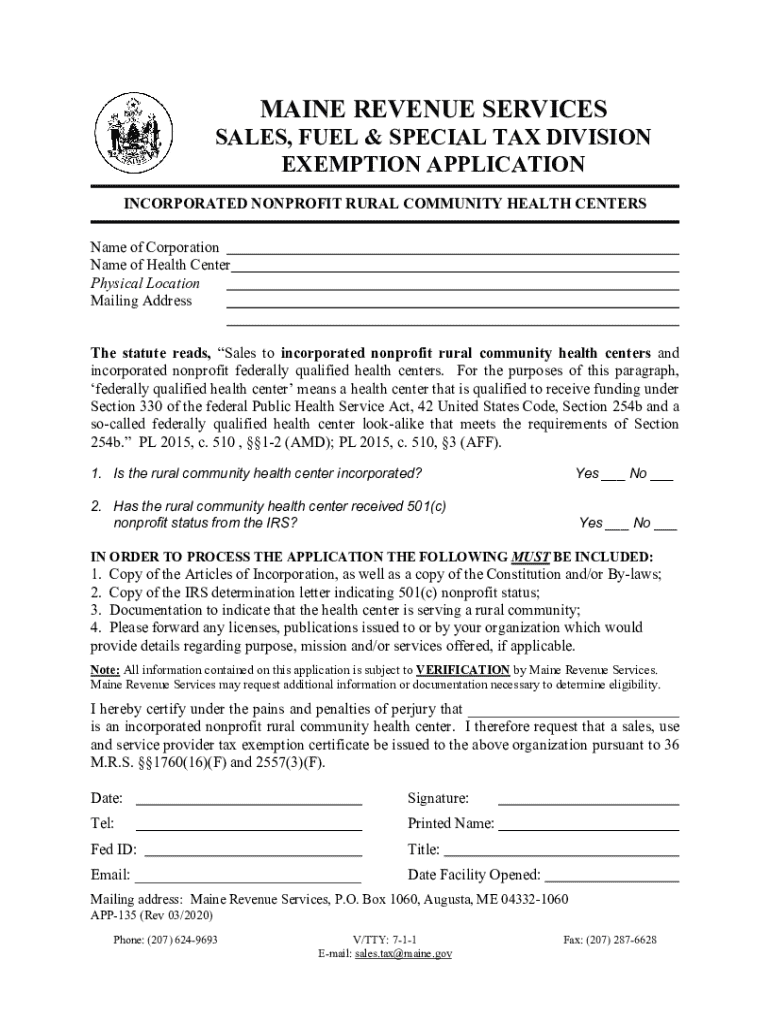

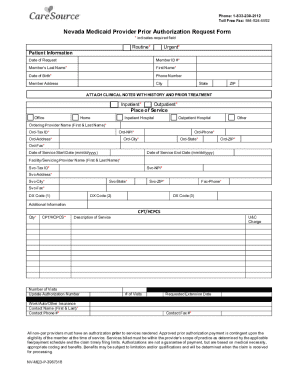

Get the free incorporated nonprofit federally qualified health centers

Get, Create, Make and Sign incorporated nonprofit federally qualified

Editing incorporated nonprofit federally qualified online

Uncompromising security for your PDF editing and eSignature needs

How to fill out incorporated nonprofit federally qualified

How to fill out incorporated nonprofit federally qualified

Who needs incorporated nonprofit federally qualified?

Incorporated Nonprofit Federally Qualified Form: A Comprehensive Guide

Understanding the concept of a federally qualified nonprofit

A federally qualified nonprofit is an organization recognized by the IRS under Section 501(c)(3) for its charitable, educational, or community benefit purposes. This designation is critical as it grants the organization tax-exempt status, allowing it to operate without the burden of federal income tax. Beyond this financial advantage, these nonprofits play a vital role in addressing community issues, from education and health care to environmental conservation and social justice.

To become federally qualified, an organization must meet specific eligibility requirements. The applicants must demonstrate that their purpose serves the public good and align with one of the IRS’s defined categories of exemption. Additionally, the organization must be structured and operated primarily for charitable purposes, which must be substantiated through comprehensive documentation.

Benefits of incorporating as a federally qualified nonprofit

Incorporating as a federally qualified nonprofit offers several significant benefits. One of the most appealing advantages is tax exemptions. Organizations can steer their funds towards activities that further their mission rather than paying taxes, significantly enhancing the financial viability of operations.

Additionally, achieving this nonprofit status lends an air of credibility and trustworthiness. Many donors and grant-making institutions prefer to contribute to organizations that have federal recognition, which translates to greater access to funding opportunities that can be crucial for expansion and sustainability.

Liability protection is another vital aspect. Board members and employees typically enjoy legal protections from personal liability concerning the nonprofit’s debts and legal actions, thus encouraging them to engage without fear of personal loss.

Steps to incorporate as a federally qualified nonprofit

The process to incorporate as a federally qualified nonprofit can seem daunting but can be simplified by following a systematic approach. Below are the essential steps to get started.

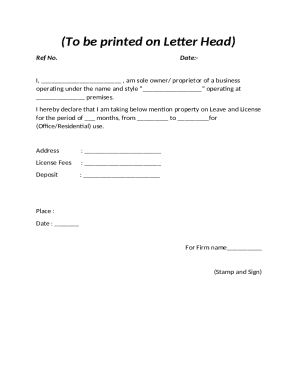

Step 1: Establish a nonprofit corporation

First, you need a distinctive name for your nonprofit. This requires checking the availability of your desired name with your state’s Secretary of State office. Once you've secured a suitable name, you will draft the Articles of Incorporation, which outline your organization’s purpose, structure, and initial governance.

After drafting these documents, file them with the Secretary of State's office in your state. Expect some processing time, which may vary based on location.

Step 2: Develop a strong mission statement

Your mission statement is crucial. It defines your nonprofit’s objectives and should resonate with community needs, thus guiding your organization’s actions and strategies.

Step 3: Form a board of directors

Establishing a board of directors is essential for governance. Members should represent diverse skills and backgrounds, allowing for comprehensive oversight and strategic planning. Clearly defining roles and responsibilities fosters accountability and functionality within the board.

Step 4: Write your bylaws

Bylaws outline how your nonprofit will operate. This includes details such as regulations around board meetings, member voting rights, and conflict resolution processes. A well-structured bylaws document will prevent ambiguity and potential tensions down the road.

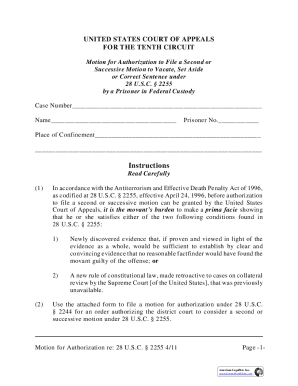

Step 5: Apply for federal tax-exempt status (501()(3))

To apply for IRS recognition as a 501(c)(3) organization, you must complete Form 1023. This comprehensive application requires detailed descriptions of your organization’s structure, governance, and projected activities. Collect all necessary supporting documents including your Articles of Incorporation, bylaws, and a narrative, showcasing your operational plan.

Step 6: Compliance with state regulations

Once the federal status is established, ensure compliance with state regulations. This often includes registering with state charity officials and understanding local fundraising laws which will guide your operational processes.

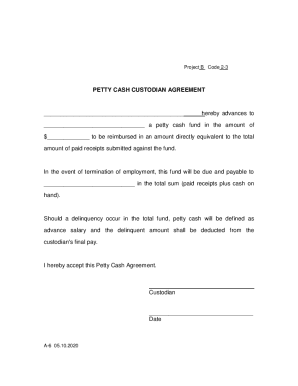

Step 7: Set up financial management systems

Investing in reliable accounting software is key. This supports effective fund management and financial reporting, ensuring transparency and accuracy in your financial dealings.

Step 8: Develop a fundraising strategy

Having a clear fundraising strategy is crucial. Identify potential funding sources such as grants, individual donations, and corporate sponsorships. Building relationships with donors and community partners can significantly enhance your competitiveness and outreach.

Frequently asked questions about the incorporation process

The incorporation process for nonprofits often raises several questions. Here are some common inquiries and their answers to help demystify the journey.

Real-world examples and case studies

Despite the challenges inherent in starting a federally qualified nonprofit, many organizations have demonstrated impressive successes. For instance, established nonprofits like Habitat for Humanity and the American Red Cross exemplify effective community service through innovative practices and strong governance.

These organizations not only provide vital services but also advocate for systemic change, proving that nonprofits can be powerful agents of transformation. Their stories highlight the importance of resilience and adaptability in overcoming challenges.

Learning from these examples can be especially beneficial. Many nonprofits employ creative fundraising strategies, such as crowd-funding, themed events, and partnerships that tap into community resources, enhancing visibility and engagement.

Interactive tools for managing your nonprofit

Managing the numerous forms and documents required in the nonprofit sector can quickly become overwhelming. This is where pdfFiller comes in—offering powerful document management solutions tailored to meet the specific needs of nonprofits.

With pdfFiller, users can fill out, edit, and sign nonprofit forms with ease. Its cloud-based platform ensures team members can collaborate from anywhere, facilitating communication and document sharing while maintaining organization.

Navigating challenges in the nonprofit sector

Nonprofits often encounter specific hurdles such as funding shortages, compliance complexities, and challenges in community engagement. Recognizing these common pitfalls early in your journey can facilitate stronger decision-making and proactive planning.

Building sustainability requires strategic thinking. Nonprofits must continually evaluate their programs, ensuring they align with community needs while being adaptable to changing circumstances. Engagement with stakeholders—including board members, volunteers, and the community at large—strengthens this process, fostering a loyal support network.

Continuously engaging the community cultivates trust and encourages collaboration, which not only bolsters funding opportunities but enhances overall program impact. Exploring new avenues and innovative approaches can reinforce your nonprofit’s mission in profound ways.

Resources to further your nonprofit journey

As you embark on this rewarding journey of establishing a federally qualified nonprofit, a wealth of resources is available to guide you. These resources range from government websites detailing incorporation requirements to nonprofit support organizations that provide valuable insights and expertise.

Additionally, exploring recommended readings and online courses on nonprofit management can enhance your understanding and develop the skills necessary to navigate your organization's challenges successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send incorporated nonprofit federally qualified for eSignature?

Where do I find incorporated nonprofit federally qualified?

How can I edit incorporated nonprofit federally qualified on a smartphone?

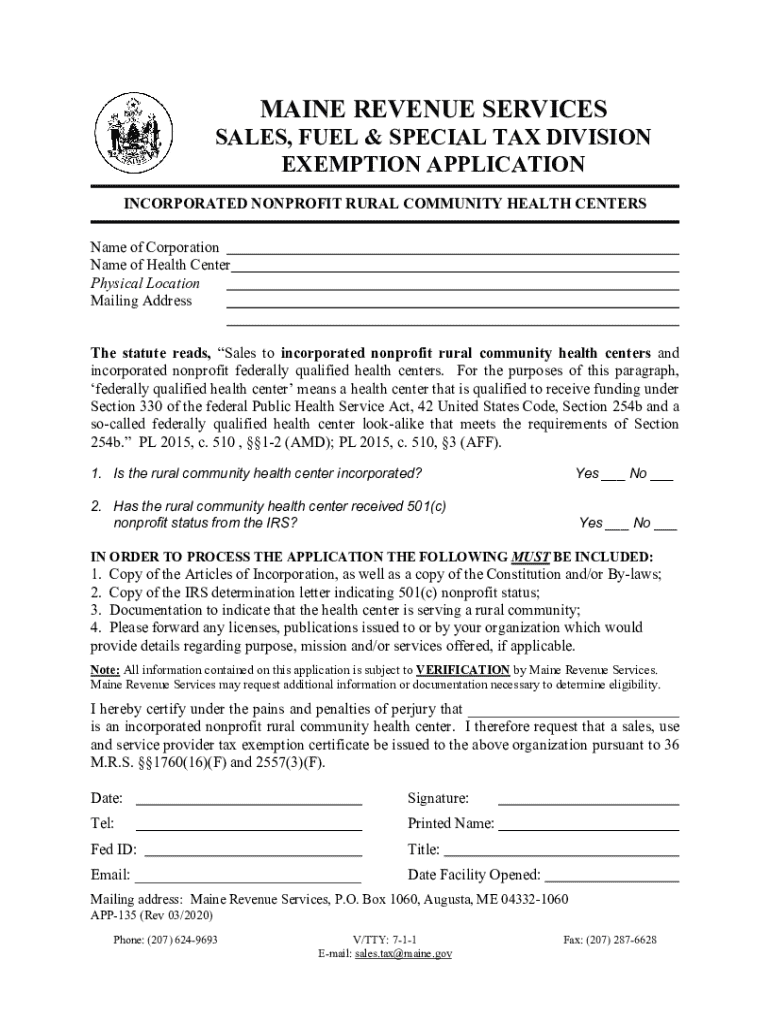

What is incorporated nonprofit federally qualified?

Who is required to file incorporated nonprofit federally qualified?

How to fill out incorporated nonprofit federally qualified?

What is the purpose of incorporated nonprofit federally qualified?

What information must be reported on incorporated nonprofit federally qualified?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.