Get the free Understanding the Indiana Contractor License and Licenses

Get, Create, Make and Sign understanding form indiana contractor

Editing understanding form indiana contractor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding form indiana contractor

How to fill out understanding form indiana contractor

Who needs understanding form indiana contractor?

Understanding the Indiana Contractor Form: A Comprehensive Guide

Defining the Indiana Contractor Form

The Indiana Contractor Form is an essential document that facilitates transactions between contractors and clients within the state. This form serves as a legal agreement that outlines the specifics of the work to be performed, ensuring that both parties have a clear understanding of their rights and obligations. For freelancers and independent contractors, this document is vital for protecting their interests while preparing for a project.

The importance of the Indiana Contractor Form cannot be overstated. It provides a structured format that helps independent contractors receive clear instructions, and terms, and conditions, thereby avoiding potential disputes. By utilizing this form, contractors can inform clients about their services, pricing, timelines, and any additional requirements necessary to complete the job, which promotes a sense of professionalism and transparency.

Indiana Contractor Form: Key Components

To successfully complete the Indiana Contractor Form, certain key components must be accurately filled out. Essential details include:

Additionally, the form contains sections detailing the work scope and project specifics. This may entail describing the services offered, various phases of work, and project deadlines. Lastly, sections devoted to certifications and compliance acknowledgments ensure that contractors recognize and adhere to any local regulations and laws governing their work.

Navigating the Indiana legal landscape

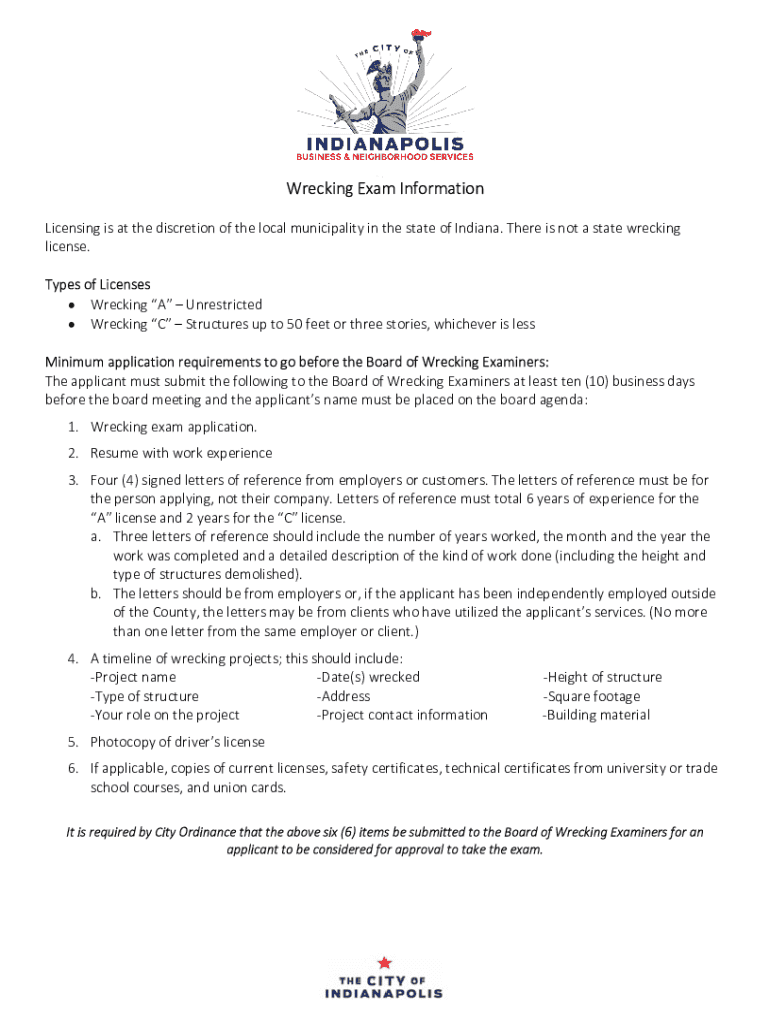

Understanding Indiana's legal framework for contractors is crucial for both compliance and successful project execution. Independent contractors must familiarize themselves with specific regulations relevant to their field, including licensing requirements which vary based on the type of work performed. For instance, contractors working in construction or electrical fields might need to obtain specific licenses to operate legally.

Equally important are tax implications and obligations. Independent contractors in Indiana must manage their personal tax responsibilities, including reporting income accurately and paying estimated taxes to avoid penalties. Understanding the distinction between employees and contractors in terms of tax reporting is essential. Unlike traditional employees, contractors are responsible for their tax liabilities, including self-employment taxes which can impact overall earnings.

Step-by-step instructions for filling out the Indiana Contractor Form

Filling out the Indiana Contractor Form can be straightforward when approached methodically. Start with a pre-filling checklist to gather necessary information, such as personal and business details, the project's nature, and any relevant timelines.

Next, follow the section-by-section guide to completing the form:

To avoid common mistakes, double-check all entries for accuracy and completeness before submission. Remember that even minor errors can lead to significant delays and complications in your working relationship.

Editing, signing, and submitting the Indiana Contractor Form

Once the form is filled, it may require some editing before it’s finalized. pdfFiller offers a variety of tools specifically designed for this purpose. You can utilize its features to annotate or add notes for clarification, ensuring that all parties are on the same page.

Incorporating digital signatures is another advantage of using pdfFiller, allowing for quick and secure approvals without the need for physical paperwork. You can then choose from several submission options; electronic submissions are generally faster, but in some cases, a paper submission might be required, particularly when dealing with particular regulatory agencies.

Managing your Indiana Contractor Form

Once you’ve completed your Indiana Contractor Form, the next crucial step is managing the document effectively. Utilize cloud storage solutions to keep your forms organized and accessible. This approach allows you to retrieve past documents easily, which is especially useful for recurring clients or projects.

Collaboration is also made easier when storing documents in the cloud. You can share forms with clients or team members while setting specific permissions for viewing or editing. This ensures that everyone included in the project is updated with the latest documents, driving productivity and reducing the risk of misunderstandings.

Payment, record-keeping, and tax reporting

An essential aspect of working as a contractor is understanding the payment terms specified in contracts. Always clarify whether payments are project-based or hourly and any penalties for late payments, which can protect your income and ensure financial stability.

Maintaining thorough records of your contractor work is also critical. Keep track of invoices, receipts, and communication with clients, which can be useful during tax season or in the event of disputes. Moreover, independent contractors must navigate IRS compliance by adhering to filing requirements and deadlines. The distinction between taxable and non-taxable deductions is particularly important for contractors, so familiarize yourself with common deductions that may apply, such as for materials or home office expenses.

Legal considerations and best practices for Indiana contractors

It’s vital to define independent contractor status clearly within Indiana, as this distinction impacts many areas from tax reporting to benefits eligibility. Understanding the differences between independent contractors and employees can prevent legal issues, such as misclassification, which can lead to penalties for both parties involved.

Another best practice to uphold as a contractor is ensuring clarity in all aspects of your contract. Nail down specific terms and project details to foster a straightforward working relationship. Additionally, both parties should be informed about liability insurance requirements applicable to their specific industry, which can mitigate risks associated with potential claims involved during project execution.

Frequently asked questions (FAQs) about the Indiana Contractor Form

As many have questions regarding the Indiana Contractor Form, it’s prudent to address some common inquiries. A frequent concern is the completion and submission process; contractors should ensure that every section is filled accurately to avoid delays in processing.

Another common inquiry involves understanding legal obligations and penalties associated with non-compliance. It’s crucial to grasp how these obligations affect not only contractual work but also your financial responsibilities. Lastly, oftentimes, clarity concerning the relationship between contractors and their hiring clients can prevent misunderstandings and ensure a smooth partnership, paving the way for future work possibilities.

Conclusion: Empowering your contracting journey with pdfFiller

Completing your Indiana Contractor Form accurately is paramount for successful project execution and legal compliance. To make this process easier, leveraging pdfFiller for your document management needs can simplify your experience. With tools for seamless editing, eSigning, and effective collaboration, pdfFiller provides an efficient, cloud-based solution tailored to the needs of contractors.

In conclusion, a comprehensive understanding of the Indiana Contractor Form not only aids in compliance but also enhances your professional journey. Embracing effective tools can make a significant difference in managing your contracting work, enabling you to focus on what you do best—providing outstanding services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my understanding form indiana contractor directly from Gmail?

How can I get understanding form indiana contractor?

How do I edit understanding form indiana contractor online?

What is understanding form indiana contractor?

Who is required to file understanding form indiana contractor?

How to fill out understanding form indiana contractor?

What is the purpose of understanding form indiana contractor?

What information must be reported on understanding form indiana contractor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.