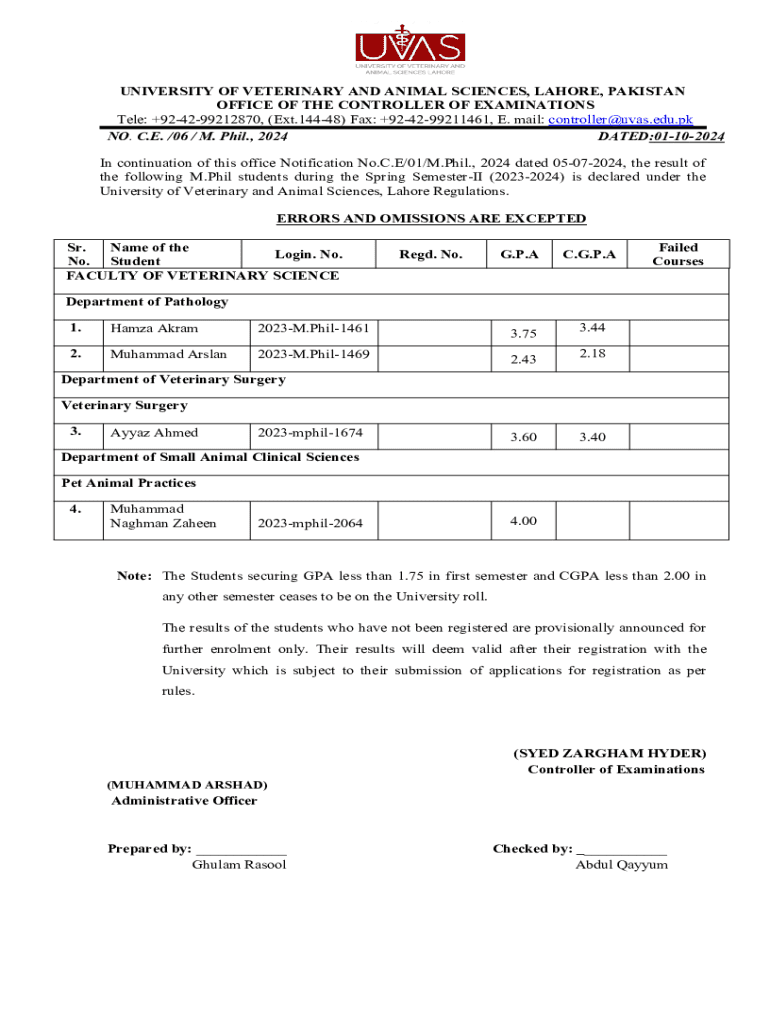

Get the free /06 / M

Get, Create, Make and Sign 06 m

How to edit 06 m online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 06 m

How to fill out 06 m

Who needs 06 m?

How to Complete the 06 form on pdfFiller

Understanding the 06 form

The 06 m form is a crucial document utilized by taxpayers for efficiently reporting their financial details to the relevant tax authorities. It is primarily used to declare income, specify deductions, and calculate tax liability accurately. The importance of this form lies in its ability to assist taxpayers in fulfilling their obligations while maximizing potential returns.

To ensure compliance and accuracy, understanding the key requirements and eligibility criteria for the 06 m form is essential. Taxpayers must verify they meet specific income and residency conditions before filing. Providing accurate information not only aids in avoiding penalties but also streamlines the submission process.

Preparing to fill out the 06 form

Before diving into the actual completion of the 06 m form, gathering all necessary documents is vital. This includes previous tax returns, income statements, and any documentation related to deductions. Without these documents, completing the form may lead to inaccuracies, potentially resulting in delayed processing or rejection by tax authorities.

Moreover, common pitfalls to avoid should be considered, such as rushing through sections or neglecting to double-check calculations. To enhance the accuracy of the provided information, consider using a structured approach whereby each document is systematically reviewed and referenced against the form. This organized strategy will help in minimizing errors.

Step-by-step instructions for completing the 06 form

Step 1: Accessing the 06 form

To find the 06 m form on pdfFiller, navigate to the site and use the search feature to locate the form. You can either download it for offline completion or use pdfFiller’s editing tools to fill it out directly online. The online option is particularly useful as it offers immediate access to all necessary functionalities to streamline the process.

Step 2: Filling out personal information

Filling out personal information includes completing your name, address, contact, and Social Security Number (SSN). It is crucial to ensure that your address is formatted correctly, and phone numbers are entered in a standardized format to avoid any confusion. pdfFiller’s interface will generally guide you to the required formats, ensuring compliance.

Step 3: Completing financial information

The next step involves entering financial information, which consists of multiple components including income sources, deductions, and tax credits. Be prepared to provide precise figures for your total income and follow specific guidelines for deductions related to transient accommodations and other relevant costs. Utilize pdfFiller’s built-in calculators to assist with complex financial figures.

Step 4: Reviewing and editing the form

After all fields are completed, it's essential to thoroughly review the 06 m form. pdfFiller provides various editing tools that allow you to make adjustments easily. Checking for errors in spelling, numerical inaccuracies, or incomplete sections will help ensure compliance before submitting your document. A thorough review could save you from potential headaches down the line.

Advanced features for managing your 06 form on pdfFiller

eSigning the 06 form

To finalize the 06 m form, electronically signing is a critical step. pdfFiller makes this process simple. You can add your signature by using the eSignature tool, which allows you to either draw your signature, upload an image, or type it. After signing, ensure to verify the authenticity of your signature by checking pdfFiller’s security settings.

Collaboration features

If you’re working in a team environment or require input from others, pdfFiller offers robust collaboration features. You can share the form with colleagues for input or review. Utilize comments and annotations to address specific sections, ensuring that every detail is accounted for. This teamwork functionality enhances accuracy and efficiency.

Saving and storing your form

Once the form is filled, saving changes is a basic yet crucial part of the process. pdfFiller gives you various options to save your file, including downloading it to your device or saving it within their cloud storage. Utilizing cloud storage allows for easy access from anywhere, making it convenient for future reference or edits.

Frequently asked questions about the 06 form

Processing times for the 06 m form can vary, but generally, you can expect it to be processed within two to four weeks after submission, depending on the volume of returns being handled by tax authorities. If you realize you've made an error after submitting the 06 m form, it is possible to modify it, but be careful to follow the proper amendment procedures outlined by the IRS or relevant tax authority.

In case you encounter any technical issues while filling out the form online, pdfFiller offers comprehensive customer support. You can reach out via a dedicated support email or call for immediate assistance, ensuring that any roadblocks you experience can be resolved quickly and efficiently.

Troubleshooting common issues with the 06 form

Errors can lead to rejection of your 06 m form and may stem from a variety of issues such as incorrect calculations or missing signatures. If your form is rejected, promptly reviewing the feedback provided is essential. Most often, the error can be corrected quickly by referencing your original documents.

To ensure compliance with filing deadlines, schedule regular reminders for when forms must be submitted. Keeping track of updates regarding tax announcements and requirements will further safeguard against unintentional errors in form submission. Consistent monitoring will allow you to stay ahead of any changes affecting your tax returns.

Important considerations and best practices

It’s imperative to keep your personal and financial information secure while filling out the 06 m form. Ensure that you are using secure connections and only entering data on trustworthy platforms like pdfFiller. Understanding your rights and responsibilities as a taxpayer is equally important; failure to comply can result in fines or penalties.

Stay informed on any changes to the 06 m form requirements each tax year. Engaging with relevant resources and announcements helps you adapt to new regulations, ensuring your submissions remain compliant and efficient over time. Keeping documentation updated and easily accessible will streamline your future filing processes.

Utilizing pdfFiller's tools for future document management

Beyond mastering the 06 m form, pdfFiller's tools allow you to manage a variety of documents. The platform offers additional document templates that can cater to a wide range of needs, from business contracts to personal letters. Leveraging a cloud-based platform means that you can store and manage your forms seamlessly and access them from anywhere, ensuring you are always equipped with the necessary information.

As team collaboration becomes more critical, pdfFiller enhances this by providing essential features like simultaneous editing and real-time feedback. This collaborative power not only improves the speed of document creation but also ensures a more thorough review process, giving users confidence in their submissions. Whether it’s an individual needs or teamwork, pdfFiller stands out as an essential tool for efficient document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 06 m in Chrome?

How do I fill out 06 m using my mobile device?

Can I edit 06 m on an iOS device?

What is 06 m?

Who is required to file 06 m?

How to fill out 06 m?

What is the purpose of 06 m?

What information must be reported on 06 m?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.