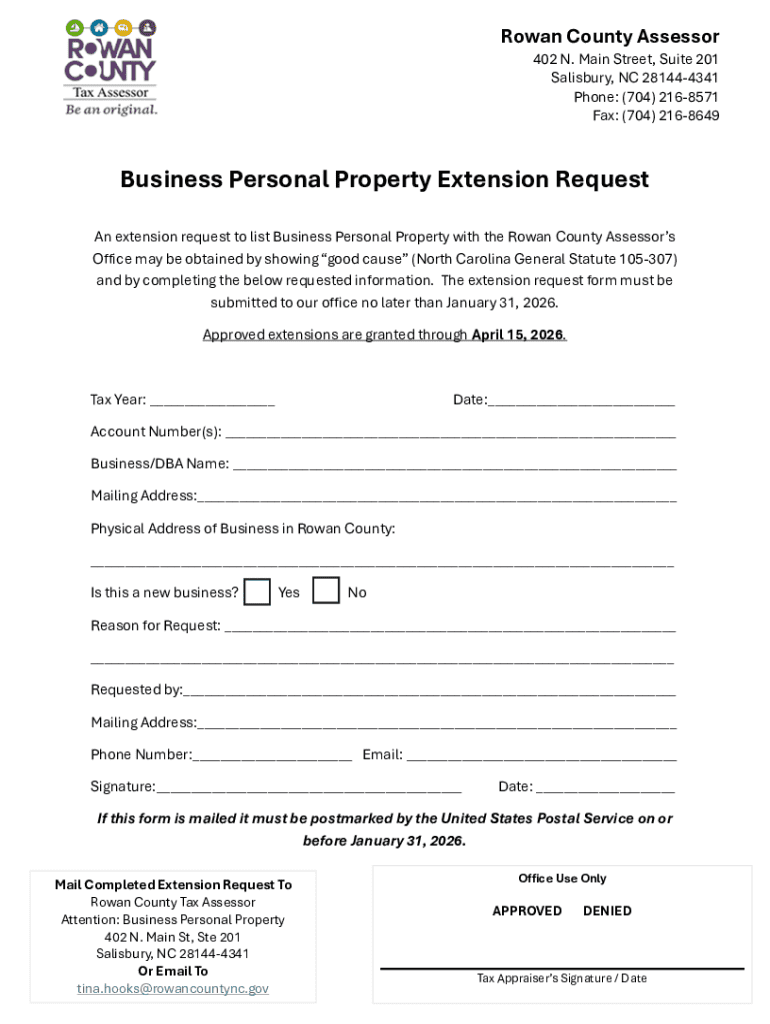

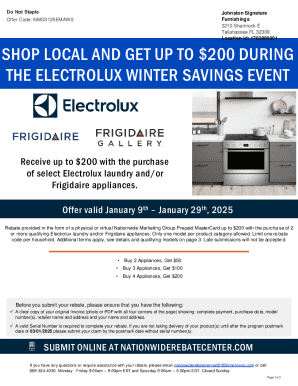

Get the free 2026 Business Personal Property Extension Request

Get, Create, Make and Sign 2026 business personal property

How to edit 2026 business personal property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 business personal property

How to fill out 2026 business personal property

Who needs 2026 business personal property?

Your Complete Guide to the 2026 Business Personal Property Form

Understanding the 2026 business personal property form

The 2026 business personal property form serves a critical role in the realm of property tax oversight. This specific form is designed for businesses to report their personal property to the tax authorities, ensuring accurate taxation and compliance with local regulations. By filing this form, businesses declare the assets they own or lease, which may include furniture, machinery, and equipment. Proper reporting helps local governments assess property tax revenues more accurately.

Key terminology associated with the 2026 business personal property form includes 'depreciation,' 'exemptions,' and 'classification.' Each term plays a vital role in how businesses manage their assets and tax obligations. Accurate reporting not only impacts financial outcomes for businesses but also contributes to community funding for public services. Therefore, understanding this form is essential for all business owners.

Who needs to complete the 2026 business personal property form?

Filling out the 2026 business personal property form is necessary for businesses that own or lease tangible personal property. This typically applies to various business types, including retail stores, manufacturing facilities, and service-based companies. However, exclusionary criteria exist for small businesses or those with a minimal amount of personal property, which may not be required to file.

Successfully navigating the tax system comes with a responsibility. Non-compliance can lead to penalties, additional taxes, and even legal trouble for the business. Hence, it's crucial to evaluate whether your business meets the criteria for completing this essential form to avoid the risks associated with neglecting this requirement.

Components of the 2026 business personal property form

The 2026 business personal property form consists of several critical components, each requiring precise input. The 'Business Identification Section' collects vital information about the business, such as its name, tax ID, and address. Following this, the 'Property Ownership Details' section informs the tax authority about the ownership status of the reported property.

Assets must be identified and classified properly under the 'Asset Classification' section, which helps determine their taxable status. Additionally, businesses need to provide 'Depreciation Schedules' that reflect the age and condition of each asset. Lastly, the 'Tax Exemptions' section identifies any applicable exemptions that could reduce the taxable amount. Common pitfalls include missing sections or providing inaccurate information; thus, diligence is necessary in each part of the form.

Step-by-step guide to filling out the form

Completing the 2026 business personal property form necessitates preparation. First, gather necessary documentation, such as previous tax returns, asset lists, and invoice records. Organizing this information effectively can save time and minimize errors during the form completion phase.

When filling out the form, start with the Business Identification Section, then proceed to Property Ownership Details. Carefully classify each asset according to tax regulations, ensuring to follow the guidelines outlined for depreciation schedules. Always be thorough in reviewing your entries to avoid inaccuracies that could lead to complications. Lastly, utilize a checklist to ensure all sections are completed before finalizing the form.

Editing and modifying your form

For businesses that need to make adjustments, pdfFiller offers a seamless solution for editing PDFs. This platform allows users to modify or update the 2026 business personal property form easily, ensuring that the information remains accurate every year. If changes are required after submission, it is imperative to follow the prescribed procedures for amending filed documents to stay compliant.

Annual updates are often necessary as businesses acquire or dispose of assets. Consider setting reminders to review the completed form regularly, ensuring all information remains current and reflective of your business’s operations. Clarifying these updates annually can significantly ease the next filing process.

Signing and submitting the 2026 business personal property form

The signing and submission process for the 2026 business personal property form includes various options for electronic signatures. Utilizing eSigning features offered by platforms like pdfFiller ensures the process is both secure and efficient. Digital signature integration is straightforward and can often save valuable time during the filing process.

Submit the completed form according to the deadlines set forth by your local tax authority. After submission, maintain organized records of your filed documents for future reference. This record-keeping practice will aid in any subsequent inquiries or assessments that may arise from the tax authority’s review process.

Post-submission: what to expect

Upon submitting your 2026 business personal property form, expect a review process from the tax authority. This may include notifications regarding your submission or requests for additional information if something appears unclear. Businesses may occasionally receive follow-ups concerning valuation or classification disputes, which are normal within the review process.

Being proactive in managing communications with the tax authority can ease any tensions. Consistently check communications for inquiries and respond promptly to ensure an ongoing, transparent relationship with tax officials. This approach will help mitigate potential issues that may impact your business.

FAQs about the 2026 business personal property form

Common queries regarding the 2026 business personal property form often revolve around eligibility and process specifics. Businesses frequently ask whether they qualify based on asset value thresholds or if certain types of assets are exempt from taxation. Clarifications on specific sections, such as depreciation and classification, are also prevalent.

Additionally, understanding the procedures for handling disputes or appeals arising from the property's valuation can significantly empower business owners. Familiarizing yourself with these aspects can facilitate a smoother experience when dealing with tax authorities.

Additional resources for effective tax management

Utilizing interactive tools and templates available on pdfFiller enhances the efficiency of filling out the 2026 business personal property form. The platform provides tailored resources designed to streamline the tax management process for business owners, offering guidance across various state-specific guidelines and requirements.

Furthermore, employing best practices for annual reporting promotes a solid understanding of tax obligations and asset management. The wealth of resources provided by pdfFiller assists users in navigating this complex landscape while remaining compliant with evolving regulations.

Encouragement for streamlined document management

The integration of pdfFiller in managing your business documents affords numerous benefits. From efficiently editing PDFs to easy eSigning features, the platform supports a smooth document management experience. By employing collaboration tools and cloud storage solutions, businesses gain a comprehensive solution for all document-based tasks.

Exploring these features not only enhances operational efficiency but also secures essential business information in a centralized location. Embracing this technology can transform cumbersome processes into streamlined workflows, making the management of the 2026 business personal property form an effortless task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2026 business personal property from Google Drive?

How can I send 2026 business personal property for eSignature?

How do I edit 2026 business personal property on an iOS device?

What is 2026 business personal property?

Who is required to file 2026 business personal property?

How to fill out 2026 business personal property?

What is the purpose of 2026 business personal property?

What information must be reported on 2026 business personal property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.