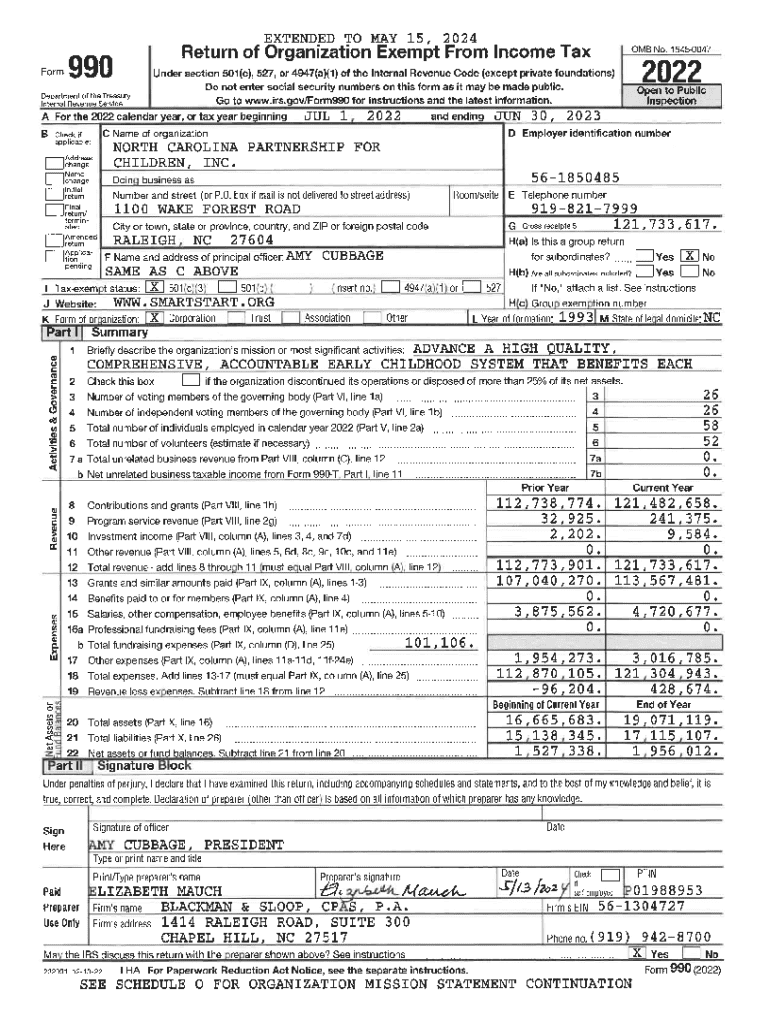

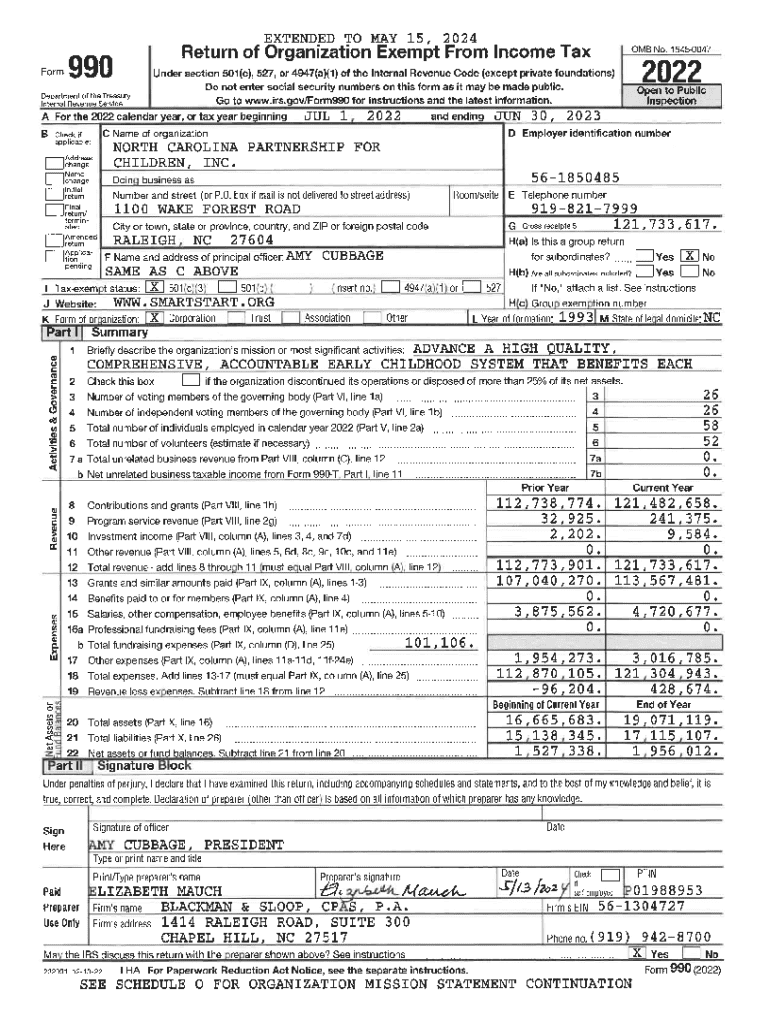

Get the free North Carolina Partnership For Children Inc - Nonprofit Explorer

Get, Create, Make and Sign north carolina partnership for

Editing north carolina partnership for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north carolina partnership for

How to fill out north carolina partnership for

Who needs north carolina partnership for?

North Carolina Partnership for Form: A Comprehensive How-To Guide

Understanding the North Carolina Partnership for Form

A partnership for form in North Carolina refers to a formalized business relationship between two or more individuals who agree to share responsibilities, profits, and liabilities of a business venture. Understanding this structure is crucial as it provides a legal foundation for operating a business while ensuring compliance with state regulations.

The purpose of forming a partnership extends beyond mere business operations. It fosters collaboration, capital sharing, and collective expertise among partners. A primary rationale for proper formation is to guarantee that the partnership is acknowledged by the state, offering legal protections and establishing rights and responsibilities.

Legal framework governing partnerships in North Carolina

The legal framework for partnerships in North Carolina is rooted in both statutory provisions and common law. The North Carolina Revised Uniform Partnership Act governs most partnerships, detailing the requirements for forming general partnerships, limited partnerships, and limited liability partnerships (LLPs).

Understanding these distinctions is crucial: a general partnership involves equal responsibility among partners, while a limited partnership has both general and limited partners, and an LLP provides liability protection to all partners, shielding personal assets from the business's debts.

Steps to create a partnership in North Carolina

Creating a partnership begins with determining its type. The essential types are general, limited, and limited liability partnerships, each possessing unique attributes. Key considerations include risk tolerance and the desired level of control, influencing which model best suits your objectives.

The next step involves choosing a partnership name. This name must not only comply with state naming regulations - such as not being deceptively similar to other registered businesses - but also convey the partnership’s business nature. Conducting availability checks is vital and can be efficiently done through the North Carolina Secretary of State’s online databases.

Following the naming process, drafting a solid partnership agreement is crucial. This document outlines roles, responsibilities, profit-sharing arrangements, and procedures for dispute resolution. A well-structured partnership agreement protects partners and facilitates smoother operations.

After drafting your agreement, it’s essential to register the partnership with the state. This includes completing the appropriate forms, which can typically be submitted online or via mail. Ensure you have all necessary information at hand, such as your partnership name, the address of the principal office, and the names of all partners.

Finally, it’s crucial to obtain any required licenses and permits based on your partnership’s business activities. This encompasses checking local zoning laws, health permits, or professional licenses, as regulatory compliance is critical to your legitimacy as a business.

Managing your partnership

Navigating the management of a partnership involves ongoing compliance with North Carolina state laws, which necessitates awareness of specific reporting requirements and deadlines. Each partnership type may have different obligations, and failure to comply can result in substantial legal ramifications.

Maintaining clear records is equally vital for successful partnership management. Accurate documentation not only assists in resolving disputes but provides a reference point for operations and financial tracking. Utilizing tools such as pdfFiller can streamline record-keeping by offering cloud-based management of documents, making them accessible and editable from anywhere.

Addressing conflicts in partnerships is another key management skill. It’s crucial to establish strategies for resolving disputes, as common issues may arise over profit-sharing or differing visions for the partnership. Mediation is often an effective first step before pursuing formal legal resolutions amid escalating disagreements.

Leveraging technology for document management

In today’s digital age, utilizing technology for document management is indispensable. pdfFiller offers a cloud-based platform tailored for partnerships, providing seamless solutions for editing PDFs, eSigning, and collaborating on documents. This flexibility enhances accessibility and collaboration among partners, especially when remote work is involved.

To effectively use pdfFiller for management, users can fill out partnership forms electronically, ensuring efficiency and accuracy. Features such as document sharing, eSigning, and commenting facilitate real-time collaboration, which is essential for decision-making in partnerships.

Furthermore, the collaborative tools offered by pdfFiller promote engagement among partners. Features such as cloud commenting and annotation support effective communication, making it easier to discuss and modify partnership documents on the go.

Special considerations for partnerships in North Carolina

One of the significant aspects of operating a partnership in North Carolina is navigating tax implications and filing obligations. Partnerships themselves are typically pass-through entities, meaning they do not pay income taxes directly. Instead, profits and losses are reported on partners’ individual tax returns, thus necessitating an understanding of the individual tax responsibilities tied to their partnership income.

Moreover, it's essential to familiarize yourself with the specific filing deadlines for tax returns to avoid penalties. North Carolina has set guidelines and resources available through the North Carolina Department of Revenue that can provide clarity to new partnerships.

Additional resources are vital for partnerships operating in North Carolina. State organizations offer support through guidance, educational workshops, and networking opportunities which can be pivotal for new partnerships seeking to navigate the initial challenges of formation and operation.

Common mistakes to avoid when forming a partnership

Neglecting to draft a formal partnership agreement remains one of the most significant pitfalls encountered by new partnerships. Verbal agreements, while common, expose partners to misunderstandings and potential litigation, as they lack the binding force of written documentation.

Another critical mistake is failing to comprehend liability. Understanding the differences between personal and business liability is essential in protecting individual assets from business debts. Choosing the right partnership structure can safeguard against unforeseen financial burdens.

Lastly, partners must be diligent in staying compliant with ongoing obligations. Regularly reviewing legal and operational requirements and addressing them promptly helps avoid penalties and ensures the partnership's smooth operation.

Interactive tools to facilitate partnership formation

Employing digital worksheets and templates can greatly aid in the partnership formation process. pdfFiller provides interactive resources, enabling partners to fill out, customize, and finalize essential documents tailored to their needs. This streamlines the often tedious process of paperwork, making it efficient and user-friendly.

Additionally, having a checklist for new partnerships can help ensure that all aspects of the formation process are covered. Such a checklist serves as a practical tool, guiding partners through the necessary steps to form a compliant and operational partnership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my north carolina partnership for in Gmail?

How do I edit north carolina partnership for on an iOS device?

How can I fill out north carolina partnership for on an iOS device?

What is north carolina partnership for?

Who is required to file north carolina partnership for?

How to fill out north carolina partnership for?

What is the purpose of north carolina partnership for?

What information must be reported on north carolina partnership for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.