Get the free Notification of Direct Deposit Authorization Change

Get, Create, Make and Sign notification of direct deposit

Editing notification of direct deposit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notification of direct deposit

How to fill out notification of direct deposit

Who needs notification of direct deposit?

Comprehensive Guide to Notification of Direct Deposit Form

Understanding direct deposit

Direct deposit is a key financial service that allows for the electronic transfer of funds directly into an individual's bank account. Rather than receiving a physical paycheck, employees can authorize their employer or government agency to deposit their earnings, reimbursements, or benefits automatically. This method not only ensures timely payment but also eliminates the risks associated with lost checks.

The workflow begins when an employer processes payroll and initiates a transfer to the employee’s bank using the provided banking information. The funds are typically available immediately or within a business day, depending on the banking institution. This quick transaction process is one of the primary reasons why many organizations and employees opt for direct deposit.

Importance of the notification of direct deposit form

The notification of direct deposit form serves as a critical document in the transition to electronic payments. Its primary purpose is to provide employers with the necessary authorization from employees to initiate direct deposits into their accounts. This form ensures that there is a legal record of the employee's request and confirms their banking information, minimizing potential errors.

Individuals who need to complete this form include new hires wanting to set up direct deposit, current employees who wish to change their banking details, or anyone modifying their direct deposit settings due to changes in financial situations. Without the completion of this essential document, payroll processing may be delayed, leading to issues such as late payments and employee dissatisfaction.

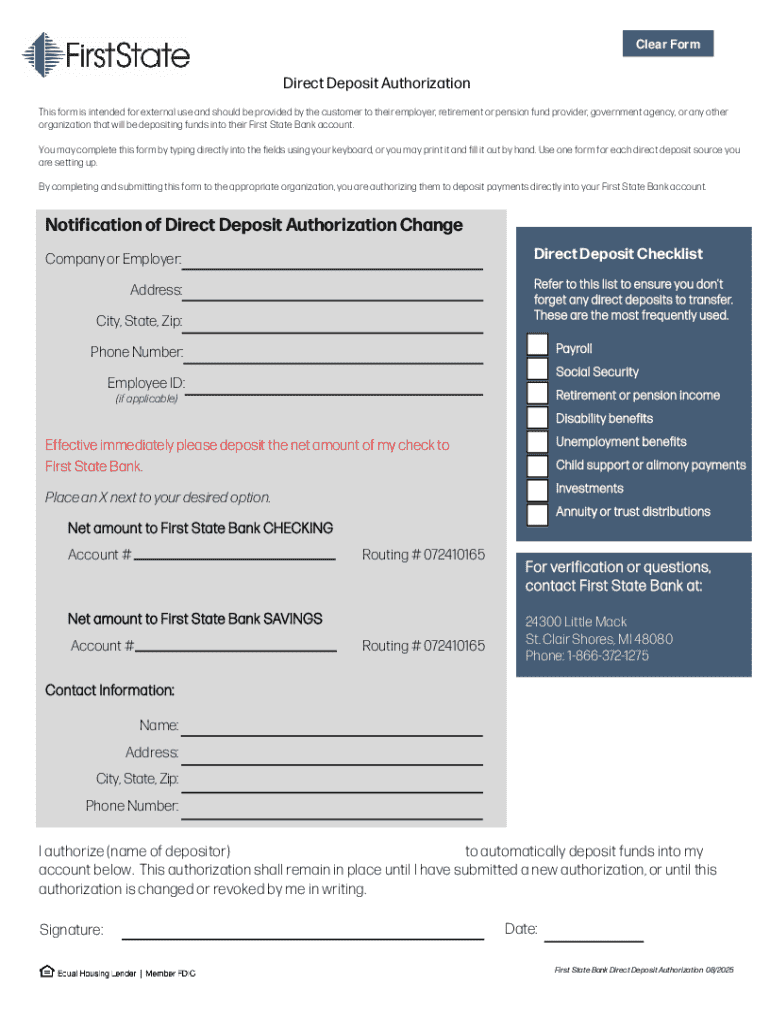

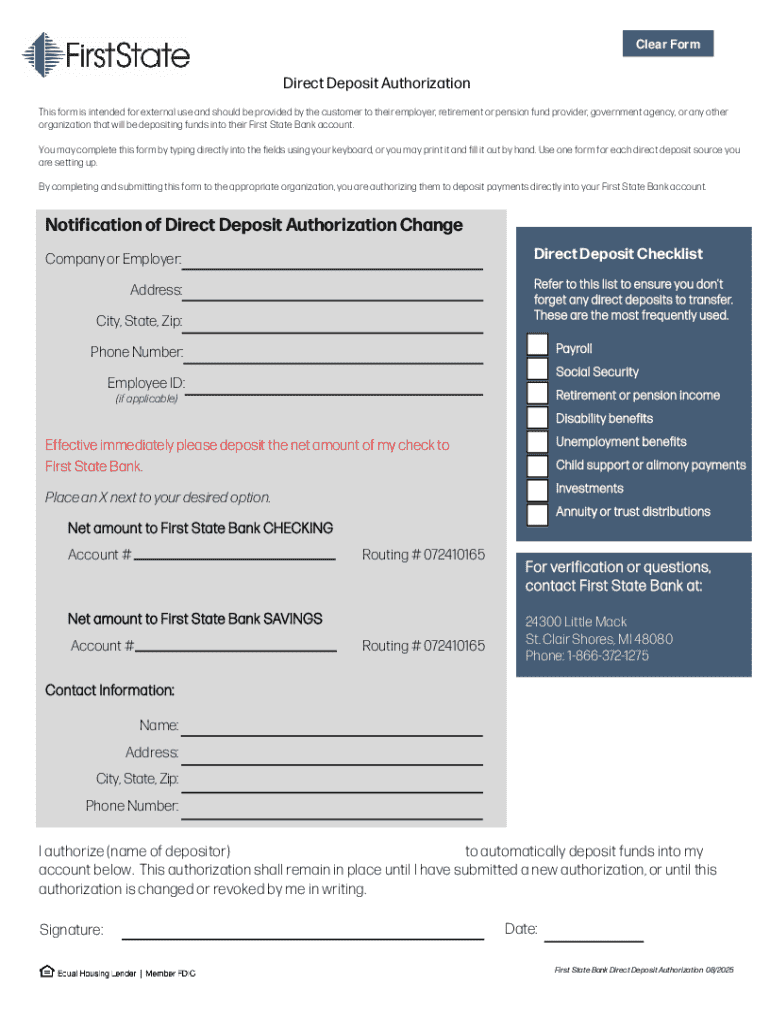

Preparing to fill out the notification of direct deposit form

Before you start filling out the notification of direct deposit form, it’s essential to gather all necessary information. Specifically, you will need your bank account details, including your account number and routing number. These numbers are vital for ensuring that your funds are deposited accurately and without delay.

In addition to banking information, personal details such as your full name, address, and Social Security number are also required. It’s crucial to have accurate and up-to-date information to prevent any issues with your deposits. When selecting a template, consider using pdfFiller’s direct deposit form template. This user-friendly interface allows for easy input of all required data.

Step-by-step guide to completing the notification of direct deposit form

To ensure accuracy while completing the notification of direct deposit form, follow these detailed steps:

Common questions about the notification of direct deposit form

As you navigate the process of using a notification of direct deposit form, you may have some pressing questions. Here are a few common inquiries:

Troubleshooting issues with direct deposit notifications

Despite the ease of direct deposit, issues can arise. Common problems include delayed payments, incorrect deposit amounts, or failed transactions. If you encounter any of these issues, follow these steps to troubleshoot effectively:

Security and privacy considerations

When dealing with sensitive financial information, safeguarding your personal details is paramount. Ensure that any communication regarding your notification of direct deposit form is done through secure channels. Avoid sharing your banking information over unsecured communication platforms. Reputable platforms like pdfFiller prioritize the protection of user data through encryption and secure storage.

By using pdfFiller, you can rest assured that comprehensive security measures are in place. The platform encrypts your documents and allows for e-signatures, enhancing both security and convenience while managing your forms.

The role of pdfFiller in managing direct deposit forms

pdfFiller stands out as a powerful tool for managing direct deposit forms. Not only does it provide an interactive platform for filling out and submitting your notification of direct deposit form, but it also offers features for editing and signing documents. Changes can easily be made to any form as needed, and comprehensive collaboration tools are available for teams who work together on financial documentation.

Additionally, pdfFiller's cloud-based access ensures that users can manage their documents from anywhere, whether in the office or at home. This level of accessibility is ideal for individuals and teams that require flexibility in their document management processes.

Conclusion: Streamlining your payment processes

Utilizing the notification of direct deposit form is a straightforward way to manage your finances efficiently. With the streamlined processes offered by pdfFiller, individuals and teams can enjoy a user-friendly experience that simplifies form completion and submission. Taking a proactive approach to manage your direct deposits ultimately leads to smoother financial workflows and improved satisfaction.

As direct deposit becomes the norm in numerous workplaces and for various transactions, embracing tools that facilitate this process will only enhance your financial management capacity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send notification of direct deposit for eSignature?

How do I execute notification of direct deposit online?

How do I fill out notification of direct deposit on an Android device?

What is notification of direct deposit?

Who is required to file notification of direct deposit?

How to fill out notification of direct deposit?

What is the purpose of notification of direct deposit?

What information must be reported on notification of direct deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.