Get the free Direct Deposit Authorization Form For Employees In ...

Get, Create, Make and Sign direct deposit authorization form

How to edit direct deposit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization form

How to fill out direct deposit authorization form

Who needs direct deposit authorization form?

Direct Deposit Authorization Form: A Comprehensive How-to Guide

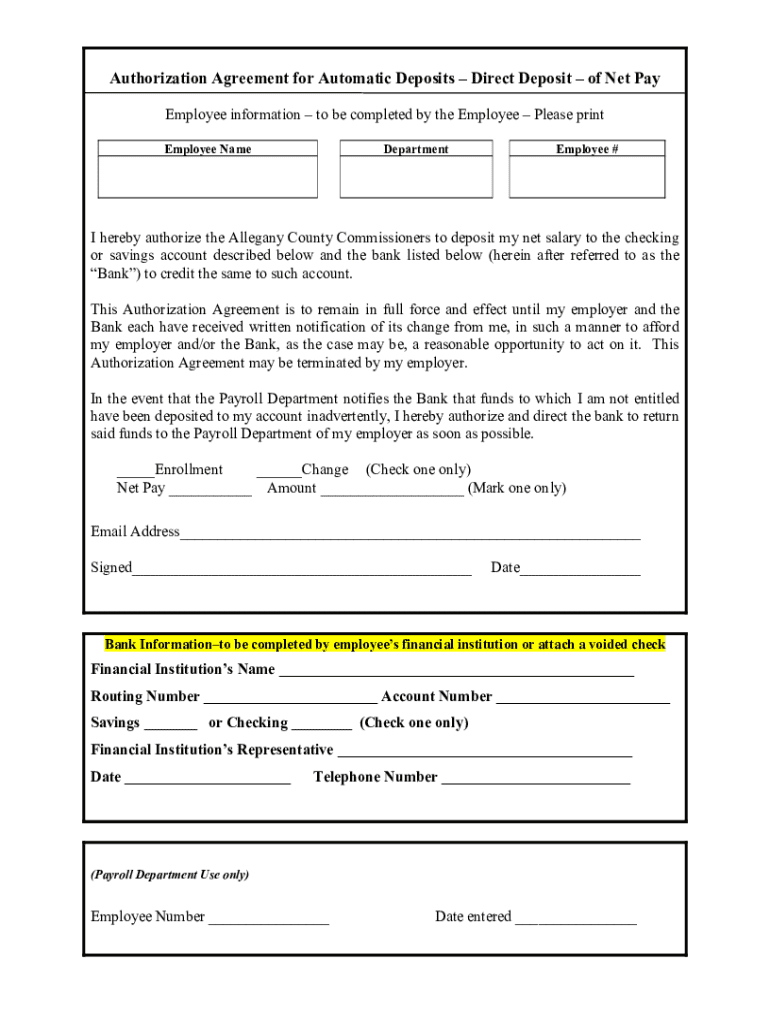

Understanding the direct deposit authorization form

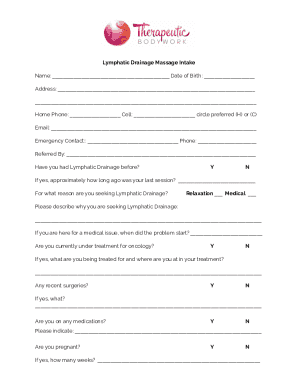

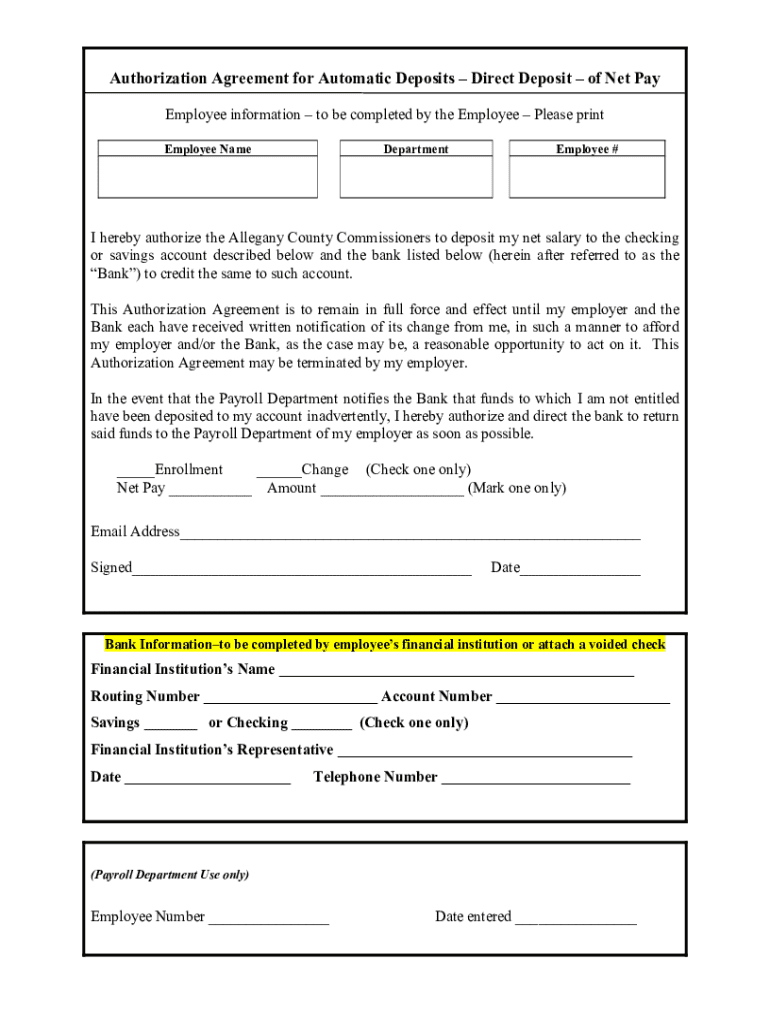

A direct deposit authorization form is a crucial document that allows employers or entities to deposit funds directly into an employee's bank account. Its primary purpose is to streamline the payroll process, enabling automatic payments without the need for physical checks. This form facilitates timely access to your earnings while minimizing the risk of lost or stolen checks, providing a convenient option for both employers and employees.

Using this form enhances financial security and accuracy in payment processing. Employees benefit from quicker access to their funds, typically on paydays, without needing to visit a bank. Moreover, for employers, it reduces administrative overhead related to check printing and distribution. Situations where a direct deposit authorization form might be necessary include starting a new job, requesting a change in bank account information, or when moving to a new employer that mandates this method of payment.

Key components of the direct deposit authorization form

To ensure the smooth processing of payments, several key components must be included in a direct deposit authorization form. Essential information typically consists of personal identification details, which help confirm your identity. This includes your name, address, and contact information. Additionally, detailed bank account information is required, which will contain your bank’s name, account number, and routing number. Lastly, employer information is included to verify the source of the payment.

A critical aspect of the form involves consent and signature requirements. You must explicitly authorize your employer to deposit funds into your designated account. Different institutions or employers may have variations, but all require various essential elements to ensure both security and compliance.

Step-by-step instructions for filling out the form

Filling out a direct deposit authorization form might seem daunting, but following a step-by-step guide simplifies the process considerably. **Step 1: Gather Necessary Information**—Before filling out the form, confirm that you have all required information on hand, including your bank account number and routing number, as well as your employee ID and employer contact details. This preparation ensures a smoother completion of the form.

**Step 2: Fill Out the Personal Information Section**—Accurate information is crucial. Enter your full name, address, and any other required personal details. Double-check spelling and accuracy to avoid any issues with payment processing. **Step 3: Enter Bank Account Information**—You need to specify whether you're deposit funds into a checking or savings account, ensuring the correct account type is selected. **Step 4: Review and Provide Authorization**—Read the consent clause carefully before signing. This clause agrees to the terms of direct deposit. **Step 5: Sign and Submit the Form**—Finally, sign the form and submit it to the designated party, typically your employer or human resources department.

Editing and customizing your direct deposit authorization form

Utilizing tools like pdfFiller facilitates easy editing and customization of your direct deposit authorization form. With cloud-based access, users can edit and save documents anywhere, ensuring mobility and convenience. You can start with pre-designed templates specifically for direct deposit, which can be modified to fit your unique situation. Moreover, maintaining compliance with company standards and professional formatting is straightforward with such tools.

The ability to edit allows you to keep your information up to date, ensuring prompt processing. This capability is essential whether you’re changing employers, updating your bank account information, or managing multiple direct deposits.

Utilizing pdfFiller for a seamless document management experience

pdfFiller offers an array of features for document creation including robust cloud-based access that enables users to manage their files from any device at any time. Its eSign features guarantee the security of your authorization while also expediting the signing process. Additionally, collaboration tools play a vital role for teams needing simultaneous input or review of documents, enhancing efficiency in managing authorization forms.

By leveraging a comprehensive library of forms and templates available on pdfFiller, users can easily navigate the complexities of direct deposit forms and related document requirements. This comprehensive system not only organizes your submissions but significantly improves your overall experience in document management.

Common mistakes and how to avoid them

While completing the direct deposit authorization form, several common mistakes can occur that may cause delays or issues in processing payments. One frequent error is failing to double-check banking information, leading to incorrect deposits. Always ensure that your routing number and account number are entered accurately to prevent problems. Additionally, incomplete forms can hinder processing, so reviewing and verifying that each section is filled out correctly before submission is advisable.

Furthermore, overlooking signature requirements can invalidate the form. Always ensure that you have signed and dated the document, confirming your authorization for direct deposits. By being meticulous in these areas, you can save time and ensure your payments are handled smoothly.

Frequently asked questions (FAQs) about direct deposit authorization form

If you need to change accounts, it's important to fill out a new direct deposit authorization form with your updated details and submit it promptly. Processing times vary by employer, but you may notice changes in your direct deposit within one or two pay cycles. It's prudent to maintain communication with your employer regarding these changes.

Many users ask about fees associated with direct deposits; generally, there are no fees for direct deposits from employers. However, if you're working with certain account types or banks, it's wise to inquire about potential fees directly. Always ensure you are aware of your bank's policies.

Troubleshooting common issues with direct deposit

While direct deposits are typically reliable, some issues can arise, such as payment delays. If you experience a delay, first check with your employer to confirm that your payroll was processed on time. If issues persist, contacting your bank can provide further insights into any complications at their end.

If you made an error on the form, address it as soon as possible. Many employers and banks have protocols for correcting authorization mistakes. Keeping thorough records and communications with your employer or bank will aid in effectively rectifying any errors.

Best practices for managing your direct deposit authorization form

Managing your direct deposit authorization form includes ensuring secure storage of all financial documents. Utilize encryption or password protection when storing digital copies. Regularly reviewing and updating your authorization information is vital, especially after life changes such as moving to a new bank or changing jobs. Staying on top of these updates will reduce the risk of payment disruptions.

Additionally, keeping track of your payment schedules and any changes will help you ascertain that deposits are made correctly and on time. This proactive approach aids in identifying inconsistencies in your finances before they escalate.

How pdfFiller simplifies your document experience

The advantages of eSigning with pdfFiller cannot be overstated; this feature helps you execute agreements quickly while maintaining the integrity and security of your documents. The collaborative aspects of the platform allow teams to share and modify documents with ease, simplifying tracking and revisions through shared access.

Furthermore, pdfFiller boasts an extensive library of document templates beyond just direct deposit forms which can accommodate a wide range of needs. This versatility enhances the document management experience significantly, providing users with a comprehensive solution for all their document-related tasks on a single platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get direct deposit authorization form?

How do I edit direct deposit authorization form in Chrome?

How do I fill out direct deposit authorization form using my mobile device?

What is direct deposit authorization form?

Who is required to file direct deposit authorization form?

How to fill out direct deposit authorization form?

What is the purpose of direct deposit authorization form?

What information must be reported on direct deposit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.