Get the free Notice to TaxpayersLegals

Get, Create, Make and Sign notice to taxpayerslegals

How to edit notice to taxpayerslegals online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice to taxpayerslegals

How to fill out notice to taxpayerslegals

Who needs notice to taxpayerslegals?

Notice to Taxpayers Legal Form: A Comprehensive Guide

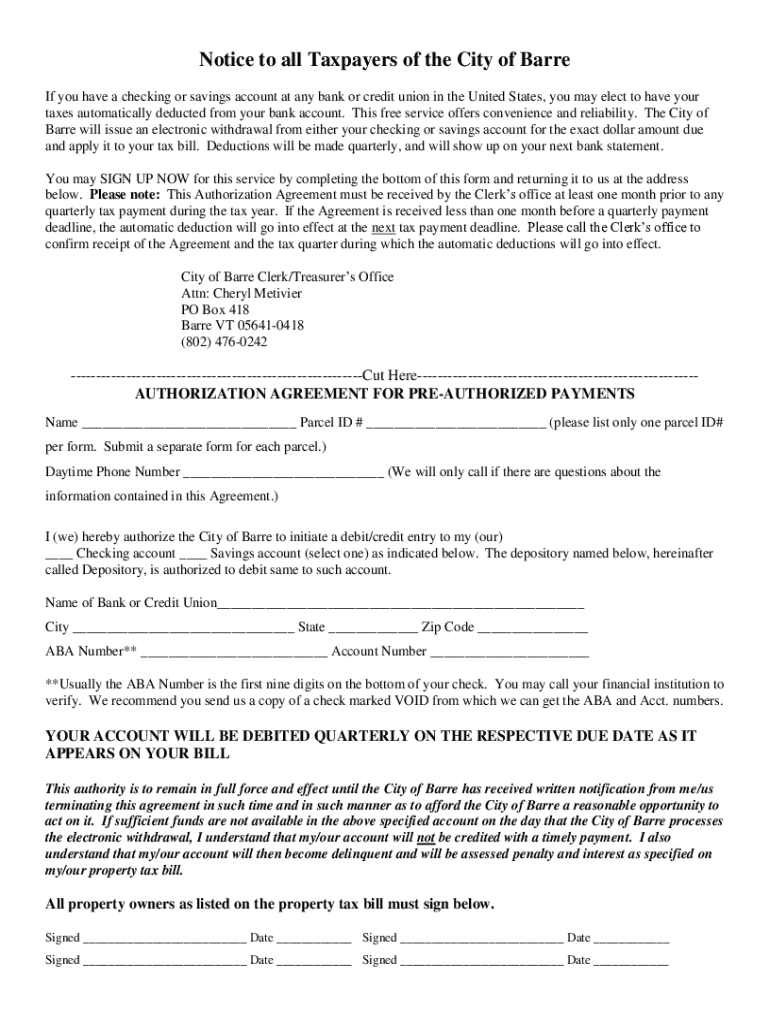

Understanding the notice to taxpayers legal form

The notice to taxpayers legal form is a crucial document designed to officially inform taxpayers about various tax-related issues, such as changes in tax law, outstanding obligations, or updates in their tax status. The primary purpose of this form is to ensure clear communication between tax authorities and taxpayers, which is essential for maintaining compliance with tax laws.

Legal implications of the notice to taxpayers legal form are significant. Failing to respond or comply with the notice can lead to penalties, interest accrual, or even legal action. Tax authorities are required to provide clear documentation, and this legal form helps fulfill that obligation, ensuring that taxpayers are duly informed of their rights and responsibilities.

Understanding the importance of this form cannot be overstated. For taxpayers, it serves as a reminder of necessary actions regarding their tax situation, helping them to stay compliant and avoid unnecessary fines or penalties.

Who needs to use this form?

The notice to taxpayers legal form is applicable to a wide array of taxpayers, including both individuals and corporations. Individuals typically use it to address their personal tax responsibilities, while corporations might use it for compliance with business-related tax obligations. Each group has unique situations where this form is required, reflecting the different tax laws that govern personal and corporate finances.

There are several scenarios that necessitate the use of this form, such as receiving a tax bill from a local tax authority, being notified of an audit, or being informed about changes to tax regulations that affect a taxpayer’s liabilities.

Components of the notice to taxpayers legal form

A well-structured notice to taxpayers legal form comprises several essential components that ensure it effectively communicates necessary information. At the outset, the form requires taxpayer identification details, which typically include the taxpayer's name, address, and Social Security Number or Employer Identification Number. Accurate identification is crucial for the proper processing of the notice.

In addition, the form should contain all pertinent legal information, including the tax periods involved, the type of tax assessment being made, and any applicable laws or sections of the tax code. Proper formatting further aids clarity, ensuring that each section is distinctly labeled and that the information is organized logically.

Step-by-step instructions for completing the form

Filling out the notice to taxpayers legal form correctly is crucial for effective communication with tax authorities. Start with Step 1: gather all necessary information. This may include financial documents, previous tax returns, and correspondence related to the tax issue at hand. Ensure that you have accurate documentation, as errors can lead to delays or complications.

Next, in Step 2, fill out the form accurately. Pay careful attention to each section, ensuring that all information provided is consistent and correct. Common mistakes include incorrect taxpayer identification or failing to attach required supporting documents. It’s vital to be thorough to avoid any back-and-forth communication that could prolong the resolution of the issue.

Finally, Step 3 is to review and edit the form before submission. Accuracy and clarity are paramount. It’s advisable to use tools such as pdfFiller’s editing features to ensure the document is polished. Double-check all entries and formatting to minimize the chances of issues arising after the form is submitted.

Submitting the notice to taxpayers legal form

Once the notice to taxpayers legal form is completed, the next step is submission. This is typically done through the local tax authority relevant to your jurisdiction. It's essential to know the submission method preferred by your local agency, as some may accept electronic filing while others require mailed forms.

E-filing options can simplify the process, offering advantages such as faster processing times and confirmation of receipt. Be mindful of deadlines for submission, as missing them can adversely affect your tax situation. Common deadlines for tax forms may vary, so always check with your local tax authority for the most current dates.

Keeping track of your submission

Monitoring the status of your notice to taxpayers legal form after submission is vital for ensuring compliance. Some tax authorities provide online portals or tracking systems where you can check the status of your submission. Keeping detailed records and confirming receipt can protect you if disputes arise.

Utilizing document management systems like pdfFiller can enhance your tracking capabilities. With pdfFiller, you can save and access your forms anytime, anywhere, using cloud-based technology. Additionally, pdfFiller offers tracking features to help you know the status of your form and facilitate the organization of your tax documents.

What to do if you need assistance

If you encounter issues while completing or submitting the notice to taxpayers legal form, it's important to know where to turn for help. Common problems include confusion over tax laws or completion requirements. In these instances, reaching out to tax professionals can provide necessary clarification and support.

Additionally, submitting a request for help from pdfFiller's support team can resolve technical or document-management questions. Their services can assist with various tools and features to ensure the completion and submission of tax forms is as smooth as possible.

Future-proofing your tax compliance

Tax regulations are continually evolving; therefore, staying informed about legal updates that impact tax notices is crucial. Regularly checking local and federal resources ensures you remain compliant with any changes in tax policy that may affect your status as a taxpayer. You may also consider subscribing to updates from credible tax blogs and newsletters.

Incorporating tools like pdfFiller not only aids in filing this particular form but also supports document management for all future tax documents. This ongoing use can foster a more organized approach, making compliance simpler as tax systems become more complex.

Interactive tools and features on pdfFiller relevant to this form

pdfFiller offers a suite of interactive form-filling tools specifically designed to simplify the experience for users dealing with the notice to taxpayers legal form. The platform allows for easy editing, commenting, and collaboration on documents, making it accessible for teams working together on tax matters.

Another notable feature is eSigning, which simplifies the legal acceptance of documents. Users can electronically sign forms, making the tedious process of printing, signing, and scanning obsolete. This streamlining enhances efficiency, ensuring that documents are completed and submitted without unnecessary delay.

Advanced tips for effective use

To maximize the utility of the notice to taxpayers legal form and the associated processes, consider automating future tax notifications. By setting reminders and utilizing pdfFiller's features, such as document templates, you can streamline your workflow and ensure timely submissions.

Integrating pdfFiller with other financial tools can also enhance your overall document management system. This integration fosters a cohesive approach to handling financial paperwork, allowing you to keep track of both personal and business tax responsibilities efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice to taxpayerslegals without leaving Google Drive?

Where do I find notice to taxpayerslegals?

How do I fill out notice to taxpayerslegals on an Android device?

What is notice to taxpayerslegals?

Who is required to file notice to taxpayerslegals?

How to fill out notice to taxpayerslegals?

What is the purpose of notice to taxpayerslegals?

What information must be reported on notice to taxpayerslegals?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.