Get the free Loan Approval Letter Template & Examples

Get, Create, Make and Sign loan approval letter template

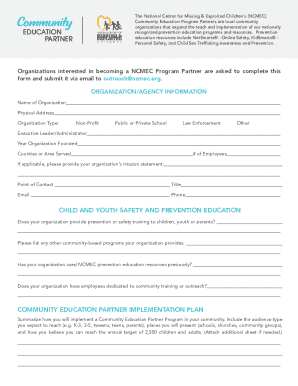

How to edit loan approval letter template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan approval letter template

How to fill out loan approval letter template

Who needs loan approval letter template?

Loan Approval Letter Template Form: A Detailed How-To Guide

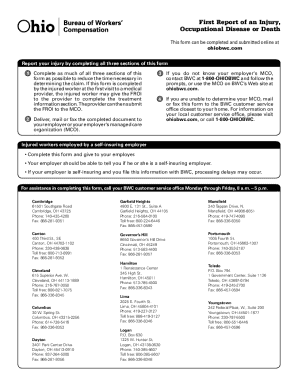

Understanding the loan approval letter

A loan approval letter is a crucial document that signifies a lender's commitment to providing funds to a borrower. It outlines specifics like the loan amount, interest rates, and terms, thus serving as a formal confirmation of the approval process. This letter is vital for individuals and teams as it not only validates their financial requests but also facilitates smoother transactions in various financial environments, from personal loans to mortgages.

There are two primary types of loan approval letters: pre-approval and final approval letters. Pre-approval letters are issued once the lender reviews initial documentation and verifies the borrower’s creditworthiness, while final approval letters are provided after all necessary checks and documentation have been completed. Furthermore, the content of the letter may vary based on the type of loan—mortgage, personal, or auto—highlighting specifics pertinent to each type.

Key elements of a loan approval letter template

Crafting a loan approval letter template requires attention to detail to include essential components that ensure clear communication with the borrower. Key items to include are the borrower's details, the approved loan amount, interest rates, repayment terms, and any specific conditions of approval that the borrower must adhere to. For instance, if the approval is contingent on providing proof of insurance or meeting certain credit requirements, that information should be readily apparent.

In addition to these elements, a template can include optional personalized messages or remarks that enhance the relationship between the lender and the borrower. These might include congratulatory notes on achieving approval or suggestions for additional financial products that could meet the borrower’s ongoing needs.

Tips for crafting an effective loan approval letter

The tone and language used in a loan approval letter should always maintain professionalism while being approachable. A friendly, yet formal language can ease anxieties that borrowers may have about their financial prospects. Clarity and conciseness are paramount; the letter should communicate all necessary details without overwhelming the borrower with jargon or excessive information.

Formatting and design also play significant roles in the letter's effectiveness. A clean layout that utilizes white space effectively enhances readability, making it easier for the borrower to grasp the main points at a glance. Suggested fonts include Arial or Times New Roman, and using bold for headings or important figures can facilitate navigation of the document.

Utilizing the loan approval letter template

Filling out a loan approval letter template requires a systematic approach to ensure accuracy and completeness. Start by entering customized sections for borrower information, including their name, address, and relevant identification numbers. Next, populate the financial details specific to the loan, such as the approved loan amount, interest rates, and payment terms. It’s important to double-check these figures to avoid any discrepancies that could lead to confusion down the line.

Interactive tools like those offered by pdfFiller can significantly enhance this process. Features such as editable fields, dropdown menus, and persistent cloud storage simplify document creation and management. Additionally, the platform offers electronic signature capabilities, allowing borrowers to sign the document digitally, paving the way for faster transaction processing. This not only convenience but also increases the efficiency of loan disbursements.

Benefits of using a loan approval letter template

Using a loan approval letter template streamlines the process for both teams and individual borrowers. Templates save time and reduce the responsibility of having to start from scratch for each letter. This efficiency is particularly noticeable in busy lending environments, where numerous applications are processed regularly. A standardized template allows staff to maintain a consistent communication style and quickly adapt to the specific needs of individual borrowers.

Furthermore, templates help in error reduction. They often include necessary legal language and the correct format that complies with regulations within a specific state or city. This safeguards against potential legal ramifications that could arise from poorly constructed letters. By utilizing a well-crafted template, lenders can ensure that all necessary components are included while minimizing the risk of oversight.

Advanced considerations for loan approval letters

When dealing with special cases, such as unconventional loans or unique borrower situations, a template may need adjustments. For example, borrowers with lower credit scores might require a more tailored letter that emphasizes the conditions under which they qualify for the loan. In such scenarios, it's essential to address the specificities within the letter clearly to manage expectations and maintain transparency throughout the approval process.

Moreover, understanding the legal implications of approval letters is crucial. A loan approval letter can sometimes create binding agreements on behalf of the lender. Therefore, ensuring clarity in terms is vital to avoid misunderstandings about loan repayment, interest rates, and conditions that may vary by state or city. Clarity in these elements will not only benefit the borrower but also protect the lender’s interests.

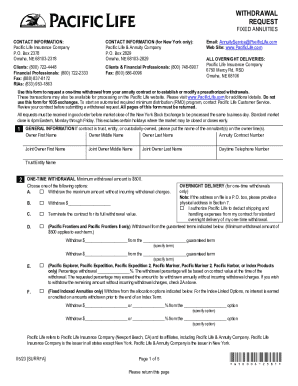

How pdfFiller enhances your loan approval letter process

pdfFiller stands out as an invaluable tool for enhancing the loan approval letter process. With its cloud-based platform, users can create, edit, and share documents seamlessly from any location. The collaborative functionalities enable multiple team members to work on letter drafts simultaneously, fostering efficiency and consistency across communications.

Additionally, pdfFiller simplifies the signing process. With electronic signing capabilities, borrowers can sign documents directly through the platform, which accelerates the overall loan approval cycle. There are numerous real-life cases where lenders have reported increased productivity and reduced turnaround times through the use of pdfFiller, demonstrating its effectiveness in streamlining document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my loan approval letter template in Gmail?

How do I complete loan approval letter template on an iOS device?

How do I fill out loan approval letter template on an Android device?

What is loan approval letter template?

Who is required to file loan approval letter template?

How to fill out loan approval letter template?

What is the purpose of loan approval letter template?

What information must be reported on loan approval letter template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.