Understanding the And When Recorded Mail Form for Property Transactions

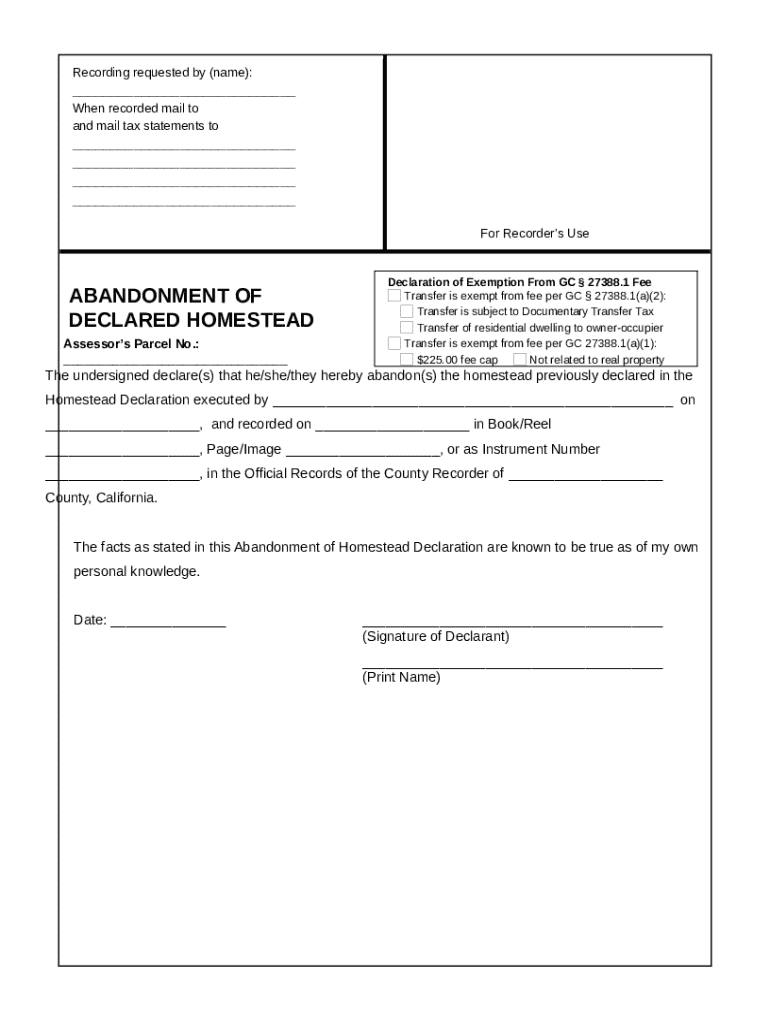

Understanding the 'And When Recorded' mail form

The 'And When Recorded' mail form is a crucial document used in property transactions, primarily acting as an instruction for the recording office on how to manage real estate transfers. This form indicates that specific documents should be recorded only after they have been executed and is often utilized when the involved parties want to ensure that the deed or other legal documents are not entered into public record until they have been signed and notarized.

Its core purpose lies in protecting the involved parties by guaranteeing that all necessary conditions are met prior to the public disclosure of property transfers. This distinction is especially important in real estate deals where timing and documentation must align perfectly to avoid legal complications.

Key components of the And When Recorded mail form

To effectively utilize the 'And When Recorded' mail form, understanding each segment of the document is essential. The primary components typically include:

Legal Description of Property - This section outlines the exact location and boundaries of the property being transferred, generally referencing a surveyor's description or a tax identification number.

Grantor and Grantee Information - Detailed information about both parties involved in the transaction is required, including full names and addresses to identify who is transferring the property and who is receiving it.

Notary Acknowledgment Requirements - Notarization is often mandated to validate the identity of the parties signing the form and to prevent fraud. This section specifies how the acknowledgment should be completed.

Completing each section with precision is vital, as inaccuracies can lead to complications in the recording process, affecting the legality of the property transfer.

Step-by-step instructions for filling out the And When Recorded mail form

Completing the 'And When Recorded' mail form requires careful preparation to avoid pitfalls. Here’s a detailed guide to assist you through the process:

Preparing Necessary Documentation - Before you begin filling out the form, gather all relevant documents, including the property deed, identification for both parties, and any previous forms that might be related.

Completing the Form - Follow these steps carefully:

Legal Description Entry - Write down the legal description of the property accurately, as this ensures correct identification in future records.

Filling in Parties Involved - Provide complete names and addresses of the grantor and grantee. Double-check spellings to prevent issues.

Acknowledgment by Notary - After filling out the document, ensure it is signed in the presence of a notary public, who will validate and notarize the form.

Reviewing Your Form for Accuracy - After completing the form, examine all entries for correctness before submission, as errors could delay the transaction.

Common challenges and solutions when completing the form

While filling out the 'And When Recorded' mail form, several common challenges can arise, including:

Misspellings and Incorrect Legal Descriptions - One of the most prevalent issues arises from typographical errors in names or property details. Always cross-reference the legal description with existing property records.

Issues with Notarization - A lack of proper notarization can lead to an invalid form. Ensure that the notary is licensed and understands their responsibilities in confirming identity.

Filing Deadlines and Regulations - Each jurisdiction may have specific deadlines for filings that must be adhered to strictly. Familiarizing yourself with local regulations can prevent unnecessary delays.

By being aware of these challenges and preparing solutions in advance, you can streamline the process and ensure effective completion of the form.

Interactive tools to simplify form completion

Various online resources can significantly facilitate the completion of the 'And When Recorded' mail form. Notable tools include:

Online Form Fillers and eSign Tools - Several platforms allow for digital completion and signing, streamlining the workflow and ensuring high accuracy.

Integrated Document Management Solutions at pdfFiller - This solution offers comprehensive services, including editing, signing, and storing forms, making document management straightforward.

Benefits of Using Cloud-based Platforms - Cloud services allow you to access your documents from anywhere, inviting collaboration and reducing the chances of lost paperwork.

Utilizing these tools can enhance your experience and ensure that all necessary components of your forms are managed effectively and efficiently.

Frequently asked questions (FAQs) about the And When Recorded mail form

As you navigate through the process of using the 'And When Recorded' mail form, several common questions may arise, including:

What Happens After Submission? - Once the form is submitted, the recording office processes it, which may take several days based on local regulations. You will receive confirmation once the form is officially recorded.

Can I Make Changes After Recording? - Changes typically require additional documentation, including possibly a new 'And When Recorded' mail form, to be filed correctly.

How Do I Know if My Form is Accepted? - You can follow up with the recording office for confirmation of receipt and acceptance of the form.

Examples and templates of And When Recorded mail form

Accessing customizable templates saves time and eliminates guesswork when filling out the 'And When Recorded' mail form. On pdfFiller, users can find several templates designed to assist in creating documents that meet local legal requirements.

Additionally, real-life examples serve to illustrate proper use and help users visualize how filled forms should appear, facilitating better comprehension.

Best practices for managing property transfer documentation

Managing documentation for property transfers requires organization and compliance with local regulations. Here are several practices to consider:

Tips on Organizing and Storing Records - Develop a filing system that makes documents easy to retrieve and organized according to type and date.

Maintaining Compliance with Local Regulations - Keep abreast of local laws governing property transactions, as regulations can vary significantly from one area to another.

Collaboration Tools for Teams Handling Property Transactions - Utilize technology that enables team collaboration, especially if multiple parties handle the transaction, fostering transparency and efficiency.

Additional insights and resources for property transactions

Leveraging additional resources, including engaging with legal professionals, can provide vital support during the property transaction process. Understanding relevant legislation and regulatory sources empowers parties in navigating potential pitfalls.

Consulting with an attorney is advisable when dealing with complex transactions or when uncertainties arise about the implications of property transfer documentation.

Navigating additional forms related to property transactions

Alongside the 'And When Recorded' mail form, various other forms play essential roles in property transactions. Common documents include Grant Deeds, Quitclaim Deeds, and other notices that often accompany property transfers.

Understanding how the 'And When Recorded' mail form interacts with these related documents can help streamline the entire process, ensuring compliance and accuracy in all legal affairs concerning property transactions.