Get the free Annual Report of the Comptroller General of the United ...

Get, Create, Make and Sign annual report of form

Editing annual report of form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual report of form

How to fill out annual report of form

Who needs annual report of form?

Annual report of form - How-to Guide

Understanding the annual report

An annual report is a comprehensive document produced yearly by companies to communicate financial performance, operations, and strategic direction to shareholders and stakeholders. This report typically integrates various segments of a business, showcasing its achievements and challenges over the past year.

Filing an annual report is crucial for businesses as it fulfills legal obligations and fosters transparency with investors. This not only enhances credibility but also influences investment decisions, thus playing a pivotal role in building trust and attracting potential stakeholders.

Key components of an annual report

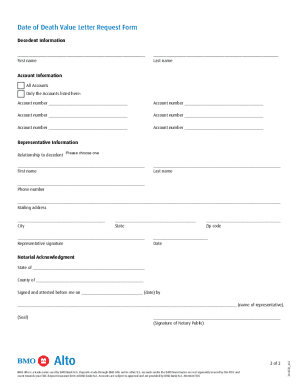

Every annual report contains essential elements that provide a clear picture of the organization’s health. First, financial statements, which include a balance sheet, income statement, and cash flow statement, present a quantitative overview of the organization’s fiscal status.

Another integral component is the Management Discussion and Analysis (MD&A), where management shares insights on financial results and engaging narratives. The auditor's report assures stakeholders of the accuracy of financial reporting, while shareholder information offers details about stock performance and dividends.

Lastly, compliance and regulatory requirements are vital as they dictate the form and content of the report, ensuring that the organization adheres to legal standards that vary by jurisdiction.

Preparing to file your annual report

Before filing an annual report, it’s crucial to gather all necessary documentation. Start by collecting financial records from the previous year, which will inform the current report. Ensure you have a copy of last year's annual report for reference, along with your business's tax identification numbers.

Common mistakes can include overlooking deadlines, incorrect financial figures, or missing compliance information. To prevent these pitfalls, create a checklist to ensure that all components are accounted for and accurately presented.

Step-by-step guide to completing the form

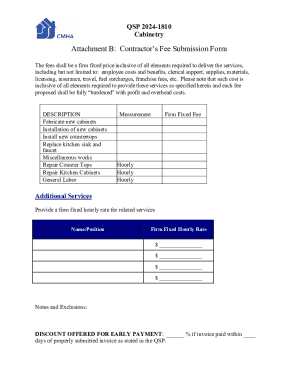

The process of completing your annual report form begins with accessing the form on pdfFiller. The platform provides tailored templates that streamline filling out all necessary sections.

While completing the form, focus on required fields such as company name, financial summaries, and contact information. Optional fields may include additional remarks or special disclosures, which can add valuable context to your submission.

Frequently asked questions (FAQs) about annual reports

A common question is, 'What is the deadline for filing my annual report?' Typically, deadlines vary by state but often fall on the anniversary of your business's formation. Understanding the specific timelines is crucial to maintaining compliance.

Another frequently asked query is regarding changes to a filed report. If updates are necessary, most jurisdictions allow modification through specific forms, but it's essential to follow the state's guidelines.

E-filing and submission process

E-filing has notably simplified the submission of annual reports. Submitting electronically via platforms like pdfFiller involves clear steps that enhance user experience, from inputting data to submitting forms to the division of corporations in your state.

The ease of e-Filing corresponds to the technology used. Supported web browsers ensure seamless access to the platform, allowing for responsive service and reducing the likelihood of technical issues.

Payment options for filing fees

Filing fees can vary widely by state and business type, with various accepted payment methods including credit or debit card payments. It's not uncommon for organizations to face confusion around these fees, but understanding your filing obligations helps mitigate risks.

Consideration of deadlines is vital; payments made after the deadline may incur additional penalties. Be proactive in guestimating your annual budget for submission costs.

After filing your annual report

Upon submission, maintaining compliance is a critical next step. Keep copies of your filings and confirmation receipts to ensure you can refer back to them as needed and verify your compliance status.

Expect a formal acknowledgment from your local authorities. If any errors occur in your submission, it's essential to reach out promptly to rectify them to avoid potential penalties or misreporting.

Special considerations

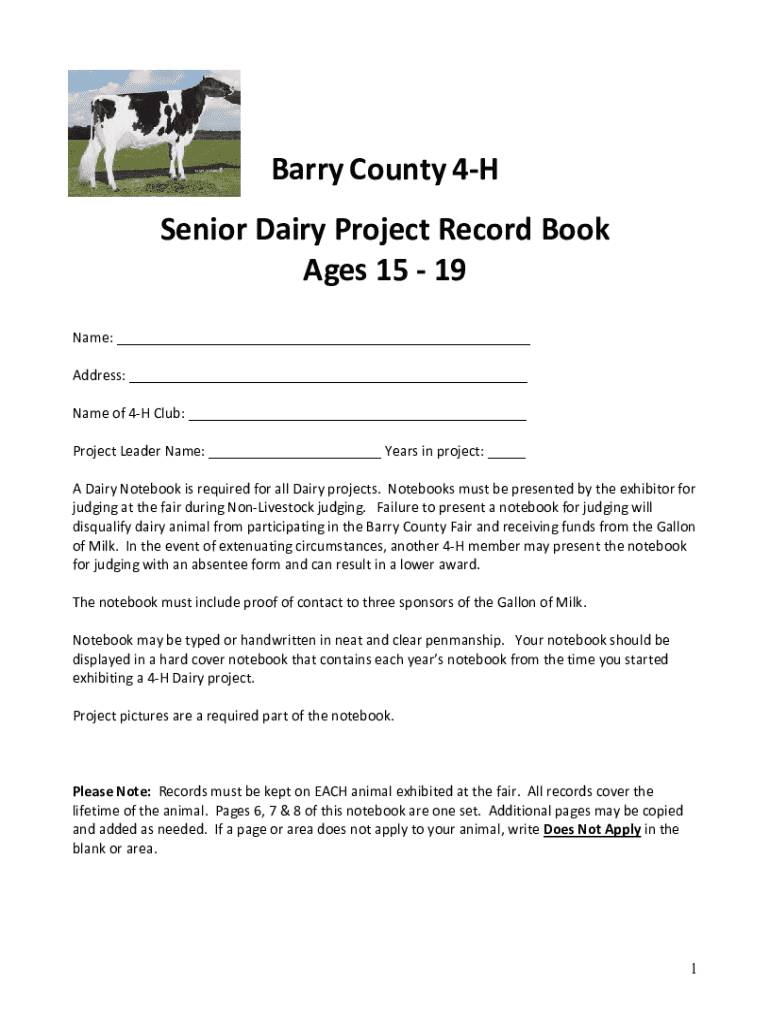

Annual reporting processes vary significantly depending on your business structure—LLC, corporation, or nonprofit. Each type has unique requirements, legal obligations, and filing frequencies, so it’s vital to be informed accordingly.

For businesses that are closing, reporting requirements may differ. Depending on state regulations, certain filings may still be necessary to formally cease operations.

Leveraging pdfFiller for document management

Using pdfFiller not only simplifies annual report submissions but also empowers comprehensive document management. With features allowing the creation, editing, and signing of PDFs, it streamlines the entire process for businesses.

Collaborative tools available within pdfFiller enhance teamwork during report preparation. Users can work together in real-time, ensuring efficient and transparent communication. Additionally, the security measures in place protect sensitive business information.

Interactive tools and resources

pdfFiller offers access to templates specifically designed for annual reports, providing a starting point for users. This resource can significantly reduce the time spent formatting documents and increase focus on content.

Tools for financial calculations and projections are also readily available, allowing for comprehensive analyses while creating your reports. User testimonials underscore how pdfFiller enhances productivity, making the annual reporting process less daunting.

Additional insights

Trends in annual reporting are evolving, reflecting shifts towards digital documentation and transparency in corporate governance. Keeping abreast of these changes is crucial for modern business practices.

The future of e-filing looks promising as more businesses transition to online platforms for report submissions. Continuous education around compliance and reporting standards ensures that business owners remain equipped to navigate these requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the annual report of form electronically in Chrome?

How do I edit annual report of form straight from my smartphone?

How do I fill out the annual report of form form on my smartphone?

What is annual report of form?

Who is required to file annual report of form?

How to fill out annual report of form?

What is the purpose of annual report of form?

What information must be reported on annual report of form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.