Get the free Return of Organization Exempt From Income Tax "' ,,,

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt from Income Tax (Form 990): A Comprehensive Guide

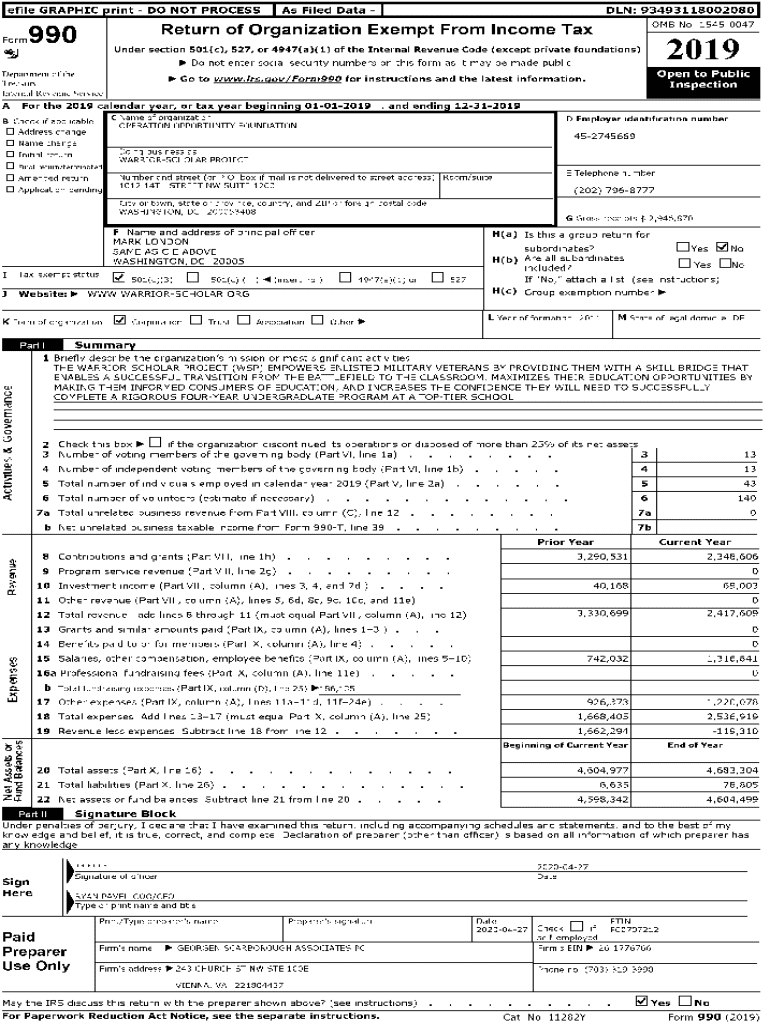

Understanding Form 990

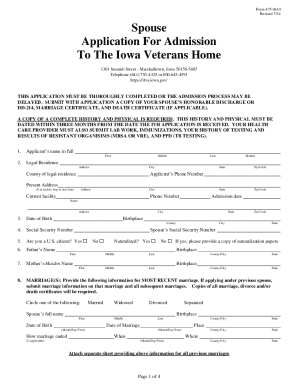

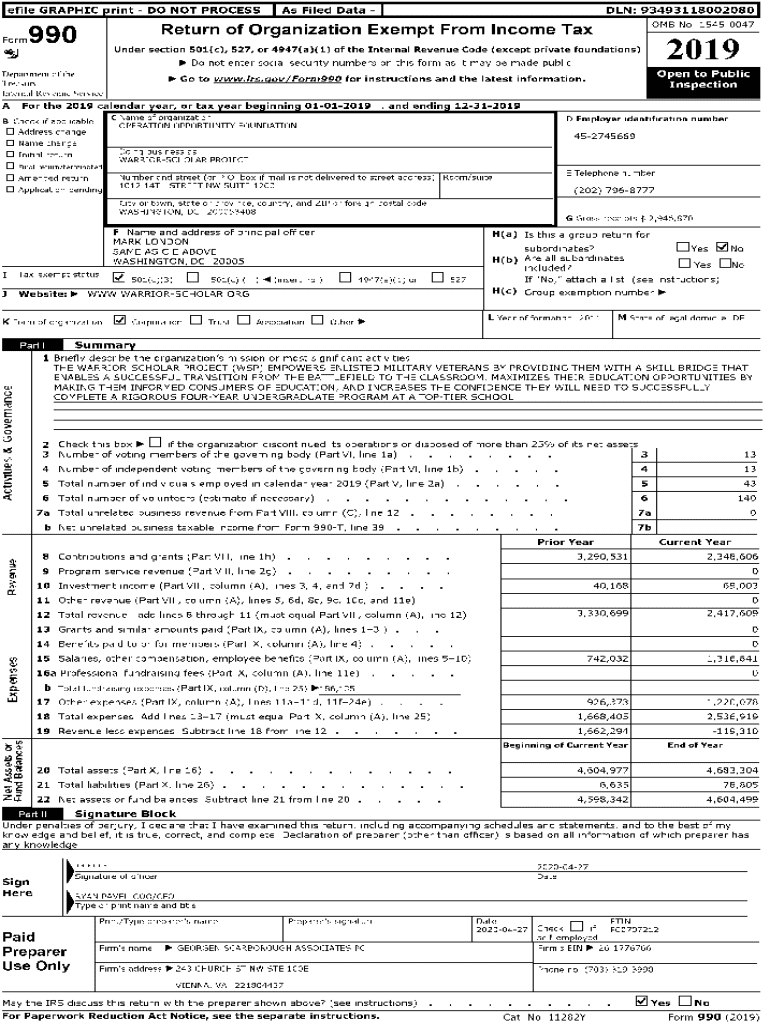

Form 990 is a crucial informational return required to be filed annually by tax-exempt organizations, including charities and certain nonprofits. This form serves multiple purposes: it provides transparency to the public regarding the organization's activities and finances, ensures compliance with IRS regulations, and maintains the integrity of tax-exempt status. Organizations that are exempt from income tax under Section 501(c) of the Internal Revenue Code are typically required to file this form, regardless of income level.

The importance of Form 990 cannot be understated for exempt organizations. By openly sharing financial data and governance structures, organizations enhance transparency and accountability within their operations. This openness fosters public trust and can have a direct impact on fundraising efforts and community support.

Key components of Form 990

Form 990 is organized into several key sections, each focusing on different aspects of the organization’s operation. The Basic Information Section gathers essential data about the organization, including its name, address, and mission statement. The Financial Statements Section allows organizations to disclose their revenue, expenses, and net assets, providing a snapshot of financial health. The Governance, Management, and Disclosure Section includes information about the organization's governing body and management policies.

Step-by-step instructions for completing Form 990

Completing Form 990 begins with gathering necessary information and documents. Collect financial records that reflect the organization’s income, fundraising, and operational expenditures. Additionally, having organizational bylaws and a copy of the previous year’s Form 990 on hand will facilitate accurate completion.

As you fill out the form, accuracy is key. Utilize pdfFiller for efficient document completion; this platform allows users to access templates tailored for Form 990 and provides helpful guides. To prevent common mistakes, double-check all financial figures, ensure consistency in reporting periods, and thoroughly review all sections before submission.

Editing and submitting your Form 990

Editing the form can be a straightforward process, especially with pdfFiller’s intuitive features. Users can easily modify various fields and incorporate e-signatures, making the form fillable and professional. When it comes to filing, organizations have the option of filing electronically via e-filing or mailing the form directly to the IRS. It's important to be aware of submission deadlines, typically the 15th day of the 5th month after the end of the organization’s fiscal year.

After submitting Form 990, organizations can expect a confirmation process that may take time. The IRS might require additional information or follow-up, particularly if there are discrepancies or questions regarding the submitted data.

Managing documents post-filing

Once Form 990 is filed, organizing your records becomes essential. Keeping digital copies safe through cloud-based solutions like pdfFiller helps ensure easy access for future filings or audits. Recommended filing systems for nonprofits include categorizing documents by fiscal year, program area, and legal compliance, making retrieval straightforward.

Furthermore, establishing document retention policies is vital. Nonprofits must adhere to IRS requirements, retaining Form 990 and supporting documentation for at least three years. Implementing best practices for audits involves regular internal reviews and ensuring all documentation is up to date and accessible.

Understanding compliance and regulations

Nonprofit organizations must navigate a complex landscape of compliance regulations. Key regulations include the IRS compliance guidelines, which provide a framework for maintaining tax-exempt status. Additionally, state-level requirements can vary significantly; thus, organizations should familiarize themselves with state-specific rules regarding fundraising activities and tax filings.

Consequences of non-compliance can be severe. Organizations face potential penalties and fines imposed by the IRS and could risk losing their tax-exempt status altogether. Regular training and updates on compliance best practices are recommended to mitigate these risks.

Additional tools and resources

pdfFiller offers interactive tools that can significantly enhance the Form 990 preparation process. Features like collaboration capabilities allow teams to work together seamlessly and track document versions. Useful resources include access to official IRS documentation and frequently asked questions sections that clarify procedural uncertainties.

Engaging with experts for assistance

While many organizations navigate Form 990 on their own, there are times when seeking professional help is beneficial. Indicators such as complex financial situations, recent changes in tax laws, or approaching filing deadlines can warrant the assistance of a financial consultant or tax professional.

Working with a consultant streamlines the filing process, ensuring compliance and accuracy. The peace of mind that comes with knowing an expert is managing the task can free up organizational resources for more direct mission-driven activities.

Community insights and user experiences

User testimonials regarding pdfFiller reflect positive experiences with Form 990 preparation. Many nonprofit organizations have reported efficiency improvements that come from using the platform's intuitive features, enabling quick edits and streamlined teamwork during the filing process.

Keeping up with changes in nonprofit reporting

Form 990 continues to evolve, influenced by legislative updates and changing reporting requirements. Organizations must stay informed about any recent updates or changes in the form itself, as well as best practices for financial reporting. An observant approach to legislative impacts ensures that nonprofits remain compliant and transparent.

Subscribing to newsletters or updates from platforms like pdfFiller can keep organizations informed about best practices and procedural changes regarding Form 990. Staying updated not only aids in compliant filing but also demonstrates an organization’s commitment to transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my return of organization exempt directly from Gmail?

How do I make changes in return of organization exempt?

How do I complete return of organization exempt on an Android device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.