Get the free Work comp: PenaltiesMinnesota Department of Labor and ...

Get, Create, Make and Sign work comp penaltiesminnesota department

How to edit work comp penaltiesminnesota department online

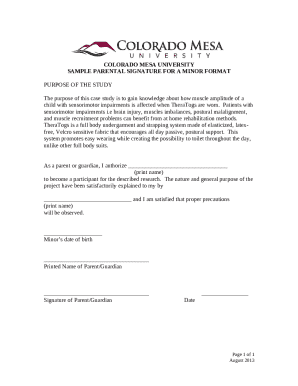

Uncompromising security for your PDF editing and eSignature needs

How to fill out work comp penaltiesminnesota department

How to fill out work comp penaltiesminnesota department

Who needs work comp penaltiesminnesota department?

Comprehensive Guide to Work Comp Penalties in Minnesota and the Department's Form

Understanding work comp penalties in Minnesota

Workers' compensation penalties are critical aspects of Minnesota's labor regulations. These penalties exist to ensure compliance with the laws that safeguard employees who suffer work-related injuries. The importance lies not just in financial implications but also in promoting workplace safety and accountability.

The Minnesota Workers' Compensation system operates with the primary goal of providing injured workers with necessary medical and wage-loss benefits while protecting employers from lawsuits stemming from workplace injuries. Unfortunately, non-compliance can lead to penalties that impact both employers and employees.

The role of the Minnesota Department of Labor and Industry

The Minnesota Department of Labor and Industry (DLI) is the state authority responsible for administering the Workers’ Compensation Act. Its primary responsibilities include ensuring compliance, educating employers, and enforcing penalties for violations. This proactive stance is essential for maintaining a fair and functional Workers’ Compensation system.

The DLI actively monitors compliance through audits, investigations, and reviews of incident reports. When violations are identified, the Department communicates directly with employers, informing them of the specific issues and the potential penalties they might incur.

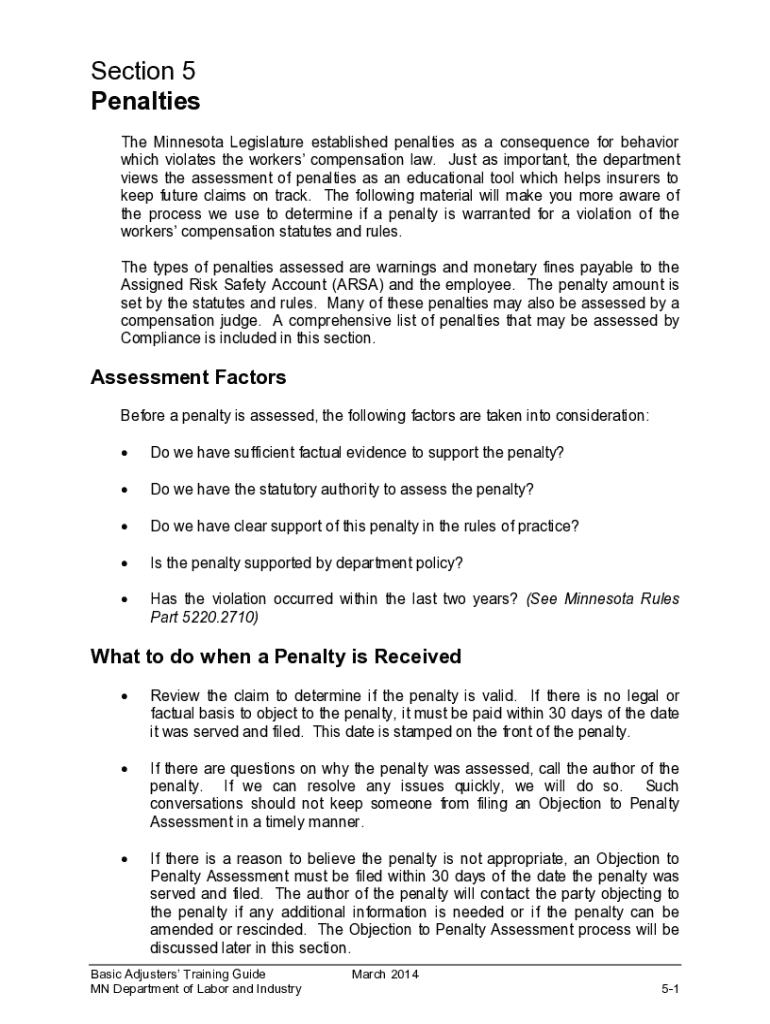

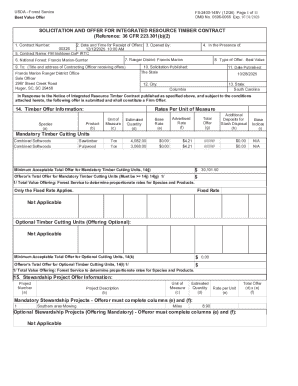

Detailed insights into the work comp penalty form

The Work Comp Penalty Form is a formal document that employers must complete and submit when facing penalization for non-compliance in the Minnesota Workers' Compensation system. Its primary purpose is to allow employers to formally address penalties, provide necessary information for reviewing the penalty, and potentially appeal decisions.

The legal basis for this form is rooted in Minnesota labor laws, specifically tailored to ensure accountability and transparency in the enforcement of workers' compensation regulations. The penalties enforced can vary significantly based on the nature of the violation.

Step-by-step guide to completing the work comp penalty form

Completing the Work Comp Penalty Form requires meticulous attention to detail. The preparation stage is crucial for gathering all necessary information and documents to ensure a smooth process.

Preparation Stage: Collect required information

Before filling out the form, it’s vital to collect relevant documentation. Key documents include previous correspondence with the Minnesota DLI, details of the incidents leading to penalties, and any previous compliance records. Understanding the specific nature of the penalties is essential.

Filling out the form

When completing the form, it is divided into several sections. Here’s a breakdown of what each section typically requires:

Common mistakes include overlooking required signatures, failing to attach supporting documents, or providing incomplete information. Take time to review the completed form thoroughly before submission.

Submitting the form

Once the form is completed, submission can occur via multiple methods depending on your preference:

It is crucial to keep track of important deadlines to avoid additional penalties. Keep copies of all submissions for your records.

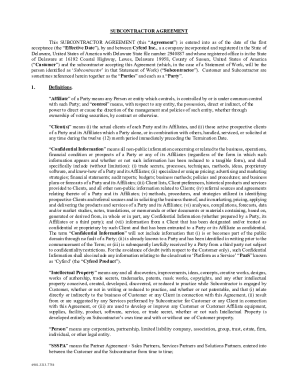

Editing and managing your work comp penalty form

Editing forms can be a hassle, but with tools like pdfFiller, the process can be quite smooth. The platform allows you to upload your Work Comp Penalty Form easily and make necessary changes.

Using pdfFiller to edit your form

Start by uploading your document directly to pdfFiller’s interface. The editing tools enable you to adjust text, add signatures, and ensure that all necessary fields are filled. Additionally, the platform allows you to save different versions of your form for comparison.

Securely storing and accessing your form

With cloud-based storage, pdfFiller ensures that your documents remain secure and easily accessible. You can store sensitive documents safely, organize them by type, and access them from any device. This flexibility is invaluable when managing multiple forms and compliance documents.

Interactive tools provided by pdfFiller for form management

pdfFiller comes equipped with interactive tools that simplify managing the Work Comp Penalty Form and other documents.

Utilize pdfFiller’s eSignature feature

One of the standout features of pdfFiller is its eSignature functionality. Users can sign documents electronically, eliminating the need for printing and scanning. This makes it easy to finalize documents without unnecessary delays.

Collaboration features for team use

Working with teams is simplified with collaborative features that allow multiple users to access and comment on documents. You can share the penalty form with coworkers, gather feedback, and make adjustments as needed.

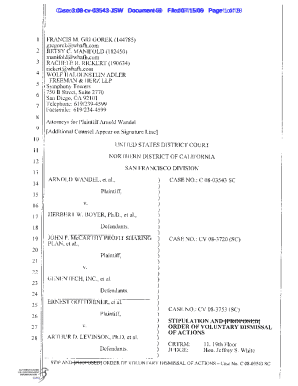

Understanding possible outcomes after submission

After submitting your Work Comp Penalty Form, the next steps involve waiting for the Minnesota DLI to process your submission. Understanding what to expect can help alleviate potential stress.

Typically, the department reviews submitted forms based on their internal timelines. Expect communication within a specified timeframe, which may vary based on the number of submissions being processed.

Navigating challenges and common issues

Incidents of missed deadlines or incorrect submissions can lead to significant challenges. Addressing these issues promptly and effectively is key to minimizing penalties.

Addressing late filing penalties

If you discover that you've missed a filing deadline, it's crucial to act quickly. Begin by submitting your Work Comp Penalty Form and provide an explanation of the circumstances that led to the delay.

Handling rejections and corrections

In situations where your submissions are rejected due to errors, act promptly to rectify these issues. Reach out to the DLI, understand the reasons for rejection, and re-submit the corrected form as soon as possible.

FAQs about work comp penalties and forms

Navigating the intricacies of Work Comp Penalties in Minnesota can lead to many questions, particularly regarding the associated processes.

Conclusion of insights and best practices

Understanding the Work Comp Penalty Form and the underlying penalties is crucial for any Minnesota employer. Keeping compliant with workers' compensation laws not only preserves your business's integrity but also ensures safer workplaces for employees.

Fostering a robust compliance strategy using resources like pdfFiller can streamline your documentation processes and enhance accountability. Prompt responses to penalties, effective communication with the DLI, and leveraging digital tools will empower you to navigate the complexities of the Minnesota Workers' Compensation landscape successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out work comp penaltiesminnesota department using my mobile device?

Can I edit work comp penaltiesminnesota department on an Android device?

How do I complete work comp penaltiesminnesota department on an Android device?

What is work comp penaltiesminnesota department?

Who is required to file work comp penaltiesminnesota department?

How to fill out work comp penaltiesminnesota department?

What is the purpose of work comp penaltiesminnesota department?

What information must be reported on work comp penaltiesminnesota department?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.