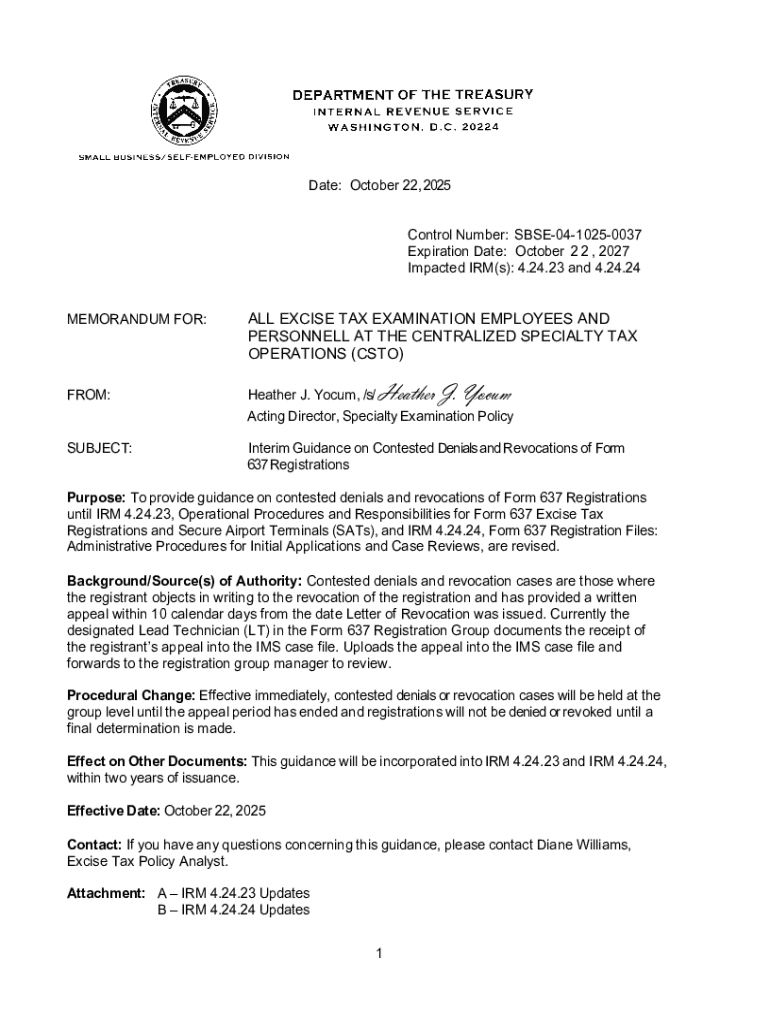

Get the free SbseInternal Revenue Service

Get, Create, Make and Sign sbseinternal revenue service

How to edit sbseinternal revenue service online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sbseinternal revenue service

How to fill out sbseinternal revenue service

Who needs sbseinternal revenue service?

Navigating the SBSE Internal Revenue Service Form

Understanding the SBSE Internal Revenue Service Form

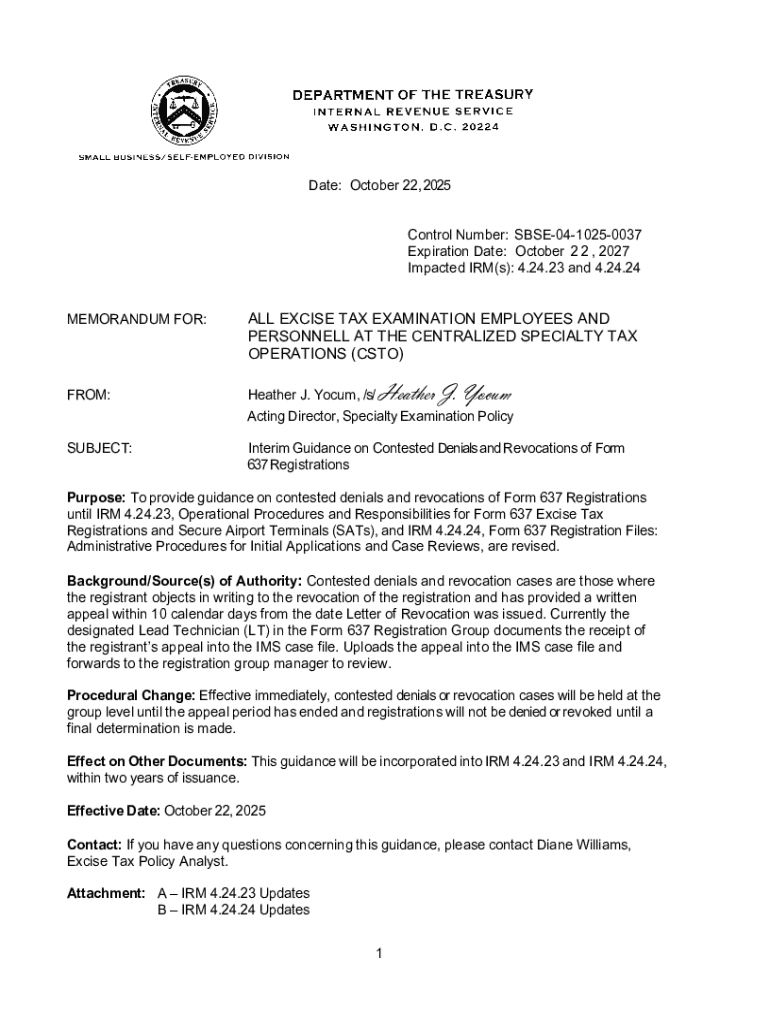

The SBSE Internal Revenue Service (IRS) Form serves as a crucial tax documentation tool primarily utilized by small businesses and self-employed individuals. It is tailored for the Small Business/Self-Employed (SBSE) division of the IRS, which focuses on providing streamlined resources and regulations for smaller-scale taxpayers. The significance of the SBSE IRS Form cannot be understated; it ensures compliance with federal tax obligations, identifying income, expenses, and potential deductions that can ultimately affect the bottom line.

Understanding who is required to use this form is equally important. Generally, small business owners and self-employed individuals whose annual gross income meets a certain threshold should complete the SBSE IRS Form. This includes sole proprietors, partnerships, and corporations subject to specific tax regulations designed by the IRS.

Key features of the SBSE IRS Form

Within the landscape of the SBSE IRS Form, several variations cater to different types of tax obligations. Notably, SBSE forms can include income tax returns, information returns for tax payments, and other documentation necessary for taxpayers to report their financial situations effectively. Understanding these types helps in ensuring the accurate documentation required for compliance.

Common scenarios for SBSE form usage include small business applications thriving in various sectors, particularly where self-employment tax considerations come into play. It is essential for individuals who may have supplemental income sources, like freelance work, to familiarize themselves with the nuances of these forms to avoid potential penalties.

Step-by-step guide to completing the SBSE IRS Form

Completing the SBSE IRS Form requires thorough preparation to ensure accuracy and compliance. The first step is to gather all necessary information. Personal details, such as your Social Security Number (SSN) or Employer Identification Number (EIN), need to be collected alongside comprehensive financial records, including income statements, expense receipts, and any deductions you plan to claim.

Once all your information is at hand, it's time to fill out the form. Each section must be addressed carefully, and it’s helpful to follow the IRS instructions closely to avoid common pitfalls. Mistakes in entering taxpayer information can lead to delays or complications during the filing process.

After filling out the form, reviewing your entries before submission is crucial. Double-checking your information helps to ensure that what you've submitted will reflect your financial situation accurately. Tips for verification include comparing your completed form against your financial records and seeking assistance from tax professionals if needed.

Editing and managing the SBSE IRS Form with pdfFiller

pdfFiller provides users the excellent capability to edit the SBSE IRS Form effortlessly. Uploading various document formats to the platform allows seamless integration and access. Users can add, remove, or modify fields according to their specific needs, ensuring that the final document accurately reflects the necessary input for IRS compliance.

Moreover, the platform offers collaborative tools meant for team submissions, enabling team members to share the form for review and make adjustments in real-time. This collaborative approach can significantly streamline the document management process and enhance productivity among teams handling tax compliance tasks.

Signing the SBSE IRS Form

The importance of electronic signatures in today's digital landscape cannot be overstated. Using pdfFiller’s eSignature feature allows users to sign the SBSE IRS Form securely and efficiently. The step-by-step signing process is intuitive, ensuring that all users, regardless of their technical ability, can complete it without challenge.

Ensuring legal compliance and security in electronic signatures is paramount. With pdfFiller, every signed document adheres to stringent regulatory guidelines, protecting user information while meeting IRS requirements for documentation. By adopting this approach, individuals can maintain a professional standard in their tax submissions.

Submitting the SBSE IRS Form

When it comes to submitting the SBSE IRS Form, understanding the best practices is essential for timely processing. Users have the option of online submission versus paper submission, each offering unique advantages. While electronic submissions are often faster and more secure, some users may prefer the traditional method for record keeping.

Tracking submission status is another critical component. After submission, individuals should ensure that they monitor their submission’s status through IRS channels to confirm acceptance. If any issues arise, having records of submission and clear communication channels with the IRS will aid in resolving discrepancies promptly.

Common questions about the SBSE IRS Form

Navigating the complexities of the SBSE IRS Form often brings about several common questions that users may have. For instance, what should you do if you made a mistake on the form? The answer entails filing an amendment to correct any errors, which is a straightforward process but requires attention to detail.

Another frequently asked question concerns the deadline for submission. Keeping track of the IRS deadlines is key to avoiding penalties related to late submissions. It’s advisable to mark these dates clearly in your calendar and allow ample time for preparation and submission of the SBSE IRS Form.

Troubleshooting and support

While completing the SBSE IRS Form is often straightforward, users may encounter challenges along the way. pdfFiller offers several resources for form completion, including video tutorials and customer support channels designed to address your specific needs. Utilizing these resources can minimize confusion and ensure accuracy.

In addition to pdfFiller support, contacting IRS support directly for specific inquiries remains vital. Understanding how the IRS views certain entries or adjustments can provide clarity for those unfamiliar with tax processes. Community forums can also serve as valuable platforms for sharing experiences and obtaining further assistance.

Maximizing pdfFiller for all your document needs

Beyond the scope of the SBSE IRS Form, pdfFiller offers an expansive suite of capabilities that cater to a variety of document management needs. From editing and signing documents to collaborating on forms with team members, pdfFiller's versatility makes it an invaluable resource for individuals and teams alike.

Integrating document management into your everyday workflow can lead to substantial efficiency gains. Success stories from users highlight how pdfFiller transformed their document processes, making it easier to manage multiple forms and documents effectively. By streamlining these tasks, users can focus their energy on growing their businesses and meeting tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sbseinternal revenue service to be eSigned by others?

How do I edit sbseinternal revenue service online?

Can I edit sbseinternal revenue service on an Android device?

What is sbseinternal revenue service?

Who is required to file sbseinternal revenue service?

How to fill out sbseinternal revenue service?

What is the purpose of sbseinternal revenue service?

What information must be reported on sbseinternal revenue service?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.