Get the free 1 MASTER GRANT SUB-RECIPIENT AGREEMENT BETWEEN ...

Get, Create, Make and Sign 1 master grant sub-recipient

Editing 1 master grant sub-recipient online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 master grant sub-recipient

How to fill out 1 master grant sub-recipient

Who needs 1 master grant sub-recipient?

Mastering the 1 Master Grant Sub-Recipient Form: A Comprehensive Guide

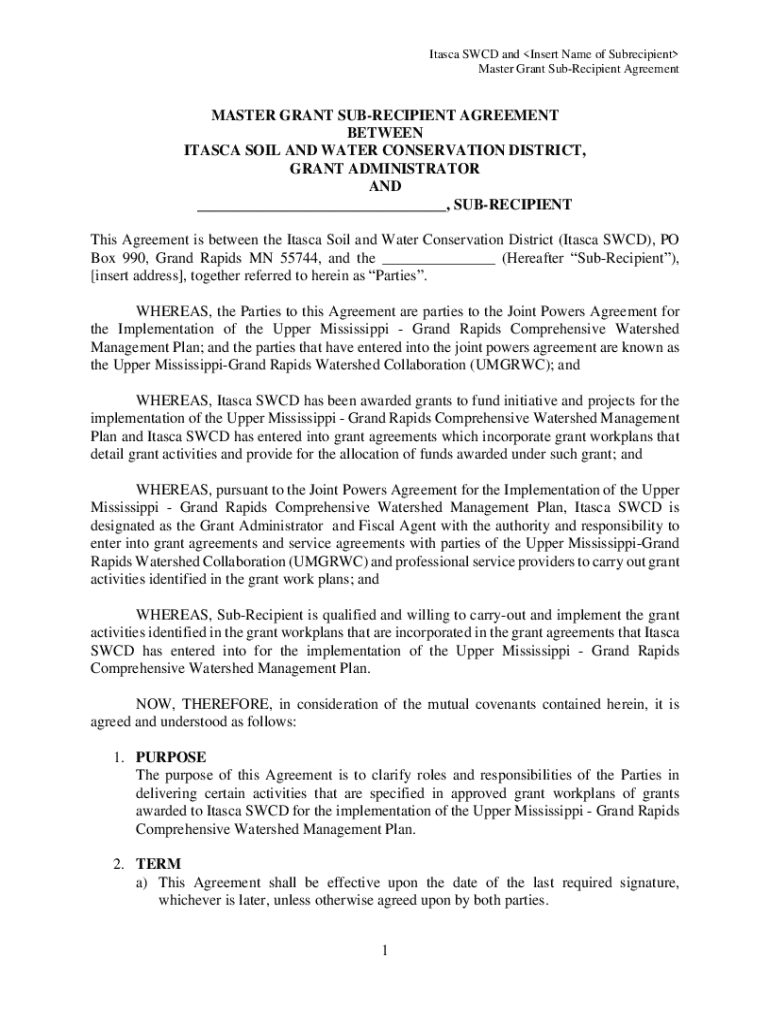

Understanding the master grant sub-recipient form

A Master Grant Sub-Recipient Form serves as a critical tool in grant management, defining the terms, roles, and expectations between primary grant recipients and their sub-recipients. This form is essential for organizations aiming to distribute grant funds correctly and ensure compliance with federal or state regulations. By clarifying responsibilities for all parties involved, it promotes a seamless flow of funds and accountability, ultimately enhancing project success.

Typically used by non-profits, educational institutions, and governmental bodies, various scenarios prompt the use of this form, from collaborative initiatives to regional funding projects. Organizations aiming to secure funding from larger entities must comprehensively understand this form to navigate the complexities of grant management effectively.

Key components of the master grant sub-recipient form

The Master Grant Sub-Recipient Form encompasses several essential sections critical to its effectiveness. Primarily, the identification section contains organization details, such as the legal name, address, and pertinent contact information, establishing a clear identification path for sub-recipients.

Following identification, the financial accountability and budget overview section outlines the sub-recipient’s financial responsibilities, including detailed budget estimates and justifications. The project description and objectives segment allows organizations to articulate the goals they aim to achieve, while the performance metrics and reporting requirements delineate how progress will be tracked and reported. These components provide clarity and help manage expectations.

Benefits of using the master grant sub-recipient form

Utilizing the Master Grant Sub-Recipient Form streamlines the grant application process by providing a clear framework for information collection and submission. This uniform approach enables both grantors and sub-recipients to better understand expectations and funding allocations. Moreover, it enhances collaboration, fostering stronger relationships built on standardized practices and transparent communication.

By ensuring transparency and accountability in grant funding, this form facilitates accurate monitoring of budget spending, project outcomes, and reporting metrics. With a structured system in place, organizations can better track results, ultimately leading to improved project effectiveness and success rates.

How to fill out the master grant sub-recipient form

Filling out the Master Grant Sub-Recipient Form requires a methodical approach to ensure accuracy and comprehensiveness. Begin by gathering all necessary information concerning both your organization and the project execution plan. This includes not only financial documents but also project descriptions and performance metrics.

1. Start with the identification section to include relevant organization details. 2. Carefully articulate your project goals and objectives—be specific and measurable to enhance clarity. 3. Prepare a detailed budget that aligns with project goals, ensuring to disclose all financial information comprehensively. 4. After filling out the form, review it for accuracy before finalizing and signing. This thorough review can help catch any inconsistencies or errors that may compromise the application.

Editing and customizing the master grant sub-recipient form

When working with the Master Grant Sub-Recipient Form, leveraging tools like pdfFiller can ease the editing and customization process. Unlike traditional paper forms, pdfFiller allows for real-time edits, ensuring that changes can be made swiftly and accurately. Users can adjust templates according to specific needs, which helps tailor the form to align with unique organizational requirements.

Collaboration features within pdfFiller foster teamwork, enabling multiple users to work on a single form. This functionality is particularly beneficial for grant teams aiming to gather diverse input and ensure that all aspects of the grant application are considered before submission.

Common pitfalls to avoid when submitting the master grant sub-recipient form

When submitting the Master Grant Sub-Recipient Form, awareness of common mistakes can prevent rejection and streamline approval. One frequent issue is incomplete information; failure to detail key aspects can cast doubt on your organization's preparedness. Additionally, neglecting to proofread increases the risk of typographical errors that might inadvertently mislead evaluators.

Importantly, establish a systematic review process to ensure all sections of the form are completed accurately. Consider introducing methods for cross-verification and feedback from others within your team before your final submission to bolster confidence in the form's comprehensiveness.

Managing master grant sub-recipient information

Managing the information associated with the Master Grant Sub-Recipient Form is essential for maintaining clarity throughout the grant lifecycle. Utilizing advanced document management solutions like pdfFiller allows for efficient tracking of grant progress and reporting. By organizing documentation systematically, organizations can maintain oversight of all grant-related activities, ensuring compliance and audit readiness.

Best practices include creating a centralized database for all submitted forms and tracking their status. Implementing regular check-ins can also enhance the monitoring process, allowing teams to address any discrepancies quickly and maintain accurate financial and performance records.

Comparing subrecipients and contractors in grant management

In grant management, recognizing the distinction between subrecipients and contractors is critical for compliance and accountability. Subrecipients typically have a more integrated role, taking responsibility for carrying out a portion of the project's objectives. In contrast, contractors offer specific services or products without taking on the project's greater goals.

Understanding these differences helps organizations determine the appropriate pathway for their funding and operational needs. When choosing between a sub-recipient and a contractor, organizations must consider the implications on compliance, reporting, and the overall grant strategy.

Monitoring and evaluating sub-recipient performance

Effective monitoring and evaluation of sub-recipient performance are essential for successful grant oversight. Establishing measurable performance indicators upfront can guide ongoing assessments and ensure projects align with objectives. By utilizing robust digital tools like pdfFiller, organizations can track progress and deliver timely feedback to sub-recipients.

Regular communication fosters transparency and collaboration, enabling organizations to navigate challenges more effectively. By scheduling consistent review sessions, teams enhance accountability and maintain alignment with project goals, ensuring that any arising issues are addressed promptly.

Managing indirect costs with sub-recipients

Understanding the dynamics of indirect costs is crucial when filling out the Master Grant Sub-Recipient Form. Indirect costs encompass expenses not directly associated with project activities but necessary for organizational support, such as administrative expenses. Organizations must clearly articulate these costs within the budget section of the form to promote transparency and facilitate accurate financial reporting.

Best practices involve adhering to established guidelines for calculating and reporting these costs, ensuring that budgets remain realistic and align with overall project objectives. By maintaining clear records and justifications for indirect costs, organizations can minimize disputes and enhance their credibility with grantors.

Frequently asked questions (FAQ) about the master grant sub-recipient form

Many users may have inquiries regarding the Master Grant Sub-Recipient Form, ranging from general procedural questions to specific compliance concerns. Addressing these FAQs can demystify the process for new users and clarify misconceptions about the form’s usage. Common queries often include topics such as the required documentation, timelines for completion, and guidance on grant accounting practices.

Engaging with pdfFiller's platform for enhanced document management

pdfFiller stands out as a comprehensive solution for managing the Master Grant Sub-Recipient Form efficiently. With features designed for seamless editing, electronic signature capabilities, and collaborative tools, pdfFiller simplifies the entire process of form management. Users can easily access templates, customize forms, and even track submission statuses from anywhere.

Case studies highlight how organizations utilizing pdfFiller have improved their grant management processes, enhancing accuracy and compliance. Additionally, its interactive tools, available via the platform, facilitate team collaboration, allowing users to communicate regarding edits in real-time, promoting a more streamlined approach to document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 1 master grant sub-recipient to be eSigned by others?

How do I fill out the 1 master grant sub-recipient form on my smartphone?

How do I complete 1 master grant sub-recipient on an Android device?

What is 1 master grant sub-recipient?

Who is required to file 1 master grant sub-recipient?

How to fill out 1 master grant sub-recipient?

What is the purpose of 1 master grant sub-recipient?

What information must be reported on 1 master grant sub-recipient?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.