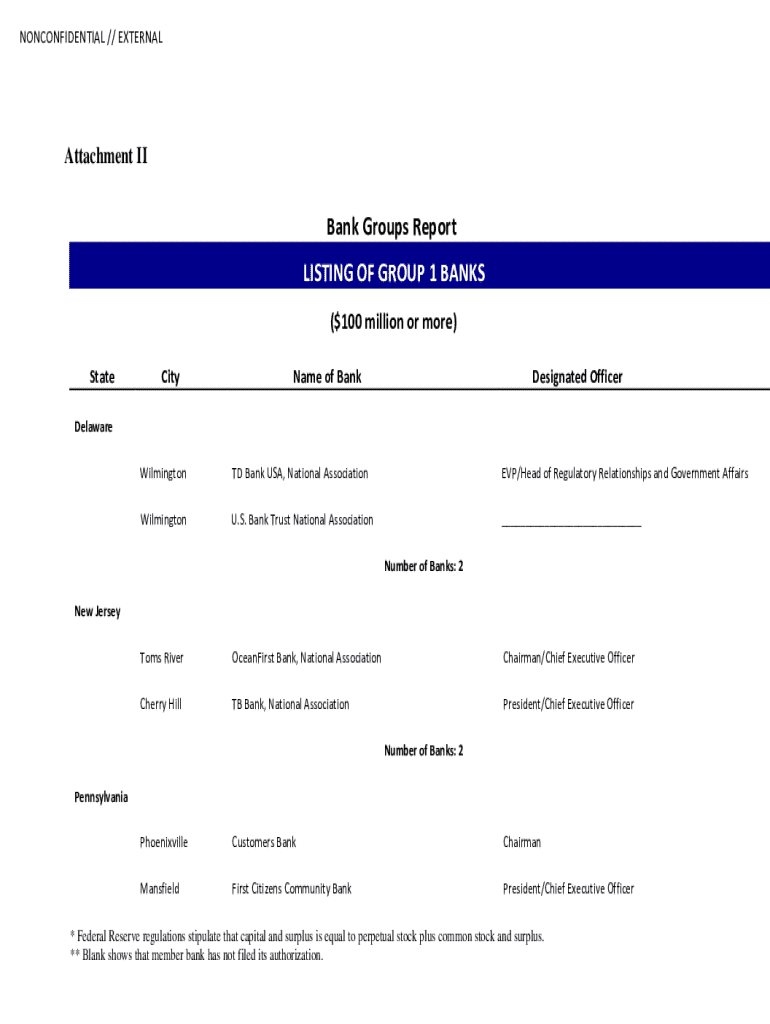

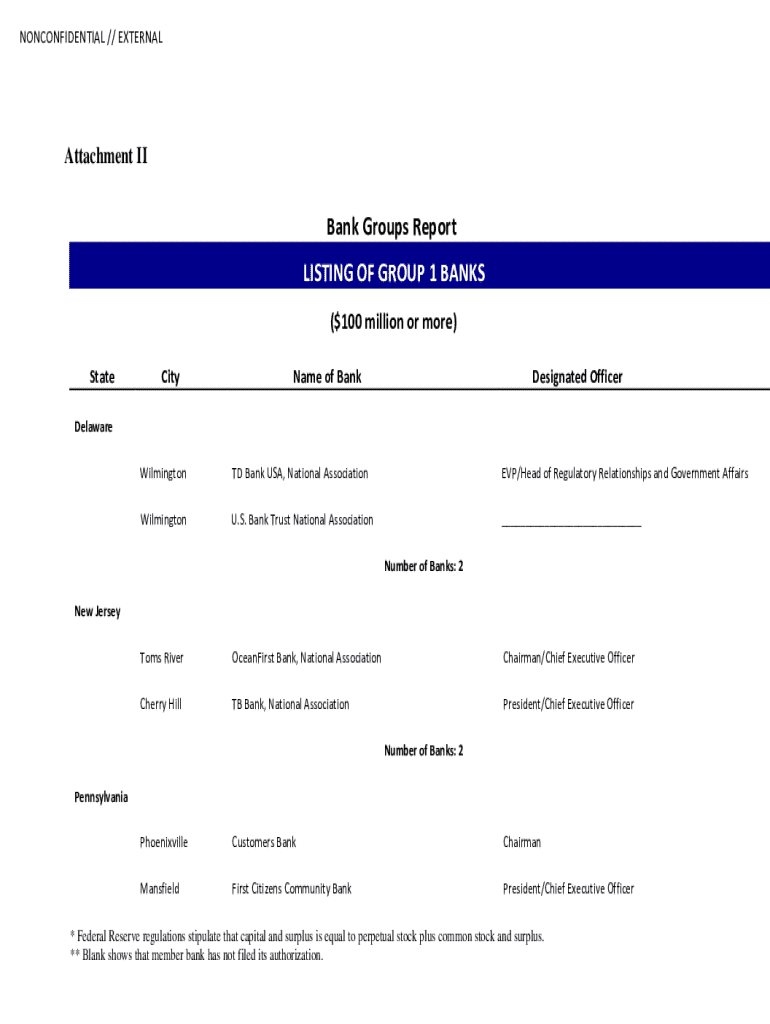

Get the free Bank Groups Report LISTING OF GROUP 1 BANKS

Get, Create, Make and Sign bank groups report listing

Editing bank groups report listing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bank groups report listing

How to fill out bank groups report listing

Who needs bank groups report listing?

Comprehensive Guide to the Bank Groups Report Listing Form

1. Understanding bank group reporting requirements

Bank group reporting forms a critical aspect of the modern financial landscape, particularly for maintaining transparency and compliance. Such reporting allows regulatory bodies to monitor the financial health of institutions and the overall stability of the economy. It includes necessary disclosures about security holdings, transactions, and financial positions that reflect an organization’s risk and compliance management. With the financial sector facing increasing scrutiny, understanding these requirements can significantly enhance a bank's operational integrity.

2. Types of reports required from bank groups

Bank groups are mandated to provide several types of reports to ensure comprehensive oversight. Each report serves a unique purpose and adheres to specific timelines. The primary categories include securities holdings reports, transaction reports detailing asset movements, and compliance reports that gauge adherence to risk management standards. Banks face the challenge of accurately gathering and submitting these reports, particularly as regulations evolve and deadlines tighten.

The frequency and deadlines for submissions can vary based on jurisdiction, with many reports required quarterly or annually. Banks must also prepare for potential challenges, such as discrepancies in data, which can lead to compliance issues and refined scrutiny from regulators.

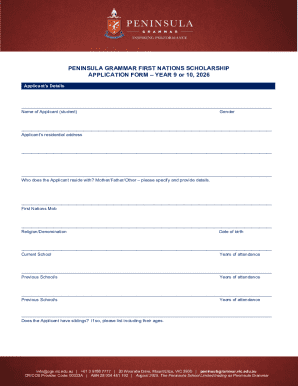

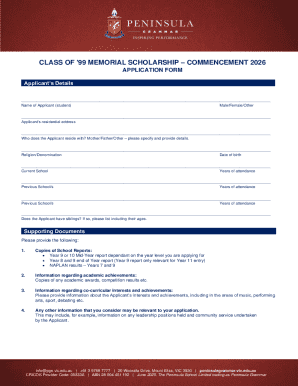

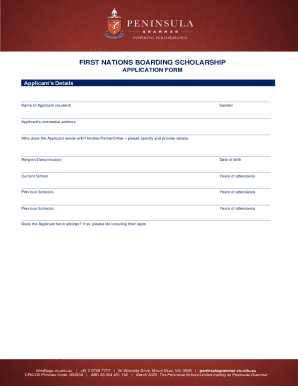

3. Introduction to the bank groups report listing form

The bank groups report listing form plays a crucial role in the submission process. It is designed to capture essential information about the reports being filed, including types of reports and submission timelines. Key stakeholders in this process include compliance officers, finance teams, risk managers, and external auditors who collaborate to ensure accuracy and adherence to regulatory requirements.

The information required on the form typically encompasses the types of reports submitted, the date of submission, and relevant signatures. Proper filling of this form aids in efficient tracking and management of submissions, which is vital for maintaining compliance and fostering transparent operations.

4. Step-by-step guide to completing the bank groups report listing form

Completing the bank groups report listing form accurately is essential for compliance. Here’s how to navigate this process effectively.

Step 1: Gathering required information

Begin by identifying the relevant data sources, including financial statements, transaction records, and compliance checks. Documenting this information upfront ensures accuracy and helps in avoiding future discrepancies.

Step 2: Accessing the bank groups report listing form on pdfFiller

Visit pdfFiller and navigate to the bank groups report listing form. If you do not have an account, you’ll need to sign up quickly; otherwise, sign in to access the form.

Step 3: Filling out the form

Start filling out the form by carefully entering all required information. Pay particular attention to each section, ensuring it mirrors the data you gathered. pdfFiller provides interactive tools that guide users through the process, allowing for easier navigation and completion.

Step 4: Editing and reviewing your submission

After filling the form, use pdfFiller’s editing tools to double-check for accuracy. It’s highly recommended that team members collaborate through the platform to ensure every detail is reviewed before final submission.

Step 5: Signing and finalizing the report

Finalizing the report entails eSigning the document through pdfFiller, ensuring all stakeholders have authorized the submissions. Once signed, save the document in a systematic filing structure that allows for easy retrieval.

5. Managing submissions and keeping track of reports

Effective document management is critical in banking operations, especially regarding compliance. pdfFiller’s document management system provides an organized solution for tracking submissions and monitoring deadlines. Users can categorize reports for quick access and regularly check the status of their filings.

Best practices for document retention include maintaining version histories and ensuring all records are archived properly. Implementing a systematic approach helps safeguard essential documents in the event of audits or unexpected reviews.

6. FAQs about the bank groups report listing form

Users frequently have questions regarding the bank groups report listing form. Common inquiries often include details on the types of information needed, how to ensure compliance, and troubleshooting tips during form completion.

For instance, users might ask about the necessary data to include for a specific type of report or what steps to take if they encounter form submission errors. Engaging with pdfFiller’s support resources can clarify these issues, providing assistance to those navigating the nuances of your required documentation.

7. The importance of compliance in bank group reporting

Compliance in bank group reporting cannot be overstated. Non-compliance risks include hefty fines, reputational damage, and heightened regulatory scrutiny. Establishing robust compliance processes with the help of tools like pdfFiller can mitigate these risks effectively.

pdfFiller empowers users to adopt best practices in document management, from detailed tracking of submissions to maintaining accurate records that meet regulatory requirements. By streamlining compliance strategies, banks can strengthen their operations and minimize vulnerabilities.

8. Additional features of pdfFiller for document management

pdfFiller's collaborative tools enhance document management efficiency significantly. Teams can work on forms simultaneously, leave comments, and suggest edits, promoting seamless collaboration. The cloud-based platform ensures that users can access their documents from anywhere, thus fostering greater flexibility and responsiveness.

Benefits include enhanced organization of documents, real-time updates, and a centralized repository that simplifies compliance management. As financial regulations continue to evolve, the adaptability of pdfFiller’s platform positions teams to stay ahead of potential challenges.

9. Exploring related forms and templates

For users seeking further assistance, pdfFiller offers a range of related forms and templates designed for banking compliance and documentation needs. These resources aid in broader understanding and streamlined reporting processes.

Navigating through pdfFiller will uncover valuable forms essential for regulatory compliance, helping users maintain a comprehensive understanding of their obligations in the face of evolving financial landscapes.

10. User testimonials and case studies

Real-world applications of pdfFiller for bank groups highlight the platform's effectiveness in simplifying complex reporting processes. Users commonly share success stories about how pdfFiller’s simplicity and efficiency have significantly reduced the time and effort required for completing compliance documentation.

Such testimonials illustrate the transformative impact of utilizing technology in finance, demonstrating that with the right tools, teams can achieve greater accuracy and efficiency in their reporting duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute bank groups report listing online?

How do I edit bank groups report listing on an iOS device?

How do I fill out bank groups report listing on an Android device?

What is bank groups report listing?

Who is required to file bank groups report listing?

How to fill out bank groups report listing?

What is the purpose of bank groups report listing?

What information must be reported on bank groups report listing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.