Get the free CitiDirectCommercial Banking Online Privacy Statement

Get, Create, Make and Sign citidirectcommercial banking online privacy

Editing citidirectcommercial banking online privacy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out citidirectcommercial banking online privacy

How to fill out citidirectcommercial banking online privacy

Who needs citidirectcommercial banking online privacy?

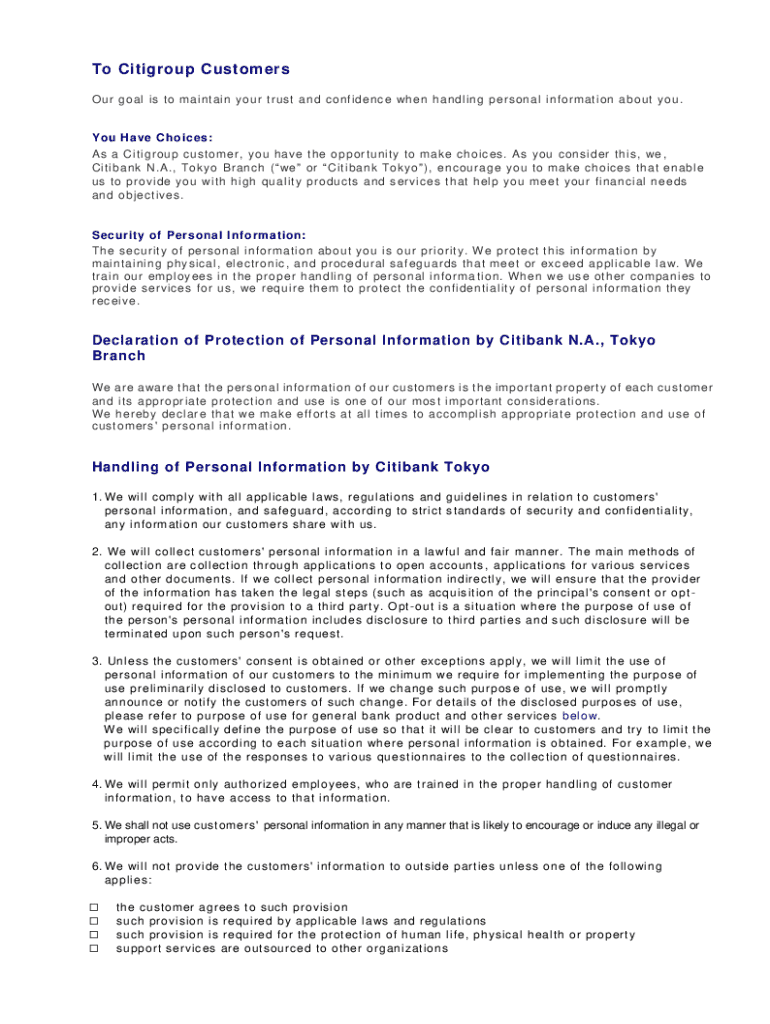

Understanding the Citidirect Commercial Banking Online Privacy Form

Global privacy notice

The Citidirect Commercial Banking Online Privacy Form plays a crucial role in safeguarding customer information. This form outlines how Citigroup and its subsidiaries manage personal information within their commercial banking services, ensuring compliance with privacy laws and regulations.

Privacy is paramount in online banking, as financial institutions handle sensitive personal data. The Citidirect form guarantees that clients' information is not only protected but also utilized transparently and responsibly.

Overview of the form

The Citidirect Commercial Banking Online Privacy Form is designed to inform customers about how their personal information is processed, stored, and protected when they use Citidirect's online banking facilities. In an era overflowing with data, where financial transactions occur at lightning speed, ensuring customer privacy and data security is of the utmost importance.

This privacy form not only complies with stringent data protection laws but also builds trust between customers and Citigroup. By clearly outlining the data collection processes and the purposes behind them, Citidirect reinforces its commitment to customer confidentiality.

Entity responsible for processing personal information

Citigroup, along with its various subsidiaries, is the principal entity responsible for processing personal information collected through Citidirect. This vast organization is dedicated to maintaining strict standards of data protection and privacy, reflecting its global presence and influence in the financial markets.

For any privacy inquiries, clients can reach Citigroup's dedicated privacy team through specified contact details provided within the form. This ongoing communication ensures transparency and holds the organization accountable for user data management.

Sources of personal information

Citidirect collects various types of personal information from its clients, which typically include: personal identification details, financial records, and transaction histories. Collecting accurate data is essential for ensuring effective banking operations and personalized service.

The most common sources of personal information stem from direct interactions with users and advanced automated technologies such as cookies and tracking mechanisms. These tools help improve user experience while presenting options for tailored services based on customer behavior and preferences.

Categories of personal information we collect and process

Citidirect processes specific categories of personal information to deliver banking services effectively. Identifiable information includes any data that can be used to identify a person, such as full name, address, and Social Security Number. Financial data includes bank account details and credit history, all of which play an essential role in understanding a client's financial activity.

Online activity data, which encompasses usage patterns and personal preferences, is also collected. This extensive categorization of data enables Citidirect to provide a customized banking experience tailored to individual needs, promoting both efficiency and security.

Purposes and uses of personal information

The data collected through the Citidirect Commercial Banking Online Privacy Form serves several critical purposes. First and foremost, it enhances the customer experience by enabling Citigroup to offer personalized services based on client preferences and behavior.

Additionally, compliance with regulatory requirements is another fundamental reason for data processing. By adhering to applicable laws, Citidirect ensures its operations remain lawful and ethical. Fraud detection and prevention are also vital interactions performed using customer information, allowing Citigroup to safeguard its clients’ financial assets from unauthorized access or fraudulent activities.

Lawful bases of data processing

Citidirect processes personal data based on several legal frameworks that provide the organization with a lawful basis for similar actions. User consent represents one of these frameworks, where clients agree to let Citidirect process their data when they use its services.

Contractual necessity is another basis, applicable when the processing of data is essential to fulfill banking agreements. Additionally, legitimate interests can justify data processing as Citigroup uses customer data to evaluate service validity and improve overall customer satisfaction. Therefore, consumers must understand their rights regarding data consent before engaging with Citidirect.

Consequences of not providing your consent or personal information when requested

Declining to provide personal information can have significant ramifications for clients using Citidirect services. Without essential data, users may face restricted access to various banking functions or products.

Moreover, clients may miss out on personalized services designed to enhance their banking experience. For some users, the option to seek alternative services might become necessary if consent is not granted for particular data processing activities, resulting in a limited banking experience.

Your privacy or data protection rights

Under relevant laws, such as GDPR or CCPA, customers enjoy various privacy and data protection rights. These rights empower individuals to access, correct, delete, or transfer their data with ease. Clients wishing to exercise these rights can contact Citidirect through the privacy inquiry options provided in the online privacy form.

This structured approach to data governance reinforces Citigroup's commitment to transparency and user empowerment, fostering trust in its banking solutions.

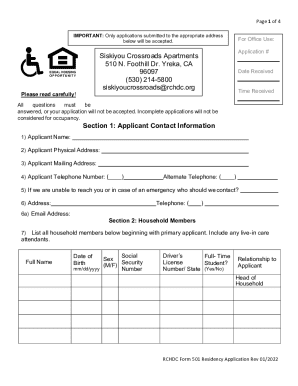

Step-by-step guide to filling out the online form

Filling out the Citidirect Commercial Banking Online Privacy Form involves a systematic process that ensures accuracy and completeness. Firstly, clients can access the privacy form via the Citidirect online interface, where a secure login is required to begin.

Next, users can fill out the required information across the various sections identified in the form, ensuring that all personal information is reported accurately. It is advisable to take time to review the submissions for any errors before proceeding, as rectifying data post-submission might present difficulties.

Potential issues and how to resolve them

Several common issues may arise while filling out the Citidirect privacy form, mostly associated with user data entry or system access. Errors in information reporting can delay processing; therefore, clients should double-check all details and familiarize themselves with the expected data formats.

In case of log-in problems or technical difficulties, users are encouraged to reach out to Citidirect support for assistance, where professional staff can guide them through the necessary troubleshooting steps.

Adapting to changing regulations and laws

The landscape of data protection laws is dynamic, requiring institutions like Citidirect to continuously adapt to ensure compliance with evolving regulations. Periodic updates to the online privacy form are made to align with changes, securing customer data effectively while ensuring transparency in operations.

Citigroup’s commitment to adapting its policies reflects the importance of data protection in maintaining customer trust, ultimately safeguarding clients' personal information throughout their banking journey.

Understanding the security measures in place

Citidirect implements robust security measures designed to protect user data from unauthorized access. Encryption protocols play a central role in safeguarding financial transactions, ensuring that sensitive information remains confidential.

In addition to corporate security strategies, consumers can take proactive steps to bolster their data privacy, such as regularly updating passwords and utilizing two-factor authentication processes when available.

Permanent access to your privacy settings

Clients can access their privacy preferences at any time through the Citidirect interface. By regularly reviewing and updating privacy settings, users can ensure that their preferences align with the current situation, applying necessary adjustments to their data sharing policies.

This proactive management of privacy options empowers customers to maintain control of their personal information while navigating their banking experience.

Interactive tools for customers

Citidirect provides several interactive tools within its online banking platform, facilitating the management of privacy options effectively. These tools, which may include dashboards and FAQs, aid clients in understanding how to navigate their privacy settings.

Additionally, video tutorials demonstrate various features, enhancing user experience and clarifying any uncertainties clients may have regarding their privacy management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute citidirectcommercial banking online privacy online?

Can I create an eSignature for the citidirectcommercial banking online privacy in Gmail?

Can I edit citidirectcommercial banking online privacy on an iOS device?

What is citidirectcommercial banking online privacy?

Who is required to file citidirectcommercial banking online privacy?

How to fill out citidirectcommercial banking online privacy?

What is the purpose of citidirectcommercial banking online privacy?

What information must be reported on citidirectcommercial banking online privacy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.