Get the free Foreign Ownership Restrictions in Communications and 'Cultural ...

Get, Create, Make and Sign foreign ownership restrictions in

Editing foreign ownership restrictions in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out foreign ownership restrictions in

How to fill out foreign ownership restrictions in

Who needs foreign ownership restrictions in?

Navigating Foreign Ownership Restrictions in Form

Understanding foreign ownership restrictions

Foreign ownership restrictions are regulatory limits imposed by governments on the ownership of assets, companies, or properties by foreign entities or individuals. These restrictions are often intended to protect national interests, maintain economic stability, and ensure security in sensitive sectors like agriculture, natural resources, and technology. Compliance with these regulations is crucial for both individuals and businesses seeking to engage in foreign investments, as failing to adhere can lead to penalties and legal ramifications.

Each country has its unique approach to managing foreign ownership, which creates a complex regulatory landscape. For example, the Agricultural Foreign Investment Disclosure Act in the U.S. requires certain disclosures regarding agricultural land ownership by foreign persons or entities. Understanding and complying with these requirements is essential for maintaining ownership rights and avoiding potential sanctions.

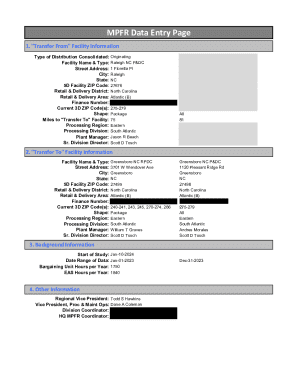

Relevant forms and documentation

To comply with foreign ownership restrictions, investors need to properly fill out specific forms that report their ownership status. These forms not only facilitate compliance but also provide the necessary documentation to regulatory authorities.

Accessing these required forms can be streamlined through platforms like pdfFiller, where users can easily find and download necessary templates to begin the compliance process.

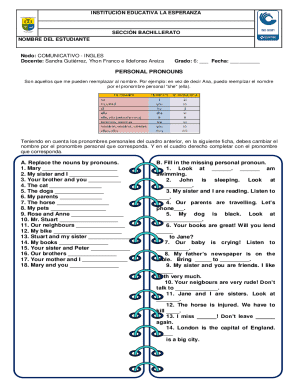

Filling out foreign ownership forms

Completing ownership disclosure forms is a critical step in the compliance process. Here’s a step-by-step guide to ensure accuracy and completeness.

Common pitfalls to avoid include misinterpretation of ownership laws and missing deadlines for submissions, which can complicate compliance and lead to unwanted penalties.

Editing and customizing forms with pdfFiller

pdfFiller offers a suite of features that enhance your ability to edit and customize forms effectively. Users can modify existing documents or create new custom forms tailored to their specific needs.

Utilizing these tools can save time and ensure that forms are accurately completed in line with foreign ownership restrictions.

Document collaboration and eSigning

Collaborating on form completion is essential when multiple stakeholders are involved. pdfFiller facilitates document collaboration by allowing users to share forms easily with colleagues or legal advisors.

This collaborative approach simplifies the compliance process and ensures that all necessary parties can contribute to the required documentation.

State-specific regulations and requirements

Foreign ownership restrictions can vary significantly between states, leading to a patchwork of compliance requirements. It’s essential to be aware of these variations to ensure adherence to local laws.

Links to specific state guidelines can be valuable for investors to familiarize themselves with the requirements pertinent to their transactions.

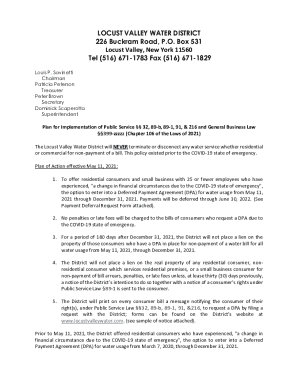

Understanding the implications of non-compliance

Failing to comply with foreign ownership restrictions can bring about severe legal risks. Misreporting or omission of necessary information on ownership forms can lead to penalties, fines, or even loss of ownership.

Several case studies highlight these consequences, showcasing the critical importance of adherence to foreign ownership regulations.

Frequently asked questions (FAQs)

Understanding common questions regarding foreign ownership restrictions can provide clarity for individuals and businesses involved in investments.

Having answers to these FAQs enables smoother navigation through the complexities of foreign ownership compliance.

Case studies and real-life examples

Analyzing high-profile cases related to foreign ownership restrictions can shed light on best practices. For instance, a prominent case in Indiana involved foreign investors who failed to disclose their ownership interests, resulting in hefty fines and regulatory scrutiny.

These cases emphasize the importance of transparency in foreign ownership and provide valuable lessons for future compliance.

Navigating federal and state proposals

With the increasing scrutiny over foreign investment, there are several federal proposals that may reshape foreign ownership regulations. Staying informed of these developments is vital for compliance planning.

Being aware of these proposals allows for proactive adjustments to strategies for managing foreign ownership compliance.

Interactive tools and resources

pdfFiller offers various tools to assist users in managing their foreign ownership documents effectively. Its user-friendly interface allows for seamless document tracking and management.

Utilizing these tools can facilitate a more efficient process for managing foreign ownership documentation.

Future trends in foreign ownership regulations

Looking towards the future, predictions suggest there will be more stringent regulations concerning foreign ownership, particularly in sectors deemed critical to national security and economic integrity.

Digital solutions like pdfFiller will play a crucial role in shaping compliance practices, streamlining document management and enhancing user collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify foreign ownership restrictions in without leaving Google Drive?

How do I make changes in foreign ownership restrictions in?

How do I complete foreign ownership restrictions in on an iOS device?

What is foreign ownership restrictions in?

Who is required to file foreign ownership restrictions in?

How to fill out foreign ownership restrictions in?

What is the purpose of foreign ownership restrictions in?

What information must be reported on foreign ownership restrictions in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.