Get the free Nebraska State Income Tax Guide - The TurboTax Blog - Intuit

Get, Create, Make and Sign nebraska state income tax

Editing nebraska state income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska state income tax

How to fill out nebraska state income tax

Who needs nebraska state income tax?

Nebraska State Income Tax Form - How-to Guide

Overview of Nebraska State Income Tax Forms

For Nebraska residents, completing the Nebraska state income tax form is a crucial step in fulfilling their tax obligations. The income tax forms are vital for reporting income and calculating tax liabilities, ensuring compliance with the state’s tax laws. All residents and nonresidents who earn income in Nebraska must understand who is required to file these forms. Generally, individuals with an income exceeding the set threshold or those claiming certain credits must submit a return.

Key deadlines for filing Nebraska state income tax returns typically fall on April 15th, mirroring the federal filing deadline. It’s essential to keep these dates in mind to avoid penalties. Late filings can incur interest and possibly additional penalties, emphasizing the importance of timely submissions.

Types of Nebraska State Income Tax Forms

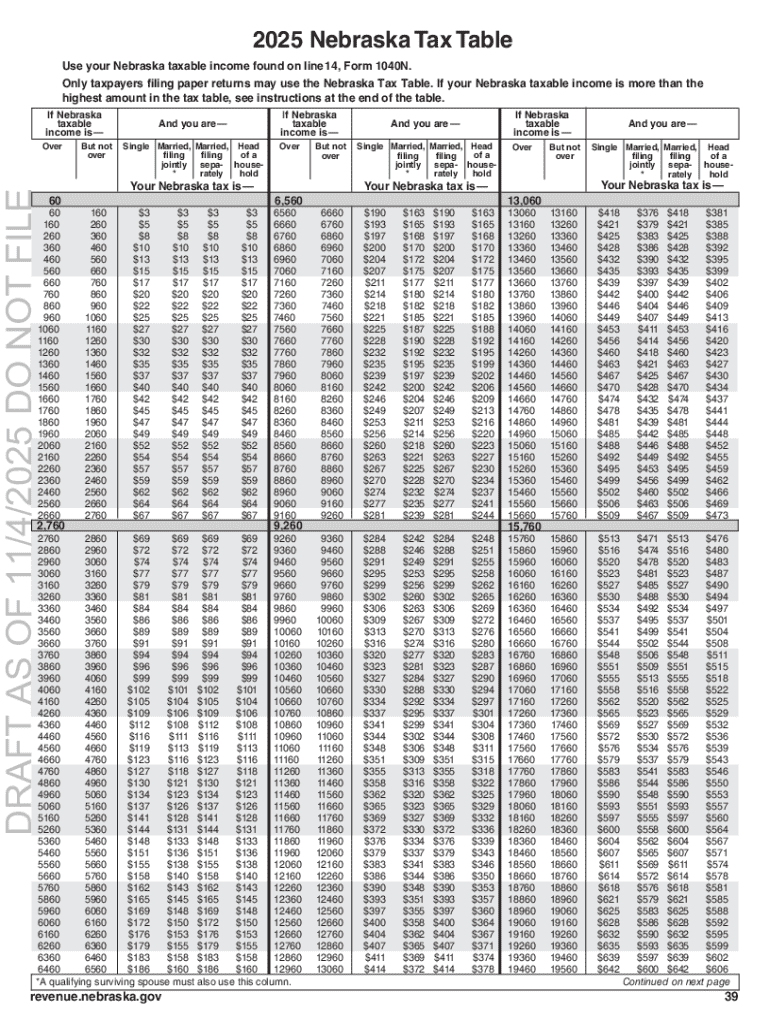

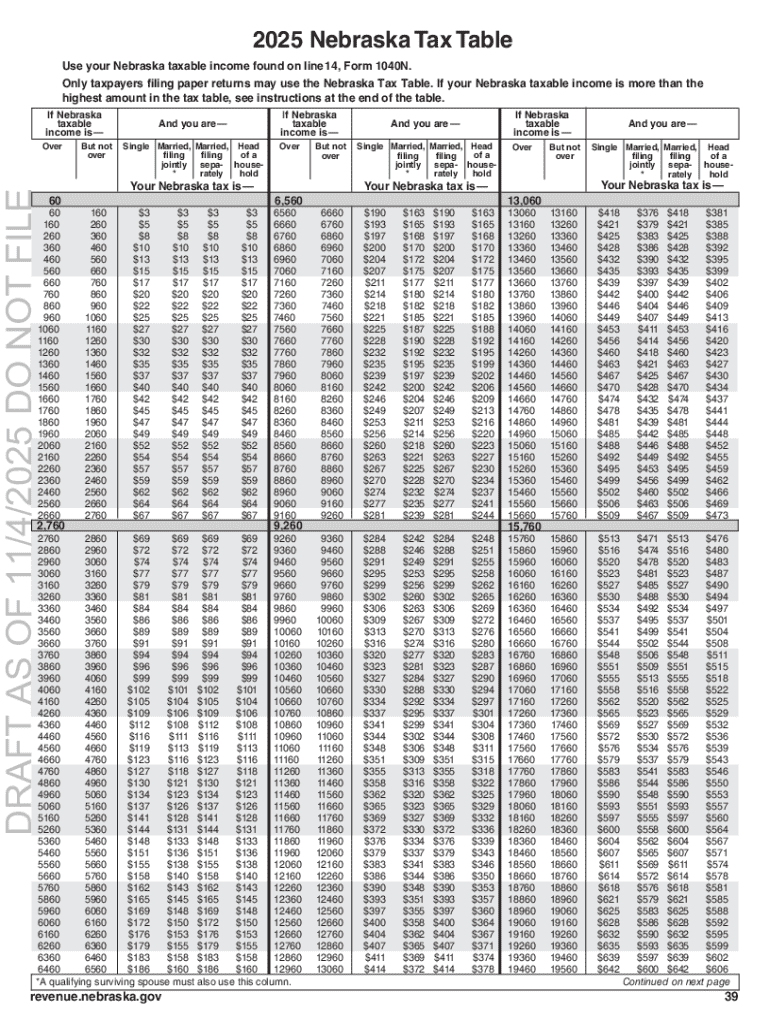

Nebraska offers various state income tax forms, tailored to meet the diverse needs of its taxpayers. For individual taxpayers, the primary form is Form 1040N, which serves as the Nebraska Individual Income Tax Return. This form captures necessary details regarding income, deductions, and credits for residents and may include schedules specific to ones’ tax situation.

Specific forms for non-residents and part-year residents differ slightly from the standard forms, making it important for taxpayers to choose the correct version based on their residency status. Supporting schedules and forms, such as the ones mentioned above, play a critical role in the overall filing process, helping itemize various deductions and credits.

How to Obtain Nebraska State Income Tax Forms

Acquiring the necessary Nebraska state income tax forms is straightforward. The Nebraska Department of Revenue provides downloadable forms on its official website. Users can navigate to the 'Forms' section and locate the needed documents. This ensures that taxpayers have the most current and accurate forms required for their filings.

Alternatively, users can access forms via pdfFiller, an online platform designed to facilitate document management. By searching for the Nebraska tax form on pdfFiller, users can complete their forms directly within the browser, streamlining the process significantly.

Step-by-step instructions for filling out the Nebraska income tax form

Before diving into filling out the Nebraska state income tax form, it’s essential to prepare all relevant information. Taxpayers should gather documents such as W-2 forms, 1099s, and any other income statements. Organizing these documents in advance facilitates easy completion of the Form 1040N. Additionally, taxpayers should keep receipts handy for any potential deductions they plan to claim.

When completing Form 1040N, attention to detail is crucial. The form requires personal information such as name, address, and Social Security number, along with income reporting from various sources. After reporting income, taxpayers will navigate through deductions and credits, which can significantly affect the overall tax liability. Common errors include mismatched information and incorrect math; therefore, thorough reviews are essential to avoid these pitfalls that can delay processing or trigger inquiries.

Editing and signing your Nebraska tax forms with pdfFiller

Using pdfFiller not only allows for easy access to Nebraska state income tax forms but also provides powerful editing tools. Once users choose the Nebraska income tax form, they can utilize features such as text editing, form filling, and adjusting layouts to ensure accuracy. These tools make it easy to correct mistakes or update information without the need to start over, which is particularly useful during the busy tax season.

Furthermore, pdfFiller offers electronic signing capabilities. After filling out the necessary tax documents, users can easily add an electronic signature, ensuring a legally binding and secure process. This feature saves time and eliminates the hassle of printing, signing, and rescanning documents, all whilst adhering to compliance regulations.

Submitting your Nebraska state income tax form

Once the Nebraska state income tax form is completed, the next step is submitting it. E-filing is highly recommended for its efficiency and faster processing time. With pdfFiller, users can easily upload their completed forms directly to the Nebraska Department of Revenue through the e-filing platform. This method not only expedites the process but also allows for easier tracking of tax submissions.

Alternatively, those preferring traditional methods can mail their forms to the appropriate tax office. It’s advisable to double-check the mailing address and use certified mail for tracking purposes. Ensuring the envelope is correctly addressed and recipients are apprised of any required documentation will prevent delays.

Post-filing steps and considerations

After submitting the Nebraska state income tax form, monitoring the status of the tax return is a necessary step. The Nebraska Department of Revenue offers an online portal where taxpayers can easily check the status of their returns and any anticipated refunds. Keeping track of this information can provide peace of mind and ensure taxpayers are aware of any issues that may arise.

In the event that taxpayers receive notices from the state regarding their returns, it’s important to take prompt and structured action. Understanding the nature of the notice is crucial, whether it pertains to an audit or request for additional information. Preparing documentation and consulting with a tax professional may often be needed to address auditor inquiries effectively. Taking a proactive approach to tax notices helps prevent complications.

FAQs about Nebraska state income tax forms

Many individuals have questions regarding Nebraska state income tax forms. One common inquiry revolves around the eligibility for various credits and deductions. It’s important to note that residents may qualify for different credits based on specific criteria, which may include age or income limits. Being informed about these aspects can greatly impact the amount owed or refunded.

Another frequent concern pertains to the consequences of errors on tax returns. The state provides avenues for corrections, allowing individuals to amend their returns if miscalculations occur. By understanding these processes and keeping accurate records, taxpayers can minimize stress and uncertainty about their tax filing responsibilities.

Additional tools and resources available through pdfFiller

Beyond just Nebraska state income tax forms, pdfFiller offers a wealth of interactive tools and resources that can assist taxpayers year-round. Among these resources are tax calculators that help estimate potential taxes owed or refunds expected based on various inputs. Templates for other types of forms facilitate efficient completion of necessary documentation.

The platform not only aids in tax document management but also streamlines broader workflows. Users can manage other documents alongside tax forms, illustrating pdfFiller's versatility as a cloud-based solution for a range of document creation needs.

Contact for further assistance

For additional support regarding Nebraska state income tax forms, taxpayers can reach out to the Nebraska Department of Revenue directly. The office provides various contact options, including a dedicated helpline and email support. This ensures that users can obtain timely assistance with any tax-related inquiries.

Additionally, pdfFiller's support team is readily available for any technical questions or issues that users may encounter while managing their income tax forms. Accessing these resources significantly eases the process and equips taxpayers with the knowledge needed to navigate their tax obligations confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nebraska state income tax from Google Drive?

How do I complete nebraska state income tax online?

How do I edit nebraska state income tax straight from my smartphone?

What is nebraska state income tax?

Who is required to file nebraska state income tax?

How to fill out nebraska state income tax?

What is the purpose of nebraska state income tax?

What information must be reported on nebraska state income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.