Get the free "Tax Clinic" by Leon M. Nad - eGrove - University of Mississippi

Get, Create, Make and Sign quottax clinicquot by leon

Editing quottax clinicquot by leon online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quottax clinicquot by leon

How to fill out quottax clinicquot by leon

Who needs quottax clinicquot by leon?

Tax Clinic by Leon Form: Your Comprehensive Guide

Understanding the Tax Clinic by Leon: A Comprehensive Overview

The "Tax Clinic" by Leon Form serves as a vital tool for individuals navigating the often-complex world of tax submissions. This form is meticulously designed to simplify the tax reporting process, making it accessible and manageable for users at various stages of their financial life.

The importance of the Tax Clinic by Leon Form cannot be understated; proper completion ensures compliance with tax laws and minimizes the risk of errors that can lead to penalties. For self-employed persons and freelancers who may not have a conventional employer to assist them with forms, this tool becomes indispensable.

Step-by-Step Guide to Accessing the Tax Clinic by Leon Form

Finding the Tax Clinic by Leon Form is straightforward on the pdfFiller website. Users can navigate to the site’s search bar and enter 'Tax Clinic by Leon' to locate the form efficiently. Alternatively, you can also access it via the direct link available on the pdfFiller platform, which will take you directly to the form.

pdfFiller provides the form in both digital and printed versions, catering to various preferences and needs. For those who prefer filling out documents on their devices, the digital version allows for real-time editing and submission, while the printed version can be helpful for those who enjoy the tangible experience of pen-on-paper.

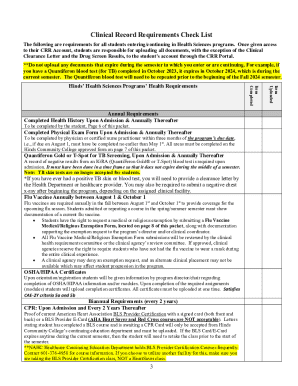

Detailed Instructions for Filling Out the Tax Clinic by Leon Form

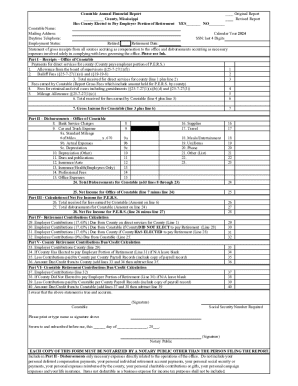

Filling out the Tax Clinic by Leon Form involves several key sections, each designed to collect essential information regarding your financial situation. The first section focuses on personal information; here, you provide your name, contact details, and identification number.

In the income reporting section, you will outline all relevant income sources—be it wages, freelance projects, or business revenue. This section must be meticulously accurate as any discrepancies can raise red flags with tax authorities. Following income, you'll detail deductions and credits, where eligible expenses can significantly impact your taxable income.

Lastly, tax payments section prompts you to record any estimated taxes paid throughout the year, providing a complete view of your tax obligations.

Common mistakes to watch for while filling out this form include missing information, incorrect numerical entries, and misinterpreting deduction eligibility. A good practice is to double-check entries against tax guidelines provided by IRS or corresponding local tax authority.

Editing and customizing the Tax Clinic by Leon Form on pdfFiller

pdfFiller is designed to simplify the editing process for the Tax Clinic by Leon Form, allowing users to make necessary changes efficiently. By utilizing the intuitive interface, you can amend any section of the form directly within your browser. This could involve correcting names, adjusting income figures, or adding missed deductions.

Interactive tools like text boxes and checkboxes enhance the customization process, enabling users to tailor the form according to their unique tax situations. Such features are particularly useful for collaborative teams working on shared documents, allowing each member to contribute effectively.

The benefits of using a cloud-based document management system like pdfFiller extend to security as well. Users can safely store forms in the cloud, ensuring access from anywhere and at any time—essential for the modern, mobile work environment.

Signing and submitting the Tax Clinic by Leon Form

To finalize your Tax Clinic by Leon Form, signing it electronically is a breeze with pdfFiller's eSignature process. Begin by selecting the eSignature option within the form interface; this will prompt you to create your signature if you haven't done so already. This feature simplifies the signing process, allowing for quick approvals without the need for printing or physical presence.

Now, when it comes to submission, you have multiple avenues. Submitting electronically through the platform is most efficient, enabling instant verification and delivery. If circumstances necessitate, traditional methods such as mailing the form are still available, but they may elongate the timeline for completion.

Managing your Tax Clinic by Leon Form with pdfFiller

Once submitted, managing your Tax Clinic by Leon Form efficiently is crucial, and pdfFiller offers several practices to keep organized. Creating folders within your account allows for categorization by year, tax type, or business project—a technique that streamlines the review process later on.

Moreover, cloud storage options in pdfFiller guarantee that your documents remain accessible anytime, from anywhere. This is particularly advantageous for individuals and teams who may need to retrieve or edit tax documents on the go. Collaboration features also foster smooth teamwork, allowing tax professionals and their clients or various team members to communicate easily on tax-related matters.

FAQs about the Tax Clinic by Leon Form

As you prepare to engage with the Tax Clinic by Leon Form, you may have several queries. Common concerns include responsibilities regarding accuracy, deadlines for submissions, and how to amend submitted forms. Knowing your obligations can ease anxiety around tax season.

Utilizing community forums on platforms such as pdfFiller can also provide valuable insights, allowing you to tap into shared experiences and practical solutions for navigating this process.

Additional support and resources

When filling out the Tax Clinic by Leon Form, where can you turn for assistance? pdfFiller offers robust customer support for users facing hurdles while completing their forms. Whether by chat, email, or phone, experts are available to help clarify challenges you might encounter.

Additionally, becoming a part of user communities can grant essential support. Here, users share tips, offer advice, and exchange experiences that could prove beneficial when using the Tax Clinic by Leon Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute quottax clinicquot by leon online?

How do I edit quottax clinicquot by leon in Chrome?

Can I create an electronic signature for the quottax clinicquot by leon in Chrome?

What is 'tax clinic' by leon?

Who is required to file 'tax clinic' by leon?

How to fill out 'tax clinic' by leon?

What is the purpose of 'tax clinic' by leon?

What information must be reported on 'tax clinic' by leon?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.