Get the free Title 50, ARTICLE 8. TAX INCREMENT FINANCEIARP

Get, Create, Make and Sign title 50 article 8

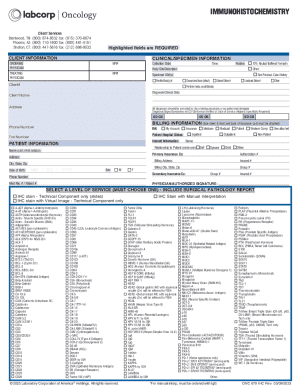

Editing title 50 article 8 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out title 50 article 8

How to fill out title 50 article 8

Who needs title 50 article 8?

How to Fill out a Title 50 Article 8 Form

Understanding the title 50 article 8 form

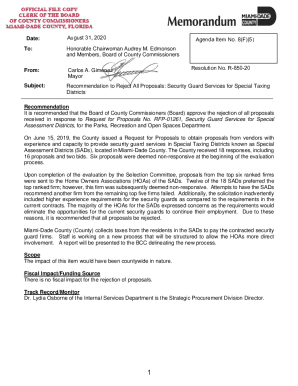

The Title 50 Article 8 Form is a crucial document used primarily in the United States for compliance with specific regulations mandated by government organizations. Its purpose extends to ensuring transparency and accountability in various transactions, particularly those related to government interactions. Filling this form correctly is vital; inaccuracies can lead to delays or rejection of submissions, impacting not just individuals but also organizations depending on government funding or compliance.

Compliance with the Title 50 Article 8 Form isn't just administrative; it holds significant importance in a variety of contexts. For instance, employees seeking government jobs or those involved in government-funded programs must demonstrate a clear understanding of their financial standing. This is essential not only for their eligibility but also for maintaining the integrity of the programs they are engaging with.

Preparing to fill out the title 50 article 8 form

To ensure proper completion of the Title 50 Article 8 Form, preparation is key. Begin by gathering all necessary information and documents, which typically include personal identification, financial details, and other data pertinent to the form's requirements. Having these documents readily available simplifies the process and helps prevent mistakes.

Reviewing the instructions for completing the form is also crucial. Common pitfalls include omitting details, misplacing decimal points in financial documents, or misunderstanding specific requirements outlined in the form. By familiarizing yourself with the instructions, you can minimize errors and improve overall accuracy.

Step-by-step instructions for completing the title 50 article 8 form

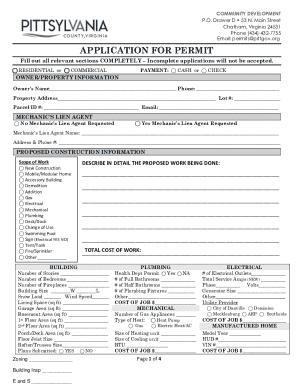

Filling out the Title 50 Article 8 Form involves several sections, requiring a detailed approach to provide accurate information. Let's break it down into manageable parts.

Section 1: Personal information

The first section necessitates precise personal information, including your name, address, and contact details. Ensure that all fields are filled in as required, and use uniform formats to maintain consistency.

Section 2: Financial disclosure

In this section, document your income and assets thoroughly. Examples of acceptable financial documentation include pay stubs, tax returns, or bank statements showing funds. It's vital to represent your financial status accurately to comply with Title 50.

Section 3: Specific article 8 requirements

Here, you'll detail compliance with any stipulations under Article 8. Pay special attention to documenting any exemptions you might qualify for. This demonstrates adherence to applicable regulations, reinforcing your application.

Section 4: Signature and dates

Finally, ensure you include your signature and date on the form. For electronic submissions, familiarize yourself with including an electronic signature, ensuring it meets legal standards for validity.

Editing the title 50 article 8 form

Once you've completed the Title 50 Article 8 Form, the next step is review. This critical phase involves going through your entries to catch any mistakes or omissions. Using tools like pdfFiller can significantly enhance this process, allowing you to edit easily.

Utilizing pdfFiller's editing tools effectively can streamline your adjustments. For example, you can edit text directly, add notes for clarity, or make necessary corrections without hassle. The importance of final revisions before submission cannot be understated – a thorough check can save time and prevent unnecessary issues.

Signing the title 50 article 8 form

When it comes to signing the Title 50 Article 8 Form, electronic signatures offer a practical solution. Using pdfFiller’s electronic signature feature is straightforward and legally binding, ensuring your form is ready for submission without unnecessary delays.

It’s crucial to understand the legal considerations surrounding electronic signatures. Ensure that all signatories are present electronically to avoid any discrepancies that might hinder the processing of your form. This is particularly important when submitting to government agencies that demand compliance with signature protocols.

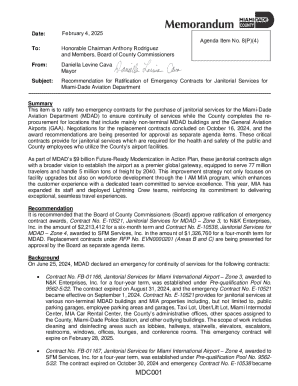

Submitting the title 50 article 8 form

Submission of the Title 50 Article 8 Form can take various routes. Understanding the available methods will help you choose the most effective option for your situation, whether online, via mail, or in-person.

Tracking your submission status is just as important as the submission itself. Confirming receipt by the relevant authority can safeguard against any administrative errors that could result in delays or complications with your application.

Managing your title 50 article 8 form post-submission

After submitting the Title 50 Article 8 Form, it’s vital to keep your document organized. You can utilize pdfFiller’s cloud storage to safely save your completed form, ensuring easy access whenever needed. This not only helps manage your current documentation but also aids in maintaining records for future use.

If you receive notifications or need to make updates to your form after submission, having easy access to your documents can facilitate those revisions. Keeping a well-organized record structure is essential for timely adjustments in response to any feedback or requirements from government organizations.

Frequently asked questions (faqs) about the title 50 article 8 form

As with any specialized government form, questions often arise regarding the filling process. Understanding common queries and troubleshooting tips can alleviate stress when managing your Title 50 Article 8 Form.

Some typical questions include clarifications on income documentation, acceptable formats for submission, or what to do if you notice an error after submission. Seeking assistance from professionals with experience in government regulations can also offer valuable insights to navigate any complexities.

Conclusion

Successfully completing the Title 50 Article 8 Form hinges on a thorough understanding of its requirements and the processes involved in filling it out. Proper form management is essential to avoid complications in compliance, ensuring that you meet regulatory standards effectively.

Encouraging positive practices for future forms can streamline your experience with government documentation. Utilizing tools like those provided by pdfFiller ensures that your submissions are precise, timely, and compliant with the necessary regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get title 50 article 8?

How do I edit title 50 article 8 on an iOS device?

How do I fill out title 50 article 8 on an Android device?

What is title 50 article 8?

Who is required to file title 50 article 8?

How to fill out title 50 article 8?

What is the purpose of title 50 article 8?

What information must be reported on title 50 article 8?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.