Get the free formulario 4547

Get, Create, Make and Sign formulario 4547

Editing formulario 4547 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out formulario 4547

How to fill out instructions for form 4547

Who needs instructions for form 4547?

Instructions for Form 4547: A Comprehensive Guide

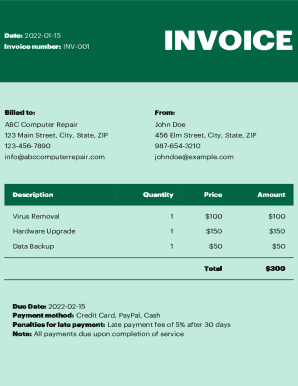

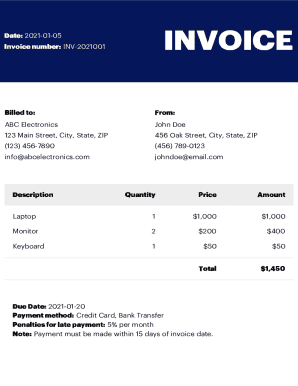

Overview of Form 4547

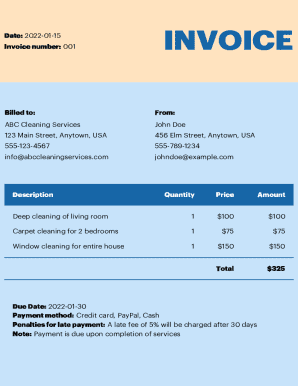

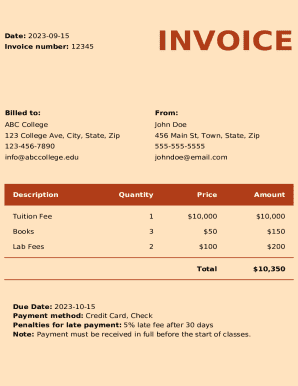

Form 4547 serves a critical role in the sphere of document management, specifically for applications related to tax accounts. This form is primarily utilized by parents funding educational savings accounts for their children, ensuring compliance with U.S. government standards aimed at tax advantages. Its significance cannot be overlooked, as it lays the groundwork for establishing qualified accounts that trigger beneficial seed contributions and savings for families.

The structure of Form 4547 is designed to be intuitive, with clearly defined sections that guide users through the necessary information step by step. This thoughtful organization not only enhances user experience but also establishes a standard across different government forms, thus increasing effectiveness in compliance and processing.

Preparing to fill out Form 4547

Before filling out Form 4547, it is essential to gather all necessary information to ensure a smooth process. Personal data required includes the contributor's full name, Social Security number, and relevant tax details linked to the account types being declared. Furthermore, parents or guardians should also have their children's details handy, such as names and Social Security numbers, especially if opening investment vehicles.

To collect this information effectively, start by organizing your documents. Utilizing folders, either physical or digital, can significantly reduce stress. It’s best to create a checklist of necessary documentation, which may include previous tax returns, account statements, and government publications that explain seed contributions and limitations on account types.

Step-by-step instructions for completing Form 4547

Completing Form 4547 can feel daunting; however, following a systematic approach will lead to accuracy and compliance. Here’s a breakdown of each section:

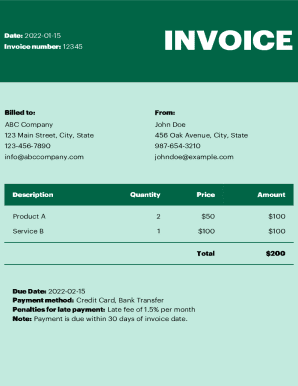

Filling out the form can be done online or offline. While both have their benefits, using pdfFiller for online submissions streamlines the process. Manual completion requires printing out the form, which could lead to variability in legibility and completeness.

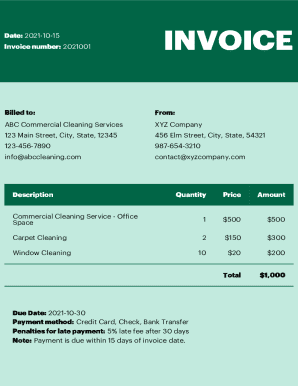

Editing and modifying Form 4547

Editing Form 4547 becomes seamless with pdfFiller. Users can upload the form as a PDF and utilize various editing tools available on the platform. This ease of modification is crucial for ensuring the document is error-free before submission.

Collaborating with team members is another asset. You can share the form with colleagues to gather input, comments, and any necessary adjustments, collectively enhancing the document’s accuracy and efficiency.

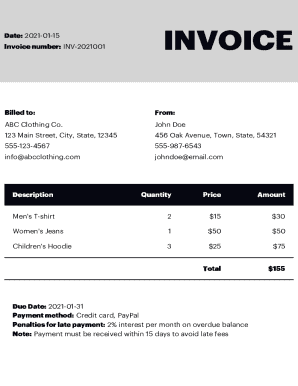

Signing Form 4547

Signing Form 4547 involves essential legalities that are simplified using pdfFiller’s eSignature features. This method is not only efficient but also legally recognized in the majority of jurisdictions, negating the need for traditional pen and paper.

For those who prefer, alternative signing methods are also available. You can print the form and sign it physically. However, manually signed documents may introduce delays in processing compared to those submitted electronically.

Submitting Form 4547

Once completed, submitting Form 4547 electronically is straightforward through the pdfFiller platform. The system provides clear prompts to guide you through final submission steps, ensuring you don’t miss crucial actions.

Being mindful of submission deadlines is vital as failing to submit on time can impede the processing of your tax-related requests. Keeping a calendar or reminders about due dates related to Form 4547 can save you from potential penalties.

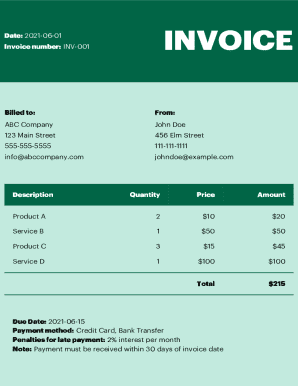

Managing and tracking your submission

Accessing submitted forms is quick and efficient through pdfFiller. Users can easily retrieve completed forms from their account, ensuring that all your essential documents are available when needed.

Additionally, tracking your submission status is crucial. Utilize the platform's features to follow up on your form's processing status, which can also provide peace of mind during waiting periods.

Common FAQs about Form 4547

Mistakes happen; if you realize an error was in the form after submission, it is crucial to know how to handle the correction process. Generally, speaking to the relevant tax authority can provide clarity on how to amend your submission.

Understanding how your form will be processed is another important aspect. Being aware of the typical timeline and processes involved can greatly help manage your expectations.

For additional concerns, having contact information readily available for resources or support is vital. Look for dedicated helplines or websites that can handle inquiries regarding Form 4547.

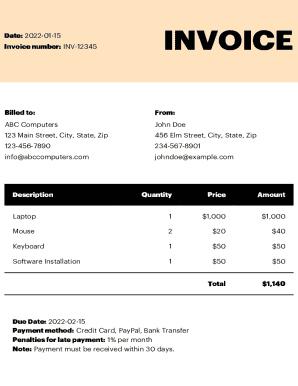

Benefits of using pdfFiller for manageability

Using pdfFiller significantly enhances the manageability of Form 4547 and various other documents. The cloud-based platform offers an accessible and organized interface, which is especially beneficial for individuals and teams relying on accurate, timely document submissions.

Collaborative editing and eSigning not only save time but also improve workflow, ensuring all users are aligned and up to date. Embrace this technology to streamline your document handling process and optimize efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit formulario 4547 from Google Drive?

How do I complete formulario 4547 online?

Can I create an electronic signature for signing my formulario 4547 in Gmail?

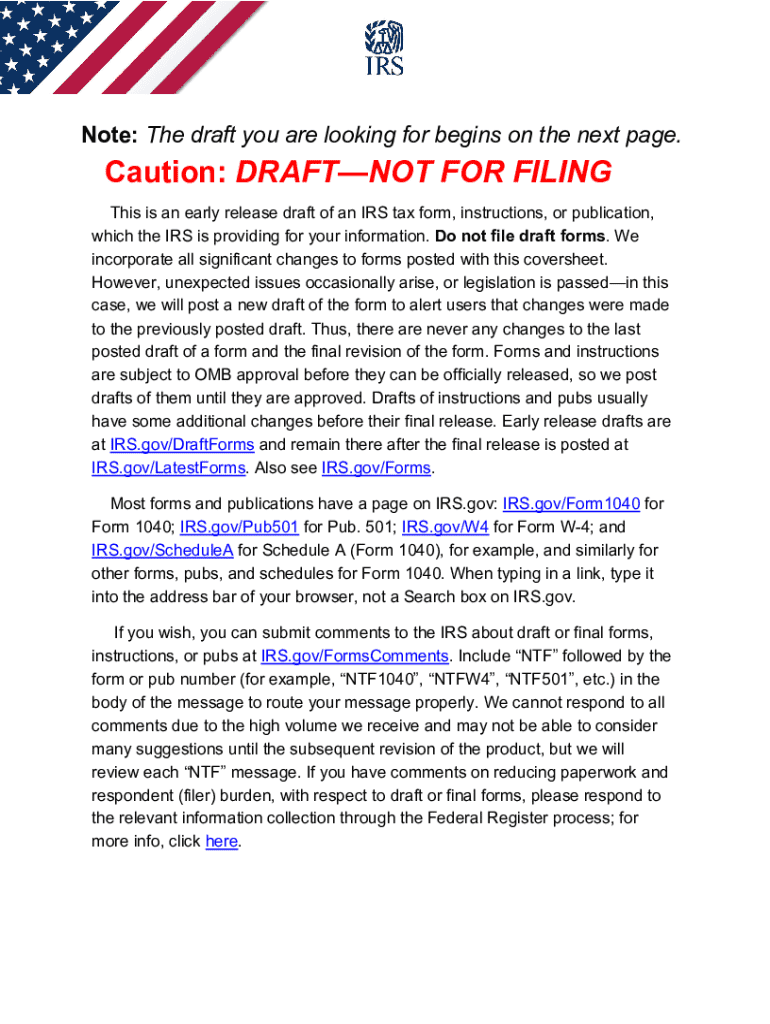

What is instructions for form 4547?

Who is required to file instructions for form 4547?

How to fill out instructions for form 4547?

What is the purpose of instructions for form 4547?

What information must be reported on instructions for form 4547?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.