Get the free New retiree enrollmentWashington State Health Care Authority

Get, Create, Make and Sign new retiree enrollmentwashington state

Editing new retiree enrollmentwashington state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new retiree enrollmentwashington state

How to fill out new retiree enrollmentwashington state

Who needs new retiree enrollmentwashington state?

New retiree enrollment in Washington State form: A comprehensive guide

Overview of new retiree enrollment

New retiree enrollment refers to the process through which individuals who have recently retired can register for various benefits and programs provided by Washington State. This includes essential aspects such as healthcare coverage, pension plans, and other retirement benefits. The registration is pivotal as it lays the groundwork for ensuring that retirees receive the necessary support and coverage they need post-retirement.

Timely enrollment in these programs is crucial. Missing the enrollment window can lead to gaps in coverage, delayed benefits, and potential out-of-pocket expenses for new retirees. Thus, understanding the enrollment process and adhering to deadlines is vital for financial security and access to necessary healthcare.

Preparing for enrollment

Before diving into the enrollment process, it's essential for new retirees to consider several key factors. Understanding your retirement benefits is imperative; this includes familiarity with the specifics of your pension plan and any accompanying insurance coverage. Additionally, evaluating your healthcare needs in the years ahead will ensure that the chosen plan aligns with your medical requirements.

Gathering the necessary documents is also an important preparatory step. Typically, this would include personal identification, retirement letters, and any previous employment records that detail insurance coverage. In terms of eligibility, most state plans are available to both former state employees and those meeting specific criteria set by Washington State. It’s advisable to review these guidelines to ensure you fit within the qualification parameters.

Enrollment deadlines

Enrollment windows for new retirees in Washington State are strictly defined. Typically, there is a specific timeframe allotted for enrollment that begins shortly after retirement. For most retirees, this window lasts for a limited period, usually 30 to 90 days from the retirement date. Knowing these deadlines is crucial for ensuring that you don’t miss your chance to enroll in essential coverage.

If you happen to miss the deadline, there are options available, but these often come with certain limitations. Late enrollment may result in higher premium costs, and benefits could be delayed. Understanding these stipulations can help you make informed decisions about your retirement healthcare.

Step-by-step enrollment guide

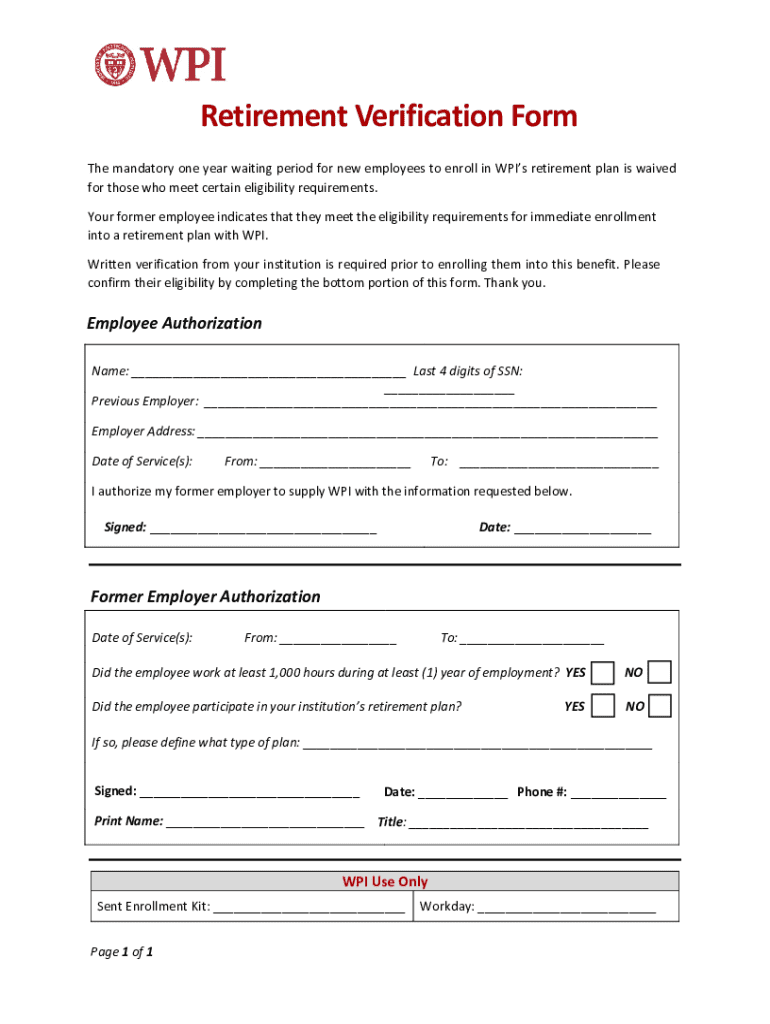

Enrolling in the Washington State retiree plan involves several clear steps. The first step is to collect all required information, which includes personal documentation and prior employment records. This information is essential for completing the enrollment form.

The second step involves accessing the enrollment form. You can find the Washington State New Retiree Enrollment Form on the official Washington State Department of Retirement Systems website or through the provided link directly to the pdfFiller platform.

Once you have your form, it’s time to fill it out. This step requires paying close attention to each section—ensure that you provide accurate information regarding your previous employment, selection of coverage, and other details.

After completing the form, reviewing your submission is the next critical step. Verify that all the details are accurate and complete, as errors can lead to processing delays.

Finally, the completed form must be submitted. This can be done online through designated state portals, by mailing in your forms, or submitting them in person at specific offices.

After enrollment: what to expect

After successfully enrolling in the Washington State plan, you may wonder when your coverage begins. Typically, benefits become effective on the first day of the month following your enrollment submission. It’s essential to be aware of this timing to manage your medical needs accordingly.

Understanding your initial benefits and plan options is also critical. Upon enrollment, new retirees are usually given access to specific healthcare coverage options, dental and vision plans, and other benefits. Familiarizing yourself with the nuances of these plans can help maximize your coverage's value.

Special enrollment circumstances

There are situations where a retiree may need to enroll after deferring their retirement. If you’ve decided to postpone your enrollment due to personal reasons, it’s important to know that you can still gain access to benefits, but the process may involve additional steps or provide different coverage options depending on your circumstances.

Changes in personal circumstances also warrant a review of your enrollment status. For instance, if you have recently moved, gotten married, or experienced significant life changes, you may qualify for special enrollment opportunities that can adjust your health benefits accordingly. It's advisable to consult with a benefits advisor to navigate these changes effectively.

Relevant laws and regulations

Understanding the legal framework governing retiree enrollment in Washington State is key for safeguarding your rights. The regulations are designed to ensure that retirees have access to necessary benefits without facing undue barriers. Familiarity with these laws can empower new retirees to advocate for themselves during the enrollment process.

As a retiree, you also have specific rights concerning your healthcare benefits. This includes the right to access accurate information, appeal decisions regarding your coverage, and understand your options. Being aware of each of these rights can make a significant difference in how you navigate your post-retirement benefits.

Frequently asked questions

As new retirees kickstart the enrollment process, several questions often arise. Common queries include how to determine which coverage options are best, what to do if you've missed the enrollment deadlines, and how to navigate changes in personal circumstances affecting your eligibility for benefits.

For inquiries not covered in this guide, reaching out to the Washington State Department of Retirement Systems or your specific benefits coordinator is advisable. They can provide tailored answers that align with your unique situation.

Utilizing pdfFiller for document management

During the completion of your new retiree enrollment process, pdfFiller can prove invaluable in editing and signing your enrollment form. The platform offers tools designed for seamless document management, allowing users to fill out forms digitally, ensuring that the submission process is streamlined and efficient.

Additionally, pdfFiller fosters collaboration among team members involved in the retirement planning process. By utilizing its cloud-based platform, you can collaborate effectively, ensuring that all required materials and documents are organized and accessible to all stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new retiree enrollmentwashington state directly from Gmail?

How do I execute new retiree enrollmentwashington state online?

How can I edit new retiree enrollmentwashington state on a smartphone?

What is new retiree enrollment washington state?

Who is required to file new retiree enrollment washington state?

How to fill out new retiree enrollment washington state?

What is the purpose of new retiree enrollment washington state?

What information must be reported on new retiree enrollment washington state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.