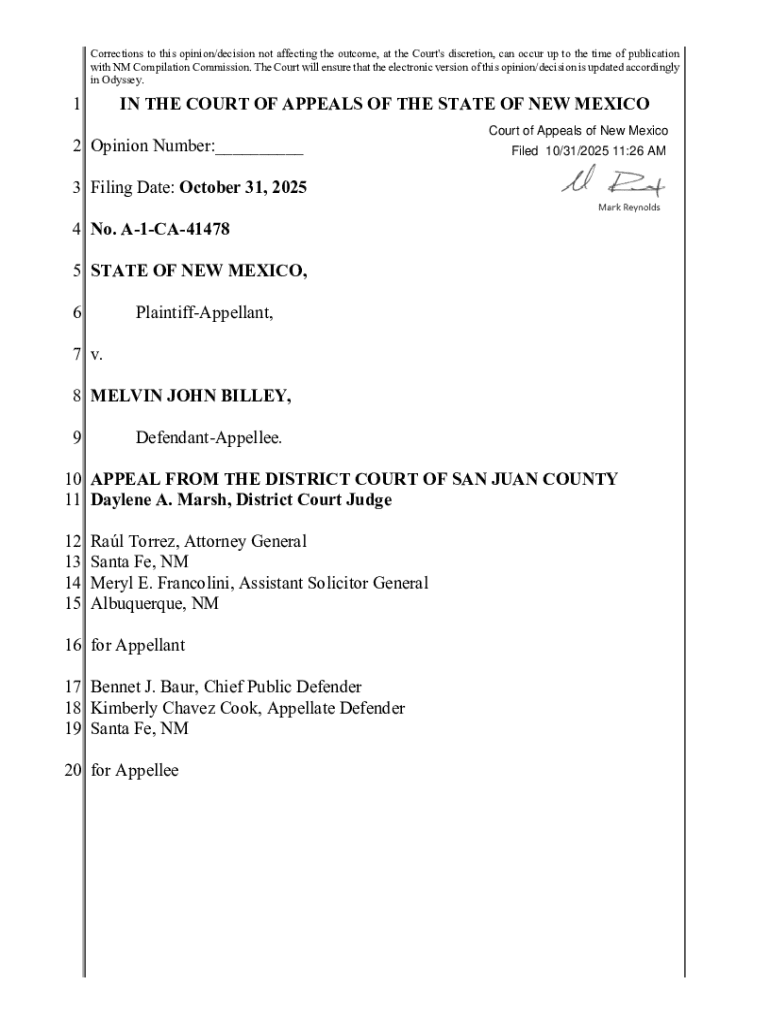

Get the free 2 Filing Date: October 31, 2025 3 No. A-1-CA-4147 - coa nmcourts

Get, Create, Make and Sign 2 filing date october

How to edit 2 filing date october online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2 filing date october

How to fill out 2 filing date october

Who needs 2 filing date october?

Understanding Your October Filing Deadline: A Comprehensive Guide to the 2 Filing Date October Form

Overview of October filing deadlines

October marks a crucial deadline for many taxpayers, as it's a month when extensions can come to a close. The filing dates in October are a second chance for individuals and businesses who didn’t file their tax returns by the original deadline in April. The significance of these dates cannot be overstated, especially for those who’ve requested extensions, as missing these deadlines can lead to severe penalties and complications.

Understanding the common forms and documents needed for filing in October is key. It’s essential for taxpayers to be aware of the necessary paperwork to avoid scrambling at the last minute. Common forms include the 1040 for individual income tax returns, the 941 for quarterly payroll tax submissions, and the 990 for exempt organizations. Each type of filing carries its own importance during this transitional month.

Key forms and their deadlines

When it comes to the upcoming October forms, the Form 1040 is likely the most recognized for individual taxpayers. Notably, individuals who applied for an extension to file their income tax returns have until October 15 to submit their Form 1040. This is crucial in maintaining compliance and minimizing tax liabilities.

If you are an employer, it’s important to note the deadlines for submitting Form 941—an essential document for reporting income taxes withheld and FICA taxes. The deadline for this form, which covers the third quarter, is typically October 31. Failure to file this form on time can result in penalties that can significantly impact your finance team’s budget.

For organizations that are tax-exempt, Form 990 is vital for compliance with IRS regulations. These organizations have until mid-October to file their annual returns. This form is essential to maintain philanthropic credibility and avoid any repercussions from government agencies.

Step-by-step guide to preparing your forms

Preparation is key to ensuring a smooth filing process. Start by gathering all necessary documentation. This includes relevant identification and personal information, such as your Social Security number and contact details. Additionally, assemble your income documents—W-2s, 1099s, and any other sources of income must be included to accurately report earnings.

Next, compile your deductions and credits information. This may include receipts for deductible expenses or 1098 forms for mortgage payments. Being thorough at this stage helps avoid common mistakes that can lead to tax risks, such as the wrong deductions, potentially leading to penalties down the road.

Utilizing tools like pdfFiller can ease the process significantly. You can access templates and forms directly from the platform, populating them efficiently with your personal data. pdfFiller also allows eSigning and submitting your forms directly, making it a secret weapon in simplifying the completion of your tax obligations.

Managing your October filing process

Establishing a filing timeline is essential for keeping track of important dates. Mark your calendar with deadlines for each form due in October, and create milestones for document preparation. This not only keeps you organized but also helps alleviate the stress associated with last-minute filings.

Consider the advantages of using cloud technology for document management. Cloud-based solutions, like pdfFiller, provide the benefit of offline and online accessibility, ensuring you can manage your documents from anywhere. The flexibility of these services allows finance teams and individuals to collaborate seamlessly on their tax filings.

Advanced considerations for October filings

It’s important to understand the implications of late filings. Penalties for not meeting your October deadlines can vary based on your tax situation but can include steep fines and interest on unpaid taxes. The stakes increase significantly with organizations where compliance plays a crucial role in maintaining their reputations.

Stay updated on potential tax reform updates, as changes can impact your obligations and deadlines. Legislative adjustments by the government can change the parameters of expectations regarding tax filings. Moreover, handling amendments and corrections post-filing can become complex if you miss the initial deadlines. Equipping yourself with knowledge and resources can help navigate these challenges effectively.

Resources for ongoing document management

As you continue to manage your documentation, leveraging pdfFiller’s extensive Resource Center can be valuable. This portal can assist you with the latest forms, filing tips, and FAQs related to your specific needs. Staying informed helps mitigate challenges in the future and promotes a proactive filing strategy year after year.

In addition to resources for immediate needs, consider integrating comprehensive filing solutions into your long-term planning. Utilizing pdfFiller helps keep all your documents organized and accessible, fostering a more manageable approach to your annual obligations. Building a connection with professional tax help through pdfFiller’s network can prove beneficial for complex scenarios.

Conclusion on the importance of staying ahead of October deadlines

Timely filing is paramount, especially with the looming deadlines of October. By outlining effective strategies and utilizing modern tools such as pdfFiller, individuals and teams can simplify their financial responsibilities and ensure compliance without the last-minute scramble. Planning ahead allows for a smoother filing experience, reducing the anxiety associated with tax obligations.

Remember, staying organized and informed about your filing requirements will pay off not only in avoiding penalties but also in optimizing your potential tax savings. Harnessing the capabilities of pdfFiller empowers you to handle all your document-related needs effectively, positioning you for success as you approach your filing date this October.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2 filing date october in Gmail?

How can I fill out 2 filing date october on an iOS device?

How do I complete 2 filing date october on an Android device?

What is 2 filing date october?

Who is required to file 2 filing date october?

How to fill out 2 filing date october?

What is the purpose of 2 filing date october?

What information must be reported on 2 filing date october?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.