Get the free Financial Inclusion in the United States: Measurement, Determinants ...

Get, Create, Make and Sign financial inclusion in form

Editing financial inclusion in form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial inclusion in form

How to fill out financial inclusion in form

Who needs financial inclusion in form?

Financial Inclusion in Form: Enhancing Access to Financial Services

Understanding financial inclusion

Financial inclusion refers to the effort to make financial services accessible to all individuals, particularly those who are unbanked or underbanked. It includes a range of services such as banking, credit, insurance, and payment services that are affordable and convenient. The goal is to ensure that people can efficiently manage their financial resources, thereby contributing to economic stability and personal financial security.

In today's economy, where financial literacy and access to banking services are paramount, financial inclusion plays a crucial role. It empowers individuals by providing them with the tools necessary to save, invest, and plan for the future. Furthermore, it helps stimulate economic growth by integrating more individuals into the financial system, ultimately leading to improved community development.

The role of forms in financial inclusion

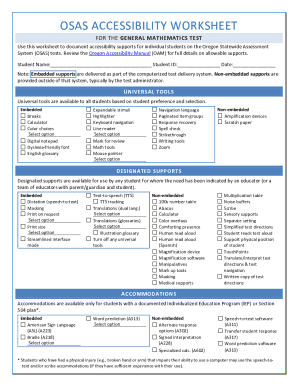

Forms are a vital component in the financial inclusion process, serving as the primary means for individuals to access financial services. They provide the necessary documentation for applying for various services, whether it's enrolling in a financial assistance program, applying for a loan, or opening a new bank account. These forms collect critical information that helps financial institutions assess eligibility and make informed decisions.

In the digital age, the impact of online forms on accessibility cannot be overstated. Digital forms are available 24/7, allowing users to fill out applications at their convenience, thus saving time and reducing barriers associated with traditional paper forms. Additionally, they often come with built-in features that help guide applicants through the process, enhancing the likelihood that individuals will complete their requests.

Key components of financial inclusion forms

When creating financial inclusion forms, it's essential to gather the right information to evaluate individuals effectively. Standard requirements typically include personal identification, such as social security numbers or government IDs, income verification to confirm financial status, and details about employment, including job title and duration. This information enables financial institutions to assess the applicant's needs and financial stability.

Moreover, user-friendly design elements should be prioritized to ensure accessibility. Clear instructions and examples can demystify complex terms, making it easier for applicants to understand what is expected. Additionally, incorporating accessibility features for individuals with disabilities, such as screen-reader compatibility and alternative text for images, is crucial in ensuring that forms are inclusive.

Steps to create financial inclusion forms

Creating effective financial inclusion forms begins with identifying the purpose and audience. Understanding who will use the forms helps tailor the content and style to meet their specific needs. Next, drafting the initial form involves selecting relevant fields that directly relate to the services offered while ensuring the language is straightforward and free of jargon.

Design considerations should focus on visual layout and clarity. A clean and organized structure enhances readability, while responsive design ensures that forms are accessible across different devices, including mobile phones and tablets. This adaptability is particularly important given the variety of technological access among potential users.

Filling out financial inclusion forms

Filling out financial inclusion forms can often feel daunting, but clear step-by-step instructions can simplify the process. Users should gather all necessary documents before starting the application. These might include identification, proof of income, and any relevant financial statements. Taking the time to prepare helps ensure a smoother completion process.

Detailed tips for completing each section, addressing common challenges, can also enhance user experience. For instance, understanding the nuances of questions—such as what constitutes 'household income'—is crucial for accurate responses. Common mistakes include overlooking required fields or misinterpreting questions, which can delay processing or lead to application rejection.

Editing and signing forms with pdfFiller

pdfFiller provides a robust solution for editing financial inclusion forms. Users can easily modify existing documents by adding or removing information as needed. The platform's collaborative features enable team members to input their feedback and comments, ensuring comprehensive input before submission. This streamlined approach fosters better communication among stakeholders.

Electronic signing is another critical feature that pdfFiller offers, simplifying the process of completing forms. The process is intuitive, guiding users through the steps to eSign. Security measures, such as encryption, ensure that personalized information is safeguarded, providing peace of mind for individuals sharing sensitive data.

Managing financial inclusion documents

After forms are completed and submitted, organizing the resulting documents is essential. Effective document management practices facilitate easy access and retrieval of information when needed. Utilizing pdfFiller for digital document management helps users store their forms securely, ensuring that they can be accessed from anywhere at any time.

Tracking the status of applications is equally important. Users should know how to follow up on submitted forms and maintain accurate records of their applications, as this plays a significant role in managing one’s financial health. Keeping documentation helps ensure all submissions are accounted for and made accessible for future reference.

Interactive tools for financial inclusion

Interactive tools play a significant role in enhancing financial inclusion through forms. pdfFiller’s library of customizable form templates is tailored specifically for financial services, catering to the unique needs of various users. These templates can be adapted to fit specific requirements, making the form-filling process more efficient and user-friendly.

Case studies highlight the success stories of individuals and organizations that have leveraged these forms to achieve financial inclusion. For example, community banks utilizing streamlined forms have significantly increased their outreach to underserved populations, demonstrating that the right tools can lead to meaningful change in financial accessibility.

Support and assistance for form users

Navigating financial inclusion forms may come with challenges, which is why accessing customer support through pdfFiller is crucial. Users can reach out for assistance through multiple channels, receiving guidance and troubleshooting support as needed. This accessibility ensures users are not left stranded and empowers them to successfully manage their documents.

Engagement with community forums and knowledge bases enhances the user experience further. By connecting with others facing similar challenges, individuals can share insights and practical tips for effectively completing financial inclusion forms. This community approach not only fosters solutions but also builds a supportive network facilitating financial literacy and inclusion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial inclusion in form in Gmail?

How do I make edits in financial inclusion in form without leaving Chrome?

Can I edit financial inclusion in form on an iOS device?

What is financial inclusion in form?

Who is required to file financial inclusion in form?

How to fill out financial inclusion in form?

What is the purpose of financial inclusion in form?

What information must be reported on financial inclusion in form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.