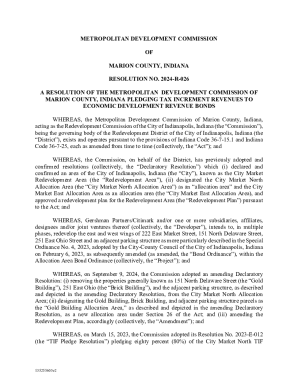

Get the free MINNESOTA 1211

Get, Create, Make and Sign minnesota 1211

Editing minnesota 1211 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota 1211

How to fill out minnesota 1211

Who needs minnesota 1211?

Minnesota 1211 Form: A Comprehensive How-to Guide

Overview of the Minnesota 1211 form

The Minnesota 1211 form, often referred to as the MN 1211 form, is an essential document utilized primarily in estate planning and asset management. This form serves to provide clear and organized information regarding an individual's assets, liabilities, and distribution wishes, which can be critical during legal proceedings or when managing affairs posthumously.

Understanding the importance of the Minnesota 1211 form is key for individuals and professionals alike. It not only helps streamline the estate administration process but also minimizes potential disputes among heirs. For financial advisors and legal professionals, possessing a thorough grasp of the MN 1211 form can aid in offering superior guidance to their clients.

Who needs to use the Minnesota 1211 form?

Various groups of people need to pay attention to the Minnesota 1211 form. Primarily, individuals engaged in estate planning should fill out this form to document their wishes accurately. This allows for clear communication of intent regarding asset distribution, which is vital to avoid future legal entanglements.

Legal professionals, including attorneys specializing in estate law, also rely on the MN 1211 form as an essential tool for managing client assets. Additionally, financial advisors who help clients navigate their estates will find the form indispensable for providing comprehensive financial planning advice. Consequently, understanding this form is critical for anyone involved in estate management.

Detailed breakdown of the Minnesota 1211 form

A structured form such as the Minnesota 1211 necessitates a detailed breakdown to comprehend its components effectively. The various sections of the form cater to specific information required for thorough asset and liability declaration.

Key sections of the form

The Minnesota 1211 form is organized into several key sections:

Common terms and definitions

Being familiar with key legal and financial terminology is essential when dealing with the Minnesota 1211 form. Understanding terms like 'beneficiaries', 'debts', and 'assets' not only aids in proper form completion but is critical when discussing these topics with legal and financial professionals. Each term represents significant components of estate management, and clarity is vital.

Step-by-step guide to filling out the Minnesota 1211 form

Filling out the Minnesota 1211 form requires careful attention to detail. A systematic approach will ensure that the required information is accurately captured.

Gathering necessary information

Before beginning the form, gather all necessary documents that will help you complete it. Useful items may include:

Completing each section

With your documents ready, follow these steps to complete the form:

Important tips for accuracy

Before submitting, ensure that all the information is accurate. Double-check everything against the documents you've collected. If there's any confusion or you feel uncertain, consider seeking legal advice to clarify any doubts.

Editing and customizing your Minnesota 1211 form

In today's digital age, editing your Minnesota 1211 form can be done seamlessly using tools like pdfFiller. Customization allows for flexibility, especially when circumstances change, or new assets are acquired.

How to edit the form using pdfFiller

pdfFiller offers a user-friendly interface to upload and modify the Minnesota 1211 form easily. You will need to create an account and follow these simple steps:

Adding signatures and initials

Once your form is complete, signing is essential. pdfFiller includes eSign features that allow you to securely add your signature digitally. For collaborative efforts, you can invite other parties to sign, ensuring all necessary stakeholders validate the document.

Common mistakes to avoid when completing the Minnesota 1211 form

While filling out the Minnesota 1211 form, there are several common pitfalls to avoid to ensure a smooth submission process. Missing critical details can lead to errors that may delay your estate planning.

Submitting the Minnesota 1211 form

Upon completing the Minnesota 1211 form, submitting it accurately is the next step. Various state agencies handle estate documents, including the office of the county clerk or probate courts. Knowing where to send your completed form is crucial to avoid unnecessary delays.

Where to submit the completed form

Once you have filled out the form, you need to submit it to the correct authority. Generally, the completed Minnesota 1211 form is filed with the probate court in your local county. Ensure you have multiple copies, as some may be required for your records.

Confirmation of submission

After submitting the form, it's wise to confirm that it has been received. Inquire with the office where you submitted the form about their process for confirmation, which may include obtaining a stamped copy of your submission or confirmation email.

Managing your Minnesota 1211 form with pdfFiller

Post-submission, effective management of your Minnesota 1211 form is essential. Utilizing a robust document management platform such as pdfFiller ensures that your important documents are always accessible and organized.

Storage solutions

pdfFiller provides cloud-based storage solutions, enabling users to keep their documents secure while ensuring they are easily retrievable whenever needed. This level of convenience is paramount for managing sensitive estate planning documents.

Organizing and retrieving documents

Harnessing pdfFiller's organizational features allows users to categorize and tag their documents, making it simpler to retrieve vital forms. This can significantly enhance workflow efficiency, especially for teams working collaboratively on estate planning.

Frequently asked questions (FAQs)

How do access the Minnesota 1211 form online?

The Minnesota 1211 form can be accessed online through official state resources or directly through platforms like pdfFiller, where users can conveniently fill out and save forms.

Can make changes to the submitted form?

Once the Minnesota 1211 form is submitted, changes may not be permissible without going through the court process. Check with local authorities if edits are necessary.

What if encounter issues with the form submission process?

For any issues, reaching out to the probate court's office can provide clarification and guidance. Additionally, consulting with a legal professional may help resolve any disputes or uncertainties.

Additional considerations

Completing the Minnesota 1211 form goes beyond mere paperwork; it bears significant legal and tax implications. Failing to fill it out correctly can lead to unexpected consequences that may affect estate distribution.

Legal and tax implications

Improper completion or omission of vital information can result in disputes among heirs and potential tax burdens on the estate. Therefore, seeking early legal advice may prove beneficial.

Resources for further assistance

Useful resources include links to Minnesota state resources, legal aid organizations, and other supportive documents that can provide assistance with filling out the Minnesota 1211 form and understanding its implications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find minnesota 1211?

How can I fill out minnesota 1211 on an iOS device?

Can I edit minnesota 1211 on an Android device?

What is minnesota 1211?

Who is required to file minnesota 1211?

How to fill out minnesota 1211?

What is the purpose of minnesota 1211?

What information must be reported on minnesota 1211?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.