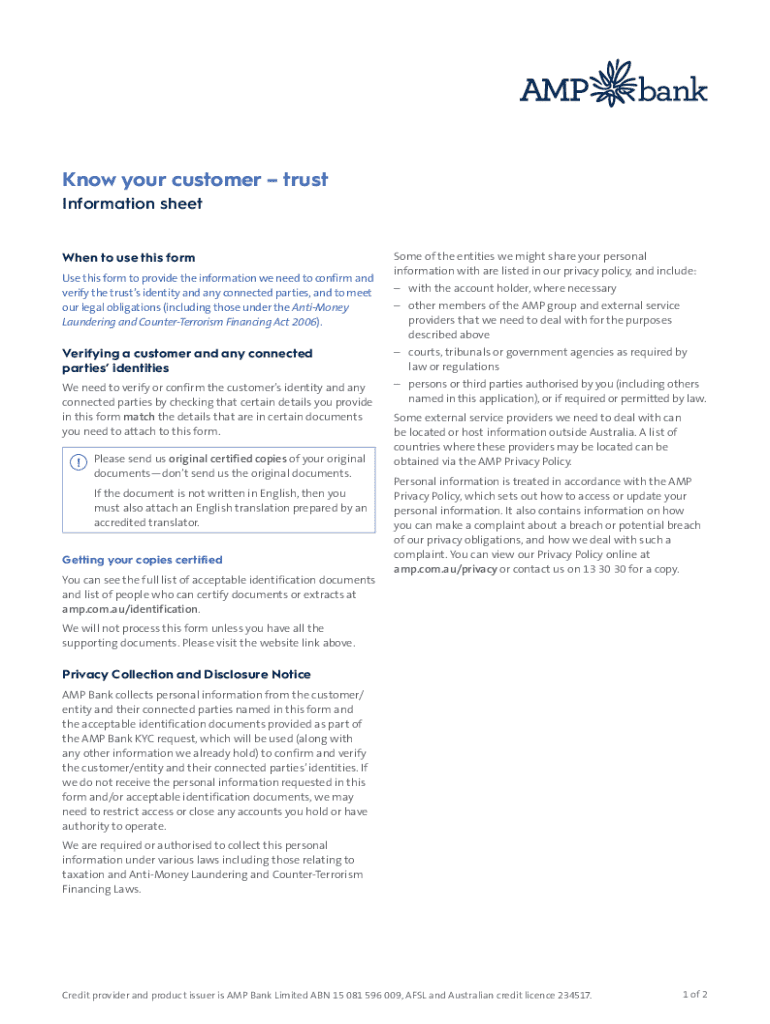

Get the free Know your customertrust. AMP Bank KYC Trust form

Get, Create, Make and Sign know your customertrust amp

How to edit know your customertrust amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out know your customertrust amp

How to fill out know your customertrust amp

Who needs know your customertrust amp?

Know Your Customer Trust AMP Form: A Complete Guide

Understanding the importance of Know Your Customer (KYC)

Know Your Customer (KYC) is fundamental in today’s regulatory environment. It entails a set of processes that financial institutions and other regulated entities use to verify the identity of their clients. By implementing KYC procedures, businesses can mitigate risks associated with money laundering and fraud. Across industries such as banking, insurance, and investment management, KYC not only safeguards entities but also enhances their credibility.

KYC compliance is not just a best practice; it's a legal requirement in many jurisdictions. Regulatory bodies worldwide enforce KYC regulations to ensure that organizations recognize their customers' risks and establish appropriate controls. Failure to comply with KYC regulations can lead to severe penalties, including hefty fines and reputational damage.

Overview of the KYC process

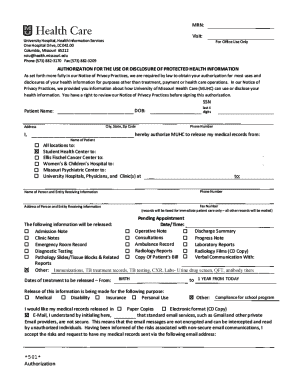

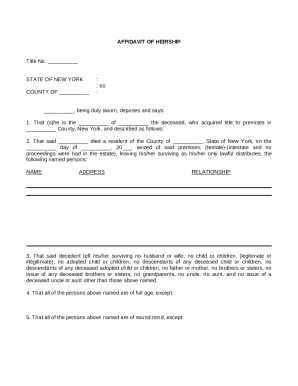

The KYC process consists of several critical components that facilitate customer identity verification. Primarily, businesses must gather personal identification data, such as passports, driver's licenses, or government-issued IDs. Following this, customer verification is conducted to ensure that submitted information aligns with external databases and other reliable sources.

Risk assessment constitutes a vital element of the KYC process. It involves evaluating the potential risks each customer presents based on their background, transaction behaviors, and other relevant criteria. Additionally, the type of KYC information required varies based on the entity involved—financial institutions may seek extensive personal, financial, and source-of-funds disclosures, whereas individual investors typically provide less detailed information.

Introducing the Trust AMP Form

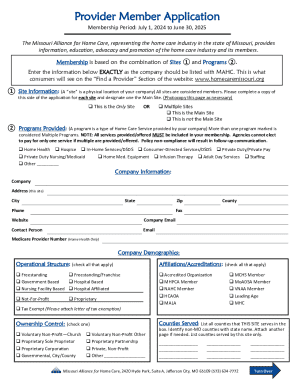

The Trust AMP Form is a specific document utilized within the KYC process, especially in the financial services sector. It serves as a comprehensive template that aids organizations in gathering essential KYC information from their clients. By streamlining KYC documentation, the Trust AMP Form ensures that businesses can efficiently implement KYC protocols while remaining compliant with regulations.

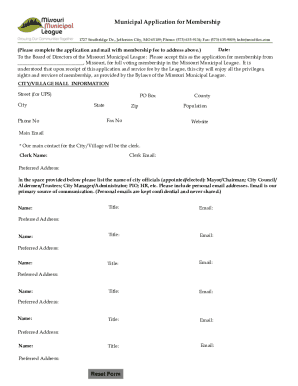

Various stakeholders require the Trust AMP Form, including financial institutions such as banks and credit unions, legal entities for compliance purposes, and individual investors looking to participate in investment opportunities. Each of these groups benefits from using the Trust AMP Form by simplifying the onboarding process and enhancing data accuracy.

Detailed instructions for filling out the Trust AMP Form

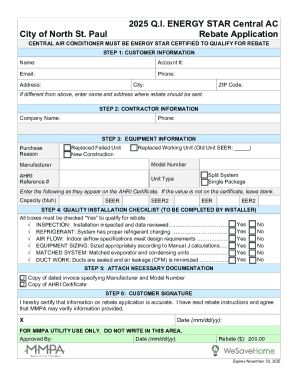

Filling out the Trust AMP Form requires attention to detail, as accuracy is critical in KYC compliance. The form typically is divided into three main sections: Personal Information, Financial Information, and Risk Assessment. Each of these sections has specific required fields designed to collect thorough and precise data.

In the Personal Information Section, be prepared to enter details such as your full name, date of birth, and contact information. Ensure that the names match official identification documents. Moving to the Financial Information Section, include information on your income, existing assets, and overall financial condition. This part is essential for evaluating your financial profile. Lastly, the Risk Assessment Section asks for qualitative data that helps gauge potential risks. Answer thoroughly to provide a complete view.

Editing and managing your Trust AMP Form

Once the Trust AMP Form has been filled out, you may need to make edits or adjustments. This is where using tools like pdfFiller becomes beneficial. pdfFiller offers user-friendly interactive tools for editing PDF documents. Users can easily add or remove information, reformat sections, and ensure that all data is presented accurately.

Collaboration features in pdfFiller allow sharing of the Trust AMP Form with team members or other stakeholders. This real-time editing functionality ensures that everyone involved can provide input, ask questions, or resolve potential issues before final submission. This not only enhances the accuracy of the form but also fosters teamwork and reduces the risk of errors.

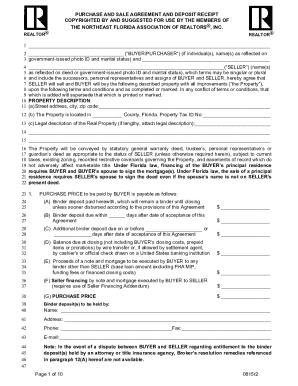

Signing the Trust AMP Form

Signing the Trust AMP Form, especially when dealing with digital submissions, can be achieved easily using various digital signature options available in pdfFiller. Adding a digital signature is straightforward through the platform’s intuitive interface, ensuring that all necessary parties can sign the document quickly and securely. It’s important to know that digital signatures have the same legal standing as traditional handwritten signatures, making them a valid form of signature in many jurisdictions.

As you finalize your Trust AMP Form, consider document security as a priority. pdfFiller incorporates features that protect sensitive information, such as password protection and encryption options. Utilizing these features is critical to safeguarding the information you provide and ensuring compliance with KYC regulations.

Submitting the Trust AMP Form

After completing the Trust AMP Form, understanding how to submit it effectively is crucial. Each institution may have different submission guidelines, but common methods include electronic submissions through secure online portals or physical mail submissions. Always review the specific guidelines provided by the requesting entity to ensure compliance.

Once submitted, it’s beneficial to track the status of your submission. Many institutions provide tracking mechanisms to let you know whether additional information is required or if your form has been processed. If follow-up action is needed, make sure to respond promptly to avoid any delays in your KYC verification process.

Frequently asked questions about the Trust AMP Form

Navigating the nuances of the Trust AMP Form can lead to questions. Common inquiries include, 'What if I make a mistake on the form?' In such cases, it's often acceptable to correct the error and initial next to the correction, but guidelines will vary, so check with the institution's specific policy. Another common question is about the length of the verification process; while it can vary widely, many institutions aim to complete the KYC checks within a week or two.

Unique circumstances, such as handling unusual financial situations or dealing with non-resident customers, may require additional documentation. Understanding these specific requirements in advance can facilitate a smoother application process and prevent delays.

Additional resources for KYC compliance

For those seeking further guidance on KYC compliance, exploring resources from regulatory bodies can be invaluable. Many national and international organizations publish comprehensive guidelines highlighting best practices and compliance standards. Additionally, services like pdfFiller provide features specifically tailored for KYC standardization, including document templates and automated compliance checks.

Individuals interested in effective KYC implementation can benefit from studying case studies that showcase how teams have successfully used pdfFiller for KYC processes, leading to enhanced accuracy and efficiency.

Final thoughts on navigating the KYC landscape

The future of KYC in a digital world is being shaped significantly by technological advancement. Emerging trends such as blockchain, artificial intelligence, and enhanced data analytics are revolutionizing how businesses verify and manage customer identities. These innovations not only streamline the process but also increase security and reliability, catering to the rising consumer demand for seamless digital experiences.

As firms continue to adapt to these evolving landscapes, choosing tools like pdfFiller, which offer robust document management solutions and KYC compliance features, will be essential. pdfFiller remains committed to helping users navigate the complexities of KYC requirements efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete know your customertrust amp online?

Can I create an eSignature for the know your customertrust amp in Gmail?

How can I fill out know your customertrust amp on an iOS device?

What is know your customertrust amp?

Who is required to file know your customertrust amp?

How to fill out know your customertrust amp?

What is the purpose of know your customertrust amp?

What information must be reported on know your customertrust amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.