Get the free Disabled Veteran Property Tax Exemptions By State

Get, Create, Make and Sign disabled veteran property tax

How to edit disabled veteran property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disabled veteran property tax

How to fill out disabled veteran property tax

Who needs disabled veteran property tax?

The Comprehensive Guide to the Disabled Veteran Property Tax Form

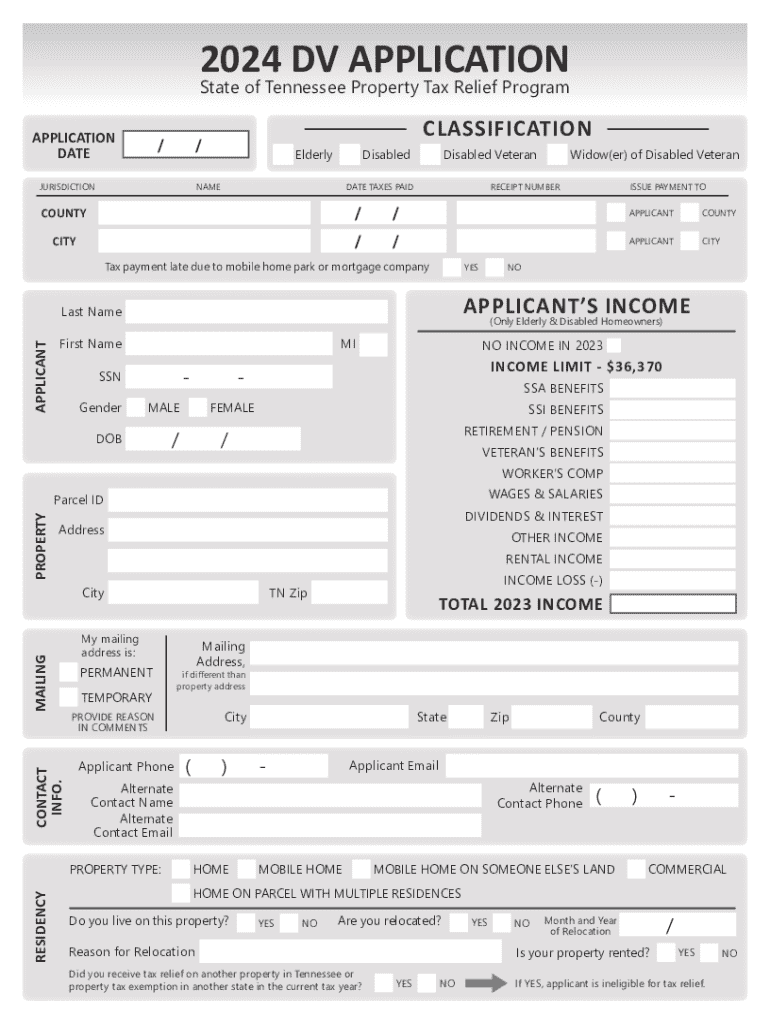

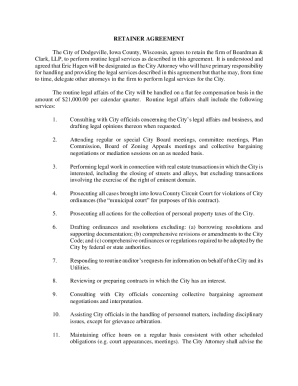

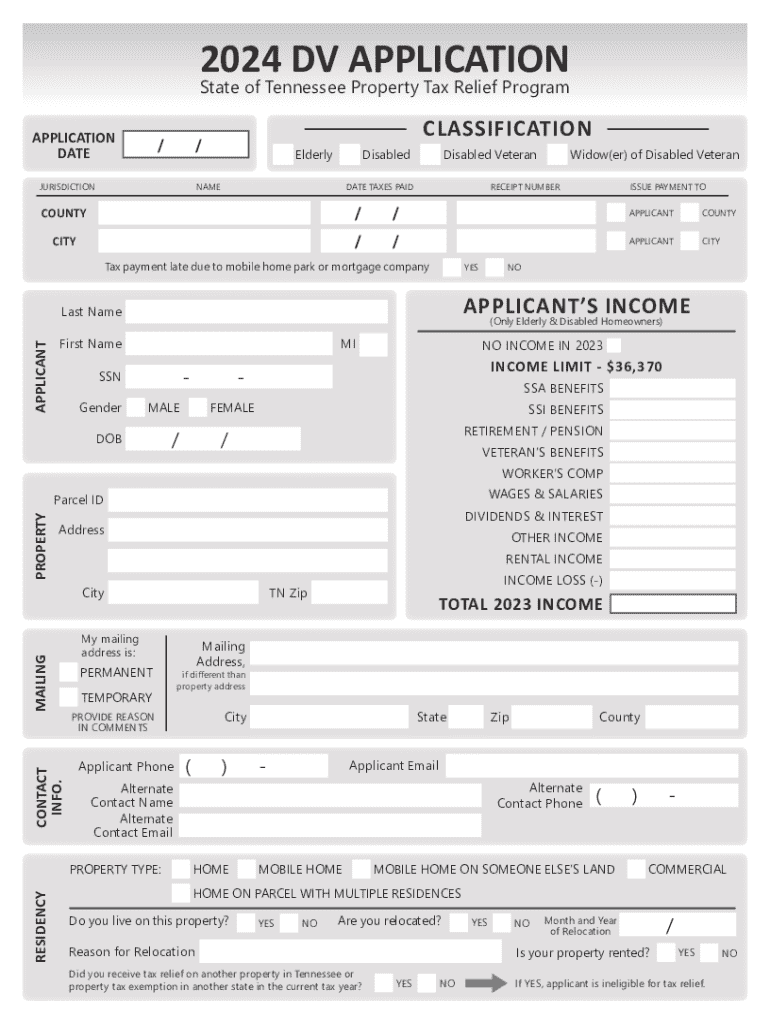

What is the disabled veteran property tax form?

The disabled veteran property tax form is a specialized document designed to help qualifying veterans receive tax exemptions on property taxes due to service-related disabilities. This form serves a pivotal role by simplifying the process for disadvantaged veterans to reduce their financial burden, thereby facilitating easier home ownership and stability.

For many disabled veterans, the financial relief associated with property tax exemptions can be life-changing. It recognizes their service while aiding in their rehabilitation and reintegration into civilian life. By alleviating property tax responsibilities, this program not only honors veterans but also ensures they can afford essential housing and amenities needed to support their families.

Eligibility criteria for disabled veteran property tax exemption

To qualify for the disabled veteran property tax exemption, several criteria must be addressed. Primarily, the definition of a disabled veteran is determined by their disability rating, as established by the U.S. Department of Veterans Affairs (VA). Generally, a minimum disability rating of 10% is required, but some states extend benefits to higher classifications, especially for those with severe disabilities, including loss of limbs or service-connected illnesses.

Residency requirements also play a critical role in determining eligibility. Many states specify that veterans must reside in the property for a set period, which can vary widely by location. Additionally, it’s essential to gather proper documentation, including proof of service, medical records confirming the disability, and any other relevant supporting documents. This ensures compliance with the state’s requirements and aids in verifying eligibility.

Understanding different types of exemptions

While the basic disabled veteran property tax exemption provides vital support, various types of exemptions also exist, tailored to specific veteran categories or service periods. Alternative veterans’ exemptions cater to veterans not covered under standard definitions, allowing property tax relief based on different eligibility factors.

The Cold War veterans’ exemption offers comparable benefits for those who served during the Cold War period, recognizing their contributions even if combat was not a factor. Furthermore, there is the eligible funds exemption, which pertains to veterans receiving qualified funding for education or housing and necessitates specific documentation to substantiate claims.

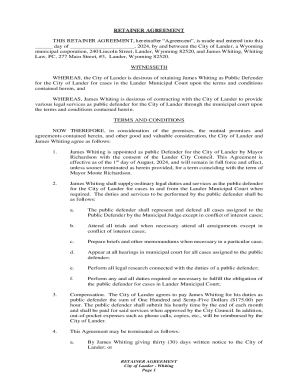

Step-by-step guide to completing the disabled veteran property tax form

Completing the disabled veteran property tax form involves several critical sections, each focusing on different aspects of your eligibility. In Section 1, you provide personal information, including your name, address, and contact details. Always double-check for accuracy, as discrepancies can delay processing.

In Section 2, share your service information, including your service branch and enlistment dates. Section 3 requires details about your disability status, specifically your VA disability rating. Make sure to include any relevant documentation or supporting evidence. Section 4 focuses on property information, where you’ll describe your residence. Finally, Section 5 is where you must to sign the form, confirming the information is accurate and complete before submission.

How to submit your disabled veteran property tax form

Once you have completed the disabled veteran property tax form, consider the different methods available for submission. Many states now offer online submission options where you can upload the form directly to the local tax office. This method not only expedites processing but also ensures that your application is securely filed.

Alternatively, for individuals who prefer in-person interaction, visiting your local tax office is beneficial. Ensure that you bring all necessary documentation to support your claim. Furthermore, if mailing your application, be certain to follow specific instructions regarding where to send it and consider using a certified mail service to confirm receipt and avoid potential issues with lost applications. Deadlines for submission can vary significantly, so it is essential to consult the local tax office for specific dates.

Making changes or appeals

If your situation changes post-submission or your application is denied, it is crucial to understand the appeals process. Changes may require submitting updated documentation or correcting errors in your initial form. For appeals, gather all necessary evidence and submit a formal request to the local tax authority. They typically have established deadlines for appeals, which can range from 30 to 90 days from the date of denial or the expected decision.

Understanding when to appeal is equally important; common reasons include discrepancies in service records or misinformation regarding disability ratings. Keeping well-documented communication can prove invaluable should you need to assert your case during the appeals process.

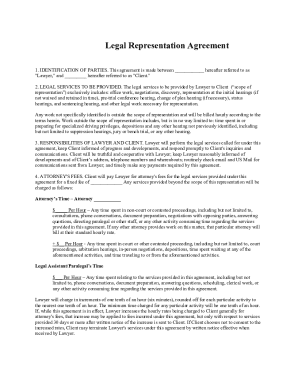

Tools for managing your property tax exemption

Utilizing tools like pdfFiller can enhance the document management process by allowing users to edit, sign, and collaborate on the disabled veteran property tax form efficiently. With its comprehensive set of features, users can edit PDFs, fill out forms seamlessly, and attain electronic signatures, making it easier to navigate the complexities of property tax documentation.

Additionally, the platform enables users to track the status of their applications effectively. Features that support ongoing assistance and clarifications can help veterans maintain their exemptions and organize necessary documentation. Overall, leveraging such tools ensures that veterans are best equipped to manage their financial responsibilities.

Frequently asked questions (FAQs)

Many veterans have common queries regarding eligibility, documentation requirements, and renewal processes associated with the disabled veteran property tax form. For instance, one frequent question is whether previous applicants need to reapply annually. The answer often depends on state regulations; some states require annual applications, while others offer lifetime exemptions once granted.

Another common concern is understanding the appropriate supporting documents needed for submission. Veterans may often confuse different forms or neglect to include essential paperwork that can delay the exemption process. Therefore, it is crucial to consult state-specific guidelines for detailed information regarding what documents are required.

Contact information for assistance

For any clarifications, the U.S. Department of Veterans Affairs, as well as local tax offices, can provide essential support. Websites dedicated to veteran assistance often list phone numbers and email contacts where veterans can directly inquire about specific services or guidance concerning the disabled veteran property tax form.

As each state's regulations can vary significantly, your local tax office often has the most up-to-date information. Connecting with these resources ensures that you can navigate your property tax responsibilities effectively and maintain any benefits you are entitled to.

The disabled veteran property tax form represents a pivotal instrument for veterans seeking tax relief, combining essential advocacy with practical support. Platforms like pdfFiller play an integral role in facilitating the completion and management of these crucial documents, offering veterans the ability to navigate these needs efficiently and effectively. By accessing comprehensive tools and expert assistance, veterans are empowered to maintain their financial independence and claim the benefits that rightfully belong to them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my disabled veteran property tax directly from Gmail?

How do I edit disabled veteran property tax on an iOS device?

How do I edit disabled veteran property tax on an Android device?

What is disabled veteran property tax?

Who is required to file disabled veteran property tax?

How to fill out disabled veteran property tax?

What is the purpose of disabled veteran property tax?

What information must be reported on disabled veteran property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.