Get the free New business opens in Oracle

Get, Create, Make and Sign new business opens in

How to edit new business opens in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new business opens in

How to fill out new business opens in

Who needs new business opens in?

New Business Opens in Form: A Comprehensive How-to Guide

Understanding the basics of business registration

Business registration is the formal process through which an individual or group legally establishes a business entity. This registration marks the transition from an idea to a legitimate venture, enabling entrepreneurs to engage in commerce. In the United States, the registration requirements can vary widely by state, yet the core principle remains the same: businesses must comply with specific regulations set forth by state and local governments.

Registering your business brings significant legal benefits that can provide peace of mind. For instance, registered businesses are often seen as more credible by clients and vendors, which can help in building trust and establishing partnerships. Legal protection from personal liability is another key aspect; forming a corporation or an LLC can shield owners' personal assets from business debts and lawsuits.

Preparing to open your business

Before you can register your business, it’s crucial to determine the appropriate structure for your operations. Common business structures include Sole Proprietorships, Partnerships, Corporations, and Limited Liability Companies (LLCs). Each type holds distinct advantages depending on your business goals, the number of owners, and the level of acceptable personal liability.

Choosing a business name also requires careful consideration. It's essential that your name reflects the nature of your business and is memorable for customers. Ensure that it isn't already in use by another entity in your state. Once you have a name, developing a robust business plan is essential. This plan should outline your business model, target market, and financial projections, providing a roadmap for your business’s growth.

Navigating the registration process

To officially register your business, you must complete several steps, beginning with obtaining an Employer Identification Number (EIN) from the IRS. This number acts as a social security number for your business and is essential for tax purposes, hiring employees, and opening a business bank account. It’s also vital to understand your federal tax obligations to ensure you remain compliant.

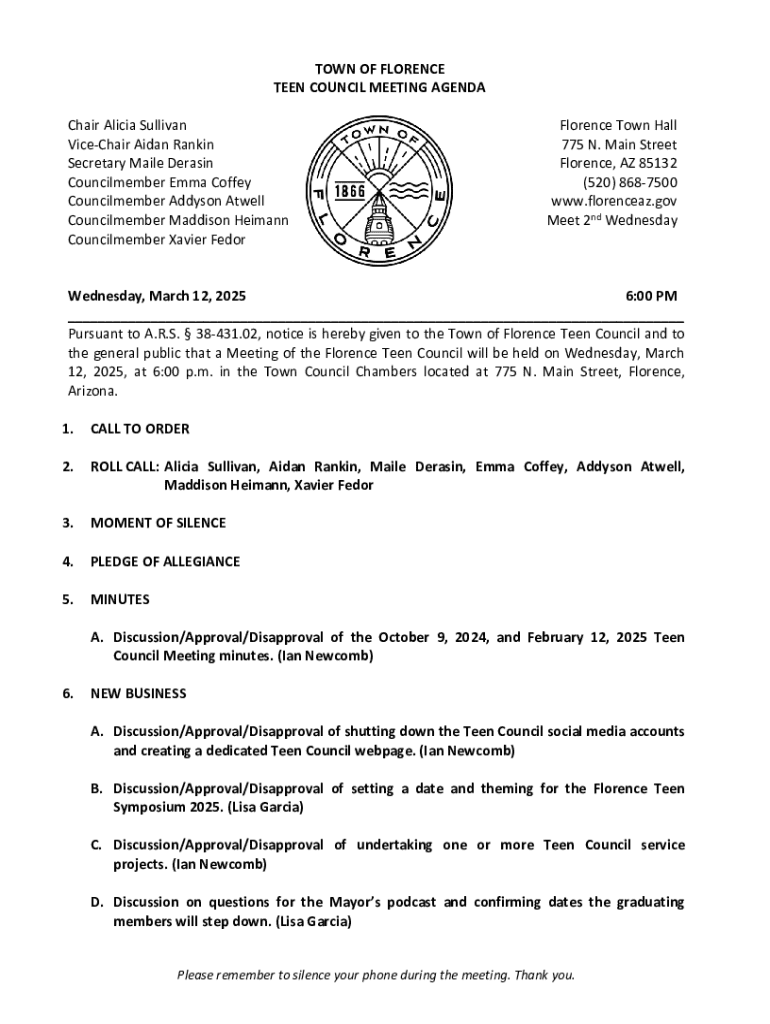

Next, you’ll need to register with state agencies. Each state has different registration procedures, often allowing you to check name availability through official government websites. Depending on your state, registration can sometimes be done online, making the process faster and more convenient. Don't forget to investigate local registration requirements; many municipalities require specific business licenses, permits, and adherence to zoning regulations.

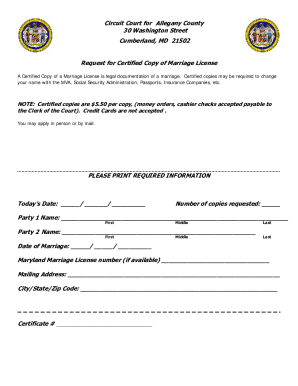

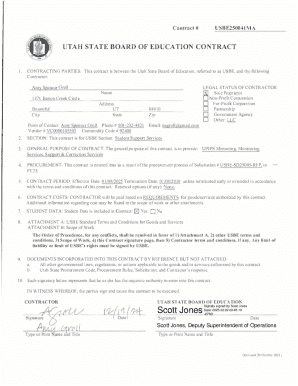

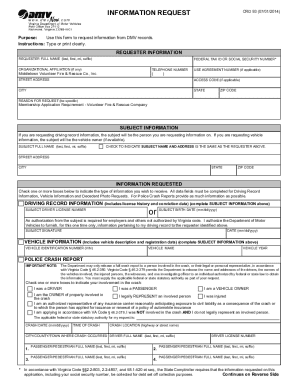

Filling out the necessary forms

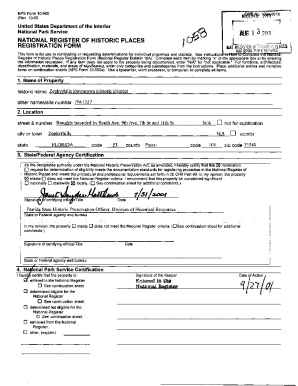

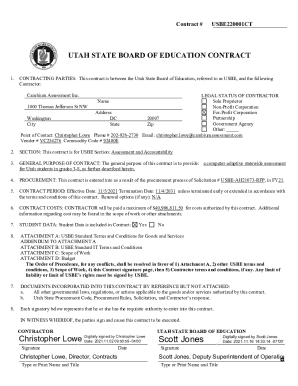

The registration process involves filling out several forms, and specific requirements may vary by location. Typically, you will need to complete the IRS form for your EIN and your state's business registration forms. These documents ask for information such as your business name, business structure, and the names of the business owners.

A step-by-step approach to completing these forms can streamline the process. For federal forms, ensure that you're providing all required information accurately, from your chosen business name to your address and EIN. States often have similar requirements but may include additional local questions or necessitate clearances for certain types of businesses. To simplify document completion, consider using tools like pdfFiller to access fillable forms directly.

Essential compliance measures after registration

Upon successfully registering your business, it’s crucial to stay compliant with ongoing obligations. Most states require businesses to file annual reports and renewals to maintain good standing. Depending on your state, you may also have additional state tax filings or licensing renewals to manage, ensuring that your business remains operational and compliant.

Keeping your documents organized is paramount in maintaining compliance. Digital storage solutions can help manage these documents effectively. Tools like pdfFiller excel not just in document creation but also in management, allowing you to store and retrieve essential compliance paperwork easily.

Common mistakes to avoid when registering your business

Several pitfalls can complicate the business registration process. Failing to conduct proper research might lead to overlooking critical local licensing requirements. It's vital to be aware of any permits or registrations required by your city or county, as these can halt progress if not secured before operations commence. Additionally, misunderstanding tax obligations can have significant ramifications, potentially leading to fines or penalties.

Being overly hasty in the registration process is another common mistake. Ensure you’re thorough and systematic in completing forms and meeting all deadlines. Allowing yourself ample time for each step will help mitigate the risk of errors that could delay your business launch.

Leveraging technology to simplify the registration process

In a world increasingly driven by technology, utilizing cloud-based solutions like pdfFiller can dramatically simplify the business registration process. These tools streamline collaboration among teams, making it easier to gather necessary information and complete forms. Document management becomes straightforward, allowing users to access, edit, and sign documents from anywhere.

With pdfFiller, it's possible to edit business forms seamlessly and eSign them digitally, which is particularly useful if multiple people need to approve documents or if you're on a tight timeline. The platform's ability to manage different document versions and maintain an organized repository of files empowers businesses to focus on growth rather than getting bogged down by paperwork.

Post-registration: Next steps for your new business

Once your business is registered, it’s time to turn your attention to growth strategies. Initial marketing efforts can be crucial for gaining visibility in your target market. Building a robust online presence with a website and social media channels can expand your reach significantly. Hosting events or attending local trade shows can also promote awareness of your new venture.

Establishing a supportive network is equally important. Connect with other business owners, mentors, or industry organizations that can provide guidance and resources as you navigate the early stages of your business. Finally, commit to continuous learning — the business landscape evolves rapidly, and staying informed will enable you to adapt and thrive.

Frequently asked questions

Starting a new business can bring a multitude of questions regarding the registration process. One common query is, 'What forms do I need to open a business?' Typically, you will require an EIN and appropriate state business registration forms. Prospective entrepreneurs often ask, 'How long does the registration process take?' While times vary by state and complexity, most processes can be completed within a few days to a few weeks if all documents are properly prepared.

Another frequently raised question is, 'Can I register my business online?' Many states offer online registration options for convenience. Lastly, if you encounter issues with your registration, reaching out to state or local business resources can provide guidance and support to navigate any challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new business opens in in Gmail?

How can I modify new business opens in without leaving Google Drive?

Can I edit new business opens in on an Android device?

What is new business opens in?

Who is required to file new business opens in?

How to fill out new business opens in?

What is the purpose of new business opens in?

What information must be reported on new business opens in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.