Get the free What to do if SmartTV is not accessible on a Philips Android TV?

Get, Create, Make and Sign what to do if

Editing what to do if online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what to do if

How to fill out what to do if

Who needs what to do if?

What to do if form: How-to Guide Long-read

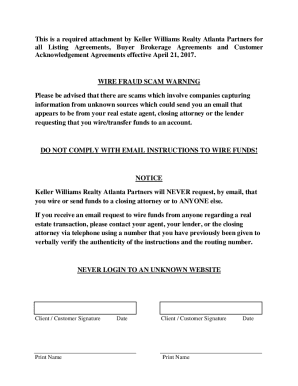

Understanding the importance of your form

Forms are essential documents that facilitate various processes, whether for tax filings, applications for benefits, or other formal purposes. For instance, the IRS requires specific forms like the IRA contribution forms to properly record various retirement contributions. Understanding the form's importance not only helps ensure compliance with regulations but also aids in steering clear of potential issues, such as missed deadlines or incorrect submissions, which can adversely affect your tax situation.

To hone in on the significance of the specific form you are filling out, consider its intended purpose. This could range from tracking traditional IRA contributions to applying for governmental benefits. Each form has unique requirements and processes that must be adhered to meticulously to avoid pitfalls.

Common reasons for seeking guidance on the form

It’s not uncommon to feel overwhelmed or unsure while filling out forms. Questions such as 'What if I'm unsure about specific sections?' frequently crop up. Many users struggle specifically with intricate fields and definitions, which can lead to confusion or the submission of incomplete forms. Understanding common key terms related to your contributions—like MAGI (Modified Adjusted Gross Income)—is crucial for accuracy.

Missing deadlines can also be a source of anxiety. If you find yourself in a situation where you may have missed a submission deadline, act promptly. Document any communication and keep meticulous records as these could be imperative should you need to appeal any penalties or seek an extension.

Step-by-step guide on how to fill out the form

Preparation is key when tackling any form. Start by collecting all necessary information. For example, if you're filling out an IRA contribution form, ensure you have your income documentation ready, including your W-2s, 1099s, and any records pertaining to past contributions. Ensuring that you have everything in one place will make the filling process smoother and faster.

When it comes to filling out the form, take a section-by-section approach. Begin with the header information, where you might need to provide your name, address, and the tax year for the submission. Following that, carefully provide your personal details, ensuring that you accurately reflect your current tax situation. If financial information is required, verify all figures to ensure compliance with the contribution limits associated with both traditional and Roth IRAs.

After you have filled out the entire form, it's crucial to review the completed document thoroughly. Utilize tools available on pdfFiller to edit PDF versions of your form easily. Checking your entries against your gathered materials will help catch any oversights.

Navigating special circumstances

Mistakes on forms can happen, and knowing how to handle them can alleviate stress. If you recognize an error after submission, be proactive in correcting it. Most forms allow for amendments, but it’s critical to consult the relevant guidelines or the IRS for instructions on how to proceed. The importance of accuracy cannot be stressed enough—it can affect your overall tax situation and future interactions with regulatory bodies.

For those needing to amend their submission, follow the prescribed steps carefully. This often involves submitting a corrected form alongside a formal request for amendment. Being transparent about the mistake and rectifying it promptly can mitigate issues down the line.

Electronic submission vs. paper submission

Using pdfFiller for electronic submission has numerous advantages. Cloud-based document management makes your submission process accessible from anywhere, which is invaluable for today’s fast-paced world. Filling, signing, and submitting documents electronically increases efficiency while minimizing the chances of loss or damage common in physical submissions.

However, there are instances where paper submission may still be warranted. For example, legal documents often require original signatures or certain authorities may mandate physical copies. It is essential to evaluate the specific requirements associated with the form you're completing to make the best choice.

Tips to ensure successful submission

To avoid complications, double-check submission deadlines rigorously. Many forms come with strict timelines that, if overlooked, can lead to missed opportunities or penalties. Setting reminders can help cultivate a culture of diligence, ensuring timely submissions become second nature.

Keeping a record of your submission is equally important. After submitting your form through pdfFiller, save confirmations and acknowledgment receipts, which serve as proof of your submission. These documents may be beneficial in addressing any future inquiries regarding your contribution or submission.

Following up post-submission can provide clarity on your form's status. If you haven't received confirmation or documentation, don’t hesitate to reach out to the authorities. Knowing how and when to contact them will further aid in easing any uncertainties regarding your submission.

FAQs: Most common questions about filling out the form

Addressing common questions about filling out forms can be invaluable for many users. For instance, if you don’t have all the required information, consider seeking alternative documents or previous records that might provide necessary details, like your MAGI to determine your IRA contribution limits.

Can you receive help when filling out the form? Absolutely! Many online resources, including the pdfFiller website, offer guidance, interactive tools, or even chat support to assist in navigating the process. Furthermore, reaching out to community forums or peer support can provide additional insights.

If issues arise during the filling process, available resources include FAQs from the IRS, tax preparation resources, or even engaging with customer support offered by pdfFiller.

Additional support and resources

pdfFiller offers a suite of interactive tools designed to streamline your document management process. From templates and examples to comprehensive support features, these resources empower users to fill out forms with confidence. Utilizing well-crafted templates can save time and reduce errors significantly.

Furthermore, links to instructional videos and webinars hosted on the pdfFiller platform can elucidate complex concepts, providing essential information directly related to your specific needs. Engaging with the community forum also opens pathways for peer advice, where you can connect with others facing similar challenges and ask for tailored guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute what to do if online?

How can I edit what to do if on a smartphone?

Can I edit what to do if on an Android device?

What is what to do if?

Who is required to file what to do if?

How to fill out what to do if?

What is the purpose of what to do if?

What information must be reported on what to do if?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.