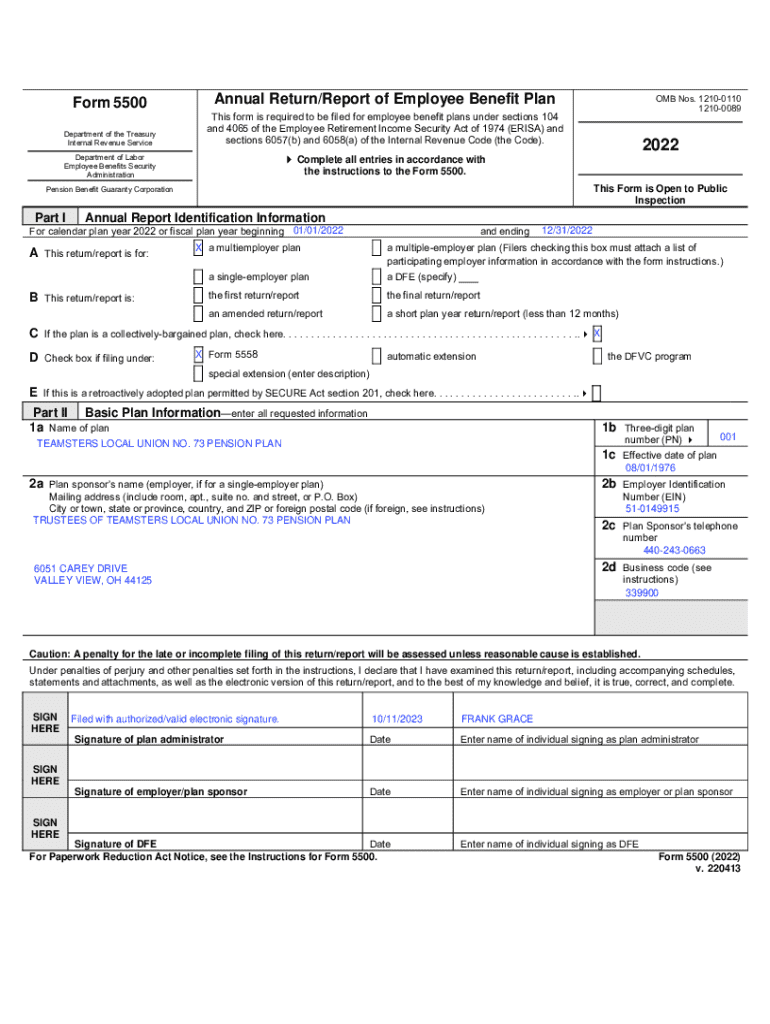

Get the free 2024 form 5500 instructions

Get, Create, Make and Sign 2024 form 5500 instructions

Editing 2024 form 5500 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form 5500 instructions

How to fill out 2024-form-5500pdf

Who needs 2024-form-5500pdf?

2024 Form 5500 PDF Guide: Essential Insights for Plan Administrators

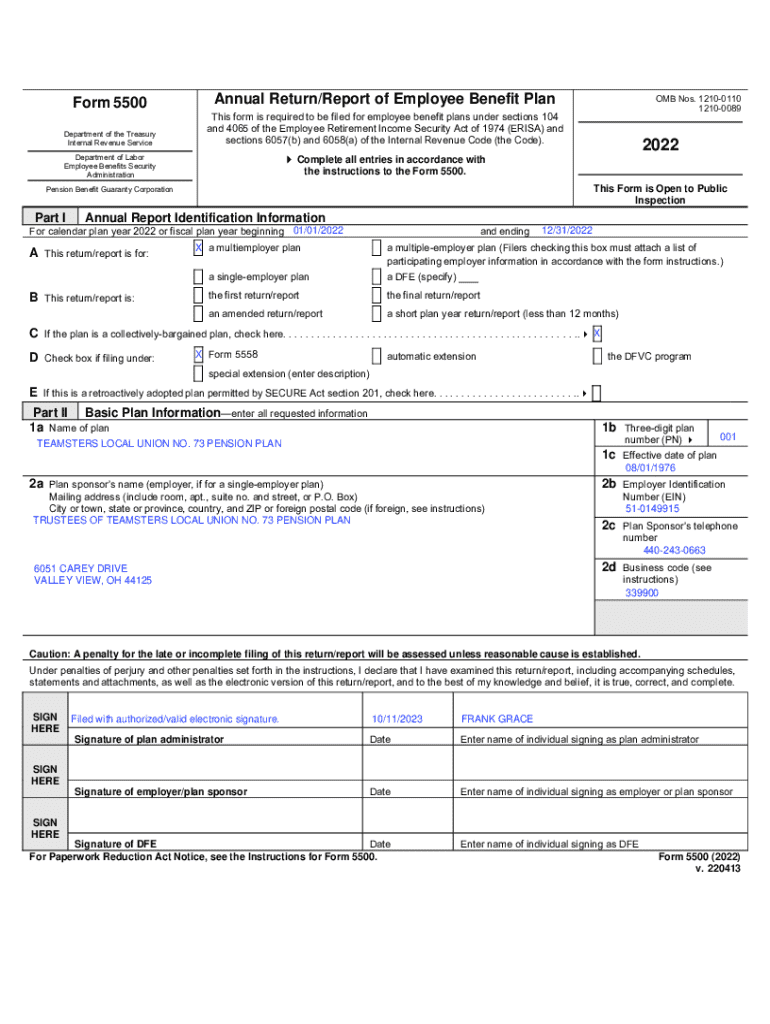

Understanding the 2024 Form 5500

Form 5500 is a crucial document for employee benefit plans, specifically used to report information about the plan's financial condition, investments, and operations. The form is part of the U.S. government’s efforts to ensure transparency in the retirement plan sector, enhancing compliance and protecting participants’ rights.

For plan administrators, understanding the nuances of Form 5500 is essential. It not only serves as a means of compliance with federal regulations but also helps in maintaining the trust of plan participants. The 2024 version of this form includes various updates, making it necessary for administrators to revisit their processes and requirements.

In 2024, several key changes have been introduced to the Form 5500. These updates reflect ongoing shifts in regulatory requirements and aim to simplify the reporting process. For instance, the form now requires more detailed data about plan investments and the demographic details of participants.

Key deadlines for filing the 2024 Form 5500 include the last day of the seventh month after the plan year ends, with extensions available upon request. Knowing these deadlines is essential to avoid penalties and maintain good standing with regulatory authorities.

Preparing to complete the 2024 Form 5500

Before diving into filling out the 2024 Form 5500, meticulous preparation is necessary. This means gathering all relevant documentation and ensuring that you have accurate information on hand. Important documents include retirement plan details, financial statements, and summary plan descriptions.

Deciding on your filing method is also a crucial step. Plan administrators can choose between online eFiling and traditional paper filing. Online eFiling through platforms like pdfFiller offers substantial benefits, including instant validation, error checks, and the ability to save and edit your form seamlessly.

Step-by-step instructions for filling out the 2024 Form 5500

Filling out the 2024 Form 5500 requires a systematic approach to ensure accuracy and compliance. By breaking the process down into manageable sections, you can streamline your efforts and avoid common pitfalls.

By adhering to these guidelines, you significantly reduce the risk of errors and omissions that could lead to compliance issues or penalties.

Editing and signing the 2024 Form 5500 with pdfFiller

Using pdfFiller to edit your 2024 Form 5500 enhances efficiency and accuracy. The platform’s user-friendly editing tools allow you to easily make changes while ensuring that your document remains compliant with federal requirements.

This ease of signing helps meet the compliance requirements of electronic signatures, ensuring that all documents are legally binding.

Collaboration and document management on pdfFiller

Collaboration among team members while preparing the 2024 Form 5500 can significantly enhance efficiency. With pdfFiller, administrators can invite team members to contribute, setting appropriate access permissions to manage who can edit and review the form.

These features enable effective teamwork, keeping everyone informed and aligned throughout the filing process.

Common FAQs about the 2024 Form 5500

Many plan administrators have questions surrounding the 2024 Form 5500. Below are some of the most frequently asked questions that can help clarify common concerns regarding the filing process.

Understanding these key questions can aid in navigating the complexities of Form 5500 filings and promoting compliance.

Additional features of pdfFiller relevant to Form 5500

Beyond simple editing and signing, pdfFiller provides additional features that make it a robust tool for managing the 2024 Form 5500. One of these is the template system, which allows for streamlined document creation.

These features collectively enhance the user experience, making it easier for teams to stay organized and compliant.

Conclusion on utilizing pdfFiller for your 2024 Form 5500 needs

Utilizing pdfFiller for managing the 2024 Form 5500 offers significant advantages for plan administrators. The platform's comprehensive document management features enable seamless editing, electronic signing, collaborative efforts, and secure sharing.

By streamlining the filing process, pdfFiller empowers users to meet their compliance obligations efficiently while reducing the risk of errors and omissions. With continued support and enhancements, pdfFiller stands out as the go-to solution for those navigating the complexities of Form 5500 filings effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 form 5500 instructions without leaving Google Drive?

How do I edit 2024 form 5500 instructions online?

Can I sign the 2024 form 5500 instructions electronically in Chrome?

What is 2024-form-5500pdf?

Who is required to file 2024-form-5500pdf?

How to fill out 2024-form-5500pdf?

What is the purpose of 2024-form-5500pdf?

What information must be reported on 2024-form-5500pdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.